OGKB 5M Investment Aggressive CounterTrend TradeAggressive CounterTrend Trade

- short impulse

+ biggest volume T1 level

+ biggest volume 2Sp-

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

1/2 yearly level take profit at 0.459

1H Counter Trend

"- short impulse

+ biggest volume TE / T1 level

+ support level

+ volume

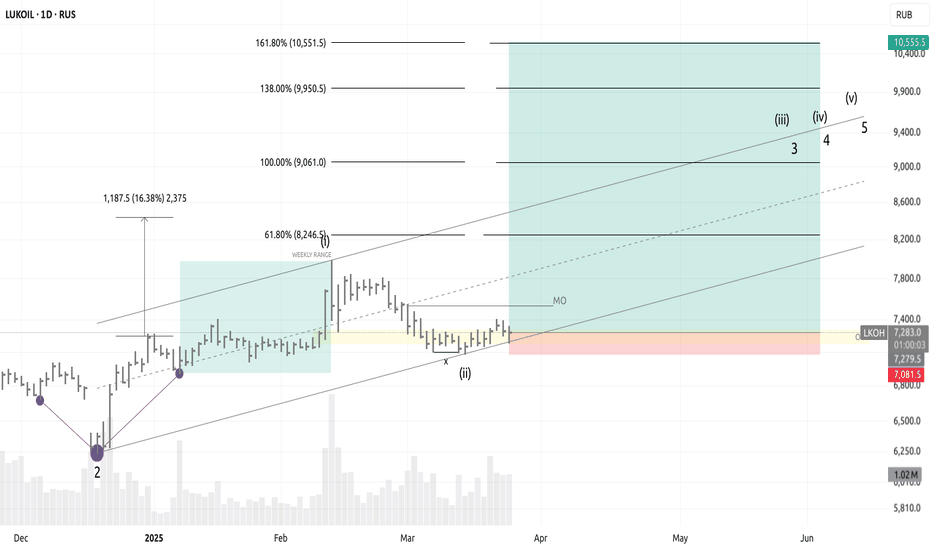

LKOH / LONG / 25.03.25⬆️ BUY LKOH 25.03.25

💰 Entry: 7279.5

🎯 Goal: 10555.5

⛔️ Stop: 7081.5

Entry reasons:

1) OSOK:

— Month minimum was set at the 2nd weekly

2) Eliott waves:

— 1D: 2th wave is formed, 3th is forming

3) Larry Williams:

— Long term point is formed

4) Range:

— Weekly bullish range, correction into OTE

Unipro UPRO Stock Technical Analysis and Fundamental Analysis📊 Technical Analysis of Unipro ( RUS:UPRO ) Stock

Current Price: 2.043 RUB (+2.46%)

Trend: The stock is in a growth phase, but signs of overbought conditions are emerging.

RSI (14): 78.91 (overbought, possible correction ahead)

MACD (12,26,9): +0.13 (bullish signal, but a reversal is possible)

Su

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Energy Minerals | ||||||||

| Finance | ||||||||

| Non-Energy Minerals | ||||||||

| Process Industries | ||||||||

| Utilities | ||||||||

| Communications | ||||||||

| Transportation | ||||||||

| Electronic Technology | ||||||||

| Retail Trade | ||||||||

| Consumer Durables |