UK100 H1 | Bullish Continuation Off Key SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 9,854.60

- Overlap support

- 38.2% Fib retracement

- 78.6% Fib projection

Stop Loss: 9,802.65

- Overlap support

Take Profit: 9,936.63

- Swing high resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com/uk ), Stratos Europe Ltd (tradu.com/eu ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com/en ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Market indices

BankNifty levels - Dec 24, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

Nifty levels - Dec 24, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

#nifty - dec 22Understand the chart, observe the analysis, implement while trading:

Key Observations:

1. Trendline Structure

Descending Resistance Trendline:

A clear downward-sloping trendline is visible, connecting multiple lower highs.

This indicates that the broader market structure is bearish, with sellers active on every upward move.

Price is currently approaching this descending trendline, making it a critical decision zone.

2. Previous Swing High (Supply Zone)

The marked “Previous Swing High” zone around 26,030–26,070 is a strong supply area.

This zone previously acted as support and later turned into resistance.

Price rejection from this zone confirms role reversal, strengthening bearish bias.

3. Support Levels

Key demand zones below the current price:

25,911 (near-term support)

25,822

25,724

These levels represent areas where buyers previously attempted to defend the market.

4. Resistance Levels

Important resistance zones above the price:

26,003 (purple level – immediate resistance)

26,069

26,160

26,246

These levels are likely to attract selling pressure if price moves upward.

5. Current Price Action

Current price is around 25,960–25,965.

Price is below the descending trendline and below the previous swing high.

The recent bounce appears corrective rather than impulsive, suggesting weak buying strength.

The yellow arrow indicates a likely rejection area near the trendline.

Scenarios:

1. Bearish Rejection (High Probability):

If price fails to break and sustain above the descending trendline + previous swing high zone, sellers may regain control.

Downside targets:

25,911 → 25,822 → 25,724

This scenario aligns with the prevailing downtrend structure.

2. Bullish Breakout (Low to Moderate Probability):

If price breaks above the descending trendline and sustains above 26,070, it may indicate a short-term trend reversal.

Upside targets:

26,160 → 26,246 → 26,301

A breakout requires strong bullish candles and follow-through.

3. Neutral Consolidation:

If price remains between 25,911 and 26,003, the market may consolidate.

This indicates indecision and lack of commitment from both buyers and sellers.

Traders should wait for clarity.

What This Chart Suggests:

The overall structure remains bearish below the descending trendline.

The current bounce looks like a pullback into resistance, not a confirmed trend reversal.

The zone near 26,000–26,070 is the most important area to watch.

Directional clarity will come only after rejection or breakout from this zone.

Trading Plan:

For Sellers:

Look for rejection near the descending trendline / previous swing high.

Targets:

25,911 → 25,822 → 25,724

Avoid selling at support without confirmation.

For Buyers:

Enter only if price breaks and sustains above 26,070.

Targets:

26,160 → 26,246 → 26,301

Avoid premature buying below resistance.

For Neutral Traders:

Stay on the sidelines while price is below the trendline and inside resistance.

Wait for a clear directional move.

US30 | Reaction at 48420 — Breakout or Correction?US30 | Technical Overview

US30 has reached the 48420 resistance level that we highlighted earlier.

The market now appears to be entering a short-term corrective move toward 48250 – 48260.

If the price stabilizes above 48420, bullish momentum is expected to resume, targeting the ATH zone around 48670 and 48850.

Directional Bias

Above 48420: bullish continuation

Below 48420: corrective movement toward lower supports

Key Levels

Pivot Line: 48420

Support: 48260, 48100

Resistance: 48670, 48850

Bias: Bullish while above 48420; corrective below it.

