ALGO Breakout Retest Setup – Bullish Continuation in Play?ALGO is showing strong signs of a potential bullish continuation on the 4H chart. After breaking above the descending trendline, price is currently retesting the breakout zone. The projected move suggests a bounce from this area with a potential rally

Market insights

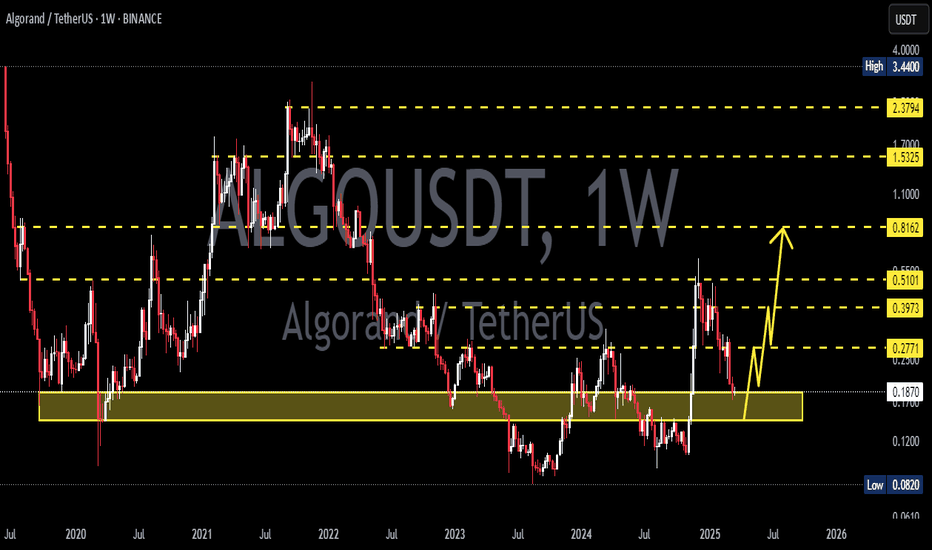

Algorand Long Trade, 6x Potential by 2026Algorand has retraced to the lower Median Line, presenting a strong investment opportunity.

With current economic conditions favoring altcoins, Algorand stands out.

Oversold at present, I project it to increase 6x from its current level, with a direct move toward the ML likely by 2026 — potentially spearheading the altcoin rally.

I’m personally invested in Algorand with a R/R ratio of 18:1.

ALGO at Golden Buy Zone | Low-Risk, High-Reward Setup (1D)The higher timeframe structure of ALGO on the weekly chart is still bullish, but on the daily and hourly timeframes, the structure is bearish. That’s why we expect major players to enter ALGO at key support zones.

Currently, it is consuming orders within the demand zone, and it is expected to eventually reach the POI and then move toward the targets.

If strong buyers step in, the price could reach the red box.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

ALGOUSDTmy entry on this trade idea is taken from a point of interest below an inducement (X).. I extended my stoploss area to cover for the whole swing as price can target the liquidity there before going as I anticipate.. just a trade idea, not financial advise

Entry; $0.1824

Take Profit; $0.1989

Stop Loss; $0.1796

ALGO, preppin for a MASSIVE ASCEND this Q2 2025 from 0.18ALGO is preppin for a massive shift based on the latest price behavior.

After goin parabolic late last year -- tapping the 0.50 mark, algo like the rest succumb to red season -- had to experience corrective pressure of the market and touching a weighty trim down to sub 0.20 area.

Today, an apparent bear saturation has been spotted. Based on the diagram we are seeing some basing zone at the higher channel -- price is being magneted on this higher area; inching closer as days progresses on that exit zone hinting a possible break in structure soon.

Ideal seeding area is the current price at 0.180.

Spotted at 0.18

Mid target at 0.5

Long term. 0.50

TAYOR. Trade safely.

Short Position ALGO/USDT#Singal

ALGO/USDT

🔴 Short Position

🎲 Entry1 @ 0.1967

🎲 Entry2 @ 0.1986

✅ Target1@ 0.1941

✅ Target2 @ 0.1903

✅ Target3 @ 0.1836

✅ Target4 @ 0.1779

✅ Target5 @ 0.1708

❌ Stop Loss @ 0.2069

Leverage: 5X_15X

Margin: 10% of Wallet Balance

⚠️"Take Care of Risk Management for Your Account"

Algorand Technical AnalyzeTrend: Price is following an ascending channel (orange lines), and it's nearing a key support level.

