Futures market

XAU/USD ) Beriash trend analysis Read the captionSMC Trading point Update

Technical analysis of XAUUSD (Gold) – 1H chart using SMC + trend exhaustion logic.

⸻

Market Context

• Strong impulsive bullish move into highs → signs of buy-side liquidity taken

• Price is now stalling at resistance

• Momentum is weakening after expansion → distribution phase

⸻

Key Area (Supply / Liquidity Zone)

• Upper blue zone (~4490–4500)

• Multiple rejections (red arrows)

• Equal highs / liquidity pool

• Classic SMC supply zone

• Indicates smart money selling into late buyers

⸻

EMA Structure

• EMA 50 far extended from price

• Typical behavior after strong rallies:

• Price returns to mean value

• EMA acts as a magnet → correction likely

⸻

Bias

Bearish retracement / reversal scenario

This is not a trend change yet, but a high-probability corrective sell after liquidity grab.

⸻

Trade Idea (Example Plan)

Sell from Supply

• Entry: 4488 – 4500 (sell on rejection / confirmation)

• Stop Loss: Above supply zone (~4510–4520)

• Targets:

• TP1: 4426 (EMA 50)

• TP2: 4380–4365 (key support / demand zone)

• Final target: ~4367 (marked target point)

RR potential: 1:3 to 1:5 depending on entry

⸻

Best Confirmation Signals

Wait for one of these at supply:

• Bearish engulfing candle (1H or 15m)

• Long upper wicks (failed breakout)

• Lower-timeframe CHoCH / BOS

• Decreasing bullish volume

⸻

Invalidation

• Clean 1H close above 4500

• Acceptance above supply zone

• Strong continuation with no rejection

If that happens → bearish idea is invalid.

⸻ Mr SMC Trading Point

Summary

This setup is:

• Liquidity grab at highs

• Supply + overextension

• Mean reversion toward EMA & demand

Patience matters — wait for confirmation, don’t chase.

If you want, I can:

• Break this down into a 15m or 5m execution model

• Or help you define partial profit & trailing logic

Please support boost this analysis

Gold Still Leads the Way — Why XAUUSD & Silver Control Flow NowOn the first major bullish move, I successfully captured +6,600 pips on XAUUSD, and I am currently holding an additional +2,000 pips in running profit.

At this stage, I can confidently say that my investment for 2026 is already secured 📈🤝

From a macro and technical perspective, Gold and Silver are positioning themselves as the leading assets for 2026.

Strong momentum, sustained demand, and long-term bullish structure continue to support this outlook.

Patience, discipline, and trend alignment remain key.

Let the market do the heavy lifting.

📈🤝 Gold & Silver — The Kings of 2026 🤝📈💰

Trading strategy! Go long on gold in the 4455-4475 range!Yesterday, the gold market once again hit a new historical high. After opening, gold prices steadily rose, successfully breaking through previous highs and surpassing $4400, with a daily increase of over $100.

I am not surprised by this significant surge. I had been issuing buy signals when gold prices were around $4040. Although there were fluctuations during the rise, the overall trend was as expected, resulting in considerable profits. New followers can check my previous analysis for verification.

The recent surge in gold prices was primarily driven by escalating geopolitical tensions and market expectations of further interest rate cuts in the US in 2026. This combination led to a renewed strength in gold prices, setting new historical highs. Looking ahead to 2026, the bullish outlook for gold remains bright.

From a technical perspective, since August, the monthly chart has seen five consecutive positive months, the weekly chart has seen three consecutive positive weeks, and the daily chart has also maintained a continuous positive trend, which is enough to show the strong upward momentum of the bulls. Therefore, in terms of trading, we will continue to follow the trend and maintain a long strategy, while also being wary of large fluctuations and market corrections.

Strategy Reference!

BUY: 4455-4475

TP: 4490-4505

The above are my personal thoughts! If they are helpful to you or you agree with my ideas, please like and follow to support me! All strategies have a limited lifespan. While referring to them, it's also important to closely monitor market changes. I will respond flexibly based on actual market fluctuations, and I will provide specific updates in the channel!

GOLD - Hunting for liquidity ahead of growth. Focus on 4475FX:XAUUSD reached a new historic high of around $4,525. However, profit-taking is causing a correction, with the 4,475-4,470 range being the area of interest in the bull market.

The dollar is weakening, with the market anticipating two rate cuts in 2026. Geopolitical risks are supporting demand for safe-haven assets. Positive US GDP data for Q3 (+4.3%) did not support the dollar due to expectations of a slowdown in growth in Q4.

The dollar index has hit its lowest level since early October. Today, US jobless claims data will be released, which may increase volatility. The overall positive sentiment in the stock markets is holding back more active growth in gold.