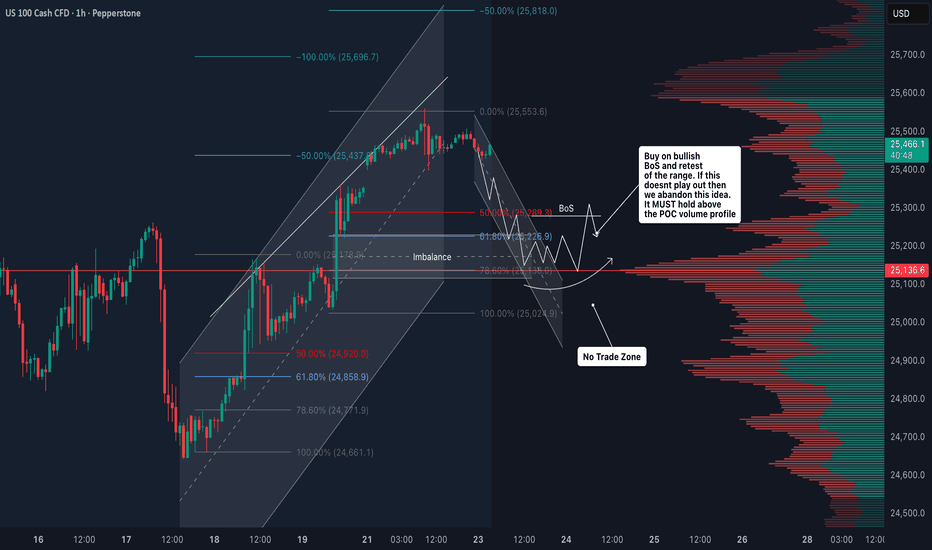

USNAS100 Consolidation Bullish momentum US100 is currently trading within an overall upward trend, shown by the rising trendline from left to right. Price has respected this trendline multiple times, indicating that buyers are still active on pullbacks.

Recently, the market experienced a strong drop, but price quickly recovered back above the trendline, which suggests bullish strength and rejection of lower prices.

If the manage bulls from the current range or may test the support level 25,200, where price bounced strongly and aligned with the rising trendline. This area is acting as a demand zone if the bulls continue we could see next resistance would be 25,800 to 26,020.

You may find more details in the chart,

Trade wisely best of luck buddies.

Ps; Support with like and comments for better analysis thanks for supporting.

SP500 Price Update – Clean & Clear ExplanationSP500 highlighting key supply & demand zones, current price structure, and a bullish continuation bias Price recently reacted from a strong demand zone around 6,760–6,720, forming a higher low and indicating buyer strength. The market is currently consolidating just above this demand area, suggesting accumulation before the next directional move.

A bullish scenario is projected price is expected to push higher toward the 6,880–6,900 resistance zone a successful breakout and retest could open the path toward the upper supply zone near 6,950–6,980 the projected move aligns with prior liquidity highs and unfilled imbalance areas

A deeper pullback into the lower demand zone could offer a better risk-to-reward long opportunity the structure favours buy-the-dip setups as long as price holds above demand, with momentum expected to resume to the upside toward higher liquidity levels.

If you find it helpful please like and comments for this post and share thanks.

USNAS100 Price Update – Clean & Clear ExplanationUS100 index on the 4-hour timeframe, focusing on a trend reversal and bullish continuation setup the market was previously in a downtrend, clearly visible by the descending trendline connecting lower highs Price respected this trendline multiple times, confirming strong bearish pressure in earlier sessions.

🔄 Trendline Break & Shift in Momentum

Recently, price broke above the descending trendline, which is a key sign of trend reversal after the breakout, price pulled back and retested the broken trendline area this retest acted as support, indicating buyers are stepping in and defending the level.

🟩 Support & Demand Zones

The lower grey zones highlight strong demand/support areas where price previously reacted aggressively the recent bounce from this zone shows buyers are in control, increasing the probability of further upside.

📈 Bullish Continuation Scenario

The white projected path shows a small consolidation or pullback, followed by continuation to the upside.

✅ Conclusion

Trendline break + successful retest strong demand zone support Higher probability of bullish continuation clear risk management with defined targets Bullish while price holds above the retested trendline and support zone.

If you find it helpful please like and comments for this post and share thanks.

NAS100 – 30-Minute Timeframe Tradertilki AnalysisMy friends, greetings,

I have prepared a NAS100 analysis for you on the 30-minute timeframe.

My friends, if NAS100 reaches the positive levels between 25.001 and 24.951, I will open a buy position and target the 25.258 level.

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏

Thank you to all my friends who support me with their likes.❤️

NASDAQ NAS100 Technical Analysis and Trade IdeaThe NAS100 is currently in a strong bullish trend 🚀. Price has been pushing higher with momentum and is now trading into a key resistance zone. We could see a short-term pullback as traders lock in profits, but overall, the trend looks ready to continue ↗️.

