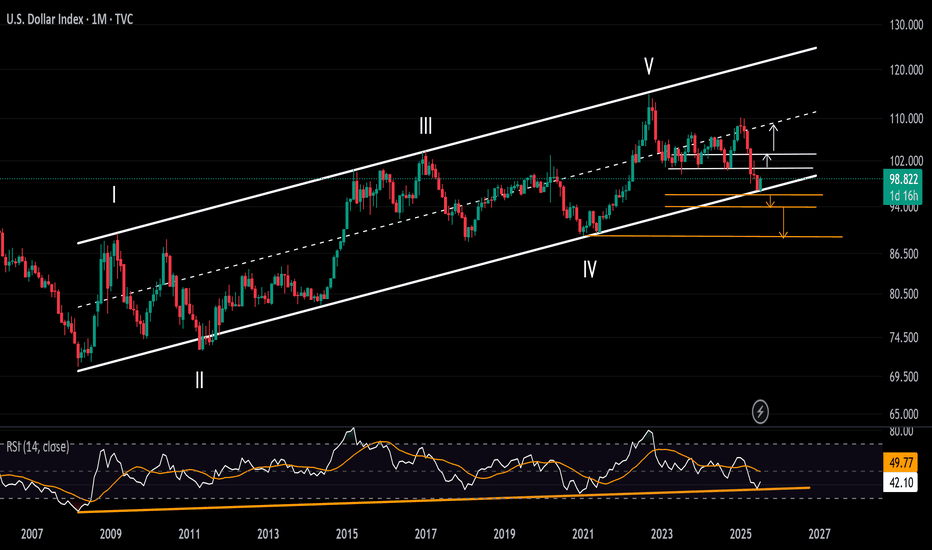

DXY | Timeframe: 1MWith the breakout of the downtrend line drawn since 1985 and its breach in late 2014, the DXY index officially entered a relatively stable upward trend and is currently oscillating within a parallel channel. Although, on the monthly timeframe, it has recently touched the lower boundary of the channel, we can expect at least a rise toward the channel’s midline. However, if the lower support of the channel is broken, a static support around the approximate rate of 88 can be considered a notable support level. Should this support also fail, the long-term downtrend dating back to 1985 would be regarded as the most important support for the DXY index. Meanwhile, moving averages such as the MA50, MA100, and other longer-period moving averages serve as dynamic supports along the way.

It is also worth mentioning that currently reaching the 120 level is considered an ideal target for the DXY index, and ultimately, it is by breaking this resistance zone that the index can reach its “Utopia”.

---------

I will try to continuously update this analysis of the TOTAL symbol according to market changes and developments. Also, I welcome reading your critiques and comments, so don’t forget to leave a comment!

Market indices

DOLLAR INDEX The federal funds rate is the interest rate at which U.S. banks and credit unions lend their excess reserve balances to other banks overnight, usually on an uncollateralized basis. This rate is set as a target range by the Federal Open Market Committee (FOMC), which is the policymaking arm of the Federal Reserve. The current target range as of July 2025 is approximately 4.25% to 4.5%.

The federal funds rate is a key benchmark that influences broader interest rates across the economy, including loans, credit cards, and mortgages. When the Fed changes this rate, it indirectly affects borrowing costs for consumers and businesses. For example, increasing the rate makes borrowing more expensive and tends to slow down economic activity to control inflation, while lowering the rate stimulates growth by making credit cheaper.

The Fed adjusts this rate based on economic conditions aiming to maintain stable prices and maximum employment. It is a vital tool of U.S. monetary policy, impacting economic growth, inflation, and financial markets.

In summary:

It is the overnight lending rate between banks for reserve balances.

It is set as a target range by the Federal Reserve's FOMC.

It influences many other interest rates in the economy.

Current range (July 2025) is about 4.25% to 4.5%.

