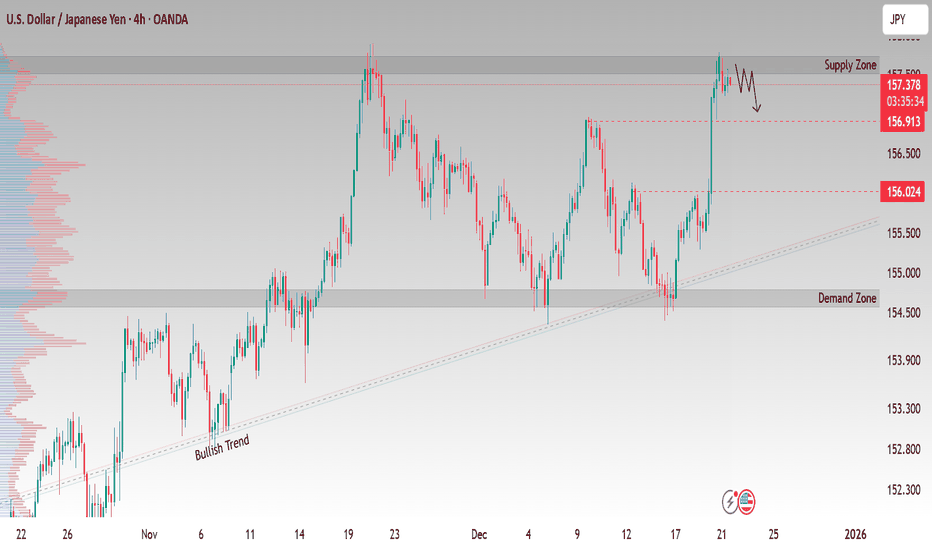

USD/JPY Looking sell from key supply zone sell strong📉USDJPY – SELL SETUP (4H TIMEFRAME)

USDJPY is showing strong selling pressure from a 4H supply zone, indicating a potential downside move. Price has reacted from a key resistance area, confirming bearish intent.

🔴 Sell Zone: 157.500

📊 Timeframe: 4H

🎯 Technical Targets:

• TP1: 156.900

• TP2: 156.000

📌 Market structure favors sellers as supply remains respected. Wait for proper confirmation and execution.

⚠️ Risk Management is Key

Always use proper stop loss, manage your position size, and avoid over-risking.

👍 Like | ➕ Follow | 💬 Comment | 🔁 Share

📈 Trade smart, not emotional.

Forex market

EURGBP WILL GO UP|LONG|

✅EURGBP taps into a refined discount zone after a sharp sell-side displacement, with internal liquidity already partially cleared. Current structure suggests a reaction from this demand, as price seeks rebalancing toward premium and targets resting buy-side liquidity above recent highs. Time Frame 4H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅

NZD-USD Local Short! Sell!

Hello,Traders!

NZDUSD is trading into a well-defined horizontal supply zone after a strong impulsive bullish leg. Price is now tapping into premium, where sell-side interest previously caused sharp displacement. A reaction from this area may trigger a bearish response, with liquidity resting below recent higher lows likely to be targeted. Time Frame 7H.

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCAD TRADE UPDATEPrice once reached a +2.5r has then comeback and hit be. That's not an issue it's part of the process, we have to understand that we are playing the long term game not the short term, so what i do? Analyse, Journal, Improve, and repeat the process.

Now we have had the acceleration once broken the daily low as expected (the acceleration), but it then has absorbed the movement and that bullish sign could potentially give me another good setup for the longs.

To confirm it i want the body of the daily candle to close below of the low of yesterday's candle, if it closes below we can then expect tomorrow for the price to have a potential rally

EURAUD: Bullish Forecast & Bullish Scenario

The price of EURAUD will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPAUD: Trading Signal From Our Team

GBPAUD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy GBPAUD

Entry Level - 2.0161

Sl - 2.0143

Tp - 2.0191

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURCAD On The Rise! BUY!

