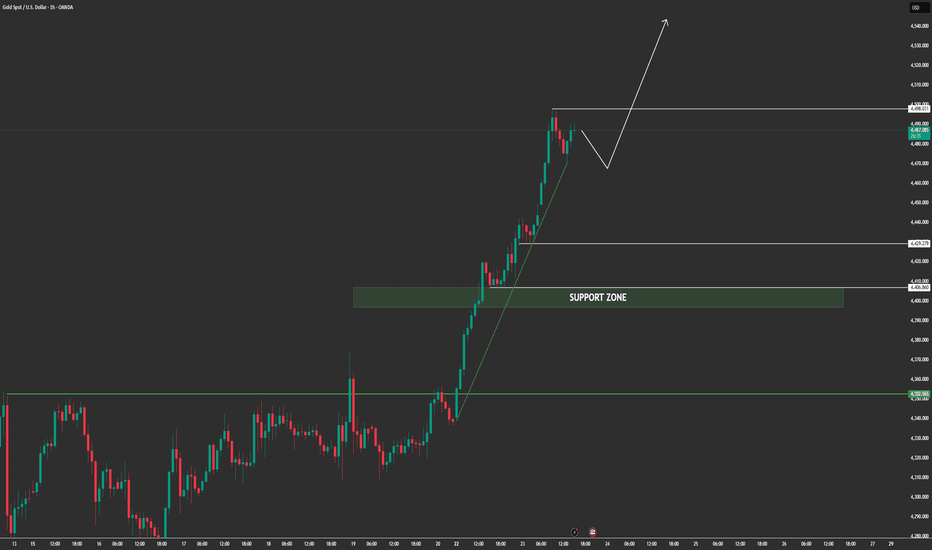

XAUUSD H4Market Structure

Strong bullish impulse with clear higher highs & higher lows.

Price is respecting the short-term ascending trendline.

Current price is in a consolidation just below resistance, typical before continuation.

Key Levels

Immediate resistance / sell-side liquidity:

4,515 – 4,520

Major sell-side liquidity target:

4,580 – 4,600

Buy-side liquidity / demand:

4,446 – 4,440

4,378 – 4,365 (stronger demand zone)

Invalidation:

Below 4,330

Price Action & Liquidity Logic

After the impulsive move, price is forming a bullish flag / compression.

Likely sequence:

Minor pullback to collect buy-side liquidity near 4,446 – 4,440

Continuation push to sweep sell-side liquidity at 4,515

Extension toward 4,580 – 4,600

A deeper pullback toward 4,378 – 4,365 would be healthy, not bearish.

Futures market

XAUUSD D1Market Structure

Overall structure remains bullish with clear higher highs & higher lows.

A CHOCH (Change of Character) earlier confirmed the shift to bullish control.

Price is moving along a rising trendline, showing strong demand.

Key Levels

Current price area: ~4,493

Buy-side liquidity (demand):

4,360 – 4,330 (major liquidity pool / trendline support)

Sell-side liquidity (supply):

4,580 – 4,600

4,710 – 4,720 (major upside target)

Intermediate resistance:

4,515 – 4,520

Price Action & Liquidity

Strong impulsive bullish candle broke above previous resistance.

Likely scenario:

Sweep sell-side liquidity above 4,550 – 4,600

Then a pullback into buy-side liquidity (4,360 – 4,330)

Followed by continuation higher toward 4,700+

This reflects a classic liquidity grab → retracement → expansion model.

Trading Scenarios

🔵 Primary Bullish Scenario (Preferred)

Buy on pullback into 4,360 – 4,330

Confirmation: bullish rejection / strong H4–D1 close

Targets:

TP1: 4,515

TP2: 4,600

TP3: 4,710 – 4,720

Stop-loss:

Below 4,300

🔻 Short-term Countertrend Sell (Aggressive)

Sell near 4,580 – 4,600 (liquidity sweep)

Target:

4,400 – 4,360

Tight SL above 4,620

⚠️ Countertrend — lower probability, manage risk carefully.

Bias Summary

📈 Medium & long-term: Bullish

🔄 Expect deep pullbacks but trend remains intact while above 4,300

🧠 Best R:R comes from buying dips, not chasing highs

If you want, I can:

Refine H4/H1 entries

Build a liquidity-based execution model

Align this setup with USD & macro fundamentals

XAUUSD (ONDA) IntraSwing Levels For 24th -25th Dec(3.30 am) 2025XAUUSD (ONDA) IntraSwing Levels For 24th -25th Dec(3.30 am) 2025

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

Do comment if Helpful .