1. ADP Non-Farm Employment Change (Forecast: +82K, Previous: -33K)

Above Forecast:

If ADP employment is much stronger than expected, the Fed would see this as a sign of ongoing labor market resilience. Robust job growth would support consumer spending, potentially keep wage pressures elevated, and could make the Fed less likely to ease policy soon. This reinforces the case for holding rates steady or staying data-dependent on further cuts.

Below Forecast or Negative:

If ADP jobs gain falls short or is negative again, the Fed may interpret it as a weakening labor market, raising recession risk and reducing inflationary wage pressures. This outcome could increase the chances of a future rate cut or prompt a more dovish tone, provided it aligns with other softening indicators.

2. Advance GDP q/q (Forecast: +2.4%, Previous: -0.5%)

Above Forecast:

A GDP print above 2.4% signals surprisingly strong economic growth and likely sustains the Fed’s view that the U.S. economy is avoiding recession. The Fed may delay rate cuts or take a more cautious approach, as stronger growth can support higher inflation or at least reduce the urgency for support.

Below Forecast or Negative:

Weak GDP—especially if close to zero or negative—would signal that the economy remains at risk of stagnation or recession. The Fed may then pivot to a more dovish stance, become more willing to cut rates, or accelerate discussions on easing to avoid a downturn.

3. Advance GDP Price Index q/q (Forecast: 2.3%, Previous: 3.8%)

Above Forecast:

A significantly higher-than-expected GDP Price Index (an inflation measure) points to persistent or resurgent inflationary pressures in the economy. The Fed might see this as a reason to delay cuts or maintain restrictive rates for longer.

Below Forecast:

If the Price Index prints well below 2.3%, it suggests that inflation is cooling faster than anticipated. This outcome could allow the Fed to move toward easing policy if other conditions warrant, as price stability is more clearly in hand.

Bottom Line Table: Data Surprises and Likely Fed Reaction

Data Surprise Fed Outlook/Action

All above forecast Hawkish bias, rate cuts delayed or on hold

All below forecast Dovish bias, higher chances of rate cut

Mixed Data-dependent, further confirmation needed

Summary:

The Fed’s interpretation hinges on how these figures compare to forecasts and to each other. Stronger growth, jobs, and inflation = less rush to cut; weaker numbers = lower rates sooner. If growth or jobs are especially weak or inflation falls sharply, expect more dovish Fed commentary and a greater likelihood of future easing. Conversely, if the data all surprise to the upside, hawkish (rate-hold) messaging is likely to persist.

The U.S. Dollar Index (DXY) is a financial benchmark that measures the value of the United States dollar relative to a basket of six major foreign currencies. It provides a weighted average reflecting the dollar's strength or weakness against these currencies. The DXY is widely used by traders, investors, and economists to gauge the overall performance and health of the U.S. dollar on the global stage.

Key Features of the DXY:

Currencies included and their weights:

Euro (EUR) – 57.6%

Japanese Yen (JPY) – 13.6%

British Pound (GBP) – 11.9%

Canadian Dollar (CAD) – 9.1%

Swedish Krona (SEK) – 4.2%

Swiss Franc (CHF) – 3.6%

It was established in 1973 after the collapse of the Bretton Woods system to serve as a dynamic measure of the dollar's value.

The index reflects changes in the exchange rates of theses versus the U.S. dollar, with a higher DXY indicating a stronger dollar.

The DXY influences global trade dynamics, commodity prices (like oil and gold)

