GOLD down slightly, watch today's data, technical conditionsOANDA:XAUUSD edged lower in Asian trading on Tuesday (August 5), currently trading around $3,380/ounce. On Tuesday, the US ISM services PMI will be released, which is the most important economic data of the week and is expected to impact the gold market.

OANDA:XAUUSD prices surged after weak jobs data increased the possibility of the Federal Reserve cutting interest rates.

Data released last Friday showed that the number of new jobs in the US non-farm sector in July was much lower than expected, and the total number of non-farm jobs in the first two months was revised down by 258,000, indicating a sharp deterioration in the labor market.

Traders now see an 87% chance of a rate cut in September, up from 63% last week, according to CME Group's FedWatch tool. Expectations of a rate cut have boosted gold prices, as the dollar provides support for the precious metal.

The US ISM non-manufacturing purchasing managers index (PMI) for July will be released today (Tuesday) and is expected to be 51.5, up from 50.8 previously.

The July ISM services PMI could impact the US dollar and gold, depending on whether it is biased towards supporting a rate cut or pausing rate cuts for an extended period.

Gold itself does not generate interest, but generally performs well in low-interest-rate environments and is seen as an inflation hedge.

On the trade front

Today (August 5), US President Donald Trump threatened to raise tariffs on Indian goods in protest at India's purchase of Russian oil. New Delhi called Trump's attack "absurd" and pledged to protect its economic interests, deepening the trade rift between the two countries.

Trump posted on the social media platform Truth Social: "India not only buys massive amounts of Russian oil, but also sells much of it on the open market at a huge profit. They don't care how many people are being killed in Ukraine by the Russian war machine."

Trump added: "Accordingly, I will be substantially increasing the tariffs that India pays to the United States."

However, Trump did not specify the specific tariff amount.

Responding to Trump's remarks, an Indian foreign ministry spokesperson said on Monday that India would "take all necessary measures to protect its national interests and economic security." The spokesperson added: "These actions against India are unjustified and unjustifiable."

Over the weekend, Reuters reported that India would continue to buy oil from Russia despite Trump’s threats.

In July, Trump announced that he would impose a 25% tariff on imports from India, and US officials have also pointed to a range of geopolitical issues as holding up the signing of a US-India trade deal.

Trump has also described the BRICS group as generally hostile to the US. Those countries have rejected Trump’s accusations, saying the group protects the interests of its members and the developing world as a whole.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, although gold has been very volatile in recent times, it is still moving sideways, with price action clinging to the EMA21. And after a strong recovery in the past three trading sessions, gold is temporarily limited by the 0.236% Fibonacci retracement level, which was the bullish target that readers paid attention to earlier. The return above the EMA21 provides gold with initial conditions for bullish expectations, but a new trend has not yet formed.

If gold takes its price action above the 0.236% Fibonacci retracement level and stabilizes above it, it will have room to continue rising with the next target being the raw price point of $3,400 rather than the $3,430-$3,450 target. But at its current position, it still has no clear trend either up or down.

Meanwhile, once gold sells below the 0.382% Fibonacci retracement level, it could continue to decline with a target of $3,246 in the short term, which also means that the $3,300 – $3,292 area is the current key support area.

Momentum-wise, the Relative Strength Index (RSI) is also hovering around 50 with little fluctuation, indicating a hesitant sentiment in the market without leaning to either side.

For the day, the technical outlook for gold is a sideways consolidation but the technical conditions are slightly more bullish, and the notable positions are listed as follows.

Support: $3,350 – $3,340 – $3,300

Resistance: $3,400 – $3,430

SELL XAUUSD PRICE 3402 - 3400⚡️

↠↠ Stop Loss 3406

→Take Profit 1 3394

↨

→Take Profit 2 3388

BUY XAUUSD PRICE 3329 - 3331⚡️

↠↠ Stop Loss 3325

→Take Profit 1 3337

↨

→Take Profit 2 3343

Futures market

Gold (XAU/USD) - Market Structure Analysis Points to Next MoveThe provided 4-hour chart for Gold (XAU/USD) displays a market structure analysis incorporating concepts like Break of Structure (BOS), Change of Character (CHoCH), Fair Value Gaps (FVG), and defined support and target (resistance) levels. The price has shown a recent bullish trend, marked by higher highs and higher lows, confirmed by BOS signals. Currently, the price is consolidating around the 1st support level after reacting to a FVG.

