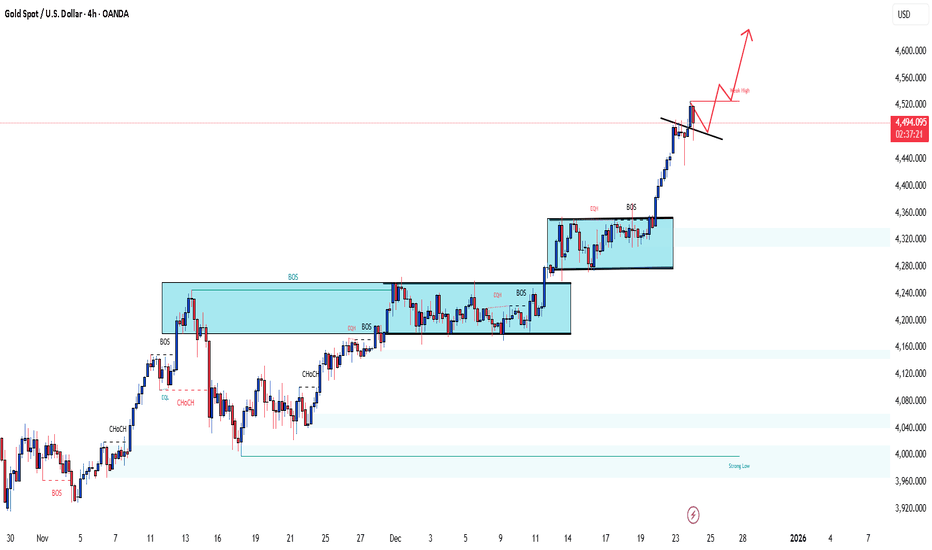

WILL GOLD RAMAIN CAPPED UNDER 4525 ZONE ?Gold is currently trading around 4488, with a resistance zone near 4525 and support around 4470. After breaking above the 4500 psychological level, price initially suggested bullish intent; however, the 4525 area is acting as strong resistance.

The recent move appears to be a bullish fake-out near all-time high levels, and signs of profit-taking are emerging as investors position themselves ahead of the New Year. This could increase downside pressure in the short term.

If selling momentum continues, a bearish move toward the 4430 demand zone becomes more likely.

Key levels should be monitored closely for confirmation and price reaction.

Futures market

Gold Reaches Fresh Record HighsHello my friends,

Gold prices continue to surge, reaching a record high around 4,505 USD during this morning’s trading session. The precious metal is being driven higher by rising safe-haven demand as the Israel–Iran conflict and escalating tensions between the United States and Venezuela fuel geopolitical uncertainty. In addition, recently subdued U.S. inflation and weak labor market reports have increased market expectations for at least two 25-basis-point rate cuts from the Federal Reserve next year, a backdrop that is clearly supportive for gold.

From a technical perspective, there are no signs of weakness in gold. The nearest support stands around 4,470 USD. As long as prices remain above this level, any short-term pullbacks are considered healthy, and buyers retain the upper hand until a new high is formed.

XAUUSD – H4 Outlook: Lana waits for a pullback to buy while respecting the high resistance zone 💛

Quick summary

Main trend: Strong bullish structure remains intact

Timeframe: H4

Context: Year-end liquidity is thin → price can be choppy and sweep liquidity easily

Strategy: Prefer buying pullbacks, and stay cautious near 4577–4580 resistance

Macro context (brief)

Fresh data shows the U.S. economy is still growing strongly (GDP +4.3%) while inflation sits around 2.8%, supporting Powell’s cautious stance. Rising long-term Treasury yields suggest markets value the Fed’s independence and remain sensitive to long-run inflation risks if policy becomes politicized.

For gold, this backdrop can still be supportive, but short-term price action may be irregular due to thin year-end liquidity.

Technical view (H4)

Price has broken the previous ATH and continues to respect the rising channel. After such a steep rally, a technical pullback is normal as the market rebalances before the next leg higher.

