Markets Eye Policy, Positioning, and PerformanceCME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! COMEX:GC1! FRED:FEDFUNDS

Happy 4th of August, Traders!

As we head into the new week, here’s a look at what’s on the calendar:

Key Economic Data Releases

Monday:

• Factory Orders (MoM) – June

• Supply: 3-Month Bill Auction, 6-Month Bill Auct

Economy

nfci corellation with Eth and altcoin Alt season is not a magic internet voodoo that happens every 4 years . It happens when the financial condition easy past a certain point , which the last two instance was -60.

Eth starts running when Nfci crosses' -50 and when that crosses -60 alt season

Data Point on when eth started its bull r

$EUIRYY -Europe CPI (July/2025)ECONOMICS:EUIRYY

July/2025

source: EUROSTAT

- Eurozone consumer price inflation held steady at 2.0% year-on-year in July 2025, unchanged from June but slightly above market expectations of 1.9%, according to preliminary estimates.

This marks the second consecutive month that inflation has align

FED: An unlikely rate cut in September, unless…The United States Federal Reserve (FED) unveiled this week a new monetary policy decision, maintaining the status quo on interest rates—hence no change in the federal funds rate since December 2024. This did not prevent the S&P 500 from hitting new all-time highs, driven by GAFAM financial results a

Latest on Fed rate cut debateThe Fed isn’t expected to cut rates this week, but this FOMC meeting should still be very interesting.

Powell will need to address growing pressure from board members Waller and Bowman, who’ve both called for cuts, citing limited inflation impact from tariffs.

Still, Powell is just one of 12 vot

Third quarter and something we didn’t expectso I’ve been watching the markets for a while and honestly this new admin is doing something that many didn’t saw coming.

it's not even a full year yet, we’re still on Q3, but the impact on the economy is starting to show. what really gets my attention is the tariff collection, it’s been really hig

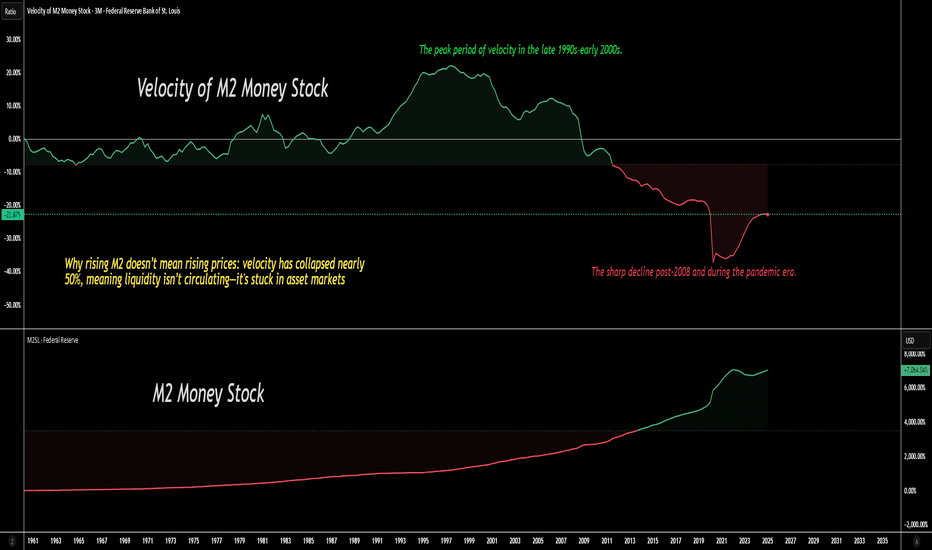

The Bubble Many Traders Missed: Money Supply Up, Velocity Down**Most traders see rising money supply (M2) and assume asset prices will soar.**

But they ignore the **Velocity of Money (M2V)**—and that’s where the real danger is hiding.

---

## **The Great Disconnect**

* **Money Supply (M2):** Central banks have flooded markets with liquidity since 2008 and a

See all popular ideas

GDPGDP GrowthReal GDPGDP Per CapitaGDP Per Capita PPPInflation RateInterest RateUnemployment RateGovernment Debt to GDPPopulationAverage Hourly EarningsHouse Price IndexManufacturing Production YoYIndustrial Production YoYCurrent AccountCurrent Account to GDPBalance of TradeEconomic Activity IndexCrude Oil ProductionSee all