Current Position: Consolidating around the 1st support level (approximately $3,365.028 - $3,353.094).

Support Levels:

1st support: Immediate support zone.

2nd support: Lower support zone ($3,328.619 - $3,320.000).

GL Zone & Support Zone: Confluence of a Golden Level and support ($3,299.096 - $3,290.067).

MAJOR SUP ZONE: Significant historical support area ($3,280.000 - $3,273.685).

Resistance Levels (Targets):

1st TG: Target/resistance zone ($3,392.891 - $3,402.807), containing a FVG.

2nd TG: Higher target/resistance zone ($3,413.659 - $3,423.805), also containing a FVG.

Market Structure: Evident bullish market structure with BOS confirmations, although a recent CHoCH suggests a potential shift or at least a temporary pause in the aggressive uptrend. Multiple FVGs indicate areas where price might find support or resistance.

Potential Trading Scenarios

Bullish Continuation: If the price respects the 1st support level and moves to fill the lower FVG within the 1st TG, a long opportunity could arise targeting the 2nd TG. Confirmation would be a break above the upper boundary of the 1st TG.

Bearish Retracement: If the 1st support fails to hold, the price could retrace towards the 2nd support level. A break below the 1st support and a failure to hold the FVG within the 1st TG would signal this scenario.

Range Trading: The price could consolidate between the 1st support and 1st TG levels, offering short-term trading opportunities within this range.

Explanation of Specific Elements

BOS (Break of Structure): Indicates a continuation of the current trend. A bullish BOS occurs when the price makes a higher high, confirming the uptrend.

CHoCH (Change of Character): Suggests a potential shift in the market's behavior. A bearish CHoCH after a bullish trend might indicate weakening buying pressure and a possibility of a reversal or a significant pullback.

FVG (Fair Value Gap): Represents an inefficiency in the market where there were aggressive price movements with less trading volume on one side. These gaps can act as future support or resistance levels as the market often tries to fill them.

Support Levels: Price levels where buying pressure is expected to outweigh selling pressure, potentially halting a downtrend.

Target/Resistance Levels (TG): Price levels where selling pressure is expected to outweigh buying pressure, potentially halting an uptrend.

GL Zone & Support Zone (Golden Level): This likely refers to a support level coinciding with a Fibonacci Golden Ratio level, often considered a high-probability reversal zone.

MAJOR SUP ZONE: A significant historical support level where strong buying interest has been seen in the past.

TradingView "Publish Idea" Post Based on the Chart

Title: Gold (XAU/USD) - Bullish Structure Consolidating at Support with Breakout Potential

Analysis:

Gold (XAU/USD) on the 4-hour timeframe shows a clear bullish market structure confirmed by multiple Breaks of Structure (BOS). After a strong upward move, the price is currently consolidating around the 1st support level ($3,365.028 - $3,353.094), which also aligns with a Fair Value Gap (FVG).

The presence of a recent Change of Character (CHoCH) suggests that the aggressive bullish momentum might have temporarily subsided, and we could be seeing a period of accumulation before the next move. The price action within the FVG near the 1st TG ($3,392.891 - $3,402.807) will be crucial.

Potential Scenarios & Trading Plan:

Bullish Continuation: If the 1st support holds and the price breaks above the upper boundary of the FVG within the 1st TG, it would signal a likely continuation of the bullish trend.

Long Entry: Upon a confirmed breakout above $3,402.807.

Target 1: The 2nd TG zone ($3,413.659 - $3,423.805), which also contains a FVG.

Stop Loss: Place below the 1st support level (e.g., below $3,353.000) to manage risk.

Bearish Retracement: Failure to hold the 1st support could lead to a deeper retracement.

Short Entry: On a confirmed break below $3,353.000.

Target 1: The 2nd support zone ($3,328.619 - $3,320.000).

Stop Loss: Place above the 1st support level.

Key Levels to Watch:

Support: $3,365.028 - $3,353.094, $3,328.619 - $3,320.000, $3,299.096 - $3,290.067.

Resistance (Targets): $3,392.891 - $3,402.807, $3,413.659 - $3,423.805.