Lana won’t chase price at elevated levels. Instead, I wait for price to return into liquidity / value areas to look for continuation buys.

Key levels Lana is watching

Primary buy zone (liquidity-based)

Buy: 4415 – 4418

This area aligns with liquidity/value and is a clean zone to watch for bullish reaction after a mild pullback.

Deeper buy zone (safer positioning)

Buy: 4370 – 4375

This was the prior ATH area and can act as a key support after the breakout.

Resistance to respect

4577 – 4580: A major resistance zone (Fibonacci extension). If price reaches this area, a short reaction/pullback is possible.

Trading plan

Focus on buying pullbacks, not chasing tops.

Use the lower timeframe for confirmation (Dow structure) before entering.

With thin liquidity: reduce size, keep stops clear, and consider scaling out as price reacts.

Lana’s note 🌿

The trend is strong, but entries matter more than direction. I’d rather wait for a clean zone and protect risk than trade from emotion.

This is Lana’s personal market view, not financial advice. Please manage your own risk before trading. 💛

Lucky Day! Trading continues, US session strategy update

Today's trading was flawless. At the Asian session open, gold rallied again, and we accurately shorted at the 4495 resistance level. Our long position near 4450 in the US session was also closed for a profit near 4475. The highlight was our timely and decisive warning at 4475 that a pullback was possible, reminding everyone that the pullback was a buying opportunity. These trades weren't just empty words; they were executed under your witness. Feel free to check our historical recommendations to verify their accuracy.

Gold is currently consolidating at high levels and remains strong. However, considering Thursday is Christmas, caution is advised on Wednesday as some profit-taking may occur before the holiday, potentially causing short-term pressure. Therefore, caution is needed during the US session; chasing the rally is not recommended. The strategy remains to buy on dips. Currently, support is seen in the 4430-40 area, with strong support at 4420-4400. Specific real-time trading strategies can be found through the channel entry.

The market is constantly changing, and trading methods need to be adjusted accordingly. True high-level trading is not about scouring vast amounts of information, but about extracting the essence, focusing on the most effective signals, repeatedly applying them, and continuously optimizing them. The simpler the strategy, the more stable the results. The more focused the execution, the more profitable the trade will be in the face of market fluctuations. Our stable returns are the best proof.

I focus solely on short-term trading and clear market analysis. In short-term trading, there is no perpetually rising or falling market, only the correct entry point at any given moment. Find the rhythm and follow the trend. This is the essence of trading. Currently, you must seize every opportunity to buy on dips. If you're struggling to execute trades precisely, try my method: start with a small position to test the market, then add to your position during pullbacks. This way, you won't miss any opportunities. If you need to recover significant losses or obtain precise trading signals, feel free to contact me. Let's work together to flexibly and steadily pursue greater profits in the ever-changing market!

Bying EthOutlook and ForecastsAnalysts project upside into 2026:Short-term — $3,200–$3,900 by year-end or early 2026

Bullish scenarios — $6,000–$8,000+ on renewed inflows and upgrades

Long-term — Potential for $10,000+ by 2030 if adoption in RWAs and AI-related dApps accelerates

In summary, late December 2025 offers a moment of weakness driven by macro caution and profit-taking, but Ethereum's fundamentals—upgrades, ecosystem dominance, and institutional tailwinds—remain intact. This could be an attractive time to accumulate for those with a multi-year horizon, though expect volatility and consider dollar-cost averaging. Always assess your risk tolerance; crypto investments carry substantial downside potential.

PROFIT TAKING AT PSYCHOLOGICAL LEVEL AND IMPACT ON GOLDGold is currently trading around 4486, with 4497 acting as near-term resistance and 4435 as a key support level.

Price is approaching a psychological area, where profit-taking pressure often emerges after extended upside moves.