My dear friends,

Please, find my technical outlook for EURCAD below:

The instrument tests an important psychological level 1.6147

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.6159

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUD/JPY — M30 | 23-12-2025 — Wave 2 (red) completed🔎 **AUD/JPY — M30 | 23-12-2025 — Wave 2 (red) completed, anticipating continuation of Wave 3 (red)**

• On the M30 timeframe, AUDJPY continues to maintain a **bullish Elliott Wave structure**, with the primary trend currently positioned within **Wave 3 (red)**.

• After completing **Wave 1 (red)** around the **104.619** level, the market entered a corrective phase in the form of **Wave 2 (red)**, unfolding as an **A–B–C correction (yellow)**.

• Within **Wave C (yellow)**, **Wave (v) in blue** has fully developed and appears to have completed around the **103.894** area, indicating a clear reduction in corrective selling pressure.

• At present, price action suggests the market is entering the **early advancing stages of Wave 3 (red)**, with its internal structure gradually taking shape.

📌 **Preferred scenario (Bullish):**

• Wait for the short-term **Wave (ii) in blue** to complete, then look for confirmation signals on lower timeframes to **buy in alignment with Wave (iii) in blue**, riding the impulsive leg within the broader bullish structure and momentum.

⛔️ **Invalidation:**

• A breakdown below **103.894** invalidates this scenario and requires a reassessment of the wave count.

🧭 **Trade tips:**

**“Trade with the dominant wave — let structure and momentum guide your decisions.”**

contraction to expansion theory Hello everyone. it has been while i have not updated a clean idea for all. Well there goes an fresh one set to next week. to whom so ever is on forex AUDUSD.

After multiple day contracting and today shown this huge ass.... bullish Marubozu candle. we're likely to expect an expansion up.

Ideas like this is i don't share so enjoy it.

NZDJPY The Target Is DOWN! SELL!

My dear friends,

NZDJPY looks like it will make a good move, and here are the details:

The market is trading on 91.035 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 90.879

Recommended Stop Loss - 91.134

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUD/NZD — M30 | 23-12-2025 — Correction Completed, Awaiting Bull🔎 AUD/NZD — M30 | 23-12-2025 — Correction Completed, Awaiting Bullish Activation

• On the M30 timeframe, AUDNZD has completed the prior bullish phase with Wave 5 (yellow) topping around 1.15067.

• The market then transitioned into a yellow A–B–C corrective structure, in which wave (v) (aqua/blue) within Wave C (yellow) formed an ending diagonal, likely concluding at the 1.14602 low.

• Price has now broken above the confirmation level at 1.14764, serving as a key validation point for a short-term bullish reversal scenario.

• A sustained move above this level strengthens the probability that the market is entering a new impulsive bullish phase in line with the Elliott Wave structure.

📌 Preferred scenario (Bullish):

• Look for buy opportunities aligned with the next developing bullish wave, prioritizing trades that follow structure and momentum.

⛔️ Invalidation:

• A breakdown below 1.14602 invalidates the scenario and requires a full wave reassessment.

🧭 Trade tips:

“Wait for confirmation — the best trends begin after the correction is complete.”

NZDUSD SHORT Market structure bearish on HTFs DH

Entry at Daily AOi

Weekly Rejection At AOi

Daily Rejection at AOi

Potential Head And Shoulder forming on the Daily

Previous Structure point Daily

Around Psychological Level 0.58000

Touching EMA H4

H4 Candlestick rejection

Rejection from Previous structure

Potential Head And Shoulder forming on the H4

TP: WHO KNOWS!

Entry 90%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

CAD/JPY — Daily OutlookBias: Bullish, looking for continuation buys

Price has pulled back into a small intraday range and is now sitting between your marked support and resistance levels. Your focus today is on a potential breakout to the upside.

Key Support Zone (~113.735)

This level is acting as your base for long positions.

As long as price holds above this support, you’re looking for bullish continuation.

Any clean rejection here gives you confirmation to buy.

Breakout Setup

If price breaks above the 113.817 resistance , you expect a continuation move to the upside.