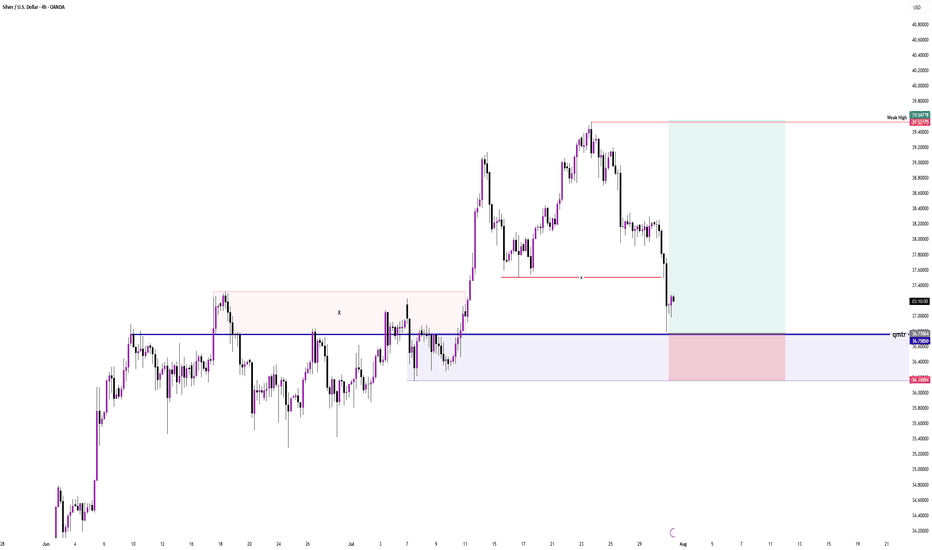

Hellena | Oil (4H): SHORT to support area of 65.944.Colleagues, I previously recommended moving trades to break-even, and for good reason. It is always necessary to hedge and reduce losses—this is part of professional work.

(Breakeven=Risk Free: Move Stop loss to the entry level).

The price has nevertheless shown a stronger correction, and I now believe that the medium-term “ABC” waves have not yet formed, nor has the large “Y” wave.

This means that I expect the completion of wave “B” and then a continuation of the downward movement in wave “C.”

I consider the support area of 65.944 to be the minimum target.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Gold's Next Move? Eyes on the Liquidity Trap Below!Gold has created internal liquidity during the New York session and is now moving downward. There is liquidity resting below the recent swing lows, and beneath that lie bullish Pending Demand (PD) arrays. If the market takes out this liquidity, we can then look for bullish confirmations from the PD arrays for potential buy opportunities.

Do Your Own Research (DYOR).

Gold Consolidates at the Top, Bearish Reversal Ahead?On the 15-minute chart, XAUUSD is showing signs of exhaustion after a strong bullish impulse. Price is currently consolidating around the 3,370–3,375 resistance area, failing to make a clean breakout. Volume is fading, suggesting buyer momentum is weakening.

Technical Breakdown:

1. Market Structure:

Since late July, the market has formed a clear uptrend with higher highs and higher lows.

However, recent price action is showing indecision at the top, with multiple rejection wicks – indicating a potential short-term distribution phase.

2. Price Action & Supply-Demand Zones:

Demand Zone 1: Around 3,310–3,320 acted as the launchpad for the strong bullish breakout on August 2.

Demand Zone 2: Around 3,345–3,350 provided support for the next leg up.

Current Supply Zone: Between 3,375–3,380 – multiple rejections have been observed here.

3. Indicators Overview:

EMA20 & EMA50 (not shown but inferred): Upward sloping, but starting to flatten – signaling potential consolidation or bearish divergence.

RSI (likely above 70 earlier): Now showing signs of bearish divergence, supporting a possible short-term correction.

4. Fibonacci Retracement Analysis:

From the recent bullish swing (3,310 → 3,375), key retracement levels are:

0.382 → ~3,350

0.5 → ~3,342

0.618 → ~3,334

This confluence around the 3,334–3,342 range makes it a critical zone for a potential bullish bounce.

