ALGO, GET LOADED! eyeing 0.40 zone from 0.26 zone.ALGO has been consistently creating higher W basing zones since 0.10 era.

After goin parabolic and tapping highs of 0.33, it has hibernated a bit, and a warranted price trim has transpired.

As of this posting, its creating another fresh w base zone from the current range at 0.26 area after tapping a 61.8 FIB level at 0.22 -- conveying a buyers convergence phase (accumulation).

ALGO is now eyeing fresh higher numbers at 0.40 zone from here 0.26.

Ideal seeding range is the current valuation.

Time to get loaded on this one as ascend series will continue for a few seasons going forward.

Current price: 0.26

Target 0.40

Mid Target 1.0

TAYOR.

Trade safely.

ALGOUSDT trade ideas

Algorand Trading Volume Signals Potential 20% Gain To 0.33Hello✌️

Let’s analyze Algorand’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

Algorand has updates coming new wallet, quantum-proof security, and enterprise tools.

Big moves like 100M USDC minted and partnerships with FIFA & TravelX show real-world use.

If the roadmap works out, demand might rise, but ALGO’s still far from its all-time high. 📈🚀

📊Technical analysis:

BINANCE:ALGOUSDT shows solid trading volume with a nearby daily support level. If this zone holds, a potential 20% upside could be expected, aiming for $0.33. Monitor the price closely and manage risk accordingly. 📈🛡️

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

ALGO/USDT 4H Technical OutlookALGO is trading around the mid-range, with S1 (50.37%) acting as immediate support. A deeper pullback may target S2 (34.77%) and S3 (-4.24%) if selling pressure increases. On the upside, R1 (63.08%) and R2 (70.58%) are the key resistance zones to watch. A confirmed breakout above R1 could strengthen bullish momentum toward R2, while a breakdown below S1 may expose the price to further downside. Monitoring volume and candle confirmations is recommended before entry.

Algorand (ALGO): Looking For Break of Structure For LongALGO has established a decent support zone, where recently we also had a smaller BOS,,, which is a pretty choppy one, so we are looking for another BOS to form, which would give us additional confirmation for our long position.

After that, we would be getting a potential 1:3 RR setup.

Swallow Academy

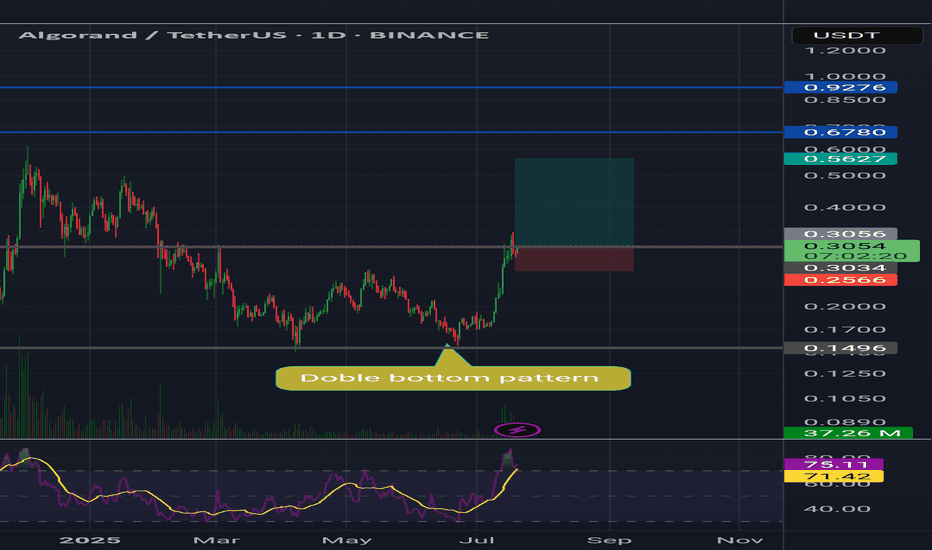

Algorand Algo usdt Daily analysis

Time frame daily

Risk rewards ratio >5.2 👈👌

Target =0.56 $

Double bottom pattern is created and algo pumped to the first target on 0.305

Daily candle closed over the target and 3 days was there for save energy of pump.

