Futures market

USOIL - Bullish Reversal Brewing?Hello Traders!👋

As we close out 2025 and head into the New Year, I'm turning bullish on USOIL (WTI Crude Oil). After a tough year of downside pressure, I see clear signs of a potential trend reversal—here's why:

Technical Overview (Daily/Weekly Timeframe):

Price has firmly bounced from the critical $55 support zone—a multi-year low and psychological floor that's held multiple times this year.

We're seeing fresh buying momentum: Higher lows forming, potential bullish divergence on RSI (oversold conditions easing), and volume picking up on the rebound.

Historically, crude often shifts direction around year-end/New Year—I've observed this pattern over many years, with bounces turning into larger moves as new trends emerge.

Key resistance to watch: $58–60 (recent highs and 50% Fib retracement). A clean break above could confirm bullish continuation.

Why Bullish Now? (My View):

The world is stabilizing: Geopolitical tensions easing (progress on peace talks), which could boost global growth and oil demand in 2026 without extreme risk premiums.

Recent U.S. sanctions on Venezuelan/Russian tankers adding short-term supply tightness, fueling the rebound from lows.

Oversupply fears are priced in at these depressed levels—any positive demand surprise or inventory draws could spark a sharp squeeze higher.

Holding this $55 base feels like a classic bottom, with new buyers stepping in aggressively.

Trade Idea (Bullish Scenario):

Long bias as long as price holds above $55.00.

Potential targets: $58.30 (near-term, 61.8% Fib), $59.20–$60.00 (mid-term), $60.42+ if breaks higher.

Stop Loss: Below $54.90 (recent low) for risk control.

Risk/Reward looks favorable here for swings into the New Year.

Is this the start of a real reversal, or just a temporary bounce in the bear trend? Bulls charging or still cautious on the glut? I will be happy if you will share me your thoughts.

Always make your research!!! This is not financial advice!!!

Gold next move (weekly forecast) (22nd Dec - 26th Dec-2025)Go through the analysis carefully, and do trade accordingly.

Anup 'BIAS for the week (22nd Dec - 26th Dec-2025)

Current price- 4400

"if Price stays below 4420, then the next target is 4384, 4370, 4345 and 4320 and Above it 4440 & 4450"

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

GOLD in 2026! Where will it go after a year of rapid growth?After a virtually unrivaled 2025, the OANDA:XAUUSD market enters 2026 with a bigger question than any specific price: will the uptrend continue, or has the market gone too far?

The short answer is: gold is unlikely to repeat the 2025 breakout, but it is also not yet in a deep downturn. 2026 will most likely be a period of significant volatility at high prices, where the uptrend persists, but the pace and rhythm have changed noticeably.

2025: A Year of Price Increases That Are Not a Chance

The more than 60% surge in gold prices in 2025, along with over 50 new record highs and a historical high of $4,381/ounce, is not a short-term speculative frenzy. It is the result of three major converging flows.

Firstly, geopolitical and trade instability. The US-Mexico-Canada trade tensions quickly moved beyond speculation, culminating in concrete tariffs and retaliatory measures. In this context, defensive capital flows returned to the gold market, a familiar instinct of the global financial system.

Secondly, there's a reversal in expectations regarding US monetary policy. Inflation data cooling faster than expected has forced the Federal Reserve to acknowledge the risk of slower growth, although it's not in a hurry to cut interest rates. The mere opening of the "door to easing" is enough to alter the pricing structure of gold, a non-interest-bearing asset that directly benefits from low interest rates.

Thirdly, there is the systematic weakening of the US dollar. When the base currency depreciates, gold doesn't need new narratives to rise; it simply reflects the adjustment in the exchange rate.

When gold surpasses the $3,000 mark in Q2 2025, the market will no longer be "waiting," but will enter a trend-following state.

Summer 2025: Sideways Movement Is Not the End

The prolonged sideways movement in July and August led many investors to believe the bull cycle was complete. But in retrospect, it was merely a necessary accumulation phase within a larger trend.

The turning point came in September, when the U.S. Department of Labor revised its employment data, revealing a significantly weaker labor market than initially reported. While this was only a revision of past figures, the message to the market was clear: the foundations of U.S. growth are not as solid as they appear.