The upward trend in gold continues. Any significant correction is likely to be seen as a buying opportunity, given the Fed's accommodative monetary policy and geopolitical uncertainty.

Resistance levels: 4500, 4525

Support levels: 4475, 4470, 4466, 4452

Focus on the current trading range of 4475-4525. A false breakdown of support could attract buyers waiting for favorable prices. I do not rule out a retest of 4452-4442 before growth (against the backdrop of aggressive profit-taking).

Best regards, R. Linda!

XAUUSD (H4) – Tuesday Outlook Broke the old ATH, trend continuation | Buy the pullback at 4442, sell premium at 4559

Strategy summary

Gold has broken the previous all-time high (ATH) and the bullish structure remains intact. Today my priority is still buying with the trend, but only on a clean pullback — no chasing. The secondary plan is a reaction sell at a premium Fibonacci zone if price extends too aggressively.

1) Technical view (based on your chart)

The breakout above the old ATH is a strong bullish signal: we have a clear higher high and price is building a new base.

The chart highlights a Buy VL / value area just below current price — a logical pullback zone to reload longs.

Above, there’s a 1.618 Fibonacci premium sell zone, where profit-taking often shows up.

Key point: The trend is bullish, but the higher we go, the more likely we see sharp wicks and quick pullbacks. Stay disciplined and trade the levels.

2) Trade plan for today (clear entry, SL, target)

Scenario A (priority): BUY the Asia pullback

✅ Buy: 4442

SL: 4435

Target: 4747 (your projected target)

Logic: This is a clean pullback into the session value area. If price holds here, continuation becomes the higher-probability path.

Scenario B: SELL the premium Fibonacci reaction

✅ Sell: 4559

SL: 4568

TP: scale out on the reaction (short-term profit-taking), or manage based on momentum after rejection

Logic: 4559 is a premium Fibonacci zone. If price spikes into it, a rejection move is very common — but only sell with reaction, not by chasing.

3) Macro context (why gold stays supported)

XAU/USD is building on yesterday’s strong rally (+2%) and is printing fresh record highs for a second day.

Price is pushing toward the 4,500 psychological level during Asia, supported by multiple safe-haven drivers.

Comments from US Treasury Secretary Scott Bessent add uncertainty around the long-term reliability of Fed policy — and uncertainty typically supports gold.

4) Risk management (Liam rule)

Don’t chase after breakout. Only buy at 4442 as planned.

Risk per trade: max 1–2%.

If stopped out, wait for the next structure — no revenge trading.

What’s your bias today: buying the 4442 pullback, or waiting for a 4559 reaction sell?

Overall trend analysis of gold at present!Gold is currently trading within a strong ascending channel, maintaining a clear bullish structure of higher highs and higher lows. Price recently experienced an impulsive rally, followed by a sharp rejection from the upper resistance zone around the 4,460–4,480 area.

After the rejection, price has pulled back and is now consolidating below the resistance, indicating short-term weakness while the broader trend remains bullish.

Market Structure Outlook

If price fails to reclaim the resistance zone, a corrective move toward the lower support areas is likely a bounce from the support zone may offer buying opportunities in line with the overall uptrend a clean break below the lower support could signal a deeper retracement within the channel we could find support level 4405 to 44375.

New Highs, No Sell-Off — Smart Money In?Based on the current news backdrop combined with the price structure on the chart , I continue to hold the view that XAUUSD is in a clear and healthy uptrend — not a temporary or emotional spike.

Gold setting a new all-time high around 4,400 shows that the market is strongly pricing in the likelihood of further Fed easing and future rate cuts . More importantly, after making new highs, price did not experience aggressive selling , but instead managed to hold at elevated levels — a clear sign that large capital flows are staying in the market, rather than this being a short-lived FOMO-driven move.

Looking at the chart, gold is moving cleanly along its ascending trendline , with consistent support from the Ichimoku system and dynamic support zones below. The recent pullbacks have been purely technical, allowing the market to “catch its breath” and absorb supply, without breaking the overall structure. This is a market that is moving strong — not overheating.

For me, the 4,380 zone remains a key support level. As long as price holds above this area, the bullish trend remains fully intact. In the short term, my preferred scenario is light consolidation at high levels, followed by a continued push to retest the 4,450 area.

In summary, I continue to favor BUY setups on pullbacks — not chasing price at the highs and never trading against the trend. When both fundamentals and technicals align, the most important skill is patience and discipline to stay with the trend, rather than trying to pick a top in a market that is clearly strong.