I guess next target is 0.6 $ and we have no resistance in the way .

Have a wonderful benefit my 🧡 friends

ALGO – Finally Getting the Retrace

Back at EURONEXT:ALGO —missed the lows, but finally seeing the retrace I’ve been waiting for.

Should’ve entered alongside CRYPTOCAP:HBAR , but this is the next best spot.

If this level doesn’t hold, we’re likely heading back below 20c, and many alts could retrace their entire impulse moves.

Starting to bid here—let’s see if it holds. BINANCE:ALGOUSDT

ALGOUSDT Forming Bullish WaveALGOUSDT is currently demonstrating a Bullish Wave Pattern, a strong technical signal that often precedes a significant upward price movement. This pattern typically forms in trending markets, suggesting a series of higher highs and higher lows that indicate sustained buying interest. With this wave structure unfolding, the market appears to be favoring a continuation of the current uptrend, making ALGO an appealing candidate for mid-term gains.

The volume profile is showing a steady increase, which supports the pattern’s validity and hints at rising momentum. A strong volume base during the formation of bullish wave patterns is often an early indication of institutional accumulation or renewed retail participation. With key support levels holding firm and resistance levels gradually weakening, the setup points to a potential price surge of 50% to 60% or more if bullish momentum continues.

Algorand’s fundamentals are also contributing to growing investor interest. Known for its scalable blockchain technology and low transaction fees, ALGO has seen increasing adoption in DeFi and enterprise-level blockchain solutions. This growing utility, combined with the current bullish technical setup, enhances the coin’s attractiveness for both swing traders and long-term holders.

In summary, ALGOUSDT’s bullish wave pattern coupled with rising volume and positive sentiment could signal the start of a powerful upward move. Traders should keep an eye on breakout zones and confirmation candles to capitalize on this emerging opportunity.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ALGOUSDT 12H#ALGO is moving inside a bullish flag on the 12H timeframe. It is currently facing resistance from both the Ichimoku Cloud and the 12H EMA50.

📌 In case of a breakout above these levels, the potential upside targets are:

🎯 $0.2653

🎯 $0.2851

🎯 $0.3041

🎯 $0.3231

🎯 $0.3503

🎯 $0.3848

⚠️ As always, use a tight stop-loss and apply proper risk management.

Algorand (ALGO): Seeing Signs of RecoveryAlgorand has made a market structure break (MSB) on smaller timeframes, which is indicating a potential trend switch here.

Now in the current timeframe we are looking for a break of that 200 EMA, as once we see the buyers take full control over it, we will look for buyside movement so eyes on it!

If for any reason we see further movement to lower zones, and we break local low on small timeframes, we are going to aim for that bearish CME, but for now, we are bullish.

