$ASML: Is the stock primed for upside? Indicators are aligned.NASDAQ:ASML is one of the very few semis cap equipment cos. which have not broken out of their previous ATH. The stock is still at lower bound of the upward slopping channel which we have been following for a few months in this blog.

IN this chart below we are following a combination of various

Rubis (RUI:EPA) - A Deep Value Infrastructure Play - TP: 60 EUR📌 Investment Thesis

Rubis is a small-cap European energy distributor undergoing a strategic transformation. Traditionally focused on downstream oil and gas distribution, the group divested its storage business in 2023 and has since begun allocating capital into renewable electricity generation in

Keep an eye on DSFIR. This might be a good opportunityDSM-Firmenich (DSFIR) is at a crossroads, trading at two-year lows with technicals pointing towards oversold. While there is bounce potential, the prevailing downtrend demands caution. A patient, incremental approach is advised - small entry now, larger position if signs of stabilization emerge. Thi

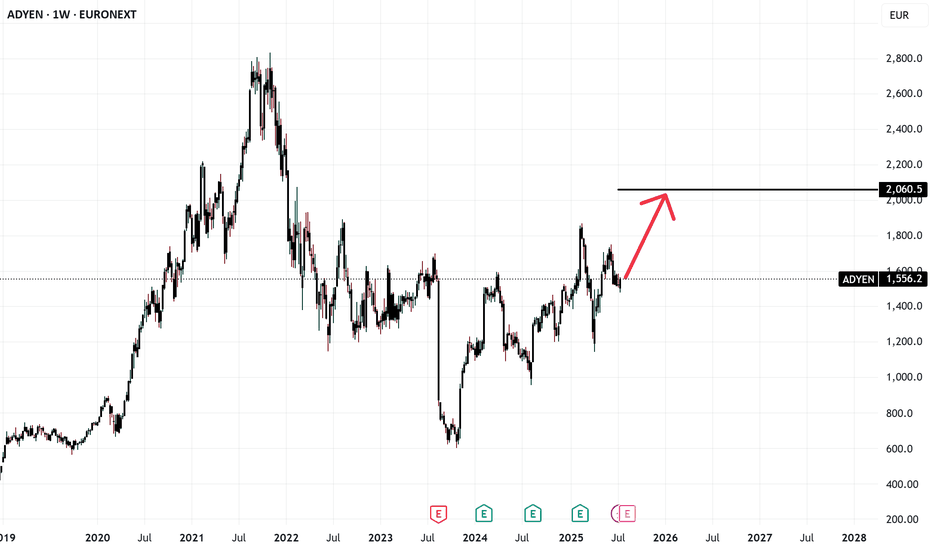

Adyen's stock price experienced a significant dropAdyen's stock price experienced a significant drop.

ADYEN plunged about 18% the past 24 hours. This decline followed the release of the company's half-year results, which revealed slower revenue growth and a lowered full-year outlook

Looking at the stock technically, I see that it is trading in an

ASML enters buy zone and will posibly rotate to uptrend again.ASML is lagging behind after stagnated growth and a weak order intake due to china chip machine restrictions and uncertaincy about chip machine import tarrifs. It looks like tarrifs on chip machinery is settled and companies will likely place orders again after internal investment approvals.

