140 or Nothing! TAMIJTEX Faces Major Resistance AheadTAMIJTEX Technical Snapshot | Can it Break the 140 Supply Zone?

I’ve marked the key support, supply, and demand zones on the chart. Now the big question is — what’s next?

Can TAMIJTEX absorb the supply pressure at the 140 level?

The demand zone around 120 must hold at all costs — that’s a critical support.

If the price fails to break and sustain above 140, there’s not much room left for technical analysis — the setup weakens significantly. Sure, it may still reach 140, but that’s not enough — we need a breakout.

Remember, not every stock can be analyzed with the same lens. TAMIJTEX is one of those that demands a zone-by-zone approach.

CVOPRL | Inverted Head & Shoulders Pattern – Bullish Reversal SeCurrent Chart Structure in CVOPRL:

CVOPRL has been in a downtrend, but recently it's showing signs of reversal.

The price has formed a clear inverted head and shoulders pattern.

The neckline resistance is currently being tested.

Volume behavior shows early accumulation, which supports a bullish bias.

Momentum indicators (RSI/MACD) are starting to turn positive, suggesting bullish divergence with price.

Trading Plan & Strategy:

Don’t jump in early. Wait for confirmation.

What to watch for:

Breakout above the neckline with convincing volume.

Retest of the neckline support (previous resistance).

Bullish candle formation (like a hammer, bullish engulfing) during retest.

Entry Point: After a breakout and successful retest confirmation.

BDLAMPS Makes New High — Buy Pullback Towards Support Levels forRecent Price Action & Technical Set-Up

BDLAMPS has recently registered a new 52-week high, signaling steady bullish momentum. The current price stands around 150

Momentum & Volume

The surge is supported by elevated trading volume—well above the weekly average—indicating institutional participation and strong buying conviction.

Support & Pullback Strategy

A pullback to the breakout range between 140/145 may offer a favorable risk-reward entry point. This zone aligns with recent consolidation and could act as a reliable support area for re-entry.

RAHIMAFOOD: Buy on Dip Strategy – 135 Looks Like a Safer Entry Someone recently asked me about RAHIMAFOOD.

At such a high price level, there are certain technical limitations one must consider before buying:

# Where will the stop-loss be set?

# Is there any resistance overhead that could limit upside?

# Can we expect a mature move from this level?

My personal view:

It’s better to aim for a potential discounted entry. Around Tk. 135 looks like a reasonable discount zone.

If the price drops further, that would be even more favorable — a real golden opportunity.

However, if you have any confirmed insider news or strong conviction, you may choose to go ahead and disregard my cautious view.

Massive Momentum in GEMINISEA – 163 is the Key for 300+ Move Technical Analysis: GEMINISEA (Weekly Outlook)

Trend: Bullish continuation with strong momentum

Volume: Significantly above average, supporting the breakout

Initial Resistance: Successfully breached at Tk. 140, confirming bullish intent

Key Breakout Level:

• Breakout candle high at Tk. 162.90

• A clean breakout above Tk. 163 on volume confirmation would validate the next leg of the rally

Potential Upside Targets (Based on Price Action & Fibonacci Extensions):

Target 1: Tk. 200

Target 2: Tk. 300

Target 3: Tk. 360 (long-term resistance zone)

Support Levels:

Immediate support: Tk. 140 (previous resistance turned support)

Stronger support zone: Tk. 125–130 (in case of pullback)

Conclusion:

GEMINISEA is showing strong bullish structure with high velocity and volume breakout. A sustained close above Tk. 163 may open up the path toward multi-level upside. Traders should watch for volume confirmation and manage risk accordingly.

