Forex market

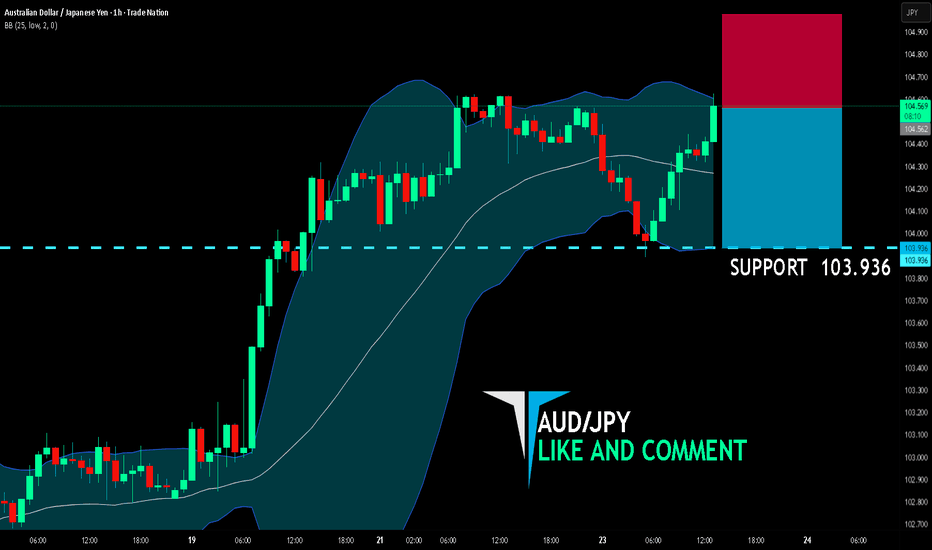

AUD/JPY BEARS ARE GAINING STRENGTH|SHORT

AUD/JPY SIGNAL

Trade Direction: short

Entry Level: 104.562

Target Level: 103.936

Stop Loss: 104.979

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USD/CAD Weekly OutlookBuy Zone (1.37757 – 1.37960)

Price remains strongly bullish as long as it stays above or inside this buy zone.

Even if price briefly breaks below, a return back above the zone would be an even stronger confirmation for long positions.

First Target / Sell Zone (1.38273 – 1.38420)

This area is your first upside target.

It’s also a potential sell zone , but you want to see clear confirmation before entering any short position.

If price rejects this zone → possible short-term sell opportunity.

If price breaks and holds above this zone → bullish continuation.

Bullish Breakout Scenario

If the 1.38273 – 1.38420 zone breaks with confirmation and price retests it successfully, you plan to continue buying toward:

Final Target → 1.39549

GBP/JPY Weekly Outlook — Four ScenariosMain Bias: Long Positions

Your primary plan is to buy from the two demand zones you’ve identified. The four scenarios simply outline how price may react depending on structure and momentum.

Scenario 1 — Bullish Reaction From First BUY ZONE

Zone: ~210.000

Price taps the first buy zone and reacts bullishly.

You look for long entries with confirmation.

This is the cleanest continuation scenario toward new highs.

Scenario 2 — Deeper Pullback Into Strong BUY ZONE

Zone: ~207.500

Price breaks the first zone but finds strong support in the deeper zone.

This is your highest‑probability long setup.

You expect a strong bullish reversal from here.

Scenario 3 — Break of First Zone → Short-Term Sell (Scalp)

If price breaks below the first buy zone, you may take a scalp sell.

Target is the deeper strong buy zone.

This is only a short-term countertrend move.

Scenario 4 — Break & Confirm Below Strong BUY ZONE

If price breaks the strong buy zone and confirms below, bullish structure is invalidated.

This opens a probable sell setup with continuation to the downside.

This is the only scenario where your bias shifts from long to short.

USDCAD – LOSS ACCEPTED | PART OF THE PROCESSYesterday, USDCAD showed signs that it could recover and move higher. Price was at a known level and conditions looked favorable at the time. However, the market did not follow through.

Price turned back down and the position was stopped out.

This is an important reminder of a core truth in trading:

Being right about the process matters more than being right about direction.