Suggested Trading Strategies

Scenario 1 – Scalping the Rejection (Counter-trend short):

Entry: SELL limit at 3,375–3,380

Stop Loss: 3,386

Take Profits:

TP1: 3,350 (Fibonacci 0.382)

TP2: 3,335 (Fibonacci 0.618 + previous support)

Scenario 2 – Trend Confirmation (Breakdown Play):

Setup: Sell if price breaks below 3,350 with volume confirmation.

Target Zones:

Initial target: 3,310 (prior demand zone)

Extended target: 3,280–3,265 (possible Wyckoff distribution breakdown)

Key Levels to Watch:

Significance: 3,380 - Resistance - Short-term supply zone

3,350: Support - Key Fibonacci 0.382 level

3,334: Support - Strong confluence zone (Fibo + demand)

3,310: Support - Bullish breakout base

Conclusion:

Gold is currently in a vulnerable position with signs of bullish exhaustion. Traders should stay patient and wait for confirmation before entering. Watch the 3,350–3,334 zone for reaction – it will likely decide the next directional move.

If you found this analysis helpful, make sure to follow for more updated strategies and save this post for future reference.

Smart Money Concept (SMC) XAU/USD Bearish Analysis – SMC

1. Market Context

The price is coming off a bullish expansion that mitigated areas of interest, but failed to break through supply structures with force, leaving an imbalance (FVG 4H) and pending liquidity at lower levels.

2. Consolidation Zone

After the surge, the market entered a consolidation phase (accumulation/distribution), forming BOS and ChoCh without generating new HH, a sign of buying weakness.

3. Fake Out and Rejection

A fake out trapped buyers and the price returned to the range, indicating liquidity absorption by institutional investors.

4. Bearish Interest

The previous LL and LH levels were not mitigated and act as price magnets. This creates bearish interest, with a high probability of seeking that liquidity.

5. Trading Plan

• Entry: Rejection at the resistance zone

• Confirmation: Failed retest and rejection (SMA rejection)

• Target: Next LL at the support zone

• Stop Loss: Above the resistance zone/fake out

Summary: The price is showing a distribution structure with accumulated liquidity below the support, increasing the probability of a bearish continuation.

GOOD LUCK TRADERS….

How to accurately capture golden trading opportunities?Bullish trend is still the main trend of gold at present. After rising to 3368 at the opening today, it fell under pressure and fluctuated. Technically, it has tested the pressure level and needs to be adjusted. The overall high-level carrying capacity has also declined, so it is not advisable to chase the rise too much. In terms of operation, it is recommended to wait for the price to stabilize before buying more. Judging from the current gold trend, the upper short-term resistance is in the 3380-3385 area, and the key pressure is at the 3395-3400 line; the lower short-term support is in the 3365-3355 area, and the key support is in the 3350-3345 range. The overall suggestion is to arrange long orders on dips around the support area, and try to maintain a stable wait-and-see attitude in the middle position. I will prompt the specific operation strategy at the bottom, please pay attention in time.

Gold Trading Strategy: Buy in batches as gold retreats to the 3365-3350 area, targeting the 3380-3385 area. If this resistance zone is broken, hold and look for upward movement.

Gold rises for three consecutive days! Buy the dip or hold on?Market News:

Spot gold prices fluctuated at high levels in early Asian trading on Tuesday (August 5), currently trading around $3,380 per ounce. Driven by weak US economic data, rising expectations of a Federal Reserve rate cut, and intensifying global trade tensions, international gold prices continued their upward trend from last Friday, marking their third consecutive day of gains. Driven by expectations of a Fed rate cut, geopolitical risks, and a weakening US dollar, gold maintains strong upward momentum in the short term. From a medium- to long-term perspective, gold's investment value remains significant. Global economic uncertainty, ongoing trade conflicts, and the potential resurgence of inflationary pressures all provide solid support for gold. Investors should pay close attention to the US June trade balance and July ISM non-manufacturing PMI data, which will be released this trading day.

