EUR/USD Daily Chart Analysis For Week of Dec 26, 2025Technical Analysis and Outlook:

In the trading session of this holiday week, the Euro market experienced an upward breakout, subsequently retesting the target of the Interim Inner Currency Rally at 1.180 and bypassing the Mean Resistance level at 1.175.

Following this retest, the euro experienced a rapid downward retreat, with the primary objective aiming at the Mean Support level at 1.175. It is important to note that this price point is the inverse of the preceding resistance level. At this juncture, we anticipate a substantial “dead cat” rebound from this support level, targeting a price objective at the Key Resistance level of 1.179.

Furthermore, some intermediate upward momentum may materialize within this downward trend before price levels realign with the anticipated trajectory.

Forex market

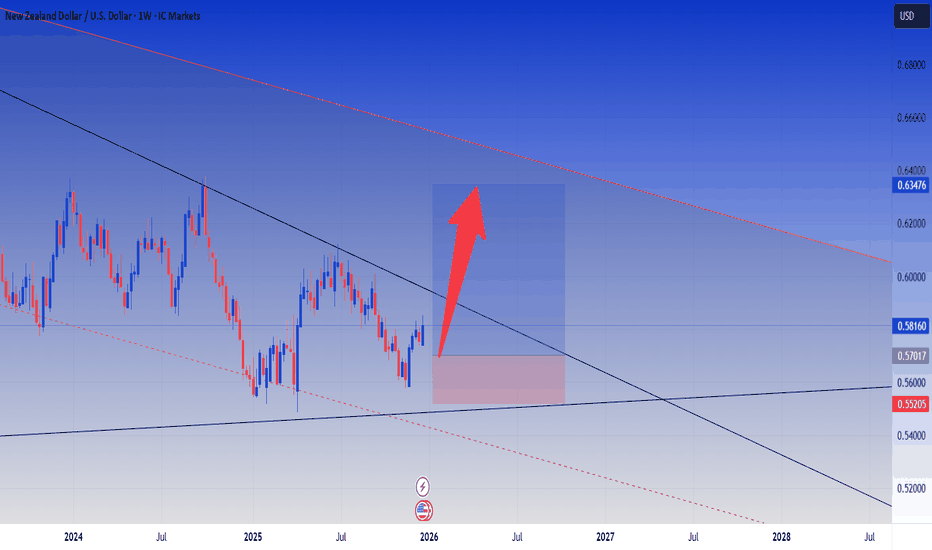

NZDUSD Trading IdeaBased on Simple Technical Analysis ( Trendline + Support & Resistance )

Risk Disclaimer:

Please be advised that I am not telling anyone how to spend or invest their money. Take all of my analysis as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this page, and they are for educational purposes only. Any action you take on the information in this analysis is strictly at your own risk. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Good luck :-)

AUDUSD Trading IdeaBased on Simple Technical Analysis ( Trendline + Support & Resistance )

Risk Disclaimer:

Please be advised that I am not telling anyone how to spend or invest their money. Take all of my analysis as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this page, and they are for educational purposes only. Any action you take on the information in this analysis is strictly at your own risk. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Good luck :-)

GBPCAD Trading IdeaBased on Simple Technical Analysis ( Trendline + Support & Resistance )

Risk Disclaimer:

Please be advised that I am not telling anyone how to spend or invest their money. Take all of my analysis as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this page, and they are for educational purposes only. Any action you take on the information in this analysis is strictly at your own risk. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Good luck :-)

USDCAD, We need a up leg in US. On the USDCAD pair, the most logical expectation would be for price to continue falling, but from these levels and considering the time of year, a small bullish rebound is more than reasonable.

Remember to protect the trade around breakeven as soon as possible.

Thanks and blessings. 🎄📈✨

EURUSD Pullback Toward 1.17500 Keeps Bullish Structure IntactHey Traders,

In today’s trading session, we are monitoring EURUSD for a potential buying opportunity around the 1.17500 zone.

The pair remains in a well-defined uptrend and is currently undergoing a healthy corrective move. Price is approaching the 1.17500 area, a key zone of confluence where trend support aligns with a former support/resistance level. This area has previously attracted strong participation, making it technically significant.

As long as this level holds, the broader bullish structure remains intact, and a positive reaction here could support a continuation toward recent highs.

don't forget to support us with boost and leave your opinion on the comment section!