Do Comment for In depth Analysis.

❇️ Follow notification about periodical View

Gold Is Repricing, Not PumpingGOLD (XAUUSD) – KEY POINTS

Technical

Clean break & hold above previous high (~4,380)

Old resistance → new support confirmed

Structure shows higher highs, higher lows

Pullbacks are continuation, not reversal

Macro / Financial Drivers

USD softening → supports gold

Real yields compressing → bullish for XAUUSD

Central bank buying absorbing dips

Year-end defensive flows into safe havens

Outlook

Bias: Bullish continuation

Strategy: Buy pullbacks, avoid FOMO

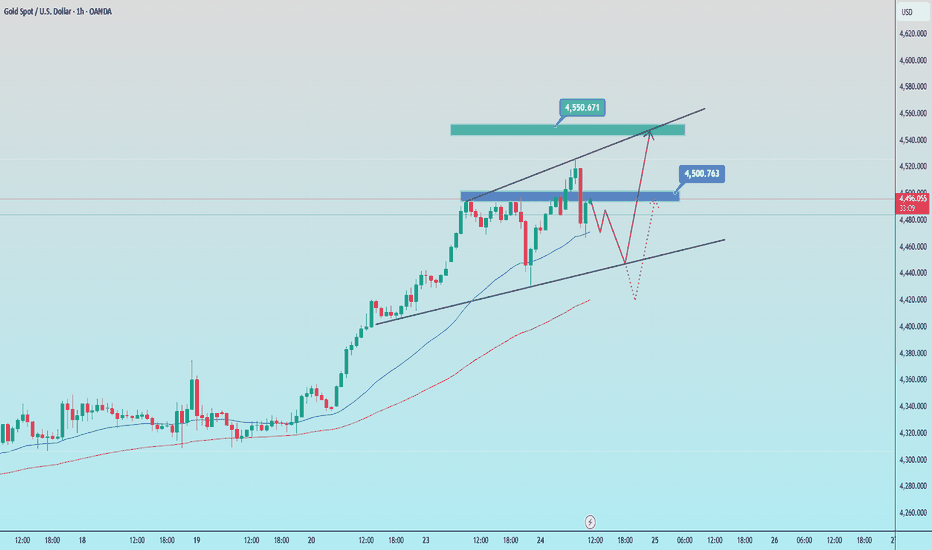

Gold (XAUUSD) – 4H Continuation After Bullish ConsolidationHi!

Market Structure:

Gold remains in a strong ascending channel, maintaining higher highs and higher lows. After briefly breaking above the mid-channel resistance, price respected the broader bullish structure, confirming trend continuation rather than reversal.

Price Action & Patterns:

The market experienced a healthy 40% corrective consolidation, followed by a strong impulsive leg that broke the local channel. This move was followed by a pennant formation, accompanied by a controlled 50% correction, indicating bullish compression rather than distribution.

Support & Demand Zone:

Price is currently pulling back into a key demand area, aligned with former resistance and the channel support. This zone is critical for continuation and provides a favorable risk-to-reward structure for trend-following setups.

Upside Scenarios:

If price holds above this demand zone, continuation toward the upper channel boundary becomes the primary scenario, with extended targets toward the 4,550–4,580 region based on channel projection.

Invalidation:

A decisive breakdown below the demand zone and channel support would weaken the bullish bias and signal deeper consolidation.

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Gold Isn’t Topping — This Is a PauseGOLD (XAUUSD) – H1

Technical Structure + Macro Context

1. Price Action & Structure

Gold just delivered a strong impulsive breakout, accelerating vertically from the 4,35xx base.

Current price action is consolidating just below the recent high, not rejecting.

This behavior = bullish continuation, not distribution.

Key observation:

➡️ Strong moves don’t reverse at the high — they pause, absorb liquidity, then expand.

2. Key Levels on Chart

Immediate Resistance / Pause Zone: ~4,485 – 4,500

Support Zone (Buyers’ Control): ~4,400 – 4,415

Trend Support: Rising impulse trendline remains intact

As long as price holds above 4,400, the bullish structure remains valid.

3. Market Psychology

Sellers failed to push price back below the support zone.

Pullbacks are shallow and corrective, showing weak selling pressure.

Liquidity is being absorbed above former resistance → acceptance at higher prices.

This is a textbook bullish flag / continuation pause.

4. Macro & Financial Drivers

USD Weakness:

Market expectations are shifting toward slower Fed tightening / future easing bias.

Real yields are stabilizing → USD momentum fades.

Safe-Haven & Inflation Hedge Demand:

Ongoing geopolitical uncertainty keeps risk premium priced into gold.

