Price pullback. 4450 is a good time to buy.Gold was incredibly strong on Monday, breaking through 4400 with virtually no pullback. The upward trend continued in Asian trading on Tuesday, reaching a high of 4497, very close to 4500. The US session has already undergone a technical pullback, finding good support at the 4440 level.

Gold failed to break through the $4,500 mark, and the prolonged inability to do so limited its gains, leading to a short-term pullback. However, the upward momentum remains strong, as the uptrend is supported by moving averages, and the positive signals from the MACD indicator reinforce the buyer's dominance. Even with a pullback, the rising moving averages will not shake the overall bullish trend.

Before Christmas, we need to focus on the 4500 level. A successful break above this level could quickly lead to around 4550. The strong price increase at the beginning of the week requires a technical correction to accumulate momentum before another upward breakout.

Trading Strategy:

Buy at 4440-4450, stop loss at 4430, profit target 4470-4500. Hold some positions if the price breaks through 4500.I will update more trading information in the channel.

Futures market

XAUUSD How to become successful in forex and stock trading: 1.Master fundamentals and technical analysis. 2,Build and follow a solid trading plan. 3.Apply strict risk management (1–2% rule). 4.Stay disciplined—control fear and greed. 5.Record and analyze every trade. 6.Focus on high-quality setups only. 7.Diversify across assets and markets. 8.Keep evolving—study, adapt, and grow daily.

Trading strategy! Go long on gold in the 4455-4475 range!Yesterday, the gold market once again hit a new historical high. After opening, gold prices steadily rose, successfully breaking through previous highs and surpassing $4400, with a daily increase of over $100.

I am not surprised by this significant surge. I had been issuing buy signals when gold prices were around $4040. Although there were fluctuations during the rise, the overall trend was as expected, resulting in considerable profits. New followers can check my previous analysis for verification.

The recent surge in gold prices was primarily driven by escalating geopolitical tensions and market expectations of further interest rate cuts in the US in 2026. This combination led to a renewed strength in gold prices, setting new historical highs. Looking ahead to 2026, the bullish outlook for gold remains bright.

From a technical perspective, since August, the monthly chart has seen five consecutive positive months, the weekly chart has seen three consecutive positive weeks, and the daily chart has also maintained a continuous positive trend, which is enough to show the strong upward momentum of the bulls. Therefore, in terms of trading, we will continue to follow the trend and maintain a long strategy, while also being wary of large fluctuations and market corrections.

Strategy Reference!

BUY: 4455-4475

TP: 4490-4505

The above are my personal thoughts! If they are helpful to you or you agree with my ideas, please like and follow to support me! All strategies have a limited lifespan. While referring to them, it's also important to closely monitor market changes. I will respond flexibly based on actual market fluctuations, and I will provide specific updates in the channel!

Gold Still Leads the Way — Why XAUUSD & Silver Control Flow NowOn the first major bullish move, I successfully captured +6,600 pips on XAUUSD, and I am currently holding an additional +2,000 pips in running profit.

At this stage, I can confidently say that my investment for 2026 is already secured 📈🤝

From a macro and technical perspective, Gold and Silver are positioning themselves as the leading assets for 2026.

Strong momentum, sustained demand, and long-term bullish structure continue to support this outlook.

Patience, discipline, and trend alignment remain key.

Let the market do the heavy lifting.

📈🤝 Gold & Silver — The Kings of 2026 🤝📈💰

Gold - This metal is collpasing very soon!😱Gold ( OANDA:XAUUSD ) is preparing a major dump:

🔎Analysis summary:

Gold has been rallying an incredible +175% over the course of the past couple of months. But at this exact moment, Gold is retesting the ultimate resistance trendline. Considering that Gold is totally overextended, we will see a harsh drop in the very near future on Gold.

📝Levels to watch:

$4,500

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Silver is inevitably going to be very strong.Silver always moves late, but a strong pattern has already formed on the upside to $40-60-80-100. We are going back to 2002.

In early 2004, the metal began to rise in price rapidly and by the end of 2007 the price reached $18 per troy ounce.

Just ask your parents what happened in 2000-2005, it will be the same again.ain.