Swallow Academy

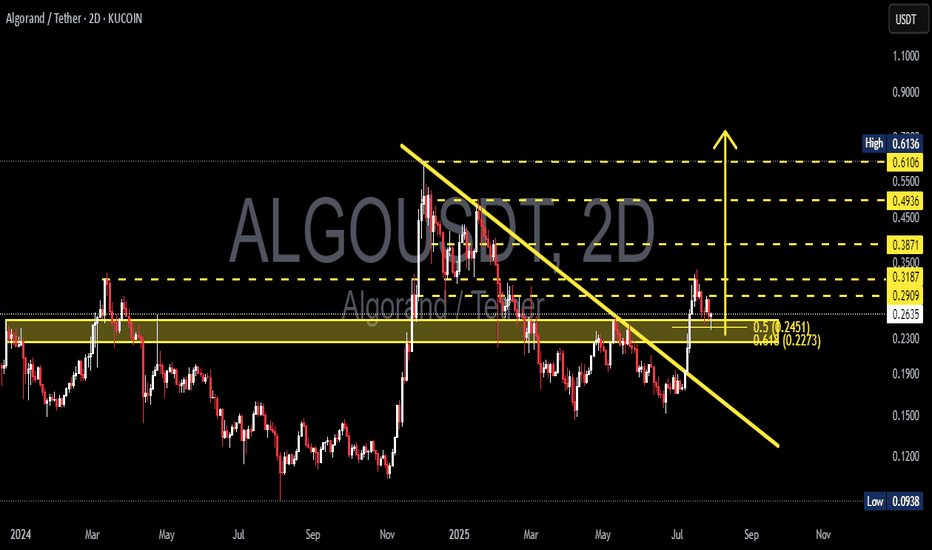

ALGOUSDT Break Downtrend – Reversal in Progress or Just a Retest📊 Technical Analysis Overview:

The Algorand (ALGO) / Tether (USDT) pair has shown a notable technical development by successfully breaking above a medium-term descending trendline that has acted as resistance since early 2025.

---

🔍 Pattern & Structure:

A clean breakout above the descending trendline (yellow sloped line) indicates a potential shift in trend from bearish to bullish.

Price is currently undergoing a retest of the breakout zone, aligning with the Fibonacci retracement levels 0.5 ($0.2451) and 0.618 ($0.2273).

The yellow horizontal zone ($0.25–$0.29) has been a significant support/resistance flip zone, showing strong historical reaction throughout 2024 and early 2025.

A higher high and higher low structure is starting to form — an early signal of a potential bullish reversal.

---

📈 Bullish Scenario:

If the price holds the support zone between $0.2451 and $0.2273, we could see a continuation of the upward move toward the following resistance levels:

$0.2909 (current minor resistance)

$0.3187

$0.3500

$0.3871

Mid-term targets: $0.4936 and $0.6106

A daily or 2D candle close above $0.3187 with strong volume would confirm a bullish continuation.

---

📉 Bearish Scenario:

On the other hand, failure to hold above the $0.2451–$0.2273 support zone could lead to a renewed bearish move with potential targets at:

$0.1900 (weekly historical support)

$0.1500

Extreme support: $0.0938 (2024 cycle low)

A break below $0.2273 would invalidate the breakout and may signal a bull trap.

---

📌 Summary:

ALGO is at a key inflection point. The current pullback could be a healthy correction after a breakout or a failed retest. Watch for price action and volume reaction near $0.2451–$0.2273 to confirm the next move.

#ALGO #Algorand #ALGOUSDT #CryptoAnalysis #TechnicalAnalysis #Breakout #BullishReversal #Fibonacci #SupportResistance #Altcoins #CryptoSetup #PriceAction

ALGO Multi-Timeframe Squeeze Near Critical Support🚨 EURONEXT:ALGO is compressing across the charts, and it's reaching a major inflection point.

📉 2H: Navigating inside a descending channel, with lower highs pressing down

📆 Daily: Price is hovering at a historically strong support zone

📅 Weekly: Still holding within a broader ascending channel

Buyers are defending key ground, but pressure is mounting. A bounce here could spark a quick reversal 🔼 — failure to hold might accelerate downside momentum 🔽

These multi-timeframe squeezes don’t stay quiet for long.

👀 Which way are you leaning — bounce incoming or support breakdown?

Not financial advice.

ALGO Swing Trade – Waiting for Pullback to Key SupportAfter a 100%+ surge, ALGO is now retracing and approaching a critical support zone. A dip into this area could offer a strong entry for the next leg higher.

📌 Trade Setup:

• Entry Zone: $0.22 – $0.23

• Take Profit Targets:

o 🥇 $0.28 – $0.33

o 🥈 $0.45 – $0.50

• Stop Loss: Just below $0.19

ALGOUSDT Forming Bullish Flag ALGOUSDT is currently trading inside a well-defined bullish Flag pattern on the 4-hour chart, a structure known for its bullish breakout potential. The price recently tested a significant demand zone, which previously acted as a base for a strong upward move earlier in July.