Central bank gold accumulation remains structurally supportive.

Inflation expectations remain sticky → gold retains long-term demand.

➡️ Macro environment continues to favor gold upside, not aggressive selling.

5. Forward Scenarios

Primary Scenario (High Probability):

Short-term pullback into 4,440–4,460

Continuation toward 4,520 → 4,550 zone

Invalidation:

Clean breakdown and acceptance below 4,400 would pause the bullish cycle.

🧠 Final Takeaway

Gold is not overextended it is repricing higher.

Gold Breaks the Channel — Momentum Is Still BuildingGOLD (XAUUSD) – 1H QUICK VIEW

Technical

Clear breakout above ascending channel resistance → bullish continuation signal.

Price holds above EMA34 & EMA89, confirming strong trend control.

Current move = breakout → shallow pullback → potential next impulse.

As long as price stays above the broken trendline, upside bias remains valid.

Key Levels

Immediate support: ~4,450 – 4,430 (retest zone)

Upside extension: 4,520 → 4,580+

Macro / News Context

USD remains under pressure as markets price in future rate cuts.

Real yields stay soft, supporting non-yielding assets like gold.

Ongoing geopolitical tensions & central bank gold accumulation keep demand elevated.

Bias

Buy pullbacks, not breakouts.

Trend remains bullish unless price falls back inside the channel.

Gold Is Not Overbought — This Is a Controlled ExpansionGOLD (XAUUSD) – SHORT ANALYSIS (1H)

Technical

Strong impulsive uptrend with shallow pullbacks → bullish strength.

Price holds well above EMA34 & EMA89 → trend intact.

Previous resistance (~4,430–4,450) flipped into key support.

Current move = impulse → brief consolidation → continuation.

Key Levels

Support: 4,430 – 4,450

Upside continuation: 4,520 → 4,580+

Macro / News Drivers

USD softness and easing real yields support gold.

Ongoing rate-cut expectations keep dip-buying active.

Persistent geopolitical risk & central bank demand underpin bullish bias.

Bias

Buy the pullbacks, not chase highs.

As long as price holds above the new support, trend continuation remains the base case.

Silver Extends Higher as Wave ((iii)) Remains in ProgressSilver (XAGUSD) maintains a bullish Elliott Wave structure with pullbacks offering buying opportunities

It continues to trade firmly higher and maintains a bullish structure. Price action respects the broader Elliott Wave sequence and keeps favoring the upside while key support levels hold. The rally from the prior swing low remains impulsive and shows no signs of exhaustion yet. From the earlier low, Silver completed a corrective phase and then turned higher in a clear impulsive advance. This move confirms that wave ((ii)) has already ended. Price has since resumed higher within wave ((iii)). Momentum remains strong, which is typical during a third-wave sequence.

Within wave ((iii)), Silver is unfolding higher in wave (i). Wave (ii) has already completed as a corrective pullback. Price has now pushed higher into wave (iii), showing strong upside acceleration. Inside this advance, red sub-wave iii appears advanced. Because of this, a brief pause or pullback may develop in the near term. Any short-term pullback should form as red wave iv and stay corrective in nature. This correction should unfold in a 3, 7, or 11 swing structure. Once complete, it should offer a buying opportunity near the extremes of the pullback. As long as Silver holds above the invalidation level at 60.753, the bullish outlook remains unchanged.

The broader structure continues to favor higher prices, and selling is not recommended at this stage. Pullbacks should be viewed as pauses within the trend rather than signs of a larger reversal.

WHY TRADING CLARITY COMES ONLY IN 3D ?🔄 Core Principle

• Each timeframe is like an independent world.

• In every world, we use three lenses:

• Macro: The broader outlook within that timeframe.

• Meso: The mid‑range cycles and routines inside that timeframe.

• Micro: The present moment and immediate details of that timeframe.

📊 Example (Daily Timeframe)

• Macro in Daily: The overall trend of daily candles over the past few months — the bigger picture.

• Meso in Daily: Mid‑range waves or corrections lasting several days within the daily chart.

• Micro in Daily: The current daily candle, today’s volume, and the quality of the immediate action.

This way, every timeframe carries its own three‑layered perspective:

big picture, mid‑cycle, and present moment.

Gold Is Not Overextended — This Is Wyckoff Markup in ProgressXAUUSD (H1) — MARKET ANALYSIS

1. Market Structure (Wyckoff Context)

Gold has clearly completed a Wyckoff accumulation cycle and is now operating inside a confirmed Markup Phase.

Phase A: Selling pressure was absorbed, volatility expanded, and downside momentum was halted.

