XAUUSD Bullish Continuation After Retest | Liquidity Expansion📊 Gold (XAUUSD) Price Action – Structure, Retest & Continuation Bias

This chart represents Gold Spot (XAUUSD) and highlights a bullish continuation setup based on market structure, liquidity behavior, and zone reaction.

After a strong impulsive move to the upside, price formed a temporary consolidation phase, indicating healthy profit-taking rather than trend weakness. This pause is important because it allowed the market to build new liquidity before the next leg higher.

🔹 Key Market Structure & Zones

Price previously created a clear bullish displacement, breaking above prior intraday resistance. Following this move, the market pulled back into a marked retesting zone, which aligns with previous demand and structure support. This retest is crucial, as it confirms that buyers are still active and defending the level.

The candles inside the retesting area show rejection and absorption, suggesting that selling pressure is weakening while buyers are stepping back in. This behavior often precedes a continuation move in the direction of the dominant trend.

🔹 Consolidation Zone (CZ) & Price Acceptance

The chart highlights a Consolidation Zone (CZ) where price spent time ranging before expanding upward. Markets tend to revisit such zones to rebalance orders. The current reaction around this area shows price acceptance, which strengthens the bullish bias.

A successful hold above the retesting zone increases the probability of a push toward higher levels.

🔹 Mini Reversal Zone & Upside Projection

Above the current price, a Mini Reversal Zone is marked. This area represents a short-term supply or reaction zone where price may experience a brief pause or shallow pullback. However, if bullish momentum remains strong, price is expected to break through this zone, triggering stops and fresh buy orders.

The projected path on the chart reflects:

Minor pullback

Continuation above resistance

Expansion toward higher liquidity targets

🔹 Trade Bias & Market Psychology

Overall sentiment remains bullish as long as price holds above the retesting support zone. The structure suggests that smart money has already accumulated positions lower and is now pushing price higher in phases.

Futures market

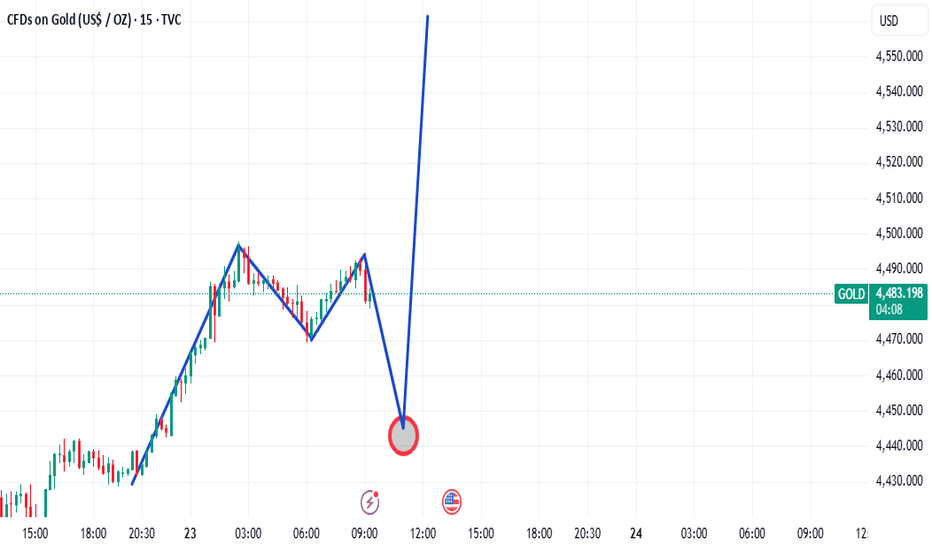

GOLD: Short Signal Explained

GOLD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry - 4485.4

Stop - 4498.2

Take - 4459.2

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

UKOIL M30 | Bullish Bounce Off Pullback SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 60.28

- Pullback support

- 50% Fib retracement

- 78.6% Fib projection

Stop Loss: 59.957

- Swing low support

Take Profit: 60.637

- Multi-swing high resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com/uk ), Stratos Europe Ltd (tradu.com/eu ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com/en ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

XAUUSD H1 | Bullish Bounce Off Pullback SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 4,331.21

- Pullback support

- 50% Fib retracement

Stop Loss: 4,313.45

- Overlap support

Take Profit: 4,354.27

- Swing high resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com/uk ), Stratos Europe Ltd (tradu.com/eu ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com/en ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Selena | XAUUSD – Thought On Year Closing December last 2 weeksFOREXCOM:XAUUSD

After a sharp rejection from all-time highs, Gold entered a corrective phase that remained controlled and trend-respecting. Buyers defended the lower parallel support multiple times, creating higher lows. The reclaim of previous rejection as support is a key structural shift, signaling that sellers are losing control. Current price behavior shows compression under psychological resistance, typically preceding an expansion.