This breakout is your main trigger for entering long positions.

The green target zone above represents your take‑profit area for the bullish scenario.

Stop‑Loss Zone (Red Area Below)

If price breaks below the support zone, your long idea becomes invalid.

This is where your protective stop sits to manage risk.

USDJPY 30-Min — Volume Sell Reversal Triggered⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

✈️ Technical Reasons

/ Direction — SHORT / Reversal 157.450 Area

☄️Bearish rejection confirmed through sharp candle body.

☄️Lower-high forming beneath resistance supply region.

☄️Volume decreasing confirms exhaustion in price rally.

☄️Sellers regained imbalance with heavy top rejection.

☄️Algorithm detects fading demand and shift to control.

⚙️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins.

⚙️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones.

⚙️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable.

EURAUD oversold bounce support at 1.7600?The EURAUD currency pair continues to display a bearish outlook, in line with the prevailing downward trend. Recent price action suggests a corrective pullback, potentially setting up for another move lower if resistance holds.

Key Level: 1.7810

This zone, previously a consolidation area, now acts as a significant resistance level.

Bearish Scenario (rejection at 1.7810):

A failed test and rejection at 1.7810 would likely resume the bearish momentum.

Downside targets include:

1.7600 – Initial support

1.7560 – Intermediate support

1.7520 – Longer-term support level

Bullish Scenario (breakout above 1.7810):

A confirmed breakout and daily close above 1.7810 would invalidate the bearish setup.

In that case, potential upside resistance levels are:

1.7860 – First resistance

1.7940 – Further upside target

Conclusion

EURAUD remains under bearish pressure, with the 1.7810 level acting as a key inflection point. As long as price remains below this level, the bias favours further downside. Traders should watch for price confirmation around that level to assess the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURCHF breakout support at 0.9270The EURCHF remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader trend.

Support Zone: 0.9270 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.9270 would confirm ongoing upside momentum, with potential targets at:

0.9330 – initial resistance

0.9350 – psychological and structural level

0.9370 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.9270 would weaken the bullish outlook and suggest deeper downside risk toward:

0.9260 – minor support

0.9240 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURCHF holds above 0.9270 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EUR/USD SHORT SIGNAL📢 Official Technical Analysis – EUR/USD

📉 Position Type: SHORT

💰 Entry Price: 1.17853 (Limit Order)

🎯 Take-Profit Targets (Partial Exits):

• TP1: 1.17768

• TP2: 1.17691

• TP3: 1.17594

• TP4: 1.17489

• TP5: 1.17385

🛑 Stop-Loss: 1.17955

📊 Timeframe: 15m

⚖️ Risk Management: Mandatory

🧠 Technical Analysis Summary

EUR/USD is showing bearish pressure after rejection from a short-term resistance zone.

Market structure on the 15-minute timeframe indicates lower highs and weakening bullish momentum.

Price is reacting below key intraday resistance, increasing the probability of a downside continuation toward liquidity targets.

Key downside levels align with our TP zones, offering a favorable short setup under proper risk management.

⚙️ Trade Management Rules

✔️ Take partial profit at TP1

✔️ Move Stop-Loss to Break-Even after TP1 is hit

✔️ Trail SL if price continues toward lower targets

✔️ Do not re-enter if Stop-Loss is triggered

⚠️ Disclaimer

This analysis is provided for educational purposes only and does not constitute financial advice.

Always manage your risk and confirm the setup on your own chart before entering a trade.

📌 TradingView Hashtags

#EURUSD #Forex #ForexTrading #TechnicalAnalysis

#ShortSetup #TradingView #PriceAction

🔹 If you want more Forex or Crypto setups, follow for future updates.

BUllsHaving broken the Weekly resistance on 09 Oct and trading above it, we have recently tested the last couple of weeks. and on the daily chart broken above the resistance(minor) line and due to double bottom before its breakout we look to purchase from the Daily FVG and in which we also find the 1Hr OB. with the previous hiighs of 161.285 region as our target.