The Fed was forced to soften its direction, and money once again flowed into gold. In September alone, the price rose nearly 12%. By October, the temporary US government shutdown due to the budget impasse became the final catalyst, pushing gold to historical highs.

Looking ahead to 2026: The trend remains, but the pace will be different.

Currently, gold is at a price point where any further increase would require stronger momentum than before. After a more than 60% increase last year, the likelihood of repeating a similar upward cycle is very low.

However, it is important that the pillars supporting gold prices have not yet collapsed.

Global monetary policy, especially that of the US, remains inclined towards easing to counter recession risks. The dollar lacks a solid foundation for a long-term recovery. And equally important, central banks continue to strategically buy gold, creating "bottom-forming" demand during periods of correction.

In this context, the most plausible scenario for 2026 is that gold prices will rise more slowly and fluctuate more widely, but the overall trend will remain upward. The market will see more technical corrections as investors are ready to take profits at high prices and restructure their portfolios towards other non-dollar assets.

Overall Fundamental Perspective

2026 may not be a year of the steep surges seen in 2025. However, it's not yet the time to turn away from the gold trend. The market is entering a rebalancing phase at high price levels, where volatility has become the norm, and policy and geopolitics remain the two variables determining the final direction.

Gold is no longer "cheap," but it hasn't lost its central role in the global defense picture.

Technical analysis and suggestions OANDA:XAUUSD

The daily gold chart shows that the medium-term uptrend remains clearly dominant, despite the price having just undergone a correction after approaching the historical peak of $4,380/ounce.

The technical structure has not been broken. The price remains above all the important moving averages, especially the short- and medium-term MAs, a typical sign of a market in a "consolidation" phase rather than a distribution phase. The price continues to move within the ascending channel, with each subsequent low higher than the previous one, indicating that underlying buying pressure remains stable.

Fibonacci retracement levels indicate that the recent correction stopped precisely at the 0.382–0.236 area, a "standard" technical support zone for a strong uptrend. The absence of a deep drop to 0.5 or lower suggests that selling pressure was primarily short-term profit-taking, insufficient to reverse the trend.

The RSI indicator has exited the overbought state, cooled down to the upper neutral zone, and is now moving upwards along with the RSI-based MA. This often precedes continued upward movements in strong trends, reflecting momentum rebalancing rather than structural weakness.

In terms of targets, once the price has absorbed the correction zone around $4,300–$4,250, a new uptrend cycle will have the necessary technical conditions to form. The next targets for the trend are:

• $4,411–$4,537 (extended Fibonacci 0.5–0.618 zone),

• Further at $4,715, and in the scenario of a strong increase in safe-haven flows, the $4,900–$4,950 zone becomes a reasonable technical target.

The risk of a short-term downward correction mainly stems from the price failing to decisively break above the $4,380 level, or from unexpected macroeconomic news causing yields and the US dollar to rebound. In that case, gold could be pulled back to retest the $4,245–$4,216 support zone; only if this zone is breached by strong selling pressure will the bullish structure be seriously questioned.

SELL XAUUSD PRICE 4419 - 4417⚡️

↠↠ Stop Loss 4423

→Take Profit 1 4411

↨

→Take Profit 2 4405

BUY XAUUSD PRICE 4355 - 4357⚡️

↠↠ Stop Loss 4351

→Take Profit 1 4363

↨

→Take Profit 2 4369

GIFTNIFTY IntraSwing Levels For 22nd Dec '25Compare with NIFTY Spot Level Wile Taking Position

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

Do comment if Helpful .

Do Comment for In depth Analysis.

❇️ Follow notification about periodical View

GOLD XAUUSD TO THE MOONWHAT IS GOLD ??

Gold is a chemical element with the symbol Au (from Latin aurum) and atomic number 79, classified as a dense, soft, malleable, and ductile transition metal known for its lustrous yellow color.

Physical Properties

Gold boasts exceptional conductivity for electricity and heat (third after silver and copper), a density of 19.3 g/cm³, melting point of 1,064°C (1,947°F), and boiling point of 2,856°C. It resists corrosion and tarnish due to chemical inertness, allowing a single gram to be stretched into a 2.4 km wire or hammered into a 1 m² sheet.