This is trend continuation logic, not mean reversion.

Key Scenarios

✅ Bullish Continuation Scenario 🚀

Condition: Hold above psychological demand + channel support

🎯 Target 1: 4,380

🎯 Target 2: 4,450

🎯 Target 3: 4,500 (psychological expansion)

❌ Bearish Breakdown Scenario 📉

Condition: 4H close below parallel support

Current Levels to Watch

Resistance 🔴: 4,380 – 4,450 – 4,500

Support 🟢: 4,280 – 4,180 – 3,925

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice.

XAU/USD: Buy on pullback in strong upward trend!◆ Market Context (M30)

Gold is in a clear upward trend, demonstrated by a series of consecutive BOS and gradually higher lows/highs. After a strong push, the price is currently consolidating sideways in the premium area, indicating the market is pausing before choosing the next direction.

◆ SMC & Price Action

• The upward structure remains intact, with no bearish CHoCH appearing.

• The current adjustment area is the Buy Zone – where the price previously created a BOS.

• This sideways movement is rebalancing, often a precursor to the next upward move if support is not broken.

◆ Key Levels

• Buy Zone: 4,476 – 4,464

• Invalid upward: clear break below 4,464

• Upper targets:

▪ 4,531

▪ 4,565

◆ Trading Scenarios

➤ Scenario A – Pullback BUY (priority)

• Wait for a pullback or hold within Buy Zone 4,476 – 4,464

• Condition: candle holds price, does not break structural low

• Targets:

▪ 4,531

▪ 4,565

• SL: below 4,464

➤ Scenario B – Break & Continue

• If price holds above the current area and continues to close bullish candles

• Follow the trend, manage orders partially at target levels

➤ Scenario C – Defensive

• If 4,464 is clearly broken

• Short-term upward structure invalidated → stay out and wait for a new setup

◆ Summary

• Main trend: Strong bullish.

• Priority strategy: BUY with the trend, do not SELL against it.

• Decision area: 4,476 – 4,464.

• Next targets: 4,531 → 4,565.

GOLD | Consolidation Near Record Highs — Breakout AheadGOLD | Technical & Fundamental Overview

Gold prices continue to advance after hitting new all-time highs, supported by strong safe-haven demand and a softer U.S. dollar amid expectations of further Federal Reserve rate cuts next year.

Lower interest rates and a weaker dollar environment naturally enhance the attractiveness of precious metals.

Gold’s move toward the $4,500 level reflects growing market acceptance of higher price levels rather than purely speculative demand.

Technical Outlook

In the short term, gold is expected to consolidate within the 4494 – 4474 range until a clear breakout occurs.

- A 15M or 1H candle close above 4494 will support a bullish continuation toward 4514, followed by 4525.

- A 1H candle close below 4474 would signal a corrective move toward 4460, with further downside toward 4440.

Key Levels

Pivot Line: 4474

Resistance: 4494, 4514, 4525

Support: 4460, 4440

Bias: Bullish above 4494; corrective below 4474

Gold Bullish Above Key Support, RSI Signals Possible Pullback📊 Market Overview

Gold prices (XAU/USD) are currently trading around ~4,480–4,490 USD/ounce, posting a strong gain over the past 24 hours (~+3.3%). The rally is supported by expectations of Fed rate cuts in 2026, rising safe-haven demand, and strong capital inflows into gold.

________________________________________

📉 Technical Analysis

Key Resistance Zones

• ~4,500–4,520 USD/oz

• ~4,550–4,580 USD/oz

Key Support Levels

• ~4,420–4,430 USD/oz

• ~4,370–4,380 USD/oz

EMA / Trend:

• Price is trading above short-term EMAs, confirming a short-term bullish trend. Moving average indicators continue to signal strong buy across multiple timeframes.

Momentum & Volume:

• RSI is in the overbought zone, indicating a potential short-term pullback or consolidation. However, the broader structure still favors a strong bullish trend supported by solid buying pressure.

________________________________________

📌 Outlook

Gold may continue to rise in the short term if buying pressure remains strong and price holds above the 4,420–4,430 support zone. Nevertheless, elevated RSI levels could trigger temporary corrections or sideways movement before the next upside breakout.