Losses are not failures when:

The setup met the rules

Risk was defined and respected

The stop was placed correctly

The trade was taken without emotion

Markets are probabilistic. Even high-quality setups will fail sometimes.

The goal is not to avoid losses.

The goal is to take losses correctly so they never damage confidence or capital.

As long as trades are executed within the rules, outcomes take care of themselves over time.

This loss changes nothing about the process.

USDJPY – FOLLOW-THROUGH AFTER FULL VMS ALIGNMENTUSDJPY made a strong impulsive move to the downside immediately after all VMS signals lined up and we entered.

This is a textbook example of why patience matters.

The move did not come from guessing or anticipation — it came after:

Price reached a key structural level

Volume confirmed participation

Momentum aligned with direction

Price action gave clear confirmation

Only after those conditions were met did the market commit.

This is the part many traders struggle with:

Entering early

Entering on hope

Entering because “it looks good”

VMS is not about being first.

It’s about being right and protected.

When you wait for full alignment, the market often does the heavy lifting quickly and decisively.

Patience before entry is what allows confidence during the trade.

EUR/USD H1 BUY Price has pulled back into the 0.618 Fibonacci retracement following the recent bullish move.

I will be looking to enter a buy from the 0.618 level, provided price holds and shows acceptance in this area.

The trade will be managed with a 2R target, maintaining a defined risk-to-reward approach.

If price fails to hold below the level, the setup will be considered invalid.

GBPJPY Might Be the Choice of Traders If Yen Intervention BeginJapan has once again captured the global market’s attention with the rising possibility of intervention. Warnings have been coming for the last few days, but the clearest signal came from Finance Minister Katayama. She said they have “free hands” to make bold moves, perhaps even departing from classic intervention tactics.

Japan conducted two repeated interventions in both 2022 and 2024. There are no clear known rules about when intervention occurs, but some signals could be important.

The first one is that USDJPY rose too fast over a couple of months. For that, we use the rate of change for 3 months (66 days). When the ROC is very near 7, it rings danger bells.

The second signal is the level of USDJPY. The first intervention came when USDJPY reached 150, and the second one came from near 160. So the 150-160 zone is clearly important for Japan’s economic administration.

The third one is not a signal but rather a market reality. Japan does not have unlimited foreign reserves to stem yen depreciation, so timing will be key. It is logical that when Japanese yen bears are close to being exhausted, yen short positions become too crowded, and market liquidity gets thinner, that is the most efficient time for intervention. The incoming low-liquidity holiday season could be a prime opportunity for Katayama. Although last year when USDJPY was very close to 160, Japan opted out of intervention, the yen still fell in early 2025.

The final move before intervention is preparing the markets. Key players like the currency chief and finance minister start to issue warnings, with each new speech more hawkish than the previous one. Warning of bold moves is a very clear step toward intervention because it creates fear in the market. This fear causes any sudden retreat in USDJPY to turn into a trigger for running away from long positions. Combined with the low-liquidity environment and overly busy long positioning, it multiplies the effect of the intervention.

So the intervention threat is real and a possible trend change could be near. To turn this into an advantage, perhaps GBPJPY is one of the most appropriate currencies at the moment. Despite weak GBP fundamentals, it rose 3.12% in the last 22 days (working days in a month) against the USD, higher than EURUSD. If this divergence corrects and a Japanese intervention comes, GBPJPY could be hit by a double combo. Currently, the 21-day z-score shows that GBPJPY has passed +2 standard deviations then retreated, a sell signal that works close to 50 percent of the time. The divergence from the longer-term average (144) has reached nearly 3 standard deviations, showing both short- and medium-term excess. The currency has also tested the upper line of the trend channel, which also supports a correction case. A pricing below 208 might be needed for a clear signal, but as long as the upper line of the channel holds, the downward opportunity might remain a decent possibility.