Keep an eye on any market-moving events later today—they could either accelerate the trend or trigger a deeper retracement. If the bullish momentum holds, a pullback might offer a good opportunity to join the trend for a continuation trade 💪.

⚡ Key Points:

NAS100 trending bullish 📈

Approaching resistance, watch for pullback ↘️

Potential continuation trade on strength 🔥

US 100 Index – Can the Year End Rally Continue?News released yesterday that Alphabet were going to buy data center partner Intersect in a deal worth around $5 billion to give it more power generation, alongside the on-going battle between Netflix and Paramount for Warner Bros has thrown the spotlight back on US stock indices, especially now that Larry Ellison, Chairman of Oracle and the world’s 5th richest man is now heavily involved in the deal.

Turning focus to the US 100 index, traders may now be wondering if it can turn its current 3 day winning streak into a longer string of daily gains, even pushing itself back up to challenge its record high set on October 30th at 26277, or whether the rally could run out of steam around current levels (25445, 0630 GMT).

With the Christmas Day holiday less than 48 hours away, today’s volatility driver could be the release of two pieces of US economic data. First up at 1330 GMT is the latest Q3 GDP growth update. Although it’s a second estimate, this could provide further insight into the current health of the US economy and shed some light on whether the market’s expectation of 2 further 25bps interest rate cuts from the Federal Reserve in 2026 is spot on, overblown or understated.

Then, next up is the US consumer confidence reading at 1500 GMT. This number has been under pressure in recent months with households worried about their financial situation and job security. Traders may be looking to see if the number has rebounded at all, which if it has, could be good news for spending and corporate profits over the important festive period.

Technical Update: Santa Rally Only Extends Sideways Range

If the latest 3.7% rally in the US 100 index from its December 17th low at 24644 can even be described as a “Santa rally,” it hasn’t so far at least brought too much in the way of Christmas cheer. As the chart below shows, price action is still trapped between the October 30th high at 26277 and the November 21st low at 23834, suggesting the index remains caught within a broad more balanced range at best.

As we move into the Christmas–New Year trading period, traders may be looking to identify key support and resistance levels to monitor in case a confirmed breakout triggers a more sustained move in the direction of the price break.

Potential Resistance Levels:

Following the latest price strength, the December 10th high at 25844 could now mark the first resistance level. While not a guarantee of further gains, closing breaks above 25844 may now be needed to open the way for additional price strength.

As the chart above shows, if the 25844 resistance were to give way on a closing basis the focus could then shift to the high from October 30th which stands at 26277. A break above that level could then open the way for scope for further upside.

Potential Support Levels:

Of course, the resistance levels highlighted above currently remain intact, and while they do price weakness can still emerge. If that happens, traders could be monitoring how the 25094 level is defended on a closing basis. This level represents half of the latest rally and could be the first support focus.

Closing breaks below 25094 could signal further price weakness, possibly leading to a test of 24644, which is the December 17th low. Closes below 24,644 could then warn of a deeper decline toward 23834.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

S&P500 INDEX (US500): Important Breakout

US500 broke and closed above a significant daily horizontal resistance cluster.

It indicates a highly probable growth further to a current ATH.

Expect a rise at least to 6915 level after a pullback.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

RISKY NAS SELLPrice has broken previous swing low and retraced in to recent supply. From there price dropped creating two supply zones, one being mitigated and rejected. Sending bearish vibes to me. Setting tp to take out swing low and possible double bottom liquidity. Risky, so set a relatively tight sl, but I see it playing out.

NIFTY Moved EXACTLY As Analyzed | Live Entries, SL & Target Hit

Today’s video has been recorded live during market hours —> no hindsight, no edited stories.

I tracked the price action candle-by-candle, explained the structure as it was forming, and shared the exact trades I took.

You will see:

• My stop-loss getting hit (full transparency)

• My targets getting hit

• Why the analysis played out perfectly

• How to adjust your plan when the market shifts

• How I manage trades in real time

This is pure live price action + real psychology.

If you follow the whole breakdown, you’ll understand exactly why the market moved the way it did and how I planned the next setups.

Let me know if you want more live breakdowns like this.

Bullish momentum to extend?S&P500 (US500) could fall towards the pivot, which acts as an overlap support, and could bounce to the 1st resistance.