________________________________________

💡 Suggested Trading Strategy

SELL XAU/USD: 4,517–4,520

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4,523.5

BUY XAU/USD: 4,473–4,470

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4,366.5

XAUUSD: Bullish Trend Remains Clear, Pullbacks Are Just a Setup Hi!

On the H4 timeframe, price is moving cleanly within a well-defined ascending channel. What I value most about this rally is not its speed, but the way the market consolidates before each breakout. After the previous advance, XAUUSD did not experience aggressive selling; instead, it entered a consolidation phase with shallow pullbacks of roughly 40–50%. This is a classic characteristic of a strong trend, where selling pressure is limited to short-term profit taking and is quickly absorbed.

Following this accumulation phase, price broke above the corrective trendline, forming a continuation pattern (pennant) and immediately triggering a strong bullish leg. This breakout pushed price deeper into the upper side of the trend channel, confirming a bullish continuation rather than distribution. From my experience, such “clean” breakouts are typically driven by institutional flows, not retail FOMO.

From a fundamental perspective, the current environment continues to favor gold. According to the Forex Factory calendar, the market is closely monitoring upcoming U.S. inflation and labor data, while expectations remain that the Fed will maintain a more accommodative stance, or at least avoid a strongly hawkish tone in the near term. Meanwhile, major outlets such as Bloomberg and Reuters continue to highlight safe-haven demand amid geopolitical risks and slowing global growth. These factors have limited the upside potential of the U.S. dollar and indirectly supported XAUUSD.

At this point, with price trading at fresh highs, I do not expect gold to move straight up. A more realistic scenario is a technical pullback toward the nearest support zone within the ascending channel, around the 4,45x–4,46x area, to retest demand. If this zone holds, it would provide a solid base for price to continue higher toward the next resistance area around 4,55x–4,58x, aligning with the upper boundary of the trend channel.

Wishing you successful trading!

(Silver / USD, 1H) Chart pattern...(Silver / USD, 1H):

Visible projected targets on my chart:

Target 1: around 65.00

Target 2: around 59.00

How this is derived (from the image):

Price is currently above an ascending trendline.

The marked arrow shows a pullback to the trendline, with the first horizontal target near 65 (previous structure support).

A deeper continuation move projects toward 59, which aligns with a stronger historical support zone.

Key levels to watch:

Trendline support: ~66.5–67.0

Invalidation: A strong close back above 69.5–70.0 would weaken this downside setup.

This is technical-level interpretation only, not a trade recommendation.

If my want, tell me:

My timeframe (scalp / intraday / swing)

Whether my looking for buy or sell targets

and I’ll refine it further 📊

Oil Rises 1.7% Since the Start of the Week On Geopolitical FactoOil Rises 1.7% Since the Start of the Week On Geopolitical Factors

As the XBR/USD chart shows, Brent crude trading opened this week near the $61.40 level, and by Tuesday morning the price was hovering around $61.50 (approximately +1.7%).

Oil prices are being pushed higher by geopolitical developments, including:

→ Pressure on Venezuela. President Trump stated that the United States could seize or sell oil from Venezuelan tankers that have been blocked.

→ Ukrainian attacks on ports and tankers linked to the transportation of Russian oil.

As a result, oil has gained around 5% from its seven-month low recorded on 16 December (point B), reflecting the risk premium that traders are building into the price of a barrel.

Technical Analysis of the XBR/USD Chart

Since mid-October, prices have remained in a downtrend, driven by a global increase in oil supply (analysts expect the supply surplus to persist into 2026).

At the same time:

→ price fluctuations have formed a descending channel, which was extended lower during the bearish impulse on 15–16 December;

→ at the low (B), the price failed to reach the lower boundary of the channel (a bullish signal), and then formed two bullish gaps (marked by arrows);

→ during the second gap, price moved aggressively into the upper half of the channel.

From a bullish perspective, price action suggests that buyers are currently in control, meaning traders should be prepared for a scenario in which rising geopolitical tensions push XBR/USD towards the upper boundary of the channel.

From a bearish standpoint, it is reasonable to assume that the area between the 50% and 61.8% Fibonacci retracement levels (where oil is trading today) could act as resistance following the A→B decline.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAU/USD (Gold) – H1 Analysis....XAU/USD (Gold) – H1 Analysis (Based on my chart)

Market Structure

Strong bullish impulse move already completed.