Earni

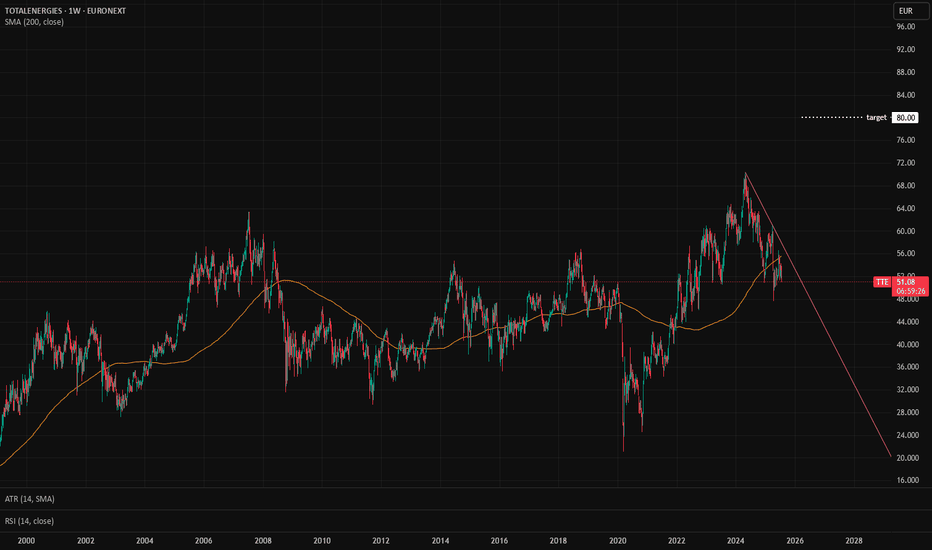

TTE: Fundamental Analysis +56 %With 2024 revenue of 195,6 billions €, Total Energies ranks among the top 10 largest energy companies in the world. EverStock identifies a fundamental revaluation potential of + 56 %.

Valuation at 7.3x net earnings

Currently valued at 115,7 billions € in market capitalization, Total Energies post

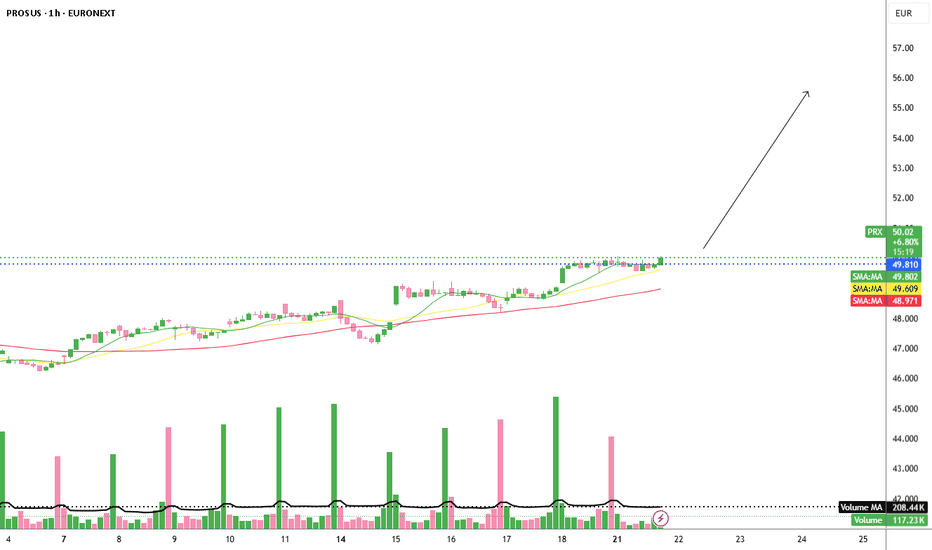

Prosus N.V. – Hidden Giant with Breakout PotentiaFollowing a strong bullish trend in July, Prosus N.V. is already up 8% month-to-date, and things are heating up. The company is reportedly in talks to acquire Just Eat Takeaway.

However, since Prosus already holds a 24% stake in Delivery Hero, the EU antitrust body has pushed back. Prosus has resp

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Tomorrow

OCIOCI N.V.

Actual

—

Estimate

—

Aug 27

KENDRKENDRION N.V.

Actual

—

Estimate

—

Aug 28

HALHAL TRUST

Actual

—

Estimate

—

Aug 28

AZRNAZERION GROUP N.V.

Actual

—

Estimate

—

Aug 28

ECMPAEUROCOMMERCIAL PROPERTIES

Actual

—

Estimate

—

Aug 29

SIFGSIF HOLDING

Actual

—

Estimate

—

Sep 2

INPSTINPOST S.A.

Actual

—

Estimate

0.16

EUR

Sep 4

CVCCVC CAPITAL

Actual

—

Estimate

0.35

EUR

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Electronic Technology | ||||||||

| Consumer Non-Durables | ||||||||

| Finance | ||||||||

| Energy Minerals | ||||||||

| Commercial Services | ||||||||

| Technology Services | ||||||||

| Industrial Services | ||||||||

| Process Industries | ||||||||

| Producer Manufacturing | ||||||||

| Retail Trade |