Periodic Table Position

Gold resides in Group 11 (coinage metals), Period 6 of the d-block, with electron configuration 4f¹⁴ 5d¹⁰ 6s¹ and common oxidation states +1 and +3. As a noble metal, it occurs native in nature and forms alloys like electrum historically..

Gold holds Tier 1 asset status for banks under Basel III regulations due to its zero-risk weighting, exceptional stability, and liquidity as physical bullion.

Basel III Classification

Basel III, implemented post-2008 crisis, categorizes allocated physical gold as a Tier 1 capital asset with 0% risk weight, equivalent to cash or top sovereign bonds, allowing banks to count it fully toward core reserves without deductions. This elevates gold from prior Tier 3 status, strengthening balance sheets amid volatility.

Strategic Benefits

Banks leverage gold for capital adequacy ratios, liquidity coverage, and loss absorption, reducing reliance on fiat assets while hedging inflation and currency risks. Central banks hold vast reserves (over 36,000 tonnes globally), signaling trust in its enduring value as "money again."

WATCH 4436-4440 AND LASTLY 4444.

WATCH 4410-4415 SELL ZONE

GOODLUCK.

Elise | XAUUSD – 30M -Liquidity Sweep → Trend Continuation SetupOANDA:XAUUSD

The sharp downside spike into 4308 was a liquidity grab, not a breakdown. Buyers stepped in aggressively, flipping momentum and pushing price back into a controlled bullish leg. Current pullback is corrective, not impulsive — suggesting continuation toward higher resistance if structure holds.

Key Scenarios

✅ Bullish Case 🚀

As long as price holds above 4332–4335, upside remains active toward:

🎯 4350

🎯 4365

🎯 4375 (Major Resistance Zone)

❌ Bearish Case 📉 (Invalidation)

A clean break and close below 4325 opens downside toward:

🎯 4312

🎯 4308 (Liquidity Base)

Current Levels to Watch

Resistance 🔴: 4350 → 4365 → 4375

Support 🟢: 4335 → 4325 → 4308

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

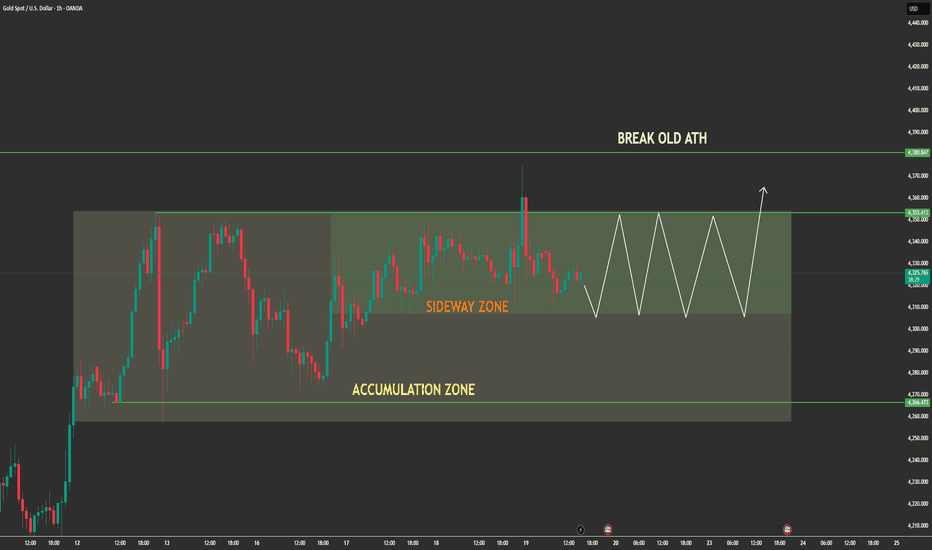

Gold Is Not Trending. It’s Deciding.GOLD (XAUUSD) – 1H TECHNICAL & MACRO ANALYSIS

Market Structure (Technical)

- Gold remains in a clear short-term uptrend, still trading above both EMA 34 and EMA 89, confirming bullish structure has not been broken.

