363 HK🌎Shanghai Industrial Holdings (363:HKEX) is an investment holding company and the core enterprise of the Shanghai Industrial Investments Holdings Co., Ltd. (SIIC) group of companies.

The company operates through several business segments:

Infrastructure and Environmental Protection: Includes investments in toll road and bridge projects, as well as water supply and clean energy projects.

Real Estate: Focuses on real estate development and investment, as well as hotel management.

Consumer Goods: Engages in the production and sale of cigarettes, packaging materials, and printed products.

Integrated Healthcare: Engaged in the production and sale of pharmaceuticals and healthcare products, the provision of distribution and supply chain management services, and the management of a franchise network of retail pharmacies.

P/B 0.3

P/E 5.6

Stable dividends paid twice a year.

Dividend yield of 6.85%

Dividend payments are expected to increase in absolute terms in the coming years.

Dividends account for 39% of profit and 72% of free cash flow.

The company's balance sheet is growing slowly.

A good dividend stock.

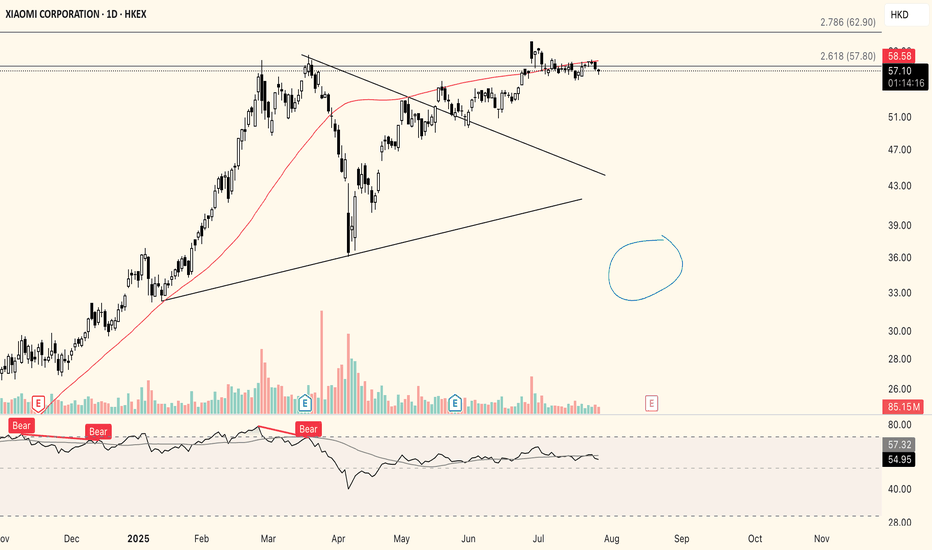

Xiaomi is going to get a fresh haircutAs you can tell by looking at the chart, there seems to be a distribution at play here. After hitting a HTF 2.618 extension, there was quite a steep retracement that resulted in what looked like a bull flag. With recent sweep of that same high at the 2.618 extension, it now looks like Xiaomi will break down sooner or later. This distribution started months ago, so expect this to take some time to play out. But by current looks, first leg down could start soon IMHO.

Lygend is at a confluence in a bull marketLygend is at 38,2% & 61,8% overlap.

Background:

1. China Construction Bank (939) just broke a key resistance level at 7.96 HKD.

2. SSE Index just broke a long-term downtrendline.

1+2 = Lygend long-term trend is up

Fib overlap = a good place for a significant pivot low.

2328 HKPICC Property & Casualty is a Chinese property and casualty insurance company.

The company's main business lines are structured into the following segments:

Automotive: Providing insurance products for motor vehicles.

Commercial Property: Commercial property insurance.

Cargo: Ship, craft, and shipping insurance.

Public Liability: Liability insurance for policyholders.

Accident & Health: Accident and medical expenses insurance.

Agriculture: Insurance products for agribusiness.

Credit & Guarantee: Insurance for credit and guarantee transactions.

Other: Includes products related to homeowners, special risks, marine hulls, construction, and credit.

Corporate Segment: Consolidates income and expenses from investing activities, share of results of associated companies, and non-operating income and expenses.

In its last six-month report, the company's earnings per share (EPS) was HK$1.20, 15.68% higher than the analyst estimate of HK$1.04.

The company's net profit for the last six months reached HK$26.27 billion, representing a 76.96% increase compared to HK$14.84 billion in the previous reporting period.