If gold fails to gain acceptance above resistance and selling pressure persists, a pullback toward the 4400 area becomes more likely.

Reactions around these levels will be important to gauge whether the move is corrective or develops into a deeper retracement.

Sorry, I'm still buying gold!Gold surged past $4,500 per ounce on Wednesday to a fresh record, driven by expectations of further Federal Reserve easing and rising geopolitical tensions.

US economic growth remained solid in the third quarter, with GDP expanding at a faster pace than in the prior period, although labor market data pointed to continued but gradually moderating job creation.

Markets are still pricing in two rate cuts in 2026 as inflation cools and employment conditions soften, even as policymakers remain divided.

Meanwhile, tensions involving Venezuela, where the US has blockaded oil tankers, have lifted safe-haven demand and increased geopolitical risk across commodity markets.

Bying silverAnalysts project sustained upside into 2026, with some targeting $80-100+/oz amid ongoing deficits and demand growth. Long-term forecasts (to 2030) remain bullish due to the green/digital economy's reliance on silver.In summary, December 2025 represents a moment of extreme momentum driven by fundamentals that show no signs of reversing soon. However, short-term pullbacks are possible in volatile markets—inflation hedges like silver can shine during uncertainty but carry risks. Always consider your risk tolerance and diversify

XAU/USD Range Market – Sell from PremiumGold is currently trading in a clear ranging (TR) environment after the recent bullish expansion. On the H1 timeframe, price has reacted from the premium zone near the previous highs, while liquidity remains stacked below the range.

🔻 Sell Scenario:

Price is expected to react from the 4303 – 4306 resistance zone, aligned with prior distribution and rejection. This area favors short-term sell opportunities while the market remains inside the range.

🔺 Buy Scenario:

The 4247 – 4245 zone represents a liquidity pocket below the major value area, offering a favorable risk-to-reward setup. With a tight stop-loss, buy limit orders are valid if price sweeps liquidity and shows reaction.

📌 Key Levels:

Resistance: 4303 – 4306

Support / Liquidity: 4247 – 4245

As long as price stays within the range, sell from premium and buy from discount remains the primary strategy. Always respect stop-loss levels and manage risk accordingly.

Will ES_F See New Highs Or A Rug Pull?Right now the Bulls are right at an important level as we are testing the previous lower high I have been talking about for a couple of days now. This is the first level to reclaim along with 6985 if the Bulls want to keep the momentum going into the end of the year. We now have four straight red days followed by four straight green days and we have almost retraced the failed breakout from December 11th. We are going to have even lower volume during RTH than we saw today so watch out for fake moves on either side. The Bulls are definitely in the driver seat but the Bears still have two more chances to put a damper on this rally.

Check out my Substack (link in Bio) for clear levels on both sides of the ES_F and SPX action.

Stop!Loss|Market View: GOLD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for GOLD ☝️

Potential trade setup:

🔔Entry level: 4471.202

💰TP: 4334.376

⛔️SL: 4539.615

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Gold is fulfilling the previously outlined scenario, and given the current market situation for this metal, a potential reversal is likely. Specifically, a false breakout has formed, and if it is confirmed (with the price not moving above 4493), we can expect a decline toward key supports near 4380. Trend support and the latest price accumulation can also be targeted. All of this is located near the 4300 area.

Thanks for your support 🚀

Profits for all ✅

BUY ASSET XAUUSD [GOLD]BUY TRADE

Gold Trade Explanation

I followed higher timeframe direction first.

Price was trading in a clean area with clear structure.

I waited for confirmation before entering.

The entry was taken only after price showed acceptance in my zone.

Risk was predefined before execution.

No chasing. No adjustments after entry.

The trade respected structure and continued as expected.

Execution followed plan and timing rules.

This was a rules-based trade.

Process first. Outcome second.

XAUUSD 15M Chart: High, Medium, Low Risk Zones Marked

"Analyzing XAUUSD on the 15M timeframe with defined risk zones.