Phase B: Price transitioned into a broad consolidation, where supply was systematically absorbed while holding above key moving averages.

ST in Phase B: The final liquidity test confirmed strong demand.

Current State: Price has broken out decisively and is now in trend continuation, not distribution.

This structure validates that the current rally is institutionally driven, not a retail spike.

2. Trend & Moving Averages

Price is trading well above EMA34 and EMA89, both sloping upward.

Pullbacks remain shallow and corrective → no structural damage.

Each retracement forms higher lows, confirming trend strength.

As long as price remains above the rising EMA cluster, trend control stays with buyers.

3. Price Action Behavior

Strong impulsive legs followed by brief consolidations.

No aggressive rejection candles at highs → buyers remain active.

The current pause near 4,480–4,500 is bullish digestion, not exhaustion.

This is classic trend continuation behavior, where the market pauses to absorb supply before the next expansion.

4. Key Levels

Immediate Support: 4,350 – 4,380 (previous resistance turned support)

Structural Support: 4,260 – 4,280

Upside Target Zone: 4,530 – 4,560

A controlled pullback into support followed by continuation would be the highest-probability scenario.

5. Forward Scenario (Preferred)

Short-term consolidation or shallow pullback

Higher low formation above 4,380

Continuation toward 4,530+, as projected on the chart

Only a decisive breakdown below 4,260 would invalidate the bullish structure — currently low probability.

Conclusion

Gold is not peaking it is executing a textbook Wyckoff markup phase. The trend remains clean, momentum is controlled, and pullbacks are opportunities, not warnings.

How will gold prices fluctuate after the GDP report?1️⃣ Trendline

The short–to–medium term ascending channel remains intact; price is moving within the channel → the primary trend is bullish.

Upper trendline (dynamic resistance): price is approaching this area → high probability of consolidation / profit-taking.

Lower trendline (dynamic support): acts as the main demand zone for pullbacks.

2️⃣ Support

4,470 – 4,468: Near-term support, overlapping with the consolidation zone & short-term MA.

4,447 – 4,445: Stronger support, structural low within the ascending channel.

4,360: Deep support; a break below this level would signal risk of channel breakdown.

3️⃣ Resistance

4,500: Psychological resistance & short-term high.

4,548 – 4,550: Major resistance, confluence of upper trendline + supply zone → primary profit-taking target.

4️⃣ Scenarios

Holding above 4,470 → favor buy-on-dips following the trend, targets 4,500 → 4,550.

Rejection at 4,500–4,550 → potential pullback toward 4,450 before the next directional decision.

Clear break and hold above 4,560 → bullish continuation / trend expansion.

📈 Trade Setup

BUY GOLD: 4,447 – 4,445

Stop Loss: 4,437

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,548 – 4,550

Stop Loss: 4,560

Take Profit: 100 – 300 – 500 pips

XAUUSD H1 CHART ANALYSIS I 12/241. Trend Overview

Primary Trend: Gold is in a strong Bullish trend. This is clearly indicated by the ascending trendline starting from the lows below 4,360.

Market Structure: The price is consistently forming Higher Highs (HH) and Higher Lows (HL). Currently, the price is showing signs of consolidation around the most recent peak.

2. Volume Profile Analysis

The Volume Profile on the left side of the chart reveals key areas of liquidity:

POC (Point of Control) – ~4,484: This is the price level with the highest traded volume. The price is currently reacting just above this level, making it a pivotal support zone. As long as price stays above the POC, the upward momentum remains healthy.

VAH (Value Area High) – ~4,499: This represents the upper boundary of the Value Area. The price recently broke above this level and is currently "retesting" it.

VAL (Value Area Low) – ~4,424: This is a major support zone further down. In the event of a deep correction, this would be a primary area for buyers to re-enter.

3. Potential Price Scenarios

Scenario 1: Bullish Continuation

If the price stabilizes and closes firmly above the 4,500 level (a psychological barrier near the VAH), Gold is likely to target higher levels such as 4,520 or beyond.

Recent candles show lower wicks (rejection), indicating buying pressure stepping in whenever the price touches the POC zone.

Scenario 2: Technical Correction

If the price fails to hold the 4,484 (POC) support, Gold may enter a short-term corrective phase toward the Trendline (roughly the 4,460 – 4,470 area).

A correction like this is often considered healthy for the market to "reset" before the next leg up.

4. Trading Strategy Reference

Long Entry (Buy): Look for buying signals around the 4,484 (POC) zone or a confirmed breakout above the 4,500 resistance with high volume.