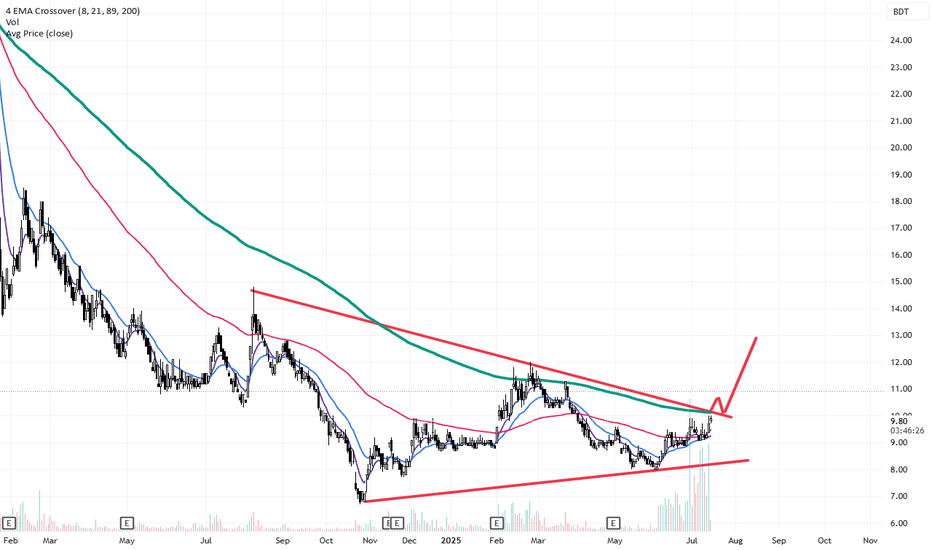

EGEN in a Long-Term Down Channel, Accumulation Phase Offers OppoEGEN has been trading within a well-defined downward channel for nearly a year. Throughout this period, the stock has made several attempts to break above the channel, with the most recent effort occurring on July 17. However, each attempt has failed to sustain a breakout.

Notably, during May and June, the stock exhibited a clean accumulation phase — indicating potential interest building up at the lower levels. Given this context, we are eyeing a buying opportunity around the 19 BDT level, where risk-reward appears favorable.

Patience and proper risk management are key while positioning in such technically suppressed setups.

NAVANAPHAR____ Watch the level 57.60 ,Critical Resistance Level NAVANAPHAR is currently positioned at a highly critical technical level. This analysis will focus on the resistance and volume cluster around the 57.60 level.

Current Situation and the Significance of the 57.60 Level:

Structural Resistance Cluster: The 57.60 level is not just a single resistance point; rather, it's a "structural resistance cluster." This implies that in the past, the stock has faced obstacles at this level multiple times and has retreated from it. It acts as a robust supply zone where sellers are active.

Significant Volume Accumulation: "a lot of volume has accumulated" at this level. This is an extremely important factor. When substantial volume accumulates at a specific price level, it indicates that many traders have bought and sold shares at that point. If the stock fails to overcome this volume cluster, it will serve as a formidable barrier.

If NAVANAPHAR successfully breaks above the 57.60 level, especially with high volume, it would indicate the following:

Resistance Breakout: This would be a strong resistance breakout, signaling a bullish move for the stock.

Continuation of Uptrend: It would confirm the continuation of the uptrend, and the stock could potentially advance towards higher price points.

Volume Support: High volume during the breakout would suggest that buyers are strong and are supporting this new higher price.

NAVANAPHAR Breakout Retest Complete – Perfect Entry Opportunity NAVANAPHAR has recently completed a breakout retest pattern, bouncing back from the previous resistance-turned-support zone. This confirms the validity of the breakout and reduces the likelihood of a false move.

Entry Point: Current market price (CMP)

Stop Loss: 50 BDT (just below the retest zone to minimize downside risk)

Target: 62 BDT (based on the projected breakout move and previous swing highs)

Risk-Reward Ratio: Approximately 1:2, which offers a favorable trade setup for short- to mid-term traders.

Sentiment: With volume supporting the breakout and broader market bullishness intact, NAVANAPHAR looks well-positioned for an upward move—making this an ideal technical entry point.