· Very High Risk: 4479.903 / 4472.164

· Medium High Risk: 4441.037 / 4429.428

· Low Risk: 4418.660 / 4406.546

Monitoring price reactions at these levels for intraday setups.

#XAUUSD #GoldTrading #RiskManagement #Intraday #TradingView"

23 DEC 2025: NQ1! MARKET RECAPLAY OF THE LAND

DISCLAIMER:

The owner of this page is an authorised Representative under supervision of TD MARKETS (PTY) LTD, an authorised Financial Services Provider (FSP No. 49128) licensed by the Financial Sector Conduct Authority (FSCA) under the Financial Advisory and Intermediary Services Act (FAIS).

The FSP is licensed to provide advice and intermediary services in respect of Category I financial products, including but not limited to derivative instruments, long-term deposits, and short-term deposits.

All investment ideas are provided in accordance with the scope of the FSP's license and applicable regulatory requirements. Derivative instruments is a leveraged products that carry high risks and could result in losing all of your capital, and past performance is not indicative of future results.

This idea and any attachments are informational/education and does not constitute a recommendation to buy/sell.

No guarantee is made regarding the accuracy or outcome of this trade idea.

If you choose to accept this idea, please do so at your own risk.

Copper (XCUUSD) 4H Analysis | Buyers Still in Control👋 Hello TradingView Traders!

Hope you’re all doing great and catching green pips in the market 📈🌱

Let’s take a look at XCUUSD (Copper / US Dollar) together.

🔎 Symbol Overview

Copper is one of the most important industrial metals and often acts as a leading indicator of global economic activity 🌍🏗️

Its price behavior is closely tied to industrial demand, infrastructure growth, and macroeconomic conditions, making it a valuable asset for trend analysis.

📈 Overall Market Structure

On the 4H timeframe, the chart is clearly maintaining a well-structured bullish trend:

Consistent Higher Highs & Higher Lows

Price moving within a clean ascending channel

Strong respect for the drawn trendlines

All these factors suggest that buyers are still in control, and the bullish momentum remains dominant 🐂💪

🧱 Key Levels & Technical Structure

🔹 Major Static Support

The highlighted support zone was previously a resistance level.

After a daily breakout, price has flipped this level into a strong support — a classic trend continuation signal 🔄✅

🔹 Dynamic Support

The rising trendline and its parallel structures below price act as dynamic support.

Any pullback into this zone can be considered a healthy retracement within the bullish trend 📐🟢

🔹 Price Projection Scenario

As long as price holds above these support zones:

Primary scenario: Continuation to the upside 🚀

Pullbacks are viewed as corrective moves, not trend reversals 🧘♂️

🧠 Technical Summary

✔️ Market Structure: Bullish

✔️ Support Zones: Strong & Well-Defined

✔️ Price Action: Trend-Respecting

✔️ Dominant Bias: Bullish Continuation 🟢🐂

Overall, unless we see a clear breakdown below the marked supports, the bullish outlook remains the higher-probability scenario.

⚠️ Disclaimer

This analysis is for educational purposes only and does not constitute financial advice.

Always apply proper risk management, use stop losses, and trade according to your own strategy and risk profile ❗🧠

📊 What’s Your View?

💬 Do you expect:

Further bullish continuation toward higher targets? 🚀

Or a deeper corrective pullback first? 🔻

Drop your thoughts in the comments, don’t forget to Like ❤️, Follow 🌟,

and let’s grow together as a trading community 🤝📈

Hellena | Oil (4H): SHORT to support area of 55.74 (Wave 5).Colleagues, wave “4” of the minor order is ending or has already ended. As part of a major downward movement in wave ‘5’ of the major movement, I expect a downward movement in wave “5” of the minor order.

This wave should update the low of wave “3”, but I believe it is worth looking at the nearest target in the support area of 55.746.