Pivot: 6,825.54

1st Support: 6,798.23

1st Resistance: 6,890.05

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Kevin Warsh vs. Kevin Hassett: Who Is More Dovish?As the Federal Reserve has lowered the federal funds rate to 3.75% and initiated a technical QE after ending its QT program, January 2026 will be directly influenced by Donald Trump’s monetary choice regarding Jerome Powell’s successor, who will take office in May 2026.

The U.S. President is expected to announce his decision at the beginning of next year, and according to the latest available consensus data, the choice should be between Kevin Hassett and Kevin Warsh. The Fed has adopted a more accommodative trajectory by modestly re-expanding its balance sheet (through short-term bond purchases to ensure the smooth functioning of the money market and interbank market), but the upcoming cycle for the federal funds rate remains uncertain and will depend on U.S. employment data (NFP reports) and inflation data (PCE & CPI) published in January and February.

However, it is essential to keep in mind that markets will also be heavily influenced by the “Shadow Fed Chair” appointed in January, who will officially take office in the spring.

Which of Kevin Hassett or Kevin Warsh can be considered the more accommodative in terms of future monetary policy?

Kevin Hassett currently appears as the most clearly “dovish” candidate from a market perspective. His profile is that of a growth-oriented economist, highly sensitive to the effects of financial conditions on investment, the labor market, and asset valuations. Historically, Hassett has consistently argued that monetary policy should remain flexible and pragmatic, even if that means tolerating periods of inflation slightly above target in order to avoid an excessive tightening of financial conditions. In the current environment, marked by high public debt and increased market dependence on global liquidity, his approach is perceived as supportive of a continued accommodative bias, or at least a very gradual normalization of real interest rates.

Kevin Warsh represents a far more orthodox and disciplined monetary stance. A former Fed governor, he has often expressed reservations about prolonged unconventional policies, arguing that massive QE contributed to significant distortions in financial markets and poor capital allocation. While he remains aware of current systemic constraints, Warsh would be more inclined to limit the expansion of the Fed’s balance sheet and prioritize anti-inflation credibility, even at the cost of increased volatility in equity markets.

The contrast between these two profiles is therefore central to the future trajectory of risk assets. A choice in favor of Kevin Hassett would reinforce the scenario of a “market-friendly” Fed, maintaining favorable liquidity conditions and implicitly supporting valuation multiples, particularly on the S&P 500. Conversely, the appointment of Kevin Warsh would introduce a more restrictive medium-term bias, with a risk of reassessing rate expectations and capping the upward momentum of equity markets.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Market ShiftingHow Global Financial Markets Are Entering a New Phase of Transformation

Financial markets across the world are undergoing a profound shift. The forces that once defined market behavior—cheap liquidity, synchronized global growth, predictable central bank support, and deep globalization—are no longer dominant. Instead, markets are being reshaped by structural changes in geopolitics, technology, monetary policy, demographics, and investor behavior. This “market shifting” phase is not a temporary correction or a short-term cycle; it represents a transition into a new market regime where volatility, selectivity, and adaptability matter more than ever.

At its core, market shifting refers to the reallocation of capital, changes in leadership among asset classes and sectors, evolving risk-return dynamics, and altered relationships between traditional financial indicators. Understanding this shift is essential for investors, traders, policymakers, and businesses alike, as strategies that worked in the past decade may fail in the decade ahead.

From Easy Money to Tight Financial Conditions

One of the most important drivers of today’s market shift is the global move away from ultra-loose monetary policy. For more than a decade after the 2008 financial crisis, central banks flooded markets with liquidity through near-zero interest rates and quantitative easing. This environment inflated asset prices, reduced volatility, and encouraged risk-taking across equities, bonds, real estate, and alternative assets.

That era has now ended. Persistent inflation forced central banks such as the U.S. Federal Reserve, European Central Bank, and others to raise interest rates aggressively. Higher rates increase the cost of capital, compress valuations, and shift investor preference from speculative growth assets to cash-flow-generating and defensive investments. As a result, markets are recalibrating what assets are truly worth in a world where money is no longer free.

Shifting Asset Class Leadership

Another defining feature of the current market shift is the rotation in asset class leadership. During the previous cycle, equities—especially technology and growth stocks—consistently outperformed. Bonds served as reliable hedges, and correlations between asset classes were relatively stable.