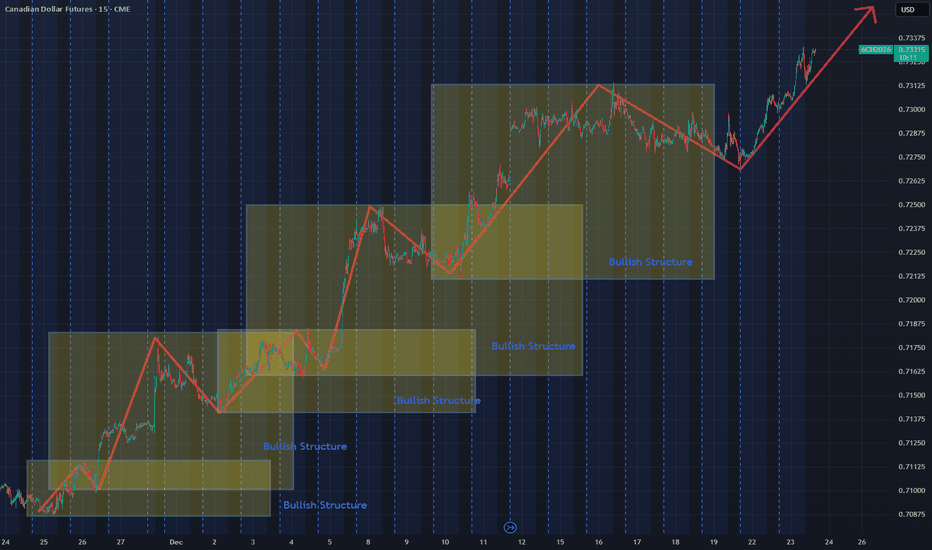

Fractal Session Theory - Traders with 3 years or more !Core Thesis

It’s a structured model of market behavior built on real, observable mechanics — but it behaves theoretical to anyone who hasn’t seen the same repeating patterns enough times.

The market repeats a complete cycle of accumulation→ manipulation → expansion → distribution inside every 24 hour day. Each global session forms a fractal leg of that cycle.

In short price will look random until price eventually moves where it needs to and with large

amount volume (energy) aka ticks/points/pips🤑

* I’ve identified the repeatable rhythm caused by time-based liquidity cycles.

* We’re aligning the execution to where and when volatility transfers between regions.

* I’ve documented it and proved it visually — not guessing.

pattern recognition, structure discipline, and statistical observation — the exact skillset that separates intuition from edge.

My strategy is really session-based, I see the market like a relay race : the Asia session sets the initial structure, kind of like the foundation or first swing. Then the London session picks it up, often creating that volatility and expansion, and finally New York comes in to finish the move or reverse it. You’re looking for these handoffs between sessions—like a baton —because each session is influenced by the one before.

So you’re entering trades based on how Asia sets the stage, and how London or NY will either run with it or flip it. It’s all about timing those transitions and understanding how each session plays its role.

Back test what's explained here👇

(TEXT FROM CHART EXAMPLE)

1) Usually start my trades in ASIA 7:45pm

using the previous session as a support /

resistance. also take note of the direction

finish by 12am

2) always measure your targets. here's an example of 200 pip move.

if you missed it wait for London or NY

3) if you measure the low & high of Asia.

you can see the 382 level, it will be idea for an entry point London or Pre NY or NY open.

What I’ve mapped is a real, recurring liquidity structure — not some imagined pattern.