Stop Loss (SL): Ideally placed below the immediate support or the ascending trendline (around the 4,450 area).

Take Profit (TP): Target the recent swing high at 4,525 and subsequent round numbers.

Note: Gold is trading at historically high levels according to this chart (4,4xx range). Be sure to monitor fundamental drivers such as the DXY (US Dollar Index) or Fed announcements to complement this technical view.

UKOIL H4 | Potential Bullish RiseMomentum: Bullish

The price has bounced off the buy entry, which has been identified as a pullback support.

Buy entry: 61.75

Pullback support

Stop loss: 60.59

Pullback support

Take profit: 63.86

Swing high resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

GIFTNIFTY IntraSwing Levels For 24th Dec '25Watch NIFTY Spot while Entering Trade

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

Do comment if Helpful .

Do Comment for In depth Analysis.

❇️ Follow notification about periodical View

Gold price analysis on December 24th📈 GOLD – Trend Analysis at Historical Highs

When prices are trading at their all-time highs, Fibonacci is the most suitable tool to identify potential resistance and support zones for subsequent price action.

The main trend remains bullish, so the current preferred strategy continues to be BUY following the trend, especially when prices undergo technical corrections to key Fibonacci levels. FOMO BUY at the peak is not recommended — patiently waiting for a pullback will yield a better R:R ratio.

🟢 BUY Strategy

Wait for clear price rejection signals at support zones: 4430, 4385, 4350 (strong support zone & uptrend line)

🎯 Target

4590 – Fibonacci extension target in an uptrend

⚠️ Risk

If the closing price and trading stabilize below 4350, the short-term uptrend structure will be broken → caution is needed with BUY orders and a reassessment of the wave structure is necessary.

📌 Summary

The uptrend remains intact. Only BUY when the price corrects to the support zone – do not chase the price at the peak.

GOLD 4H CHART ROUTE MAPDEAR TRADERS,

Our Previous 1H Chart & 4H Chart has been completed well and all profit hits successfully.

Gold has broken its previous high today and made history by printing a new All-Time High (ATH).

We will now wait for a healthy pullback and retest at the key support zone.

Entry Zone: 4375 – 4385

Bullish Targets:

4419 • 4444 • 4459 • 4480

Bearish Targets:

4380 • 4327 • 4300 • 4270

As we are in the month of December and the festive season is approaching, this week is packed with high-impact news on the forex calendar. Unexpected volatility is highly possible. Please trade with caution, discipline, and proper risk management.

Your support means a lot—please show it with likes, comments, and boosting 🙌

— The Quantum Trading Mastery

Gold Hits a New All-Time HighHello everyone, let’s take a look at XAUUSD today.

Gold continues its strong rally, trading around 4,480 USD, up more than 111 USD compared to the same time yesterday. Notably, this marks a new all-time high, decisively breaking above the previous peak.

The sharp rise is driven by surging safe-haven demand at the start of a shortened trading week due to holidays, amid escalating geopolitical tensions.

Gold gained further momentum after weekend reports that the United States is pursuing a third oil tanker near Venezuela. According to a U.S. official, President Trump has intensified oil sanctions against the government of Nicolás Maduro.

Bloomberg reported that the tanker being pursued was operating under a false flag and is subject to a court seizure order, believed to be the Bella 1, a Panama-flagged vessel sanctioned by the U.S.

These actions follow earlier incidents in which the U.S. military boarded the supertanker Centuries and previously the vessel Skipper. The blockade appears to be pressuring Venezuela’s oil storage capacity and could lead to production declines and broader civil instability.

From a technical perspective, the next upside target for February gold futures bulls is a break above the strong resistance at 4,500 USD per ounce. Initial support is seen at 4,400 USD, followed by the overnight low at 4,365 USD.

I remain bullish on gold—what’s your view?

XAUUSD WeAxes scalper plan (next few sessions):Structure: Gold is still in a strong uptrend, trading above all key SMAs on D and H4, but momentum is stretched with RSI in overbought territory.

Premium zone (short‑term fades only): 4,430–4,480. I only look for shorts after a sweep of highs + M15/H1 CHoCH down, targeting 4,400 then 4,370.

First discount buy zone: 4,390–4,400 (near 4H 20‑SMA / VWAP). I look for sweeps of lows + CHoCH up to long back toward the highs.

Deeper discount (A+ only): 4,350–4,320; if tapped with strong news flush, I’ll wait for liquidity grab + displacement up and aim for a rotation back toward 4,400–4,430.

No trades in the middle, London/NY only, risk 0.25–0.75% per trade, 1% only on A+ sweep + CHoCH setups.