Technical Analysis:

Last week, gold closed with a long lower shadow, a bullish candlestick pattern. This is a clear sign of stabilization, and the price remains firmly within the middle band. This week, the upward trend may continue, with repeated attempts to test the resistance point derived from the lower band of the previous upward trend. This maintains a bullish outlook for the medium- to long-term trend, and represents a period of strength within this bullish trend. The daily short-term trend also remains bullish. The recent three-month consolidation period is a correction, with the lows gradually moving higher. The longer the sideways trend, the stronger the potential for a bull market continuation, both in terms of strength and timing, once it breaks higher. Last Friday, a strong bullish candlestick pattern formed at the bottom, stabilizing the 5-day moving average and returning to the converging triangle channel. This suggests a continued bullish outlook today. A pullback confirms support at the lower band of the converging triangle, approximately 3345-48, also the 10-day moving average. After testing support in today's Asian session, support is indeed present. Focus on the upper band around 3410.

Trading strategy:

Short-term gold: Buy at 3362-3365, stop loss at 3354, target at 3380-3400;

Short-term gold: Sell at 3407-3410, stop loss at 3419, target at 3370-3350;

Key points:

First support level: 3370, second support level: 3363, third support level: 3350

First resistance level: 3397, second resistance level: 3410, third resistance level: 3422

Gold prices have retreated slightly. Is there an opportunity to From the daily chart:

Gold prices haven't held above 3380, so the primary resistance level remains around 3385.

Currently, the daily moving average support is far from the high, with support below 3340-3360. While the daily trend remains bullish, the risk of a pullback and subsequent upward movement cannot be ruled out.

From the 1-hour chart, Quaid believes the price cannot fall below 3365. 3365 marked the opening high on Monday. Common sense suggests that if gold remains above 3365, it may remain at a high level for a short-term consolidation.

Thus, today's focus is on the key level of 3365. If the price doesn't fall below this level, consider going long at this level, waiting for a profit after another rally to the resistance range, and then shorting within the key resistance range.

NQ Power Range Report with FIB Ext - 8/5/2025 SessionCME_MINI:NQU2025

- PR High: 23360.00

- PR Low: 23316.25

- NZ Spread: 97.75

Key scheduled economic events:

09:45 | S&P Global Services PMI

10:00 | ISM Non-Manufacturing PMI

- ISM Non-Manufacturing Prices

Session Open Stats (As of 12:35 AM 8/5)

- Session Open ATR: 294.27

- Volume: 23K

- Open Int: 278K

- Trend Grade: Long

- From BA ATH: -2.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

XAUUSD – Mid-Channel Rejection Near Key Supply ZoneGold has made an impressive recovery off the $3,250 zone, pushing back into the $3,380–$3,390 region — a key supply area which previously led to strong sell-offs.

We’re now sitting at the upper boundary of a 1H ascending channel and just under a significant resistance area seen on the 4H and daily timeframes.

Although bullish momentum is still present, price is showing early signs of exhaustion at this level — with small rejections forming and volume beginning to taper off.

The key zone to watch is $3,384 – $3,390. If price fails to break and close above this zone cleanly on the 4H, we may see a corrective pullback back toward the midline of the channel — or even a full retest of the lower boundary near $3,305 or $3,268 depending on momentum.

Bias: Short-term bearish / corrective – waiting for confirmation of rejection or bearish candle formation below $3,384.

3 Powerful Buy Signals on Gold – Rocket Booster Strategy ⚡ 3 Powerful Buy Signals on Gold – Rocket Booster Strategy Engaged!

Asset: XAU/USD (Gold)

Timeframe:

Bias: Bullish Reversal Setup

Strategy: Rocket Booster Strategy

Signal Strength: ✅✅✅

🔍 Breakdown of the 3 Signals:

1️⃣ Volume Oscillator – Buyer Volume Building

Gold is showing a strong surge in buy-side volume, indicating institutional accumulation after recent dips. The Volume

Oscillator is sloping upward — a key reversal sign.

2️⃣ MACD – Bullish Crossover Below Zero

The MACD has crossed up while still below the zero line, giving us a first-mover signal. This is often seen before price breaks out —

great risk-reward territory.

3️⃣ ADX + DI+ – Momentum Swinging to the Bulls

ADX rising toward/above 20 = trend strength building

DI+ crossing above DI- = buyer dominance confirmed

This confirms the momentum shift backing the volume and MACD signals.