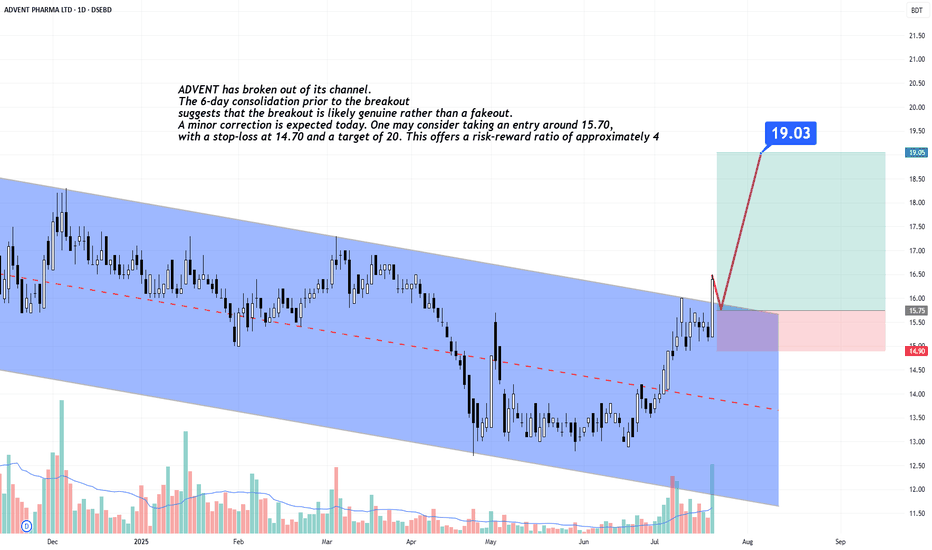

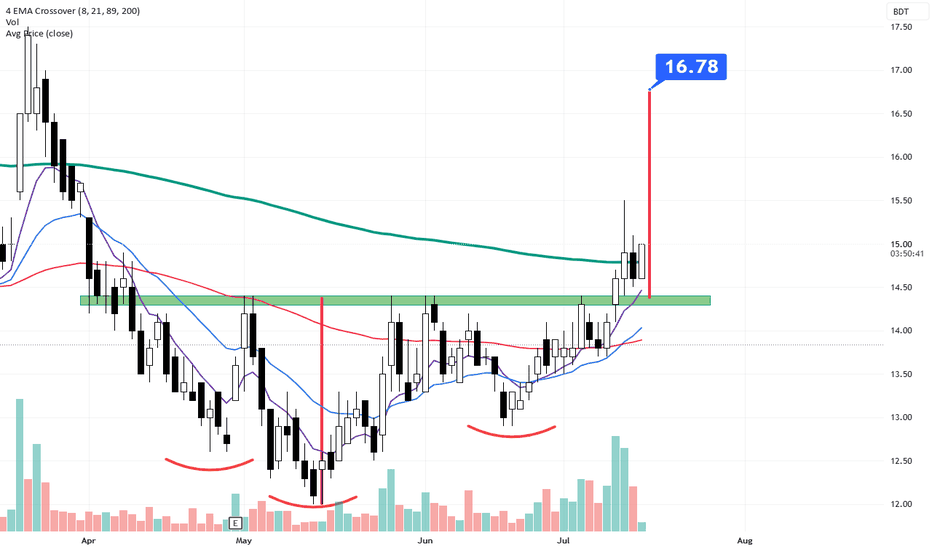

ADVENT Breakout After ConsolidationADVENT has broken out of its channel. The 6-day consolidation prior to the breakout suggests that the breakout is likely genuine rather than a fakeout. A minor correction is expected today. One may consider taking an entry around 15.70, with a stop-loss at 14.70 and a target of 20. This offers a risk-reward ratio of approximately 4