ROE 14.5%

P/E 10

P/B 1.3

Dividend yield 3.2%

1117 HK🌎China Modern Dairy is a dairy farming and raw milk production company in mainland China.

Main Business Activities:

Raw Dairy Business: Breeding dairy cows for the production and sale of raw milk

Feed Business: Trading, manufacturing, and selling animal feed

Other Activities: The company is also involved in e-commerce operations, forage crop planting, and dairy cow breeding.

The company is a subsidiary of China Mengniu Dairy Company.

The company posted a loss last year, but is expected to return to profitability by 2025, with 2026 also expected to be profitable.

The company's return to profitability in the medium term is the main fundamental driver.

P/B 1.00

Net Debt 13.08 B RMB

OCF 2.5 B

FCF -1.95 B

The company is also expected to return FCF to profitability in the near future.

2469 HK🌎Fenbi is a holding company operating in China. Its primary activities are focused on the informal vocational education and training sector. The company's business model is divided into three key segments:

Classroom Tutoring: Providing tutoring services through in-person classes at learning centers and campuses.

Online Learning: Includes online courses, subscription packages, and interactive exercises.

Book Sales: Production and sales of educational literature, as well as related printing and technical services.

The most significant positive factor is the company's net profit for the last reporting half-year. Net profit changed from a loss of -41.41 million HKD to a profit of 243.46 million HKD.

ROE 13.6%

OCF and FCF are positive

Net debt is negative

2888 HK🌎Standard Chartered is a British bank focused on emerging markets.

Its key features include:

Approximately 90% of the bank's profits come from Asia, Africa, and the Middle East. This distinguishes it from many other British banks, as it does not engage in retail banking in the UK.

The bank's core activities include wealth management, corporate and investment banking, and treasury services. The bank serves corporate, institutional, and high-net-worth clients.

At the end of Q2 2025, underlying profit before tax increased by 34% year-on-year to $2.4 billion.

The Wealth Solutions business is demonstrating exceptional results, with revenue growth of 29% in Q2 2024 and 20% year-on-year in Q2 2025.

Net New Money inflow reached a record $16 billion in Q2 alone.

ROE ~10.3%. This is the highest level in recent years.

P/B 1.1

Buyback:

2024: 1.5B

From the beginning of 2025: 1.3B

A partnership with Alibaba to implement artificial intelligence in the bank's operations could potentially lead to increased efficiency and lower costs in the future.

POPMART STORE IS PACKED!Went to the mall today, I saw the POPMART store closed. Thought "oh I guess the trend is over" then I turned around, the POPMART store moved to a bigger store.

Walked around a bit more, and saw another POPMART store (yes there's 2) and there was a very long line in a retractable queue barrier. Like 30 minutes to an hour long line just to enter the store.

All this to say, it makes no sense that it's down 30% right now. Yes, lines this long are a major top signal, but it shouldn't be down 30% at peak hype. I'd gladly risk 10% to make 50% here.

Stop chasing the high price - no need to FOMO, let it come downOften, when some gurus online said they have taken a position in some stocks , be it in US or HK, I will get PMs from my followers asking for my thoughts !

True enough, the price has already run so high and anyone that goes in now will definitely have a LOWER margin of safety. So, what's the rush ?

Is this company the only one in the world that produce such products/services ? If your idea of investing is to collect branded names stocks so that during lunch breaks, you can brag around, then so be it ! Else, you should have the patience and wait for it to come down , hopefully.......

In this case, I think the chances is quite high though not guaranteed. The chart shows us selling pressure is building or profit taking is on the table. So let the sellers sell and wait at lower ground to pick up the shares before another round of rally .

Of course, this is provided you have done your extensive research on this company and its financial performance !

Best of luck !

Xiaomi is offering a discount soon, are you ready ?I was talking to my wife who does not quite like this company for basically copying what the western brands are doing. Haha, a different perception from me.

Imo, this is a smart move instead of reinventing the wheel. It has already proven it works and people like it so tweaking the products from smartphone to EVs to cater to the local demand is a smart move. And in the process, it has done extremely well with excellent top and bottom line figures. What's not to like ?

There will be 2 price points that I will be keen to go LONG should it come down , the first being higher probability than the second one.

Please DYODD

Is Meituan still worth investing ?This is a common phenomenon in China. When one major player in any industry does well, it attract others to come and join in the party. Look at EV sectors, with so many brands cutting prices so frequent that consumers are spoilt for choice and delayed in making purchases, resulting in market shares dilution for the players.