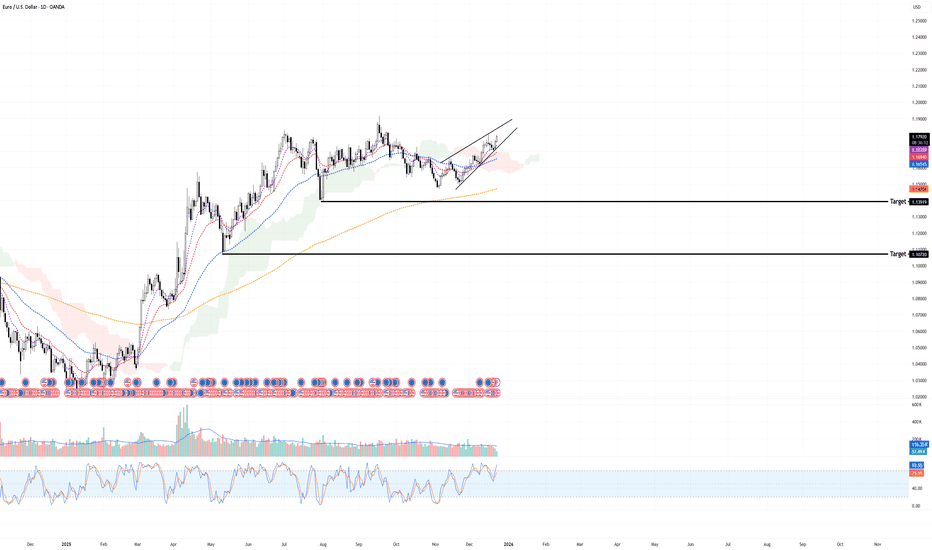

EURUSD 1-month Channel Up targeting 1.18850.The EURUSD pair has been trading within a 1-month Channel Up, supported by the 4H MA50 (blue trend-line) and has already started its new Bullish Leg. The 4H MACD Bullish Cross has confirmed it, similar to what happened on both previous sequences.

Both of those Bullish Legs rallied by a little more than +1.60%. This gives us a short-term Target at 1.18850.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDJPY Update Week 52 Day 23Most of my drawings on this chart are from previous posts. What I have done is to zoom in to lower time frame to see how this asset is pricing.

I maintain a bullish sentiment on this pair, even though sellers are taking me down, and perhaps proving me wrong. Does this change my sentiment? No. It means that I can either join the sellers or look for buying opportunities, or at best, stay away completely.

Where do I want to join the sellers? 154.365 is the dotted line shown in pink. With a small risk in my capital, I will take a sell below this price.

Sell stop 154.300

Stop loss 155.300

Take profit 152.300

Risk reward ratio 2:1

154.365 is an area of previous support. Price failed to push into an area of resistance, which I have shown to be 158 with a green line. I have explained the 151 and 149 levels before. Also, the market gap has been explained in my previous post. And if the market continues to be bearish, we will see the market close this gap.

If you like my post, please give it a boost and let me know if there is an asset you want me to analyse. Share your own views with me in the comments section below

Disclaimer: This is not financial or trading advice; it is only for educational purposes.

EUR/USD)Bullish trend analysis Read the captionSMC Trading Point update

Technical analysis of EURUSD – 4H chart using SMC + trend continuation + EMA confluence.

⸻

Market Context

• Bias: Bullish

• Clear break in structure (BOS) to the upside

• Strong impulsive candles → institutional participation

• Price is trading above EMA 50 & EMA 200

• EMA 50 acting as dynamic support

⸻

Key Demand Zone (Blue Area)

~1.1715 – 1.1730

Confluence:

• Previous resistance → flipped to demand

• EMA 50 support

• Consolidation base before impulse

• Liquidity swept below prior lows before rally

This zone is the origin of the move, making it a high-probability re-entry area.

⸻

Trade Idea (Continuation Long)

Buy on pullback / buy on confirmation

• Entry: 1.1720 – 1.1730

• Stop Loss: Below demand (~1.1690)

• Targets:

• TP1: 1.1800 (recent high)

• Final TP: 1.1875 (marked target point / range high)

Risk–Reward: ~1:3+

⸻

Confirmation Triggers

Best confirmation inside demand:

• Bullish engulfing (4H or 1H)

• Long lower wicks rejecting the zone

• Lower-TF CHoCH

• Momentum expansion after pullback

⸻

Invalidation

• 4H close below 1.1690

• Acceptance below EMA 50 & demand zone

If that occurs → bullish continuation idea is invalid.

⸻ Mr SMC Trading point

Summary

This setup is a classic bullish continuation:

• Structure break

• Demand + EMA confluence

• Clean expansion leg targeting higher liquidity

Patience = edge. Let price retrace or confirm before entry.