Support: The green support around 0.14–0.15 is a critical level, and a break below this could lead to further downside.

Resistance: Resistance is at 0.30–0.40, where the price has previously faced rejection.

Volume: Volume is still low, indicating weak momentum.

Price Action: Watch the price action near 0.15. A bounce could target 0.30–0.40, but if the price breaks below 0.14, further downside toward 0.10 is possible.

ALGO in coming days ...The pattern has broken, and now I expect the price to rise to $0.23 .

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

ALGO / USDT - Big Move AheadEvening fellas,

I got an order ready near the gap I believe its at $0.1844, it would require coming back down to the purple between both trendiness, one placed at the wick low, and the other at the body.

Maybe it moves up to resistance once again before a final shakeout.

It'll be a nice long.

Trade thirsty.

ALGOUSDT Facing a Major Reversal? Bears Ready to Take Over!Yello, Paradisers! Is ALGOUSDT about to take a sharp dive? The price is currently hovering around a key supply zone, struggling to push higher. With buyers failing to break through, the risk of a strong bearish rejection is increasing, signaling a potential short opportunity.

💎The market structure has shown a clear Change of Character (CHoCH), suggesting a shift from an uptrend to a potential downtrend. Price remains below the 50 EMA, reinforcing the bearish momentum. If sellers step in with force, the downside move could accelerate quickly.

💎Key downside targets are forming around 0.2188 and 0.1663, where the next major support zones lie. If the bearish scenario plays out, these levels could be reached sooner than expected. Any failure to reclaim higher levels will only strengthen the case for further declines.

This is where patience and discipline pay off. Market traps are everywhere, and only those who stay focused and trade smart will come out on top. Be ready for the move, Paradisers!

MyCryptoParadise

iFeel the success🌴

ALGO Update: Spot/Futures Position & Potential Price ActionHey traders! 👋

Let’s take a quick look at Algorand (ALGO), which has been showing some interesting price action lately. 🇺🇸 As we know, ALGO has been closely tied to the broader market sentiment, and with all the attention around US-based projects, it’s definitely one to watch, especially with the current political landscape.

1️⃣ The Sell Signal – We received a strong sell signal earlier, and as a result, we decided to exit our spot position. Since then, we’ve been in a clear downtrend with lower lows and lower highs. 🔻

2️⃣ Fib Level 0.786 – Currently, we’re approaching the 0.786 Fibonacci level, which could act as a potential retracement point. Could this be the level where the market reverses? 🤔 If we see a bounce here, we might fill the demand zone and potentially add more spot positions.

However, there’s also the possibility of a breakout to the downside if the current downtrend continues. Will the bulls step in at this crucial point, or are we heading lower?

What do you think? 🤨 Drop your thoughts below and let’s discuss the next move! 💬 Don’t forget to follow for more insights on ALGO and other cryptos.

Happy trading, everyone! 💰📈

ALGOUSDT - a realistic target for bullshi traders,

The higher low may be in the making.

The chart still looks good. Still much better than many altcoins that made new lows.

If ALGO holds the higher lows structure, we should see 0,75-0,80$ this summer.

Don't be greedy. This is completely different market than in 2021.

Good luck

ALGO buy setup (1D)Here, we have a high-potential zone for ALGO.

The green zone represents strong support, and if the price reaches this area, we will look for buy/long positions.

The red box is a fresh order block that hasn’t been tapped yet, containing the main sell orders.

The target can be this red box.

Closing a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

#ALGO/USDT#ALGO

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.2351

Entry price 0.2434

First target 0.2479

Second target 0.2536

Third target 0.2594

ALGO/USDT 1W🩸 EURONEXT:ALGO ⁀➷

#Algorand. Macro chart Another

💯 Intermediate Target - $0.76

🚩 Macro Target 1 - $1.21

🚩 Macro Target 2 - $2.28

🚩 Macro Target 3 - $4.01

- Not financial advice, trade with caution.

#Crypto #Algorand #ALGO #Investment

✅ Stay updated on market news and developments that may influence the price of Algorand. Positive or negative news can significantly impact the cryptocurrency's value.

✅ Exercise patience and discipline when executing your trading plan. Avoid making impulsive decisions driven by emotions, and adhere to your strategy even during periods of market volatility.

✅ Remember that trading always involves risk, and there are no guarantees of profit. Conduct thorough research, analyze market conditions, and be prepared for various scenarios. Trade only with funds you can afford to lose and avoid excessive risk-taking.