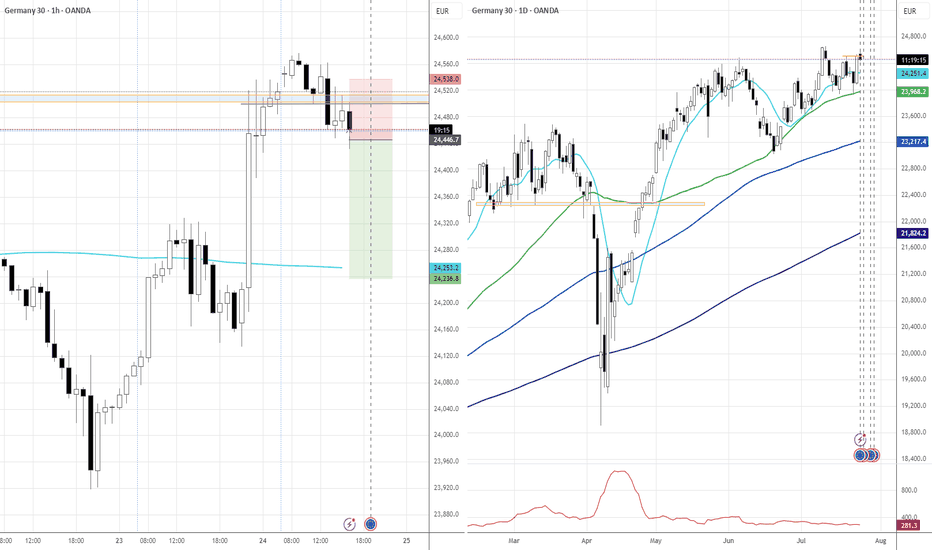

HSI dipping, traders are flipping,stay Zen - Index is yoga-ing!Hello everyone!

Today HK50 PEPPERSTONE:HK50 D open at 25350, Hi:25446 Lo:25164

IMO: Deep retracement is happening with profit taking from futures expiring tomorrow for traders & waiting for catalysts for talks next week.

For 4H - Index moving closer to Gravity Trend Line - look out for entry for swing (using shorter tf to entry).

At point of writing ✍️: the HK50 $PEPPERSTONE uptrend mode is on track and now in the retracing mode.

currently on D Chart -

🗝️ Resistance Level : 25300

Support Level : 24950

Support level 24558 (MA30)

🗝️ Strong Support Level : 24048 (Gravity Trend Line)

1H Chart HK50 $PEPPERSTONE

If today not able to close 25304 (25335 HSI), it's likely a deep retracement.

Shor term pullback -for swing trade and for mid-longer term it's still on bull track. Most likely people profit taking before the HSI futures expires tomorrow.

Macro view - Index continue to be Bullish. Well, markets cooled a bit waiting for details from the ongoing US-China trade talks early August'25.

Higher Hi🚩point marked in Chart HK50 $PEPPERSTONE

21May2025 -23909

11June2025 -24430

25June2025 -24531

16Jul2025 - 24842

18Jul2025 - 25052

24Jul2025 - 25729

?? ??2025 - 26163 Revised Target

The HSI Index HSI:HSI

At point of writing ✍️ Index is being sucked towards to D GravityLine - 24085; it fall below the sideway box.

If it doesn't close above the key support level this week, the deep retracement is happening.

🧨🧨🧨Pay attention and cautious.

🗝️ Next Resistance Level : 25350

🗝️ Next Support Level : 24900-25200

🗝️ Strong Support Level : 24300-24750

Let's follow your own zentradingstrategy , continue to trade; Observe your emotions as you would the clouds—passing, shifting, never you.— Mindfulness helps you respond, not react, in volatile markets and moments.

Be ease at trading!

** Please Boost 🚀, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!

Share your trading journey here to encourage the community and friends who pursing the same journey.

DXY Surge Pressures Currency Market in Volatile Market WeekThe US Dollar Index (DXY) has held its rebound off historical support zones on both the price chart and the RSI indicator throughout July. The monthly RSI is bouncing off a support line extending between the troughs of 2008 and 2020. Meanwhile, price action is rebounding from a support trendline that connects the lows of 2008, 2014, and 2021, within the 96–94 zone.

Bearish Scenario: A solid close below this support zone may confirm a long-term bearish signal, potentially pushing the index toward the 94 and 90 levels.

Bullish Scenario: A confident move above 100 and 103 could signal a reversal in the currency market, potentially leading the DXY back toward the mid-range of the long-standing channel between 105 and 107, originating from the 2008 lows.