- Price is currently consolidating below Target 1 (~4348) after a sharp impulsive move, which is typical bullish digestion, not distribution.

- The recent pullback respected the weak support zone around 4313–4320, aligning closely with EMA 89 → this indicates buyers are still defending dips.

- As long as price holds above the strong support zone (~4270–4280), the broader bullish structure remains intact.

Key Levels

Resistance / Target 1: ~4348

Target 2 (Old ATH): ~4380

Weak Support: ~4313–4320

Strong Support: ~4270–4280

Scenarios

Primary (Bullish continuation – higher probability):

Sideways consolidation → higher low → break above 4348 → extension toward 4380 (old ATH) and potential new ATH.

Alternative (Deeper pullback, still bullish):

Loss of weak support → retrace into strong support → liquidity grab → continuation higher.

CONCLUSION

Gold is not rejecting resistance it is absorbing liquidity below it.

This price behavior, combined with a supportive macro backdrop, strongly favors a continuation move toward the old ATH and beyond, rather than a trend reversal.

XAUUSD – 4H | Conditional Bearish Scenario if We Close Below KeyThis is a what-if scenario, not a prediction.

Gold is currently compressing under resistance after a strong impulsive move up. Price is now reacting around prior structure, with liquidity already taken above.

Key level to watch:

– Acceptance and 4H close below the marked PDL / range support

If we get a clean close below this zone, it would signal loss of bullish control, opening the door for a deeper retracement.

What that could lead to:

Failed reclaim of the broken support

Lower high forming under resistance

Continuation toward the next HTF demand zone below

Invalidation:

Strong reclaim and acceptance back above the range highs

Bullish displacement through resistance

Until a clear close happens, this remains a conditional scenario. I’m waiting for confirmation, not guessing direction.

Levels marked on the chart.

Not financial advice.

Gold Isn’t Stalling — It’s Loading Liquidity for BreakoutGOLD (XAUUSD) — DETAILED TECHNICAL & MACRO ANALYSIS

1. Market Structure

- Gold remains in a clear bullish market structure on the H1–H4 timeframes.

The impulsive leg that pushed price toward $4,380 confirms strong buyer dominance.

- Instead of rejecting sharply from the high, price has transitioned into a sideways-to-slightly-up consolidation, which is a classic continuation pattern, not distribution.

- Higher lows continue to form inside the range, showing controlled pullbacks rather than panic selling.

This behavior indicates acceptance near highs, which is a key characteristic of strong trends.

2. Key Price Zones & Liquidity Behavior

Resistance Zone: $4,350 – $4,380

This zone is being tested multiple times without aggressive rejection.

Each pullback from resistance is becoming shallower, signaling supply absorption.

Sellers are active, but they are not in control.

Support Zone: $4,250 – $4,270

Buyers consistently defend this zone.

No clean breakdown or high-volume sell-through has occurred.

This confirms that downside moves are corrective, not trend-reversing.

Liquidity Insight

Liquidity is building above the range highs.

Compression inside the box suggests the market is preparing for expansion, not exhaustion.

3. Price Action Interpretation

- Gold is forming a bullish consolidation below previous highs, often seen before breakouts.

- Volatility contraction inside the range implies energy buildup.

- Chasing price inside the range is low probability.

- Edge only appears on confirmation : a clean acceptance above resistance or a sweep-and-hold from support.

4. Macro Environment (Why Gold Is Supported)

Federal Reserve Policy

The Fed remains restrictive, but markets increasingly price rate cuts in 2025, not further hikes.

Real rates are no longer accelerating higher.

The “higher-for-longer” narrative is fully priced, reducing downside pressure on gold.

U.S. Dollar & Yields

The U.S. Dollar is struggling to extend its upside momentum.

Real yields have stabilized, removing a major headwind for gold.

This macro balance allows gold to hold elevated levels instead of correcting deeply.

Risk & Capital Flows

Risk assets (equities, crypto) remain volatile and rotational.

Capital is flowing toward defensive and hedging assets.

Central bank gold demand remains structurally strong.