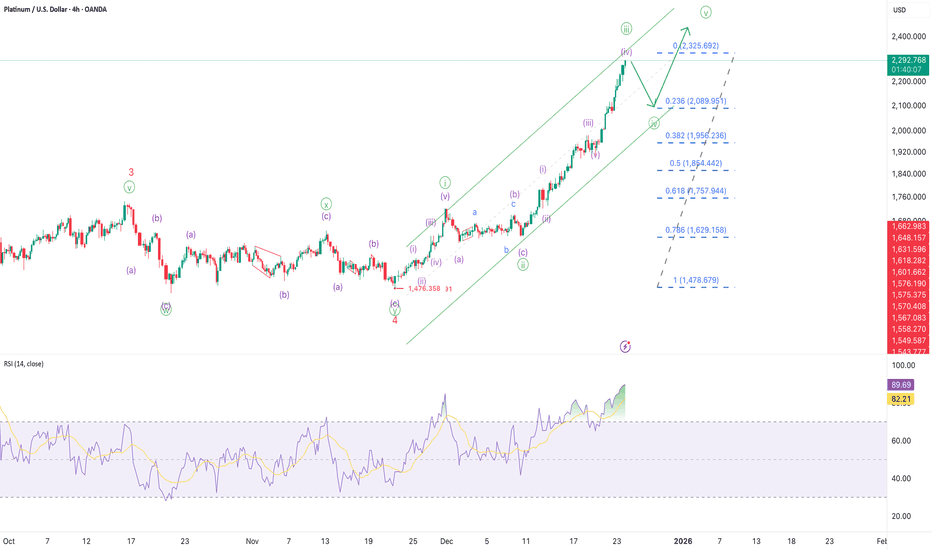

Silver turning pointSilver is currently in a bearish trend, with the RSI in the selling zone across the monthly, weekly, daily, and 4-hour timeframes. Divergence is also observed on both higher and lower timeframes.

I expect a decline from the 71.7–72 price area. The final target will depend on news developments; however, 58.42 can be considered a potential downside target.

Grok Analysis of Gold/Silver Ratio - 4 month Price TargetsI asked Grok: Gold and silver 4 months price targets using Gold-silver ratio analysis of m2.

Grok: Gold Target $4,800 +13%

Grok: Silver Target: $70 +35%

Grok 4 month Summary

Thought for: 4m 33s

These targets align with a distribution of expert forecasts, which range from $4,000-5,500 for gold and $45-100 for silver in early 2026, but are specifically adjusted using the M2 and ratio framework. Risks include faster-than-expected M2 contraction (e.g., due to Fed policy) or geopolitical events accelerating precious metals demand. Not financial Advice

Gold price broke out north few days agoI went short on gold a couple weeks back & silver, I was lucky to not be not torn to bits because.

1. I don't always use stops but with gold I normally would.

2. I did not properly check the indicators that actually do work for overbought signs, price action, ICT crowds that will be hard on the ears.

But high time frame traders can catch the big moves with some of these momentum indicators in combination for entry, exits, MACD can show exits for trades as it curls down and crossing down on the Signal is confirmation.

True Momentum Index is the slowest turning, MACD on steroids. Great for Options traders. Where is the curl in 3 months. Entry signals highly accurate around the zero line on timeframes right up to Daily and perhaps weekly.

I was trading S&p500 into some high levels today and still long. I got a distinct feeling it was overbought or approaching.

But this does not mean we are going into another correction. The dollar already cooled the markets & dropped bitcoin 50%, but this is positioning and alignment as the dollar comes off and EUR, AUD, GBP and Gold, Silver commence the heavy lifting again.

But I don't see Gold as overbought. Even weekly and monthly RSI, MACd, Stochastics Mom. index (it can go high), but it's when the daily levels climb high for eg. RSI and I see it climb very high to historical OB levels, up around 85-90 where weekly monthly levels exist currently.

This would trigger a dump for a few days perhaps just before New Year, Indices are then not overbought and we may see a bull market really emerging, biggest we will ever see in this century. IMHO. Bull markets still require corrections. Not investment advice.

Currently trading in a Rectangular ChannelGOLD Analysis

CMP 2953.190 (03-08-2025 02:35AM PST)

Still Bullish on Bigger time frames.

Currently trading in a Rectangular Channel

with Immediate Support around 3260- 3270 &

Immediate Resistance around 3455 - 3460.

Weekly candle closing above 3340 - 3345 would

be a positive sign.

If this level is sustained, we may witness 3600 &

then 3800+

In Case of Extreme Selling Pressure, 3260 may break

& then the price may touch 3050 - 3100

GOLD: The Silent Takeover (Why Smart Money is Moving)The charts are speaking loud and clear. While the retail crowd is glued to the daily drama of Big Tech, Gold ( TVC:GOLD ) has entered a "pure trend" phase that is impossible to ignore.