XAU/USD | Golf going strong! (READ THE CAPTION)Gold reached a new ATH! I believe all of you are aware of it. Gold went as high as 4497, but faced a little bit of correction and it's being traded at 4488. There are no indications whatsoever for gold to stop going higher. Next targets for Gold: 4500, 4514 and 4532.

DeGRAM | GOLD is preparing for consolidation📊 Technical Analysis

● XAU/USD trades inside a rising channel but has reached the upper resistance near 4,500, where price was repeatedly rejected, forming exhaustion wicks after a sharp impulsive rally. This suggests weakening bullish momentum at channel highs.

● The breakout from the prior consolidation accelerated price vertically, increasing pullback risk. A corrective move toward the mid-channel and horizontal support at 4,450–4,405 is favored while resistance holds.

💡 Fundamental Analysis

● Strong USD positioning and cautious expectations around future Fed easing reduce short-term upside for gold, encouraging profit-taking after the recent surge.

✨ Summary

● Short bias near 4,500 resistance. Targets: 4,450–4,405. Invalidation above channel resistance.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

XAUUSDXAUUSD remains in a strong uptrend. Today, the price reached a new high of $4997 Due to excessive buying pressure, I believe that if the price fails to break through $4510, a short-term correction is possible. Consider selling in the red zone

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

This content is not financial advice. Always conduct your own financial due diligence.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

GOLD BUYS I’m expecting price to buy right after taking ASIA! Why? During NYC yesterday price created a bullish order block on the 4hr time frame and is currently retracing I believe the initial push up on Asia is only manipulation to bring in early buyers. I’m expecting price to make a reaction either on London or NYC (high chances it might be NYC ) because of new

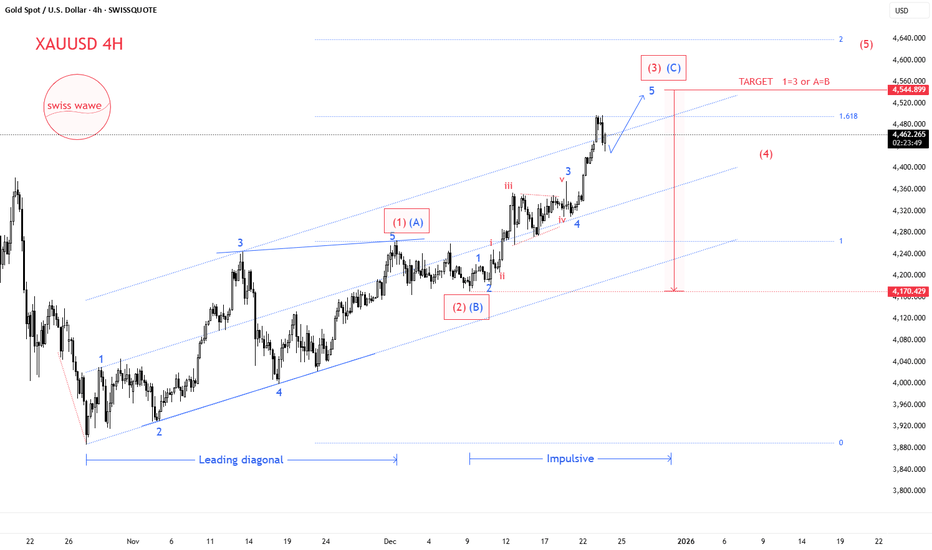

XAUUSD | Structure isn't Complete (MUST READ CAPTION!)Hello traders,

I already explained in a previous educational post why a new ATH in Gold was expected. it was structural. It is how market has to move.

XAUUSD | Going To New ATH

XAUUSD | ATHs Aren’t Resistances. They’re Liquidity

Now lets talk about some Elliot Wave principles.

When wave 2 does a correction of 61% or more of wave 1, that is called a deep correction.

Accordingly, Wave 3 is still expected to extend, but a 1.618 projection of wave 1 is the more conservative and realistic target, while 2.618 remains less likely at this stage.

Now on the 4HTF, price respected the impulsive sequence perfectly:

- Strong impulsive price action

- Clear BOS

- Followed by bullish continuation

But that is only 1.41% extension. Which is not random and not enough. That is only where some will take their profit off the table. This is where late longs take profit and short liquidity starts to build.

This is NOT the top

As long as price holds structure, 1.618 extension will be my end goal before an actual correction.

Pullbacks are corrective, not impulsive

Shorts positions before structure completion remain liquidity, not smart positioning.

There is no "too expensive" price. Markets will move when structure is finished and liquidity is swept.

I expected this ATH. I explained why beforehand. Now I’ll be watching how the market complete the wave.

Beware, price could pullback to clear the low FVG before it continues upward.

Good Luck!