Written by Razan Hilal, CMT

Dow Jones Index (DJI) – July 30, 2025 | 30-Min Chart Analysis

1. Current Market Structure

DJI is consolidating just below the intraday resistance at 44,777. Price is attempting to recover after a sharp drop from the 45,154 high.

2. Supply Zone Rejection

Price faced strong rejection near 45,154 and again at 44,968 — confirming this area as an active seller zone.

3. Support Zone Defense

Buyers stepped in at 44,587 and 44,403, creating a short-term demand base. These levels have provided stability for now.

4. Trend Outlook

The lower high formation and recent sharp sell-off hint at bearish pressure. Price is currently in a retracement — unless 44,968 breaks cleanly, sellers remain in control.

5. Key Levels to Watch

Resistance 44,777 → 44,968 → 45,154

Support 44,587 → 44,403 → 44,239

🔁 Bias: Short-term bearish unless price breaks above 44,968 and holds.

U.S. Dollar Index (DXY) – July 30, 2025 | 15-Min Chart1. **Range-Bound Structure**

DXY is consolidating between 98.588 support and 99.134 resistance. The 98.68–98.74 zone has acted as demand, but repeated retests show weakening buyer interest.

2. **Failed Breakouts**

Multiple rejections at 99.134 indicate it's a trap zone where sellers absorb buy-side pressure.

3. **Bearish Momentum Signs**

Lower highs and wicks into resistance with weak closes suggest distribution. Momentum likely shows bearish divergence.

4. **Critical Levels**

* **Support:** 98.588 — a break below this opens downside potential.

* **Resistance:** 99.134 — bulls need a strong breakout above this for continuation to 99.41+.

Summary:

Sellers dominate below 99.134. If 98.588 breaks, expect bearish continuation. Only a confirmed breakout above 99.134 shifts bias bullish.

S&P 500 as expensive as at the end of 2021 in valuation terms !Two weeks ago, I shared a technical analysis of the S&P 500 across all timeframes. This analysis outlines price targets for the end of 2025 based on technical and fundamental criteria. You can revisit this analysis by clicking the first chart below.

WARNING: A major bullish target I previously mentioned is close to being reached—6,475 points on the S&P 500 futures contract. The market may soon enter a consolidation phase.

Given this week's packed fundamentals, it's wise to start locking in your gains by moving up your stop-loss levels—especially as the S&P 500 has now returned to its end-2021 valuation peak.

Click on the table below to access details on this week's significant fundamental developments:

1. Caution: The S&P 500 has reached its end-2021 valuation record!

While technical market analysis is important, valuation metrics are even more so. The S&P 500 has just reached its previous valuation peak from the end of 2021—historically the starting point of the 2022 bear market. While the current macro context is different, this level could trigger a short-term market pause.

Chart showing S&P 500 valuation via the CAPE Ratio (Shiller PE):

2. S&P 500 seasonality is weaker in August and bearish in September

Another cautionary factor is seasonality. A statistical look at average S&P 500 performance by month highlights a weaker period in August and a typically negative one in September.

In summary, technical, fundamental, and seasonal analysis all point to securing gains as we approach August/September—without questioning the underlying long-term uptrend.

Chart showing S&P 500 seasonality since 1960:

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

NAS100 - Potential TargetsDear Friends in Trading,

How I see it,

I know I'm posting the same old overbought pattern...

"I think I found a background I like at last - Just Testing"

1) A previously discussed we will notice a "SIGNAL" Type candle

2) It can be on 1HR-4HR-1D TF

3) Today is FOMC and Friday NFP

These two events will for sure give us the signals we need to clarify

the way forward

Let this very important week play out, I'll touch base again next week

I sincerely hope my point of view offers a valued insight

Thank you for taking the time study my analysis.

CNXENERGYCNXENERGY

* Left Shoulder: Formed after an initial decline and a bounce.

* Head: A deeper decline followed by a strong upward move.