If you want, I can:

• Refine this into a 1H / 15m execution model

• Or help you turn this into a repeatable SMC playbook

Please support boost this analysis

USD/JPY )Bullish trend analysis Read the captionSMC Trading point update

Technical analysis of USDJPY – 1H chart using SMC + Fibonacci + trend continuation logic.

⸻

Market Context

• Higher-timeframe bias: Bullish

• Price is still trading inside an ascending channel

• Structure remains higher highs / higher lows

• Recent move down is a pullback, not a reversal

⸻

Pullback Analysis (Why Price Dropped)

• Strong impulsive rally → liquidity taken at highs

• Price retraced back into:

• EMA 50 & EMA 200 confluence

• Previous demand zone

• Fibonacci OTE area (0.705 – 0.79)

This tells us the move down is corrective.

⸻

Key Buy Zone (Blue Area)

~155.90 – 156.20

Confluence:

• SMC demand / order block

• Fib 0.705–0.79 (OTE)

• EMA 200 support

• Channel mid-support

• Marked reaction candle + green arrow → buyers stepping in

This is the highest-probability long zone.

⸻

Fibonacci Logic

Measured from impulse low → swing high:

• 0.5 / 0.62 → shallow pullback (failed)

• 0.705 – 0.79 → institutional rebalance zone

→ Market reacted exactly where it should in a bullish trend

⸻

Trade Idea (Example Plan)

Buy on confirmation inside demand

• Entry: 155.95 – 156.15

• Stop Loss: Below demand (~155.50)

• Targets:

• TP1: 156.55 (EMA 50 / mid-range)

• TP2: 157.30

• Final TP: 157.65 (marked target point / range high)

RR potential: 1:3+

⸻

Confirmation Triggers (Important)

Enter only after:

• Bullish engulfing / pin bar (1H or 15m)

• Lower-TF CHoCH

• Strong rejection wick from demand

⸻

Invalidation

• 1H close below 155.50

• Clean break & acceptance below EMA 200 + demand

If that happens → bullish idea is invalid.

⸻ Mr SMC Trading point

Summary

This setup is a textbook bullish continuation:

• Trend intact

• OTE + demand confluence

• Mean reversion → expansion toward highs

Best execution = wait for confirmation, don’t chase.

If you want, I can:

• Refine this into a 5m / 15m sniper entry

• Or help you build a repeatable SMC trading model

Please support boost this analysis

EURUSD Short: Head & Shoulders at Resistance - Target 1.1670Hello, traders! EURUSD previously traded within a well-defined Descending Channel, confirming sustained bearish pressure and controlled sell-side momentum. Price consistently respected the channel boundaries, forming a sequence of lower highs and lower lows. Multiple breakout attempts occurred within the channel, but each upside move was capped by the descending resistance, reinforcing the bearish structure. The market eventually reached a clear Pivot Point near the lower channel boundary, where selling pressure weakened and buyers briefly stepped in, producing a corrective rebound rather than a full trend reversal. Following this rebound, EURUSD pushed higher and managed to break above local resistance levels, leading to a short-term bullish expansion. However, this move lacked strong follow-through and transitioned into a distribution phase near the Supply Zone around 1.1760. At this area, price formed a clear Head and Shoulders pattern, signaling exhaustion of bullish momentum and a return of sellers. The left shoulder, head, and right shoulder developed directly under resistance, confirming strong supply presence and rejection from higher prices.

Currently, price has broken below short-term structure and is pulling back from the supply zone, signaling the start of a corrective-to-bearish continuation move. The market is now rotating lower toward the Demand Zone around 1.1670, which aligns with a previous breakout level and acts as the nearest downside objective. This zone represents a key area where buyers may attempt a reaction, but overall structure still favors sellers.

My primary scenario is bearish as long as EURUSD remains below the 1.1760 Supply Zone and continues to show rejection from this area. The current pullback appears impulsive rather than corrective, favoring continuation toward the 1.1670 Demand Zone. A clean breakdown and acceptance below demand would confirm further downside continuation. Until then, this level remains the key decision point. Manage your risk!