🚀 Rocket Booster Strategy Criteria:

✅ Price is now trading above both EMA 50 and EMA 200

✅ The EMAs are beginning to turn up — trend confirmation in progress

✅ All 3 pillars — trend, momentum, and volume — are now aligned

💡 Trade Setup (Example Only – Use Your Risk Profile):

Entry: Current price or on a minor pullback

Stop-Loss: Below recent swing low or just under EMA 50

Target 1: Nearest resistance or last swing high

Target 2: Fibonacci extension or 2R/3R profit level

Optional: Trail your stop below EMA 20 or use ATR for dynamic exits

Rocket Boost This Content To Learn More

⚠️ Disclaimer:

This analysis is for educational purposes only and not financial advice.

Always use a simulation account to test any strategy before trading live.

Apply solid risk management and profit-taking strategies.

Only risk capital you can afford to lose.

🧠 Final Thoughts:

Gold has entered Rocket Booster territory. With momentum shifting, volume confirming, and trend structure aligning, this is one of those rare high-conviction setups.

Watch closely. Let the market confirm your plan. 🚀

XAU/USD Bullish Setup Building MomentumGold has reclaimed bullish momentum after a strong bounce from the recent demand zone around 3319–3322. The chart shows a clear Change of Character (CHOCH) and subsequent Break of Structure (BOS), suggesting buyers are regaining control. Price is now trading above the Ichimoku cloud, further confirming bullish pressure. The upward arrow highlights the potential path toward the next key resistance area near 3380–3400. As long as price sustains above the previous structural break and the cloud base, continuation toward the upside remains likely. Market structure favours buying opportunities on dips, with bulls targeting a higher move in the short term.

Entry Buy: 3334

Target Point: 3404

If you found this analysis helpful, don’t forget to drop a like and comment . Your support keeps quality ideas flowing—let’s grow and win together! 💪

Bullish Breakout to $4,060 TargetOn the daily chart, XAUUSD is forming a Symmetrical Triangle with a bullish breakout potential.

📍 Buy zone: Around $3,200 (strong support and point D of the pattern)

📍 Target: $4,060 based on breakout projection.

Quick Analysis:

Pattern: Symmetrical Triangle + ABCD Harmonic

Buy near strong support at $3,200

Big upside potential after breakout

Good risk/reward for medium to long-term trades

Dow Futures (YM) Nearing Final Push Before Significant RetreatThe Dow Futures (YM) cycle, initiated from the April 2025 low, has reached a mature phase and could conclude soon. We anticipate one final push higher to complete the impulsive cycle from that low. As shown on the one-hour chart, wave (3) of this impulse peaked at 45,312. The subsequent wave (4) pullback concluded at 43,467, forming a zigzag Elliott Wave structure. From wave (3), wave A dropped to 44,418, wave B rallied to 44,852, and wave C fell to 43,467, finalizing wave (4). The Index has since turned upward in wave (5), but it must surpass the wave (3) high of 45,312 to eliminate the possibility of a double correction.

Currently, wave (5) is unfolding as a lower-degree impulse. From wave (4), wave ((i)) reached 43,864, followed by a wave ((ii)) pullback to 43,542. The Index then advanced in wave ((iii)). From wave ((ii)), wave (i) hit 43,997, and wave (ii) corrected to 43,881. We expect a few more highs before wave 1 of (5) completes. A wave 2 pullback should follow, but the Index will likely resume its ascent afterward. As long as the pivot low at 43,467 holds, dips should attract buyers in 3, 7, or 11 swings, supporting further upside in the near term.

Gold is fluctuating at a high level. Latest analysis.On Monday, gold surged to around 3370 in the morning before retreating slightly. It fell back to support near $3345 in the European session. The dividing line between bulls and bears lies below 3340, which also marks the support level and the top-bottom reversal before the close of last Friday's non-farm payroll report.

Quaid planned to go long near 3340 on Monday, but the price rebounded to 3345, halting its decline and then fluctuating sideways, preventing an entry opportunity. However, a short opportunity near 3385 was successfully implemented with a slight pullback. Although it did not reach the expected target, a small profit was achieved after the pullback to 3370.

Monday showed an overall upward trend, with the closing price fluctuating at a high level, reaching a high around 3385 before retracing to confirm 3370. The overall market trend remains upward, with a temporary potential for a move to around $3400. Quaid recommends a buy-on-low strategy today. Currently, the 1-hour moving average is trending flat, and the trend of prices continuing to fluctuate at high levels cannot be ruled out.