Today, those relationships are changing. Bonds are no longer guaranteed safe havens during inflationary periods, commodities have regained importance as inflation hedges, and currencies are becoming active trading instruments rather than background variables. Gold, energy, industrial metals, and even agricultural commodities have taken center stage as investors seek protection against inflation, supply shocks, and geopolitical risk.

This shift means diversification strategies must be rethought. Traditional 60/40 portfolios are under pressure, pushing investors to explore alternatives such as commodities, infrastructure, private credit, and tactical trading strategies.

Geopolitics and Fragmentation of Global Markets

Geopolitical tensions are accelerating the market shift. The U.S.–China rivalry, regional conflicts, trade wars, sanctions, and the reshoring of supply chains are fragmenting global markets. Instead of one integrated global financial system, the world is moving toward regional blocs with distinct rules, risks, and capital flows.

This fragmentation impacts markets in multiple ways. Supply chain disruptions increase costs and inflation volatility. Trade restrictions alter corporate earnings and sector leadership. Capital controls and sanctions affect currency stability and cross-border investments. For markets, geopolitical risk is no longer a tail risk—it is a core pricing factor.

Technology, Automation, and Market Structure Changes

Technology is also reshaping how markets function. Algorithmic trading, artificial intelligence, high-frequency strategies, and retail participation through digital platforms have altered market microstructure. Price movements can be faster, sharper, and sometimes disconnected from fundamentals in the short term.

At the same time, technology-driven sectors are themselves undergoing a shift. Investors are now distinguishing between profitable, scalable tech businesses and those reliant on cheap funding. Innovation remains powerful, but valuation discipline has returned. This change reflects a broader market shift toward quality, earnings visibility, and balance sheet strength.

Behavioral Shifts Among Investors

Investor psychology is changing as well. The “buy the dip” mentality that dominated during central-bank-supported markets is no longer universally effective. Increased volatility, sudden drawdowns, and macro-driven price swings have made market participants more cautious.

Retail investors are more active but also more selective. Institutional investors are shortening time horizons, using derivatives for hedging, and actively managing risk rather than relying on passive exposure alone. This behavioral shift reinforces market volatility and creates frequent rotations between risk-on and risk-off environments.

Emerging Markets and Capital Flow Realignment

Market shifting is also visible in emerging markets. Higher global interest rates have reversed capital flows that once favored emerging economies. Stronger reserve currencies, especially the U.S. dollar, have pressured emerging market currencies, debt, and equities.

However, this shift is uneven. Countries with strong fundamentals, manageable debt, domestic growth drivers, and stable policy frameworks are attracting selective investment. Others face capital outflows and market stress. This divergence highlights how the new market environment rewards differentiation rather than broad-based exposure.

Implications for Traders and Long-Term Investors

The ongoing market shift demands a new approach to strategy and risk management. For traders, volatility creates opportunity, but it also increases the importance of discipline, position sizing, and macro awareness. Technical analysis must be combined with macro context, as news events and policy signals can override chart patterns.

For long-term investors, patience and selectivity are crucial. Instead of chasing momentum, focus is shifting toward valuation, earnings resilience, dividends, and real assets. Flexibility—across asset classes, geographies, and styles—is becoming a competitive advantage.

Conclusion: Adapting to the New Market Reality

Market shifting is not a crisis; it is a transition. Financial markets are adjusting to a world defined by higher interest rates, geopolitical complexity, technological disruption, and changing investor behavior. While this environment is more volatile and uncertain, it also offers opportunities for those who understand the new rules.

Success in this phase depends on adaptability, risk awareness, and a willingness to move beyond outdated assumptions. Markets are no longer driven by a single narrative or policy backstop. Instead, they reflect a complex interplay of economics, politics, and psychology. Recognizing and respecting this shift is the first step toward navigating the markets of today—and thriving in the markets of tomorrow.

Potential bullish rise?DAX40 (DE40) has bounced off the pivot and could rise to the 1st resistance, which acts as a swing high resistance.

Pivot: 24,210.89

1st Support: 24,102.79

1st Resistance: 24,434.34

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off?Dow Jones (US30) is falling towards the pivot, which is a pullback support and could bounce to the pullback resistance.

Pivot: 48,242.25

1st Support: 48,027.46

1st Resistance: 48,693.05

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party