Trade safe,

Joe

GBPNZD Trading IdeaBased on Simple Technical Analysis ( Trendline + Support & Resistance )

Risk Disclaimer:

Please be advised that I am not telling anyone how to spend or invest their money. Take all of my analysis as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this page, and they are for educational purposes only. Any action you take on the information in this analysis is strictly at your own risk. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Good luck :-)

GBPAUD Trading IdeaBased on Simple Technical Analysis ( Trendline + Support & Resistance )

Risk Disclaimer:

Please be advised that I am not telling anyone how to spend or invest their money. Take all of my analysis as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this page, and they are for educational purposes only. Any action you take on the information in this analysis is strictly at your own risk. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Good luck :-)

EURNZD Trading IdeaBased on Simple Technical Analysis ( Trendline + Support & Resistance )

Risk Disclaimer:

Please be advised that I am not telling anyone how to spend or invest their money. Take all of my analysis as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this page, and they are for educational purposes only. Any action you take on the information in this analysis is strictly at your own risk. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Good luck :-)

EURAUD Trading IdeaBased on Simple Technical Analysis ( Trendline + Support & Resistance )

Risk Disclaimer:

Please be advised that I am not telling anyone how to spend or invest their money. Take all of my analysis as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this page, and they are for educational purposes only. Any action you take on the information in this analysis is strictly at your own risk. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Good luck :-)

USDJPY Bullish ConsolidationUSDJPY remains in a clear bullish structure, characterized by higher highs and higher lows on the daily timeframe. After a strong bullish impulse, price is now moving in upper-range consolidation, which signals continuation and accumulation rather than reversal. As long as range support and the rising trendline hold, any downside movement is likely a healthy pullback, with the potential for a breakout to the upside to resume the broader uptrend.

From a fundamental perspective, the bullish bias is supported by monetary policy divergence. The US dollar stays relatively strong even as markets price in gradual rate cuts by the Federal Reserve, while the Japanese Yen remains weak due to the accommodative stance and cautious normalization approach of the Bank of Japan. Unless there is a major shift in policy expectations or a sharp risk-off move, the outlook favors continued USDJPY strength following this consolidation phase.

Build a PF 10+ "God" Strategy in 1 Min(Live: Total Ruin Awaits) Traders, you've seen them all over TradingView: strategies with Profit Factors (PF) of 10+, 15+, and even 20+. Backtests look god-tier—gross profit 10-20x gross loss, equity curve smooth as silk, annualized returns in the thousands. You think, "This is the Holy Grail!" and go live in full size.

Then reality hits: the market shifts a little, the strategy goes silent or starts bleeding, a string of losses, a massive drawdown... or total account wipeout.

Why? Because a PF of 10+ is dangerously easy to fake through aggressive curve-fitting/over-optimization. You're forcing the strategy to match past data, not discovering a real edge perfectly.

In 1 minute, the three classic tricks to "build" insane PF... then expose why they almost always blow up live.

Trick 1: Parameter Hunting Until You Find the "Magic Numbers"

How: Fire up the strategy optimizer (or manually tweak in Pine Script). Test hundreds/thousands of combinations of periods, thresholds, and filters.

Example: You discover a 47-period EMA + RSI at exactly 62.7 threshold + a specific session filter "magically" catches every single turn in the last 5 years.

Result: Almost every historical move is "predicted" perfectly, big winners, tiny losers → PF shoots to 10-20+ instantly. Backtest looks flawless.

Trick 2: Over-Segmentation + In-Sample Fitting

How: Split data into bull/bear/range regimes and optimize separate "best" parameters for each, or use rolling/walk-forward that still stays mostly in-sample.

Go nuclear: Stack 10+ filters (volume spikes, specific hours, news-day exclusion) until only the "perfect" trades remain.

Result: The strategy only trades when history was "kind"—PF explodes because ugly periods are filtered out.

Trick 3: Brutal Fitting on Small or Cherry-Picked Samples

How: Use just 1-2 years of data (especially a strong trending bull run) and optimize aggressively until it hugs every candle.

Or throw in a kitchen-sink of indicators (10 MAs + 5 oscillators + dozens of combos)—run the optimizer overnight, and it will always find a unicorn parameter set with insane PF.

Why 99% Blow Up Live (This Is the Sneakiest Killer):

All these tricks teach a strategy for predicting the past, not the future.

As soon as market regime changes (volatility shift, macro environment, black swan), your "magic 47-period" stops working. Fake breakouts everywhere.

What was PF 15 in backtest drops to 0.6 or worse, live—string of losses eats the account.

Overfit strategies are fragile glass: the more perfect the backtest, the more spectacular the future failure. Pros call it data-mining bias.

Institutions laugh at PF 10+ screenshots.

They check:

Out-of-sample performance consistent?

Parameter robustness (small change → PF still stable)?

Works across different regimes?

Overfit strategies fail these tests instantly.