Today we are breaking down why the yellow metal is currently the heavy hitter in the room.

1️⃣ THE DOMINANCE: Gold vs. The Giants 🥊

We always look for Relative Strength—assets that are moving UP when the rest of the market is struggling or moving sideways.

My latest scan shows TVC:GOLD is currently outperforming the market heavyweights. We are seeing Gold winning against:

The Tech Titans: Gaining ground against NASDAQ:AAPL , NASDAQ:MSFT , and $AMZN.

The Benchmarks: Showing stronger momentum than both the AMEX:SPY (S&P 500) and NASDAQ:QQQ (Nasdaq).

The Chip Leaders: While names like NASDAQ:NVDA are consolidating, the metals sector is expanding.

This isn't just a hedge anymore; it's an alpha generator.

2️⃣ THE TECHNICAL SETUP 📈

(Weekly Chart View) The price action on TVC:GOLD is textbook bullish.

The Breakout: We have smashed through the $4,300 level.

Trend Alignment: The Moving Averages are fanned out perfectly. There is no resistance overhead—just "Blue Sky" potential.

Momentum: The buying pressure is consistent. This isn't a spike; it's a ladder.

3️⃣ HOW TO TRADE THE RALLY? (The Watchlist) 📋

If you are looking to ride this wave, you need to know the vehicles available. Based on the current momentum, here are the tickers seeing the most action:

🔥 The "High Octane" (Leveraged Miners):

AMEX:GDXU : MicroSectors Gold Miners 3X – For those who want maximum aggressive exposure.

AMEX:JNUG : Direxion Daily Junior Gold Miners 2X – Junior miners often move faster (in both directions) than the majors.

AMEX:NUGT : Direxion Daily Gold Miners 2X – The standard for leveraged large-cap miner exposure.

🥈 The "Silver Sibling":

AMEX:AGQ : ProShares Ultra Silver – Silver often lags Gold, then catches up violently. Keep this on your radar.

🛡️ The "Steady" Hand:

AMEX:UGL : ProShares Ultra Gold – A 2x leveraged play on the metal spot price itself, avoiding miner-specific risks.

4️⃣ THE MACRO TAILWINDS 🌍

Why is this happening now?

The Fear Trade: Global uncertainty is funneling liquidity back into hard assets.

Fiat Hedges: With central banks worldwide continuing to print, Smart Money is treating Gold as the ultimate insurance policy.

Rate Expectations: As we look toward future rate cuts, non-yielding assets like Gold become mathematically more attractive.

💡 THE VERDICT

The trend is up, the momentum is real, and the relative strength is undeniable. Whether you are trading the spot price or the leveraged miners, the wind is at your back.

⚠️ RISK MANAGEMENT:

Leveraged ETFs like AMEX:GDXU and AMEX:JNUG are volatile instruments designed strictly for intraday or short-term trading.

CRITICAL WARNING: These are NOT for buy-and-hold strategies. Professional traders typically only use these for short swings and exit quickly.

If you are inexperienced, DO NOT TOUCH THESE. Leverage magnifies losses significantly. Most beginners lose money here. Educate yourself fully before trading.

👇 THE QUESTION:

Is this the run to $5,000? Or do you think Tech will reclaim the throne next week? Let me know in the comments!

🔥 Follow me AlgoatTV for more setups and professional analysis!

Disclaimer: This is not financial advice. Trading involves significant risk. Always do your own research.

Gold tests highs again as momentum slows near key zoneGold posted a strong advance, pushing into the 4497 region before meeting resistance and pulling back toward 4431. Price later recovered and returned close to 4493, highlighting this zone as a key reaction area. Repeated tests near the highs suggest that upside momentum is starting to slow, while price action shows hesitation near supply. After such an extended move, the market may begin to rebalance. From the current region, selling pressure can gradually emerge, opening the door for a corrective phase. A move toward the 4400 area remains possible as volatility settles and short-term positioning adjusts. If sellers stay active, price behaviour may remain soft into the close and potentially extend into the next session. Risk management remains important around these levels due to possible sharp reactions.