Price is overextended and reacting from the top.

Likely healthy pullback / correction toward trendline + Ichimoku support (as marked).

📉 Sell (Correction) Scenario

Sell Zone: 4480 – 4495

🎯 Target Points

Target 1: 4440

Target 2: 4400

❌ Invalidation

A strong H1 close above 4500 will invalidate the correction sell.

📌 Summary

Trend: Bullish (higher timeframe)

Current Move: Bearish pullback

Expectation: Price to retrace toward 4440 → 4400 before next bullish continuation

Gold Facing Rejection at Key Resistance – Bearish BiasGold is showing signs of bearish continuation after a strong impulsive move into a clear supply / resistance zone. Price has reacted multiple times from this area, indicating selling pressure and weak bullish follow-through. The current structure suggests a potential lower high, favoring a downside move.

A sell entry is planned near the highlighted resistance zone, with a stop loss placed safely above the supply area to invalidate the setup if price breaks higher. The target is aligned with the previous demand zone, offering a favorable risk-to-reward ratio.

Key Technical Factors:

Rejection from a strong supply zone

Market showing exhaustion after bullish momentum

Bearish structure forming on the intraday timeframe

Target aligned with prior support / demand area

Trade Management:

Wait for confirmation near entry zone

Manage risk strictly as per plan

Partial profits can be secured near intermediate support levels

XAUUSD – Gold, 2H chart pattern

(XAUUSD – Gold, 2H timeframe), here is the target explanation in clear English:

📈 Market Structure

Trend is bullish (higher highs & higher lows).

Price is above the ascending trendline → buyers are in control.

Price has broken the previous resistance zone and is holding above it (now acting as support).

🎯 Targets

First Target (TP1): 4,450

Main Target (TP2): 4,500 – 4,520

(This matches the marked “target point” zone on my chart)

🛡️ Support / Invalidation

Key Support: 4,360 – 4,340

If price closes below 4,330 (2H close), bullish setup becomes weak.

📌 Summary (Simple)

Gold is in an uptrend. As long as price stays above 4,340, buying pressure remains strong and price can move toward 4,500+.

If my want, I can:

Give a short signal-style format (Entry / SL / TP)

XAUUSD – Bullish Reversal From Demand Zone (30M)Gold is showing signs of bullish continuation after a corrective move into a strong demand zone. Price previously respected this area and is now attempting to push higher, suggesting buyers are stepping back in.

Trade Plan:

Entry: Around 4300.70

Stop Loss: Below 4273.20 (below demand structure)

Target: 4426.60 (prior supply / resistance zone)

Rationale:

Price reacting from a well-defined demand zone

Higher-timeframe bullish structure remains intact

Previous resistance zones above act as logical profit targets

Favorable risk-to-reward setup

Invalidation:

A strong close below the demand zone would invalidate the bullish scenario.

Always manage risk properly. This is not financial advice.

COFFEE Breakout to the DownsideLook at the broader picture. Price has been making lower highs and lower lows, respecting a clean descending trendline. Sellers have been in control for a while.

Now focus on that support zone, from where price bounced multiple times. But notice what changes on the most recent test.

Instead of a clean reaction like before, price breaks below with momentum.

That’s a major shift. When demand fails like this, it often flips into resistance.

Now price holds below the broken zone with no strong reclaim or immediate buyer response.

That tells us selling pressure is real. The small bounce we see afterward is corrective.

It lacks momentum and happens below structure.

As long as price remains below the broken level and the descending trendline, I expect the move to continue towards 315.0 level.

Invalidation; a strong reclaim back above the highlighted zone would require a reassessment.

Until that happens, for me this is a trend continuation scenario.

The market already made its decision, now it’s following through.

The 2025-2026 Silver Rally + 3-Step Rocket Booster Strategy--

Let me tell you

the amount of research i did

just to be able to confidently write

this message to you has been insane and hard.

And i went down a rabbit hole.

I couldn't stop but i had to come out

for fresh air.

This is what i have found... during

this data of research this is

the most fear i have ever felt.

Let me tell you why...

When i began trading around

2017 silver was one of the first

assets i bought on

margin.

I did this during February

around 2018

i lost all my money on this trade

i remember i kept buying silver COMEX:SI1!

and the price kept crashing..

today the margin level for silver

is high!!

At that time i could only

buy like "x2" margin.

At that time this was considered

very volatile

and expensive.