Key Points:

Bullish Flag Structure: Price is compressing within converging trendlines, forming lower highs and lower lows a classic bullish flag pattern.

Support Zone: The $0.24 – $0.255 area has acted as a strong demand zone, providing reliable support.

Bounce Potential: A bullish reaction from the lower flag boundary and demand zone could lead to a move toward the upper trendline and potentially trigger a breakout.

200 EMA Support: The 200 EMA is currently providing dynamic support, reinforcing the bullish setup.

Breakout Confirmation: A breakout above the flag resistance with strong volume could initiate a rally toward the $0.30 – $0.40 zone.

Cheers

Hexa

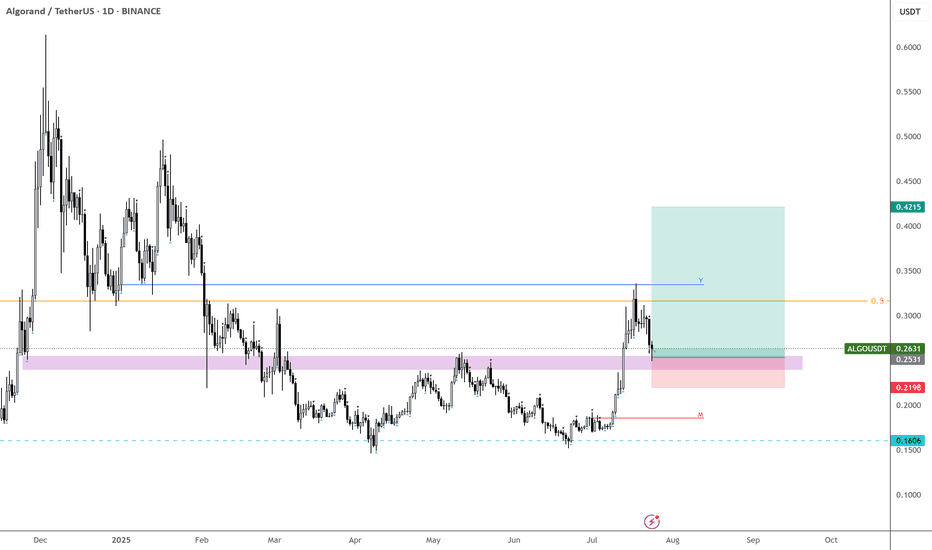

ALGO | #1D — Building the Spot Position LowerALGO has completed its first local move and is now retracing toward key support levels. The price remains under the 200DMA and is heading into the first cluster of demand zones.

Step-by-Step Price Scenario:

Initial Support: Watch the 0.2413–0.2268 zone — this is the first area to scale in spot buys.

Main Accumulation: If price drops deeper, the main spot buy window is $0.22–0.20 (0.5–0.618 retracement of the recent rally and the main demand block).

Invalidation: Breakdown below $0.1726 would invalidate the spot strategy and suggest deeper downside.

Bullish Confirmation: A strong reaction from either of these support levels, followed by reclaiming the 200DMA, would set up the next move toward $0.33–$0.35.

Why this plan:

Buying spot on pullbacks into HTF demand with clear invalidation below keeps risk defined, and the current market structure allows for compounding if the trend resumes.