Our analysis is shared with honesty, care, and real effort. If you find value in it, a like or comment means a lot to show your support🙏📊

Gold Price Update – Clean & Clear ExplanationGold is showing a strong bullish structure on the 1-hour timeframe. Price has been moving inside an ascending trendline, making higher highs and higher lows, which confirms that buyers are in control.

Gold Price broke above a key resistance zone near 4400–4420, indicating a bullish breakout after the breakout, gold is pulling back slightly, which looks like a healthy correction, not weakness this pullback is happening above previous resistance, which is now acting as support — a positive sign.

The market is respecting the trendline and structure, which favours further upside as long as support holds. 4400 to 4390 after again price bullish and hit the all time high level our target will accepted 4435 to 4465

Gold has broken resistance, buyers are strong, and after a small pause, price has a good chance to move higher toward the next targets if support remains intact.

If you find it helpful please like and comments for this post and share thanks.

Price pullback. 4450 is a good time to buy.Gold was incredibly strong on Monday, breaking through 4400 with virtually no pullback. The upward trend continued in Asian trading on Tuesday, reaching a high of 4497, very close to 4500. The US session has already undergone a technical pullback, finding good support at the 4440 level.

Gold failed to break through the $4,500 mark, and the prolonged inability to do so limited its gains, leading to a short-term pullback. However, the upward momentum remains strong, as the uptrend is supported by moving averages, and the positive signals from the MACD indicator reinforce the buyer's dominance. Even with a pullback, the rising moving averages will not shake the overall bullish trend.

Before Christmas, we need to focus on the 4500 level. A successful break above this level could quickly lead to around 4550. The strong price increase at the beginning of the week requires a technical correction to accumulate momentum before another upward breakout.

Trading Strategy:

Buy at 4440-4450, stop loss at 4430, profit target 4470-4500. Hold some positions if the price breaks through 4500.I will update more trading information in the channel.

NIFTY MONTHLY VIEW — TIME & PRICE ANALYSIS NIFTY MONTHLY OUTLOOK — TIME & PRICE ANALYSIS (HIGH CONVICTION)

Best Risk–Reward Buy-on-Dips Phase Till Jan 2026

Nifty is entering a major monthly Time & Price accumulation phase, where trend structure, cycle timing, and risk–reward alignment are favoring buyers over sellers.

This is not a short-term noise trade.

This is a positional structure developing on higher timeframes.

🔑 Key Levels (Monthly Framework)

CMP: 26,236

Target 1: 26,545

Target 2: 26,795

Laxman Rekha (Critical Demand Zone):

26,045 – 25,925

Time Horizon: On or Before 07 Jan 2026

Strategy: Buy on Dips

🧠 Market Context (Why This Matters)

Monthly trend structure remains constructive

Dips are turning into opportunities, not threats

Risk–reward is asymmetric in favor of buyers

Sellers are exhausting near demand zones

Time cycle suggests continuation, not distribution

👉 This is the kind of phase where smart money builds quietly,

while retail waits for “confirmation” near the highs.

📌 Execution Thought

Look for buying opportunities on every dip,

only when risk–reward is favorable.

Avoid emotional entries.

Respect the Laxman Rekha — it defines structure.

Markets don’t reward prediction.

They reward positioning + patience.

XAUUSD 1H – Bullish Market Structure with Pullback Continuation

This chart shows Gold (XAUUSD) on the 1-hour timeframe displaying a clear bullish market structure.

Price initially moved in a slow consolidation phase, forming a channel before breaking to the upside. After the breakout, the market created a strong impulsive bullish move, confirming the presence of strong buyers and momentum.

A higher low (Swing Low) was formed, which is marked as an important support / demand zone. From this level, price aggressively pushed higher, creating a new Swing High. This confirms that the trend remains bullish with buyers in control.

Currently, price is consolidating near the highs, indicating profit-taking and market rest rather than weakness. This consolidation suggests a bullish continuation pattern, where the market may pull back slightly before making another upward move.

The Last Low zone and the lower support zone are key areas to watch. As long as price remains above these levels, the bullish structure stays intact. A pullback into these zones can provide potential buying opportunities.

The projected arrows on the chart highlight a possible pullback followed by continuation to new highs, aligning with the overall bullish trend.

🧠 Conclusion

Trend: Bullish

Market Structure: Higher Highs & Higher Lows

Bias: Buy on pullbacks

Invalidation: Break below major support

Silver turning pointSilver is currently in a bearish trend, with the RSI in the selling zone across the monthly, weekly, daily, and 4-hour timeframes. Divergence is also observed on both higher and lower timeframes.

I expect a decline from the 71.7–72 price area. The final target will depend on news developments; however, 58.42 can be considered a potential downside target.