Final Warning: Stop Worshipping Perfect Backtest Curves

Anyone can create a PF 10+ monster in minutes. Saving the account afterward? That's the hard part that takes years.

Stop fitting history. Stop hunting "perfect" parameters.

Real edge is simple, robust, explainable—and survives the future.

Survive first. Only then conquer.

GBPUSD: Bearish Forecast & Bearish Scenario

The price of GBPUSD will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDCHF at Key SupportUSDCHF is currently trading at the lower boundary of a long-term descending range, where price has repeatedly found support in the past. Technically, this area opens the possibility of a short-term rebound, as selling pressure may temporarily weaken and buyers attempt to defend the range low. A corrective move toward the mid or upper range is possible if support holds. However, the broader structure still shows lower highs within a descending channel, meaning any bounce is likely corrective rather than a full trend reversal. A clean break below the range support would signal a bearish continuation, opening downside potential toward lower levels.

From a fundamental perspective, USDCHF is driven by policy divergence and risk sentiment. The US dollar is facing pressure from expectations of gradual rate cuts by the Federal Reserve, which reduces yield support for USD. Meanwhile, the Swiss Franc remains relatively resilient due to its safe-haven status and the steady policy stance of the Swiss National Bank. As long as global uncertainty persists, CHF strength may cap USDCHF upside, making the current support zone a key decision area between a temporary bounce and a broader bearish breakdown.

EUR/USD has hit the 1.1800 Resistance.* The U.S. dollar has struggled lately, weakening against many currencies, including the euro — partly due to expectations of Federal Reserve rate cuts in 2026 and slower U.S. inflation. This trend supports EUR/USD upside.

EUR/USD has hit the 1.1800 Resistance. and now it seems possible to move from 1.1700-1.1725 to 1.18750.

CHFJPY in Consolidation: Awaiting the Next DirectionCHFJPY is currently moving sideways within a consolidation range after a prior bullish impulse, indicating that the market is absorbing liquidity and has not yet committed to the next directional move. The price structure remains constructive, with higher lows still being respected, meaning that as long as range support holds, the bias favors a bullish continuation. A reasonable scenario is a shallow pullback toward range support, followed by a potential push higher toward the upper boundary.

From a fundamental perspective, this pair is influenced by the safe-haven nature of both currencies. The Japanese Yen remains structurally weak due to accommodative policy and cautious normalization by the Bank of Japan, while the Swiss Franc is relatively stable but may lose some appeal if global risk sentiment improves, given the measured policy stance of the Swiss National Bank. This combination keeps the short-term bias mildly bullish for CHFJPY, unless a strong risk-off shock triggers broad Yen strengthening.

AUDUSD A Fall Expected! SELL!

My dear friends,

My technical analysis for AUDUSD is below:

The market is trading on 0.6715 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.6613

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD Will Go Down! Short!

Here is our detailed technical review for EURUSD.

Time Frame: 8h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 1.177.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 1.168 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

EURUSD - Bears can't keep the pace with bullsOn the EURUSD chart, we can see clearlly that bulls have more power on the long run.

Daily chart present to us more liquidity zones higher, arround 1.18199 (and the last high) wich both form EQ highs.

Fractal point of view, daily chart is bullish, with the fractal low at 1.17022. From the fractal low to fractal high we do have daily FVG wich can act as a magnet for the price. Also daily fractal can change, making it bearish because the last fractal is actually a liquidity point itself as bellow it is resting a fresh demand zone protected by another FVG.

Moving on to the 4h chart, fractal wise we still have bullish momentum, fractals are bullish but last low fractal is looking very much likelly that it will be liquidated so that also the 4h chart can link-up with the 4h FVG (inside the daily FVG).

So a quick 1:1 trade for eu is very much likely to happen in my point of view, as a countertrend short for a market that is looking for a strong 2026 bullish movement.

As a confluence, the 1h chart is already changing to bearish for today, as price already reacted from the BB from the zone 1.17873 with another confluence that fractal is bearish on 1h chart.

Right now we do have another BB close to our price right now, wich i am considering to resist and give the price more power to move to downside respecting the 1h fractal high.

It is a quick trade, looking to make a connection with internal liquidity for a future long plays.

AUDCHF Will Move Lower! Sell!

Take a look at our analysis for AUDCHF.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 0.529.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 0.528 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

AUD/NZD SHORT FROM RESISTANCE

Hello, Friends!

It makes sense for us to go short on AUD/NZD right now from the resistance line above with the target of 1.148 because of the confluence of the two strong factors which are the general downtrend on the previous 1W candle and the overbought situation on the lower TF determined by it’s proximity to the upper BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