Seasonality

Year-end and early Q1 historically favor gold due to:

Portfolio rebalancing

Lower liquidity amplifying moves

Institutional positioning for the new year

5. Scenario Outlook

Primary Scenario (High Probability)

Continued consolidation above support

Gradual pressure against resistance

Clean breakout → new ATH above $4,380

Alternative Scenario

Another rejection from resistance

Range extension without breakdown

Structure remains bullish as long as $4,250 holds

Only a strong, high-volume breakdown below support would invalidate the bullish thesis — currently not supported by either price action or macro data.

6. Final Conclusion

Gold is not topping — it is digesting gains.

Technically: bullish structure + acceptance near highs

Macro-wise: supportive environment, not restrictive

Behavior: accumulation and compression, not distribution

This is a macro-aligned continuation setup, where patience is rewarded and impulsive entries are punished.

GOLD ANALYSIS 12/22/20251. FUNDAMENTAL ANALYSIS:

a) Economic:

• USD: After U.S. PMI data came in above 50, the USD saw a short-term technical rebound. However, this is not a new uptrend, but mainly a post-news reaction.

• U.S. equities: Narrow range trading – wait-and-see sentiment, no strong risk-on capital flow yet.

• FED: Still in an easing cycle – interest rate cuts expected in the medium term, providing a supportive foundation for gold.

• Trump administration: No new shock policies → markets remain temporarily stable.

• Gold ETFs (SPDR): No strong buying or selling → indicates big players are not distributing, leaning toward accumulation.

b) Politics:

• No major geopolitical tensions, but underlying risks remain, continuing to support gold.

c) Market sentiment:

• Risk-neutral → slightly risk-off

• Short-term traders taking profits, large capital waiting for deeper pullbacks to buy

=> Fundamental conclusion:

Gold is in a short-term correction – the medium- and long-term trend remains BUY on dips, not chasing sells.

2. TECHNICAL ANALYSIS:

Main structure:

• Trend: Clear uptrend

• Price is trading within an ascending channel

• Pullbacks to the Fibo 0.5 – 0.618 zone are attractive buy areas

Indicators:

• RSI: Neutral range → not overbought

• MA: Price holds above fast MAs → trend remains strong

=> Technical conclusion:

This is a technical pullback within an uptrend, not a reversal.

RESISTANCE: 4,351 – 4,362 – 4,380

SUPPORT: 4,330 – 4,309 – 4,288

3. PREVIOUS MARKET SESSION (19/12/25):

• Price bounced strongly from the 4309 zone

• Retested the 4351 supply but failed to break decisively and dropped back to test 4335

• Signs of short-term profit taking

• No large distribution candles appeared

=> Nature: The market flushed liquidity, not an exit from positions.

4. TODAY’S STRATEGY (22/12/25):

🪙 SELL XAUUSD | 4419 – 4417

SL: 4423

TP1: 4411

TP2: 4405

🪙 BUY XAUUSD | 4355 – 4357

SL: 4351

TP1: 4363

TP2: 4369

Gold 1H – CPI Ambiguity Sets Liquidity Traps Near 4400🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (22/12)

📈 Market Context

Gold is trading near the upper boundary of a well-defined bullish channel as markets react to renewed uncertainty surrounding U.S. inflation data and the Fed’s policy outlook.

Recent CPI-related commentary has reignited debate over whether inflation is cooling fast enough to justify near-term easing, keeping USD flows unstable and risk sentiment mixed.

This macro backdrop favors liquidity engineering over clean continuation, with Smart Money likely targeting both premium and discount extremes to induce breakout traders before the next directional expansion.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Bullish structure approaching premium exhaustion

Key Idea: Expect liquidity interaction at 4400–4402 (premium) or 4340–4338 (discount) before meaningful displacement

Structural Notes:

• Higher-timeframe bullish BOS remains valid

• Price is pressing into buy-side liquidity near channel highs

• Clear impulsive leg up created an unmitigated FVG above 4370

• Rising structure shows signs of short-term distribution, not confirmed reversal

• Liquidity rests clearly above 4400 and below 4340

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4400 – 4402 | SL 4410

• 🟢 BUY GOLD 4340 – 4338 | SL 4330

🧠 Institutional Flow Expectation:

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4400 – 4402 | SL 4410

Rules:

✔ Sweep above psychological 4400 buy-side liquidity

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

1. 4370

2. 4350

3. 4340 – extension if USD strengthens on CPI reassessment

🟢 BUY GOLD 4340 – 4338 | SL 4330

Rules:

✔ Liquidity grab into discount and channel support

✔ Bullish MSS / CHoCH confirms demand control

✔ Upside BOS with strong bullish displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4360

2. 4385

3. 4400 – extension if USD weakens amid CPI doubt

⚠️ Risk Notes

• CPI-driven uncertainty increases fake breakouts

• No entry without MSS + BOS confirmation

• Expect volatility during U.S. session

• Reduce risk around unexpected Fed or inflation headlines

📍 Summary

Gold is trading at a decisive premium within a bullish structure, but CPI ambiguity keeps conviction fragile. Smart Money is likely to engineer liquidity at the extremes before committing:

• A sweep above 4400 may fade toward 4350–4340, or

• A liquidity grab near 4340 could reload bullish flow toward 4385–4400+

Let structure confirm — Smart Money reacts, retail anticipates. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold Is Not at a Top — It’s Compressing Below HistoryGold continues to trade in a strong bullish structure on H4, with a clear sequence of higher lows confirming that buyers remain firmly in control. After the impulsive leg up, price is now consolidating directly below the previous highest high around 4,380 a textbook bullish consolidation rather than a distribution phase. This range-bound movement shows that selling pressure is being absorbed, not expanded, as pullbacks remain shallow and demand consistently steps in. As long as price holds above the higher-low base of the consolidation, the broader bias stays bullish, and this sideways action should be viewed as a buildup of pressure. A clean acceptance above the 4,380 resistance zone would likely trigger continuation toward a new ATH, while failure to break simply extends the consolidation, not invalidates the trend. This is a wait for expansion environment patience is the trade.

The market is starting to explode - Gold's new ATH is 4417.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) extends its bullish trajectory in Monday’s Asian session, surging to a fresh all-time high near the $4,380 level. The advance is underpinned by heightened geopolitical risk, with the Israel–Iran conflict and escalating tensions between the United States and Venezuela driving robust safe-haven flows into the precious metal.

In parallel, a run of softer US inflation readings and cooling labor-market indicators has reinforced market conviction that the Federal Reserve is likely to deliver at least two 25-basis-point rate cuts next year. Expectations of a more accommodative policy stance tend to weigh on nominal and real yields, thereby reducing the opportunity cost of holding non-interest-bearing assets and providing a strong fundamental tailwind for Gold prices.

⭐️Personal comments NOVA:

The December interest rate cut ultimately had a positive impact on gold prices, with money flowing into the world's safest asset, and gold continuing its major upward trend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4417 - 4419 SL 4424

TP1: $4408

TP2: $4390

TP3: $4375

🔥BUY GOLD zone: 4362 - 4360 SL 4355

TP1: $4375

TP2: $4390

TP3: $4408

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

This Is Not a Breakout Yet — Gold Is Quietly Loading the MoveOANDA:XAUUSD 1H Technical Analysis

Market Structure

Gold is no longer trending impulsively. Price has transitioned into a clear accumulation → sideways expansion phase right below the old ATH.

What matters here is behavior, not direction.

- Strong impulsive leg already completed

- Price failed to immediately break higher

- Market shifted into range compression instead of reversal

This confirms buyers are still in control, but they are absorbing supply rather than chasing price.

Key Zones on the Chart

Upper Range / Pre-ATH Supply: ~4,350 – 4,380

- Sideway Zone (Value Area): Mid-range where price is rotating

- Accumulation Base: ~4,260 – 4,280 (range low / demand pocket)

Price continues to respect the range boundaries:

- Highs are capped → liquidity building above

- Lows are defended → no breakdown structure

This is balanced price action, not weakness.

Price Action Logic

Inside the box:

- Overlapping candles

- Repeated up/down rotations

- No follow-through selling

This is time-based correction, not price-based correction.

Markets often do this before expanding through major highs.