The same can be said for the food delivery business. Once, Meituan held a dominant market share position but over time, Ele.me (Alibaba) and now JD.com has slowly increased their market shares as well. The price war is so severe that the government has summoned the players for a meeting.

We can see that the share price of Meituan has dropped from a peak of 216 to current price of 101 , more than 50% fall from its glorious days. Sales moving forward will become harder to achieve with the two competitors. It may have to share its leadership position with them, reluctantly.

I see a valued buy at the 87 price level where I am likely to accumulate this company.

Please DYODD

Opportunity to buy Alibaba shares For those who are regretting not getting onboard the Alibaba ship earlier, now is your opportunity. It is highly likely that when HK market opens tomorrow, this counter will head south , hopefully 5-8% as the Alibaba shares in US market was down 8% upon closing last Friday.

The first buying zone will be between 147 - 150 price level. Here, you deploy your first tranche of capital. The all important news that everyone is waiting will be how China will retaliate next week given the new tariffs will be effective on Nov 1. I expect some volatility of both countries firing at one another (trade tactics) before we see some form of settlement before Nov 1. The game is nothing new.

If we are lucky and tech shares get sell down even more , then we can the price revisit the 118-128 price level. Here, you can deploy 20% more capital to go LONG.

The above analysis is based on one's conviction in Alibaba's fundamentals and future position in the AI space.

As usual, please DYODD.

1186 (CRCC) HKEX 🌎China Railway Construction Corporation Limited (CRCC) is one of the world's largest companies specializing in the design, construction, and management of infrastructure projects. It is a Fortune Global 500 company and a leading Chinese enterprise.

Core Businesses

Engineering Contracting: Railways, Highways, Urban Rail Transit (Metro), Bridges, Tunnels, Airports, Ports, Hydraulic Structures, and Real Estate

Equipment and Materials Manufacturing

Design, Surveying, and Consulting Services

Cargo and Materials Logistics and Trade

Financial Operations and Asset Management

Operates in both the domestic and international markets.

An extremely low price-to-earnings ratio is key.

P/E Ratio: 3.63

P/B Ratio: 0.20

Dividend Yield: Approximately 5.37%

As a reminder, the Hong Kong dollar is pegged to the US dollar, meaning the yield is denominated in US dollars.

Notably, the company's operating cash flow showed negative growth (-RMB 29.2 billion over the 12-month period), which is related to the implementation cycle and financing characteristics of large-scale infrastructure projects.

Last quarter, new urban rail contracts saw a significant increase (109.0% year-on-year).

Public-Private Partnership (PPP) projects accounted for 25-30% of new orders, indicating the company's transition to a higher-quality, more stable business model.

New overseas contracts increased by 59.1% year-on-year (data based on year-on-year figures from the previous reporting period).

The company's debt level is relatively low.

Free cash flow (FCF) is negative, but we expect it to gradually turn positive.

KUAISHOU (1024) ; Breakout 52 weeks high with low retrace. KUAISHOU (1024) ; Breakout 52 weeks high with low retrace. TF week is also looking good Possible for the next big bull run. First target price at 103.0 (Fibo proj 100%) and Stoploss at 79.20 ; RR ratio = 3.41. And the rest let profit run with whatever EMA you trust.

Xiaomi 1810 HK LongXiaomi reports revenue of RMB 111.3 billion in Q1 2025, up 47% YoY

Adjusted net profit up 64% YoY to RMB 10.7 billion

Operating profit margin and net margin improved to 11.8% and 9.6%, respectively

Xiaomi became the leader in China's smartphone market in Q1 2025 with an 18.8% share (up 4.7 p.p. YoY) for the first time in 10 years

Global market share was 14.1%, keeping the company in 3rd place globally

IoT and lifestyle revenue up 59% YoY

EV business posted revenue of RMB 18.6 billion in Q1 2025, while operating loss narrowed to RMB 500 million

New model YU7 launched 2025, which is positioned as a competitor to Tesla Model Y😈

news in june

Xiaomi unveiled the YU7 electric SUV at a price lower than the Tesla Model Y

Xiaomi: over 200,000 pre-orders in 3 minutes

The launch of the new YU7 model is expected in July 2025, which is positioned as a competitor to Tesla Model Y

The company's debt is completely covered by the money on the balance sheet

The company's balance sheet is growing steadily every year

🚀We expect continued growth in revenue, profit, OCF, FCF🚀

A great company with a growing business