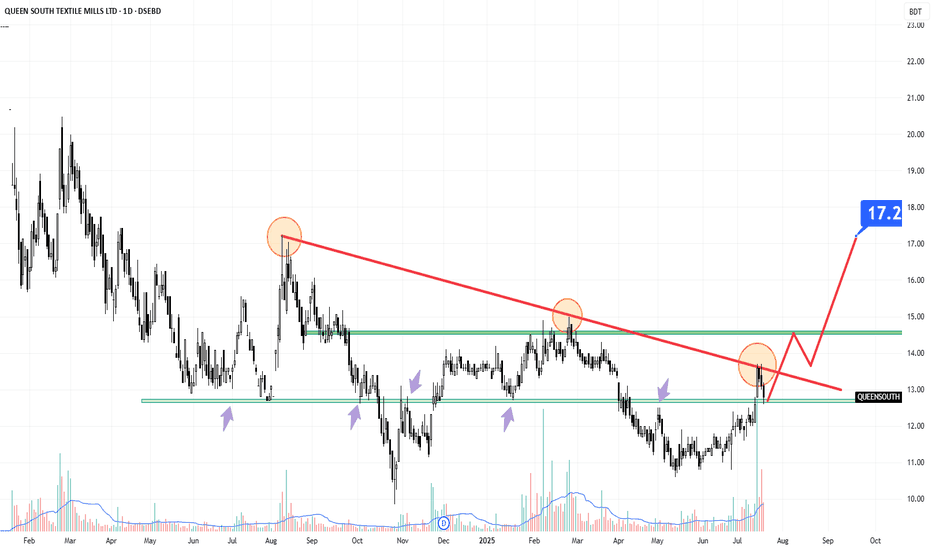

QUEENSOUTH Facing Resistance – Strategic Entry Points ExplainedQUEENSOUTH recently encountered a diagonal resistance while attempting an upward move. Despite a notable increase in trading volume, the stock was unable to decisively break through this resistance level. As a result, it has entered a consolidation phase and is currently holding above a key support level at 12.60.

From a trading strategy perspective, there are two potential entry points: one could initiate a position at the current support level with a tight stop-loss, or alternatively, wait for a confirmed breakout above the diagonal resistance — ideally above 13.70 — for a momentum-based entry. As always, prudent risk management and patience are advised.

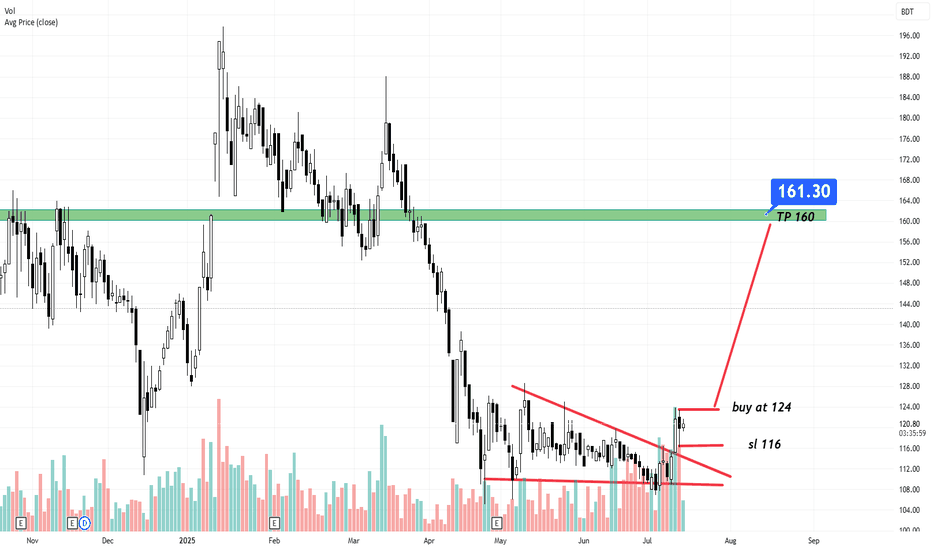

BEXIMCO Pharma Bleeding may end soon?DSEBD:BXPHARMA

BEXIMCO pharma is currently on major discount level & also resisting on the current support level.

Also some interesting news about the company is supporting the stock.

EPS announcement is on the door as well.

I am assuming the worst is over for DSEBD:BXPHARMA & it may regain its dominating position very soon!

I according with my current analysis with DSEBD:DSEX i am expecting a reverse in trend.