It was so expensive that

you could lose

your money in one bad trade

Today the margin level is super high around

"20x " minimum bro

the amount of fear from the past

has stuck with me

because at the time

i risked all i had it wasn't much

but i had to go all in to

learn how to trade well.

This was a dark peroid of my life

and now full circle

i cant believe it

am back here again

but this time

am truly humbled

and my fear now is way more higher..

if this trade doesn't go well

am done...

am hanging my gloves with this trading stuff

and going to work a job

at a fast food business

atleast i can eat the food for free

in the back.

Even if am mopping floors and taking out

trash.

But now am going to put in something

special the rocket booster

strategy it has 3 steps:

-The price has to be above the 50 EMA

-The price has to be above the 200 EMA

-The price should increase in momentum or gap up

this last step is measured

by the RSI+Stochastic indicator.

This has been one of the most

challenging articles

because it reminds me

to be humble

and sharing it with you is not easy

so am wishing you happy holidays

because sharing this with you is my gift

and am saying thank you for

following me

and trusting me to help you

on your trading

the rocket booster

strategy is the reason

why i have reached this far on

my trading journey...

In other news the oil and gas

companies seem to be trending

up for example companies like NASDAQ:FANG

follow the rocket booster

strategy and looks like a good buying investment

Long term

If you want you can learn more

about oil and gas companies.

Because i believe this is another trend

going on in the back ground.

Rocket boost this content to learn more

thank you for reading.

Happy Holidays and enjoy!

Disclaimer: Trading is risky please learn about

risk management and

profit taking strategies

Also feel free to use a simulation trading account

before you trade with real money.

XAUUSD in Uncharted Territory – Bullish Momentum Unleashed!

After fantastic yesterday session where price reached my target, gold extended its rally during the Asian session, breaking through $4,450 and nearly reaching the psychological benchmark of $4,500. This move places the market in uncharted territory, with price now trading above the upper boundary of the ascending channel that has guided the trend since October 2025, a strong technical signal for potential continuation of the bullish trend if the breakout sustains.

The decisive move above the channel’s upper resistance line marks a major bullish development. Historically, such breakouts often lead to accelerated gains, provided price holds above the breakout zone.

Key Levels:

Support: Asian session low at $4,457.

Resistance: Asian session high at $4,497; next psychological level at $4,500.

RSI on H4 is in overbought territory. Notably, the last two times RSI reached similar levels, gold delivered corrections of over 1.5%, signaling potential short-term exhaustion.

Moving averages (50-SMA and 200-SMA) remain strongly bullish.

On the daily chart, this peak could form the head of a potential Head and Shoulders pattern. Volume analysis will be critical for confirming whether this is a continuation or the start of a reversal structure.

With year-end approaching, this rally may represent a seasonal peak, aligning with historical patterns of profit-taking before the new year.

Today's Trading Strategy

Bias: Bullish as long as price holds above $4,457 and remains outside the channel.

Setup: Break above $4,497 could target $4,520–$4,550.

Failure to hold above $4,457 may trigger a pullback

Gold Trade plan 23/12/2025Dear Traders,

Price is currently trading within a bullish institutional framework following a confirmed Break of Structure (BOS) to the upside. After sweeping internal liquidity above prior highs, the market transitioned from accumulation to expansion, indicating strong participation from smart money.

The recent impulsive leg shows efficient price delivery, while the current consolidation suggests re-accumulation rather than distribution.

🔹 Market Structure (HTF)

Confirmed Bullish BOS

Clean sequence of HH / HL

No HTF CHOCH detected

Trend remains valid while structure holds

🔹 Liquidity & Orderflow

Buy-side liquidity above recent highs is being targeted

No sell-side imbalance strong enough to indicate reversal

Volume behavior supports continuation, not exhaustion

🔹 Key Institutional Zones

Breaker / Demand (HTF POI)

4460 – 4430

Former supply → flipped to demand

Confluence with channel midline

Secondary Demand

4300 – 4250

Range equilibrium & unmitigated demand

Liquidity Targets (Premium Zones)

4580 – 4620

4700+ (External liquidity)

🔹 Imbalances & Fair Value

Minor inefficiencies have been partially mitigated

Any return into HTF imbalance within demand is considered optimal entry

🔹 Execution Model (LTF Alignment)

📌 Primary Setup(Looking for buy)

Wait for price to tap HTF demand (4460–4430)

Look for LTF CHOCH → BOS

Enter on displacement

Target buy-side liquidity above highs

Invalidation level : Close below 4430

Regards,

Alireza!