* Right Shoulder: A shallower decline similar in depth to the left shoulder, followed by another upward move.

This is a bullish reversal pattern, often seen at the bottom of a downtrend.

Green Line:

Acts as the neckline retest zone. Price seems to have retested this after the breakout — a textbook behavior in an inverse H&S.

Red Line:

Clearly marked as our stop-loss,

DISCLAIMER : I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only.

JPY at Key Zone – EURJPY & GBPJPY Could Drop 1k+ PipsExactly one year ago, the JPY Currency Index broke above the falling trendline of a falling wedge, signaling the end of a bearish cycle that had lasted nearly five years.

As is typical after long-term reversals, the reaction was sharp and fast, and the price quickly reached the first resistance target of the pattern.

Since then, the index entered a lateral phase, with clear support forming around the 730 zone.

________________________________________

🔍 Current Price Action

Recently, the price pulled back to test that same support, and at the time of writing it sits at 737, forming a tight consolidation.

This suggests we’re again at an inflection point.

________________________________________

📊 Trade Outlook

From a medium-term perspective, I believe the index is preparing for another leg higher, potentially toward resistance at 780.

➡️ That would mean a 7% rise on the JPY Index – and this move could translate into more than 1,000 pips of downside for pairs like EURJPY and GBPJPY.

________________________________________

🔄 What’s Next?

In the coming sessions, I’ll focus on these two pairs as they offer the clearest setups and have the strongest volatility.

Stay tuned — follow for the next updates. 🚀

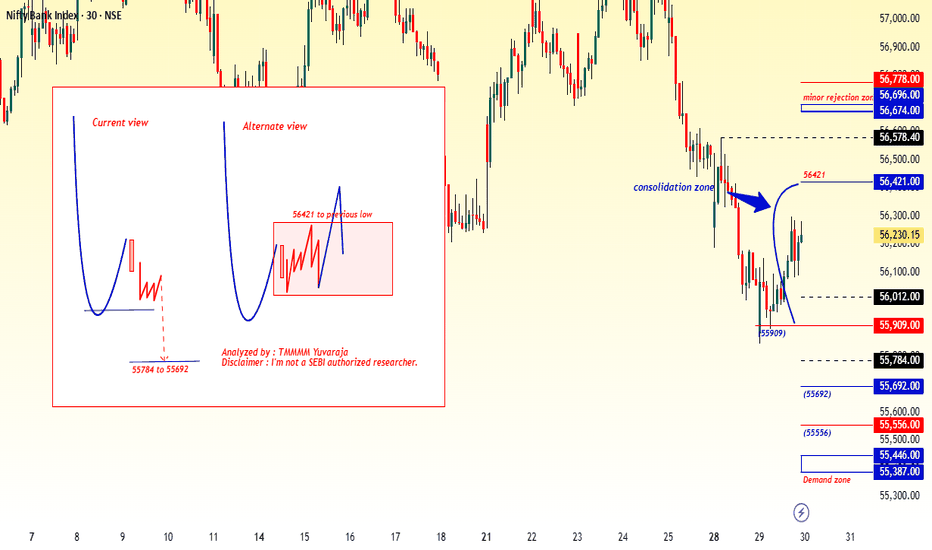

#Nifty directions and levels for July 30th:Good morning, friends! 🌞

Here are the market directions and levels for July 30th:

There have been no major changes in the global market. The global sentiment remains moderately bullish,

while the local market continues to show a bearish tone.

Today, Gift Nifty indicates a gap-down opening of around 40 points.

What can we expect today?

In the previous session, both Nifty and Bank Nifty took a solid pullback after the gap-down start.

However, neither of them broke the 38% Fibonacci level in the current swing.

So, unless the 38% level is broken, we should continue to approach the market with a bearish view.

At the same time, key parameters have been lagging recently, which has made it difficult for the market to take a clear direction.

My primary expectation is consolidation within the previous day's range.