Support for Tuesday's pullback lies near 3370. The key to a renewed rally lies at 3360, also the level of resistance before Monday's US market opening. As long as this level remains intact, the overall strategy remains unchanged. Alternatively, watch for a re-break of 3385, with upside targets at 3385-3390-3400.

Strategy:

Long at 3360-3365, stop-loss at 3355, profit range at 3380-3400;

Short at 3395-3400, stop-loss at 3410, profit range at 3370-3350;

Key Points:

First Support Level: 3370, Second Support Level: 3360, Third Support Level: 3350

First Resistance Level: 3385, Second Resistance Level: 3395, Third Resistance Level: 3405.

August 5, 2025 - XAUUSD GOLD Analysis and Potential OpportunitySummary:

Price action has been choppy and indecisive, with no clean signals or clear levels. In the absence of a solid short setup, the main idea for the Asian session is to buy on dips. Watch the 3385 resistance zone closely — if price breaks and holds above, look for long opportunities on a pullback. If 3385 is rejected, it may offer a good risk-reward short setup.

📍 Key Levels to Watch:

• 3405 – Resistance

• 3400 – Psychological level

• 3385 – Resistance

• 3378 – Resistance

• 3371 – Key intraday support

• 3365 – Support

• 3350 – Psychological level

• 3345 – Support

📈 Intraday Strategy

SELL if price breaks below 3371 → watch 3365, then 3358, 3350, 3345

BUY if price holds above 3378 → target 3385, then 3394, 3400, 3405

👉 If you find this helpful or traded using this plan, a like would mean a lot and keep me motivated. Thanks for the support!

Disclaimer: This is my personal view, not financial advice. Always use proper risk control.

Gold – Eyeing the H4 FVG Before the Next Bull RunPrice has been consolidating within the current Asian range after running last week’s high and today’s daily high. The move into D-H lacked strong momentum, and with a large unfilled H4 Fair Value Gap (3,350–3,372) below, I’m anticipating a retracement to rebalance liquidity before resuming the bullish trend.

Key Notes:

D-H (~3,436) acting as short-term resistance.

Watching for a sweep of D-H to create excess on the DOM, then a potential breakdown toward the H4 FVG.

Bearish path targets: 3,397 → 3,372 → 3,350.

Bullish continuation requires a clean breakout and hold above D-H with volume.

This scenario could set up a stronger bullish leg later in the week, especially if the retracement aligns with London or NY session volatility.

Gold price today August 5: strong reversalWorld gold prices unexpectedly reversed sharply, as Europe and the US continued to release poor economic data. Specifically, the European economic area announced the investor confidence index released monthly by Sentix GmbH, August at a decrease of 3.7 points, much lower than the increase of 4.5 points in July.

In the US, factory orders released monthly by the US Census Bureau, measuring the change in the value of new orders for goods purchased at US factories, decreased by 4.8% in June compared to the previous month. Although slightly higher than the forecast of a decrease of 4.9%, it decreased sharply compared to the increase of 8.3% in May.

Thus, both the US and the European region are showing weaknesses in economic development. Because new orders in the US are considered a forward-looking indicator of upcoming demand for manufactured goods. Falling orders indicate that the production and business activities of US enterprises will face difficulties in operation.

8/5: Watch for Short Opportunities Near 3400Good morning, everyone!

On Wednesday, gold held above the key support area at 3343–3337, and subsequently broke through the 3372–3378 resistance zone, leading to a strong bullish move and solid long-side gains.

Today, attention should shift to the major resistance around 3400. If bullish momentum continues, price may approach the secondary resistance near 3420. However, from a technical perspective, signs of bearish divergence have begun to emerge. Should price continue rising while momentum weakens, the risk of a short-term correction increases accordingly.

Key levels to monitor:

Primary resistance zone: 3404–3416

Intermediate supply area: around 3398

Crucial support zone: 3372–3363 (a hold here could support further upside)

⚠️ Cautionary Note:

The US PMI data release during the New York session could introduce volatility. Be sure to maintain strict risk management and stop-loss discipline during periods of increased uncertainty.

🔁 Trading Bias for Today:

Prefer selling into strength near resistance, while cautiously considering buying on dips near support.

The 3343–3337 area continues to serve as the primary support zone, and price action around this level will be critical in determining the next directional move