Scenarios Ahead

Primary (Higher Probability):

- Continued oscillation inside the range

- Liquidity builds on both sides

- Expansion → break above old ATH

Alternate:

- Sweep lower range once more

- Immediate reclaim

- Same upside continuation

A clean break below the accumulation base would be the only structure failure — and that has not happened.

Bottom Line

Gold is not stalling.

It is compressing energy inside value.

When this range resolves, it will not be subtle.

Crude oil bulls are gathering strength for an upward surge.Bullish Supports: Geopolitical Catalysts + Technical Rebound

1. Escalating Geopolitical Risks

The U.S. intercepted a Venezuelan oil tanker over the weekend, marking the third such law enforcement operation in two weeks. Coupled with Ukraine’s drone strikes on vessels belonging to Russia’s shadow fleet, these events have heightened short-term supply concerns. Russia has maintained a lukewarm stance toward the Russia-Ukraine peace agreement, leading to a marginal rebound in market risk aversion and a renewed injection of geopolitical premium into prices.

2. Technical Recovery Signals

After rebounding from the low of $54.98, the daily chart closed with a small bullish candle. The MACD green bars are contracting, and the KDJ has formed a golden cross, indicating that the price has moved out of the oversold zone in the short term and technical recovery demand has emerged. Stabilization above the $56 psychological round-number level has laid the foundation for short-term support.

3. Expectations of Policy Intervention

With oil prices currently trading at relatively low levels, the market expects that OPEC+ may issue stability-maintaining signals if geopolitical conflicts escalate or prices decline further, creating potential bullish expectations.

Crude oil trading strategies

buy:56.5-56.8

tp:57.5-58

GOLD XAUUSD WHAT IS GOLD ??

Gold is a chemical element with the symbol Au (from Latin aurum) and atomic number 79, classified as a dense, soft, malleable, and ductile transition metal known for its lustrous yellow color.

Physical Properties

Gold boasts exceptional conductivity for electricity and heat (third after silver and copper), a density of 19.3 g/cm³, melting point of 1,064°C (1,947°F), and boiling point of 2,856°C. It resists corrosion and tarnish due to chemical inertness, allowing a single gram to be stretched into a 2.4 km wire or hammered into a 1 m² sheet.

Periodic Table Position

Gold resides in Group 11 (coinage metals), Period 6 of the d-block, with electron configuration 4f¹⁴ 5d¹⁰ 6s¹ and common oxidation states +1 and +3. As a noble metal, it occurs native in nature and forms alloys like electrum historically..

Gold holds Tier 1 asset status for banks under Basel III regulations due to its zero-risk weighting, exceptional stability, and liquidity as physical bullion.

Basel III Classification

Basel III, implemented post-2008 crisis, categorizes allocated physical gold as a Tier 1 capital asset with 0% risk weight, equivalent to cash or top sovereign bonds, allowing banks to count it fully toward core reserves without deductions. This elevates gold from prior Tier 3 status, strengthening balance sheets amid volatility.

Strategic Benefits

Banks leverage gold for capital adequacy ratios, liquidity coverage, and loss absorption, reducing reliance on fiat assets while hedging inflation and currency risks. Central banks hold vast reserves (over 36,000 tonnes globally), signaling trust in its enduring value as "money again."

WATCH 4436-4440 AND LASTLY 4444.

GOODLUCK.

Correction Is Not a Reversal — Gold Is Reloading 1. Market Structure Overview

- Gold is still trading within a medium-term bullish structure, but price has entered a short-term corrective phase after failing to hold above the upper resistance zone.

- Strong rejection occurred at the POC / resistance area 4.35x – 4.38x, confirming active profit-taking.

The current price action is developing a classic ABC correction:

- Wave A: Completed with a sharp pullback.

- Wave B: Ongoing technical rebound.

Importantly, price remains above the major moving averages, meaning the primary uptrend is still intact.

This correction is technical in nature, not a trend reversal.

2. Market Context & Liquidity Behavior

Sellers are active near the highs, but downside momentum remains controlled.

The market is likely seeking liquidity clearance before deciding the next impulsive move.

The 4.26x – 4.20x zone stands out as a key re-accumulation area where buyers may step back in.

3. Today’s Price Scenarios

🔹 Primary Scenario (High Probability)

Price continues its corrective leg toward 4.26x – 4.20x.