However, if the market breaks the bottom with a solid structure, then we can expect the correction to continue.

#Banknifty directions and levels for July 30th:

What can we expect today?

In the previous session, both Nifty and Bank Nifty took a solid pullback after the gap-down start.

However, neither of them broke the 38% Fibonacci level in the current swing.

So, unless the 38% level is broken, we should continue to approach the market with a bearish view.

At the same time, key parameters have been lagging recently, which has made it difficult for the market to take a clear direction.

My primary expectation is consolidation within the previous day's range.

However, if the market breaks the bottom with a solid structure, then we can expect the correction to continue.

Nasdaq and S&P 500 higher than ever. Crash incoming??The stock market is now more expensive than ever.

Some people are calling the top, saying that the market is overbought and too high.

There are indicators that show that the market is overheated, but NO ONE KNOWS whether it's going to crash next week or continue running up for months.

Since April, Nasdaq has gained 40%, which is a lot. Congrats if you bought some QLD and TQQQ back in April when I posted about it.

SP:SPX : All-time high. NASDAQ:NDX : All-time high. BITSTAMP:BTCUSD : All-time high. TVC:GOLD : All-time high HOME PRICES ( ECONOMICS:USSFHP ): All-time high. Sounds a bit like a bubble.

The S&P 500’s market cap now equals 28x real disposable personal income — a record.

The stock market Shiller PE ratio is at its highest in 20 years.

Nasdaq companies, especially the MAG7, are strongly outperforming small-cap companies. The last time this happened at this speed, we had the dot-com crash.

The top 10 stocks in the S&P 500 account for 40% of the index.

So, saying this, is the market going to crash?

I don't know, but I know that it's more likely to crash now than it was 3 months ago. It might continue running higher, too, as the FED is expected to cut rates. Really, no one knows. 😊

Here's what I'm doing:

I trimmed down some overpriced stocks from my portfolio: Lemonade, Coupang, Shopify, and Crowdstrike

I trimmed down some of my crypto, especially Bitcoin and Ethereum

I stopped DCA'ing into leveraged ETFs

I'm accumulating cash

I'm still investing (added more healthcare stocks to the portfolio)

Quick note: I'm just sharing my journey - not financial advice! 😊

DOLLAR INDEX The federal funds rate is the interest rate at which U.S. banks and credit unions lend their excess reserve balances to other banks overnight, usually on an uncollateralized basis. This rate is set as a target range by the Federal Open Market Committee (FOMC), which is the policymaking arm of the Federal Reserve. The current target range as of July 2025 is approximately 4.25% to 4.5%.

The federal funds rate is a key benchmark that influences broader interest rates across the economy, including loans, credit cards, and mortgages. When the Fed changes this rate, it indirectly affects borrowing costs for consumers and businesses. For example, increasing the rate makes borrowing more expensive and tends to slow down economic activity to control inflation, while lowering the rate stimulates growth by making credit cheaper.

The Fed adjusts this rate based on economic conditions aiming to maintain stable prices and maximum employment. It is a vital tool of U.S. monetary policy, impacting economic growth, inflation, and financial markets.

In summary:

It is the overnight lending rate between banks for reserve balances.

It is set as a target range by the Federal Reserve's FOMC.

It influences many other interest rates in the economy.

Current range (July 2025) is about 4.25% to 4.5%.

1. ADP Non-Farm Employment Change (Forecast: +82K, Previous: -33K)

Above Forecast:

If ADP employment is much stronger than expected, the Fed would see this as a sign of ongoing labor market resilience. Robust job growth would support consumer spending, potentially keep wage pressures elevated, and could make the Fed less likely to ease policy soon. This reinforces the case for holding rates steady or staying data-dependent on further cuts.

Below Forecast or Negative:

If ADP jobs gain falls short or is negative again, the Fed may interpret it as a weakening labor market, raising recession risk and reducing inflationary wage pressures. This outcome could increase the chances of a future rate cut or prompt a more dovish tone, provided it aligns with other softening indicators.

