ACH Update!Hello Traders, 👋

I hope you're all doing well!

Here’s a quick update on ACH on the weekly timeframe 🕒:

ACH is currently forming an ascending triangle, a bullish pattern that often leads to a breakout once price clears the resistance trendline. On higher timeframes, this setup tends to perform wel

ACH/USDT - Potential Bounce Incoming 30%+ Gains PossibleI'm analyzing the ACH/USDT 4-hour chart and spotting signs of a potential rebound. Here’s what I’m seeing:

✅ Support Zone: Price is testing a key support level around $0.02119, which has held strong in the past. The market appears to be accumulating in this area.

✅ EMA Crossovers: The chart shows

Long Entry Signal for ACH/USDT - Bullish Setup (Daily Chart)

Symbol:

Timeframe: Daily

Analysis:

MLR > SMA: The MLR (blue) is above the SMA (pink), signaling a bullish trend.

MLR > BB Center: MLR exceeds the Bollinger Bands Center Line (orange), showing strong bullish momentum.

PSAR: PSAR dots (black) are below the p

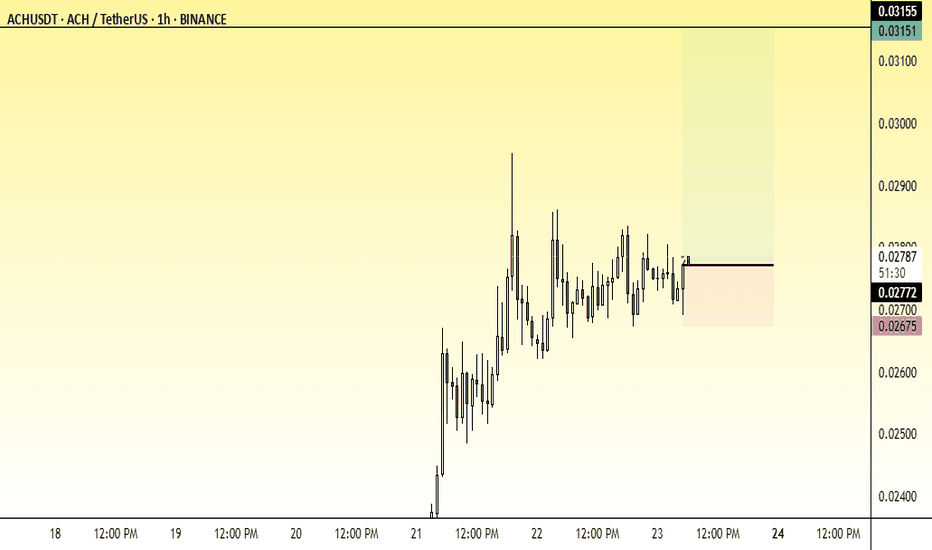

ACHUSDT (1H) - Technical Analysis & Trade Setup📌 Market Overview:

The price is currently at 0.02783, forming a range-bound consolidation after an initial bullish move.

A potential breakout setup is visible, with an entry at the current market price (CMP).

The risk-to-reward ratio suggests a bullish trade setup with defined stop-loss and take-p

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.