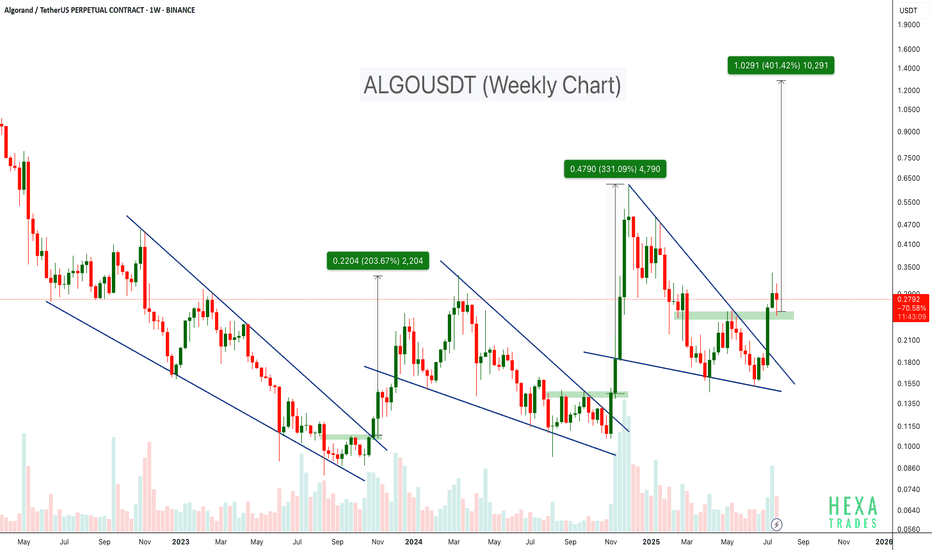

ALGO Breaks Out of Falling Wedge – 400% Target Ahead?BINANCE:ALGOUSDT has consistently followed a bullish pattern on the weekly timeframe. Each major rally has been preceded by a falling wedge breakout, as shown by the three highlighted instances on the chart.

- First breakout: ~200%+ move

- Second breakout: ~300%+ move

- Current breakout projection: Potential target up to +400%

The price has just broken above the wedge and is currently retesting the breakout zone. If history repeats itself, ALGO may be poised for a strong upside move from its current levels.

Cheers

Hexa🧘♀️

COINBASE:ALGOUSD EURONEXT:ALGO

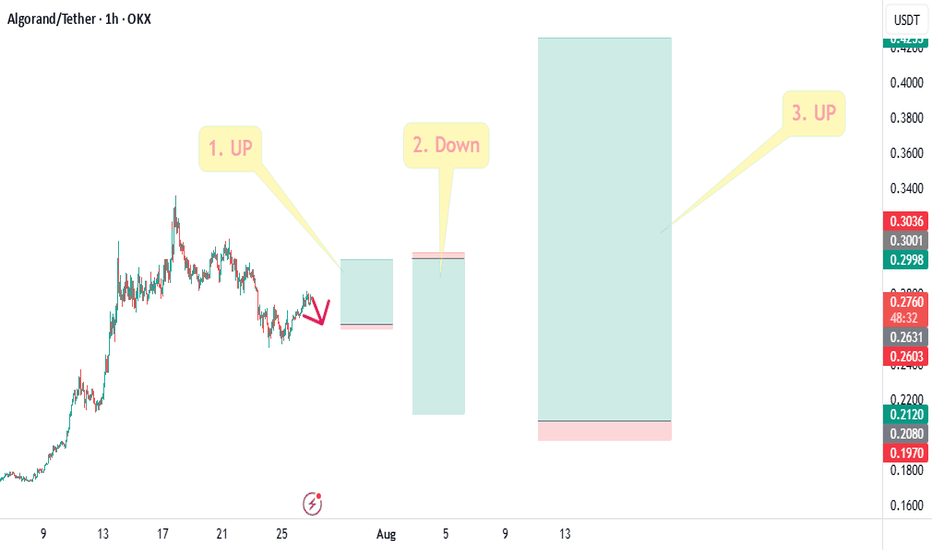

#ALGO Moves of 3 trades in a single chart.#ALGO Moves of 3 trades in a single chart.

In this, the first trade represents a long position on a short-term time frame. Then, a short position can be opened for the retracement. After that, the final third move could be an upside move of more than 100%.

Join Us For All Updates.