2. Advance GDP q/q (Forecast: +2.4%, Previous: -0.5%)

Above Forecast:

A GDP print above 2.4% signals surprisingly strong economic growth and likely sustains the Fed’s view that the U.S. economy is avoiding recession. The Fed may delay rate cuts or take a more cautious approach, as stronger growth can support higher inflation or at least reduce the urgency for support.

Below Forecast or Negative:

Weak GDP—especially if close to zero or negative—would signal that the economy remains at risk of stagnation or recession. The Fed may then pivot to a more dovish stance, become more willing to cut rates, or accelerate discussions on easing to avoid a downturn.

3. Advance GDP Price Index q/q (Forecast: 2.3%, Previous: 3.8%)

Above Forecast:

A significantly higher-than-expected GDP Price Index (an inflation measure) points to persistent or resurgent inflationary pressures in the economy. The Fed might see this as a reason to delay cuts or maintain restrictive rates for longer.

Below Forecast:

If the Price Index prints well below 2.3%, it suggests that inflation is cooling faster than anticipated. This outcome could allow the Fed to move toward easing policy if other conditions warrant, as price stability is more clearly in hand.

Bottom Line Table: Data Surprises and Likely Fed Reaction

Data Surprise Fed Outlook/Action

All above forecast Hawkish bias, rate cuts delayed or on hold

All below forecast Dovish bias, higher chances of rate cut

Mixed Data-dependent, further confirmation needed

Summary:

The Fed’s interpretation hinges on how these figures compare to forecasts and to each other. Stronger growth, jobs, and inflation = less rush to cut; weaker numbers = lower rates sooner. If growth or jobs are especially weak or inflation falls sharply, expect more dovish Fed commentary and a greater likelihood of future easing. Conversely, if the data all surprise to the upside, hawkish (rate-hold) messaging is likely to persist.

The U.S. Dollar Index (DXY) is a financial benchmark that measures the value of the United States dollar relative to a basket of six major foreign currencies. It provides a weighted average reflecting the dollar's strength or weakness against these currencies. The DXY is widely used by traders, investors, and economists to gauge the overall performance and health of the U.S. dollar on the global stage.

Key Features of the DXY:

Currencies included and their weights:

Euro (EUR) – 57.6%

Japanese Yen (JPY) – 13.6%

British Pound (GBP) – 11.9%

Canadian Dollar (CAD) – 9.1%

Swedish Krona (SEK) – 4.2%

Swiss Franc (CHF) – 3.6%

It was established in 1973 after the collapse of the Bretton Woods system to serve as a dynamic measure of the dollar's value.

The index reflects changes in the exchange rates of these currencies versus the U.S. dollar, with a higher DXY indicating a stronger dollar.

The DXY influences global trade dynamics, commodity prices (like oil and gold), and financial markets.

It is calculated as a geometric mean of the exchange rates weighted by each currency's significance in U.S. trade.

#DXY

In essence, the DXY is a crucial tool to assess how the U.S. dollar is performing against its major trade partners’ currencies, helping market participants make informed decisions in foreign exchange and broader financial markets.

AUS200/ASX200 - ANOTHER OPPORTUNITY TO SHORT AUS200Team, today, good data came out from the AUS200

The market has given some steroids

Time to put an end to this

SHORTING AUS200 at 8761 toward 8772 with stop loss at 8810

Target 1 at 8732-8726 - take 50% volume and bring stop loss to BE

TARGET 2 at 8712-8696

ENJOY YOUR DAY!

Bullish continuation?S&P500 is falling towards the pivot and could bounce to the swing high resistance.

Pivot: 6,334.93

1st Support: 6,292.36

1st Resistance: 6,420.86

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish reversal?The US Dollar Index (DXY) is rising towards the pivot and could reverse to the 1st support.

Pivot: 99.24

1st Support: 98.27

1st Resistance: 99.97

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.