GBP/JPY) Bullish trend analysis Read the captionSMC Trading point update

Technical analysis of GBPJPY, 4H), using SMC + Fibonacci + trend structure.

⸻

Market Structure Context

• Overall bias: Bullish

• Price is making higher highs & higher lows

• Respecting an ascending trendline

• EMA confirmation

• EMA 50 above EMA 200 → bullish trend continuation

• Current pullback is corrective, not reversal

⸻

Key Zones (SMC Logic)

• Upper blue zone (~210.20–210.40)

• Previous demand → now acting as mitigated / weak support

• Price already reacted and broke below → not ideal for fresh buys

• Lower blue zone (~208.80–209.30) High-probability demand

• Confluence of:

• Demand / order block

• Trendline support

• EMA 50

• Fibonacci 0.705–0.79 retracement

• Marked with green arrow → main buy zone

⸻

Fibonacci Insight

Measured from recent impulse low → swing high

• 0.5 / 0.62 → reaction zone (minor bounce)

• 0.705 – 0.79 → optimal trade entry (OTE)

→ Institutions often rebalance here

This aligns perfectly with the lower demand zone.

⸻

Trade Idea (Example Plan)

Buy Limit / Buy on Confirmation

• Entry: 208.90 – 209.20

• Stop Loss: Below demand & trendline (~208.20)

• Targets:

• TP1: 210.20 (previous structure)

• TP2: 211.90 – 212.00 (range high / target point)

Risk–Reward: ~1:3 or better

⸻

What Confirms the Trade?

Wait for confirmation inside the zone, such as:

• Bullish engulfing candle

• Long lower wicks (liquidity grab)

• Lower-timeframe BOS / CHoCH

⸻ Mr SMC Trading Point

Invalidation

• Clean 4H close below demand + trendline

• Strong bearish momentum breaking EMA 200

If that happens → bullish idea is invalid.

⸻

Summary

This is a bullish pullback trade:

• Trend continuation

• Strong SMC + Fib confluence

• Patience is key → let price come to you

If you want, I can:

• Refine this into a lower-timeframe entry (15m/5m)

• Or help you journal this

Please support boost this analysis

USDJPYPrice action trading is a methodology in financial markets where traders make decisions based on the actual price movements of an asset over time, rather than relying heavily on technical indicators or fundamental analysis. It involves observing and interpreting patterns and trends in price charts to predict future price movements.

USDJPY: Resistance.Hi everyone,

USDJPY has completed my previous idea, by successfully reaching our first and the second profit target. we can all see how the price respected the support zone, retracing above it.

Meanwhile, the price is presently at the resistance, a chance of possible reversal below this level might occur, though there may be a breakout above the resistance in regards to the previous daily candle.

Key points;

A confirmed pullback below this zone, would set off a downward move to 155.34 Tp1 and 154.43 Tp 2

Lets see how it plays,

Thanks for reading.

GBPAUD-Waiting for a Fake Break at Support Price has tested a key support level multiple times, forming an almost range-like structure, while a moderate bullish trend remains in the background.

Technically, long positions can be taken from this support, but my personal preference is to wait for the support to break first and then enter during a fake breakdown.

Even if price rallies directly from this level, I won’t take the trade. Each reaction from this support has become weaker over time, and in my view, only a fake break can properly confirm momentum and provide a cleaner, lower-risk entry.

EURJPY | Breakout & Pullback Buy ScenarioA breakout above a key resistance followed by a pullback to that level — now acting as support — can offer a good buying opportunity.

However, the pullback must be clean and convincing, with price reacting strongly from the support. Otherwise, the move could turn into a fake breakout.

For proper confirmation, we need to see a strong bullish candle, and entries should only be taken with a clear trigger.

Short Trade Update | RR 1.5 Reached — Holding Toward Range LowThe short position initiated from 157.170 has now reached RR 1.5, confirming that price is moving as expected within the channel structure.

At this stage, the position will be kept open toward the bottom of the range, as long as price action remains consistent with the bearish structure.

Risk can be managed according to individual strategy — partial profits may already be secured, while the remainder of the position is allowed to run.

If market conditions change or we see signs of a structural shift, the analysis will be updated accordingly. For now, the plan remains unchanged: hold the position toward the range low.