This zone acts as a decision point:

Holding above it → supports re-accumulation and trend continuation.

Strong breakdown → opens room for a deeper short-term correction.

🔹 Alternative Scenario (Lower Probability)

Failure to reclaim strength after the correction may extend downside pressure.

Confirmation only occurs if support is decisively broken with volume.

4. Intraday Trading Setups — Re-Accumulation Focus

📌 SETUP 1 – Intraday Sell (Correction Timing)

XAUUSD SELL ZONE: 4369 – 4372

Take Profit: 4366 – 4361

Stop Loss: 4376

📌 SETUP 2 – Intraday Buy (Re-Accumulation Zone)

XAUUSD BUY ZONE: 4262 – 4265

Take Profit: 4268 – 4273

Stop Loss: 4258

⚠️ Always apply strict risk management to protect capital.

5. Summary & Trading Guidance

Main Trend: Bullish

Short-Term State: Correction → Re-accumulation

Bias: Wait for price to reach key zones, avoid chasing highs

👉 Today’s session is a balancing phase. The market’s reaction at the support zone will define whether gold resumes its uptrend or extends the correction. Patience and discipline remain the optimal strategy.

Elliott Wave Analysis – XAUUSD Week 4 of December

1. Momentum Overview

Weekly (W1)

Weekly momentum is currently preparing to reverse to the downside. If a confirmation candle appears next week, a weekly bearish trend is likely to be established. This would indicate the beginning of a multi-week corrective phase.

Daily (D1)

Daily momentum has already confirmed a bearish reversal. Therefore, the downside bias is expected to dominate in the coming week.

H4

H4 momentum is approaching bearish confirmation. This suggests that selling pressure may begin to emerge as early as the Asian session at the start of the week.

2. Elliott Wave Structure

Weekly (W1)

The price structure on W1 clearly shows that the market is positioned at the top of Wave 3 (yellow). Combined with the weekly momentum preparing to reverse, the market is likely to continue into Wave 4 (yellow), developing as a flat corrective structure.

After Wave X is completed, price is expected to decline in line with weekly momentum to complete Wave Y. The completion of Wave Y may take several weeks, until weekly momentum reaches the oversold zone.

Daily (D1)

Within the purple Wave X structure, price is forming a red ABC corrective pattern.

Inside red Wave C, we observe a five-wave impulse structure (1–2–3–4–5) in blue.

At present, price is trading in blue Wave 5. With daily momentum already reversing to the downside, I expect blue Wave 5 to be complete, which implies:

- Red Wave C has finished

- Purple Wave X has also completed

Following this, the market should enter a declining phase to form Wave Y.

Regarding time symmetry:

- Wave W previously took approximately 3 weeks to complete

- Therefore, Wave Y is expected to last at least a similar duration

In the coming week, I want to see strong selling pressure, with sharp downside movement, forming a clear five-wave bearish structure.

H4 Structure

Looking at the blue Wave 5, we can identify an internal five-wave red structure (1–2–3–4–5).

The breakout above 4365 suggests that the price objective of red Wave 5 has already been achieved.

Currently:

- Daily momentum has reversed bearish

- H4 momentum is also turning bearish

- Price failed to break and hold above 4365

- The latest candle closed below 4348

Based on these combined signals, I expect the top of Wave 5 to be in place.

3. Volume Profile & Price Scenarios

From the Volume Profile perspective:

- 4348 is a high-liquidity zone acting as a strong resistance

- Price has not yet been able to break decisively above this area

Primary bearish scenario:

If price closes below 4317 (a low-liquidity void) at the start of the next session, the market is likely to move quickly through this area and decline toward the next high-liquidity zone near 4215.

This scenario would provide strong confirmation that Wave 5 has completed.

Alternative scenario:

If price breaks above and holds above 4348, Wave 5 may extend further, potentially forming a terminal triangle. In that case, I will continue to monitor higher target zones and provide updates once additional data becomes available.

4. Trading Plan

At current levels, this is a potentially strong sell zone.

However, to define a precise entry plan, I need additional confirmation from price action at the market open tomorrow. Once clearer signals appear, I will update the trading plan accordingly.