@Namaste@

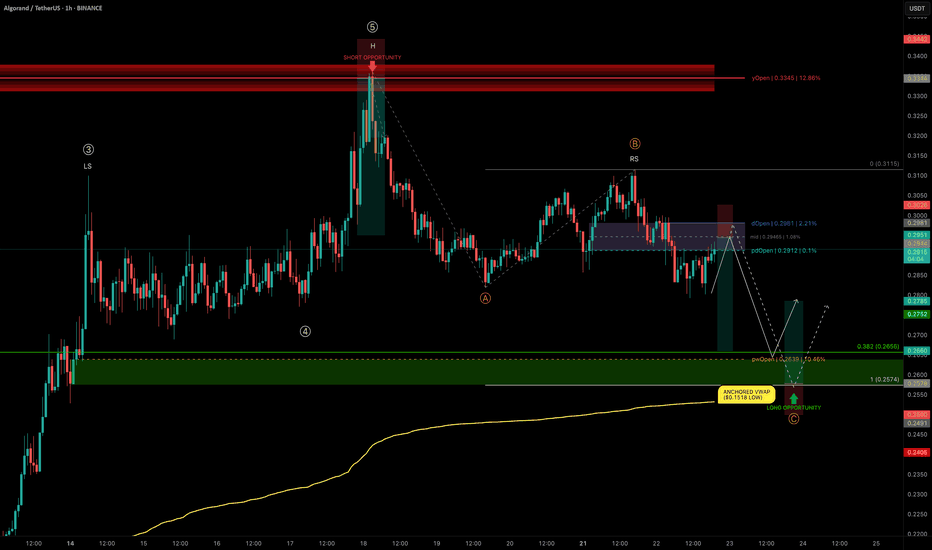

ALGO rejects at yOpen — Mapping High-Conviction Trade ZonesALGO has delivered an impressive +124% rally from $0.1518 to $0.336 in just 25 days, completing a 5-wave Elliott impulse right into the yearly open resistance.

We are now in a correction phase, and the current structure is showing a head and shoulders pattern, with the right shoulder currently forming.

Let’s break down the key levels and setups.

🧩 Technical Breakdown

➡️ ABC Corrective Structure:

Targeting wave C near the trend-based fib extension (TBFE) at $0.2574

➡️ Fib Retracement Confluence:

0.382 retracement of the entire 5-wave move → $0.2656

Previous weekly open (pwOpen) → $0.2639

Liquidity pocket likely to be swept

Anchored VWAP from the $0.1518 low (start of the bullish trend) → currently at $0.2532, acting as a major support layer

Conclusion: Long opportunity zone between $0.2656–$0.2574

Trade Setups

🔴 Short Setup:

Why? ALGO has lost dOpen and pdOpen — a bearish sign for downward continuation.

Entry Zone: Between dOpen and pdOpen

Stop-loss: Above dOpen

Target (TP): 0.382 fib retracement (~$0.2656)

R:R: ≈ 1:3.5

🟢 Long Setup:

Entry Zone: Laddered Entries between $0.2656–$0.2574

Stop-loss: Below anchored VWAP (~$0.2532)

Target (TP): ~$0.2785+

R:R: ≈ 1:2.65

🛠 Indicator Note

I’m using my own indicator called "DriftLine - Pivot Open Zones " for this analysis, which I recently published.

✅ Feel free to use it in your own analysis!

Just head over to my profile → “Scripts” tab → apply it directly to your charts.

💡 Educational Insight: Why Confluence Matters

High-probability trades aren’t based on just one tool or level — they come from confluence, where multiple signals align: fib levels, VWAP, liquidity pools, price structures , and key levels.

For example, in this ALGO setup, it’s not just the fib retracement or just the VWAP — it’s the stacking of all these elements together that creates a precise zone with a better statistical edge.

✍️ Lesson: Don’t chase trades off single signals; stack tools for confirmation.

Patience, confirmation, and confluence — as always, the keys to high-probability setups. 🚀

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

ALGO Fighting in Support ZoneALGO sitting in support zone its not strong support zone with many price rejection in this price range from December 2022

But if this line break maybe we can heading to the greatest and strongest support zone around 0.09 like in June 2023 and ABCDE pattern completed then consolidate a while before next jumping