I also allow for the possibility of reaching the 59.00 area before the price begins a downward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

NIFTY INTRADAY VIEW — TIME & PRICE ANALYSISNIFTY INTRADAY VIEW — TIME & PRICE ANALYSIS

Buy on Dips | Dual Time Window Active

Nifty is trading within a well-defined intraday Time & Price support structure.

As long as price respects the Laxman Rekha, dips are likely to attract buyers rather than trigger panic.

🔑 Key Levels

CMP: 26,220

Target 1: 26,295

Target 2: 26,345

Laxman Rekha (Line in the Sand): Below 26,155

Strategy: Buy on Dips

Time Window: 13:55 or 15:25

This setup is about timing over prediction.

If price holds above the Laxman Rekha, intraday pullbacks can act as fuel for the next leg higher within the defined time windows.

No chasing.

No emotional entries.

Just structure + timing + discipline.

⚠️ Disclaimer

This analysis is for educational purposes only and reflects personal market views. Please manage risk as per your own trading plan.

The price of gold still has room for further increase!Gold prices continue to surge, reaching a record high around 4,505 USD during this morning’s trading session. The precious metal is being driven higher by rising safe-haven demand as the Israel–Iran conflict and escalating tensions between the United States and Venezuela fuel geopolitical uncertainty. In addition, recently subdued U.S. inflation and weak labor market reports have increased market expectations for at least two 25-basis-point rate cuts from the Federal Reserve next year, a backdrop that is clearly supportive for gold.

From a technical perspective, there are no signs of weakness in gold. The nearest support stands around 4,470 USD. As long as prices remain above this level, any short-term pullbacks are considered healthy, and buyers retain the upper hand until a new high is formed.

GOLD → Long squeeze support could strengthen the price to 4500FX:XAUUSD continues its aggressive rally. The price has reached a new high of 4497.5, leaving a small gap of $2.5 to 4500 (insurance against profit-taking???). A retest of support could renew interest in buying...

Statements by US Treasury Secretary Bentsen about a possible transition to inflation targeting (instead of a fixed target of 2%) undermine confidence in the Fed's long-term policy.

• The escalation of US sanctions against Venezuela (detention of tankers) and continued tensions in Ukraine and the Middle East are boosting demand for defensive assets.

Today, US GDP data for the third quarter and durable goods orders are expected. Speeches by Fed members may cause increased volatility amid low liquidity (end of the year).

The upward trend in gold continues, but in order to continue growing, the market may switch to liquidity hunting mode and form retests of support levels...

Resistance levels: 4497.5, 4500, 4510

Support levels: 4470, 4460, 4450

The 4470 zone is a liquidity pool; a retest or long squeeze could resume the rally. However, I do not rule out that, against the backdrop of the news, gold may test 4460 - 4450 before continuing to grow. In the current situation, all attention is focused on the range of 4470 - 4500.

Best regards, R. Linda!

Gold will adjust downwards below 4500!⭐️GOLDEN INFORMATION:

Gold (XAU/USD) retreats modestly from its fresh record peak at $4,526 during early European trading on Wednesday, as short-term traders lock in profits following the recent sharp rally. The pullback is further reinforced by stronger-than-expected US Gross Domestic Product data, which tends to underpin the US Dollar and, in turn, creates headwinds for USD-denominated assets such as Gold by increasing their relative cost for non-US investors.

That said, downside risks for the yellow metal appear contained. Ongoing geopolitical uncertainty—most notably surrounding tensions between the United States and Venezuela—continues to support safe-haven demand, providing an underlying bid that may help limit deeper corrective moves.

⭐️Personal comments NOVA:

Gold is consolidating and correcting downwards after reaching its all-time high of 4526.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4524 - 4526 SL 4531

TP1: $4515

TP2: $4500

TP3: $4485

🔥BUY GOLD zone: 4404 - 4406 SL 4399

TP1: $4420

TP2: $4435

TP3: $4450

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account