Price Entered Range — Move Toward Upper Boundary ExpectedPrice has entered a clearly defined trading range (corridor). The lower boundary of this range is acting as strong support, where buyers are consistently stepping in.

As long as price holds above this support zone, the market structure favors a move toward the upper boundary of the range.

🔼 Bullish scenario:

– Holding above the lower range support

– Continuation toward the top of the corridor

– Long target: 🎯 $0.08

The lower boundary remains a key invalidation level. A breakdown below support would invalidate the bullish range scenario, but while price stays inside the corridor, upward continuation is the higher-probability outcome.

Market insights

ARC/USDT on 1 hour timeframe upwards potentialThe price is hovering just above the 0.618 Fibonacci retracement level (0.04047), which is often seen as a strong support zone in bullish setups

Entry: 0.04047

Stop Loss (SL): 0.03872 (below support zone)

Take Profit (TP1): 0.04968 (near 0.382 retracement)

Risk/Reward Ratio: Favorable, assuming bounce from 0.618 level

This setup suggests a bullish reversal expectation, with a tight stop and a target near the next resistance

ARC Buy/Long Insight (4H)The ARC structure has gained strong bullish momentum after the main CH, and continuous bullish BOS can be seen on the chart.

After the liquidity sweep, the price has moved upward again. By tracking the structure, it becomes clear that the price is aiming to reach the higher-timeframe supply zones, and we are looking for buy/long positions at the origin zones.

The entry zone, stop, and targets are marked on the chart.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

ARC BOTTOMED OUTPrice more than 90% down in past few months but technicals showing bullish reversal now. Use Proper risk management as it's highly risky

ARC - READY TO MOON ?? Im still holding LSE:ARC and it's likely to explode soon; here's why:

📈Multi month wedge

📈Strong buy volume (weekly) |accumulation]

📈Bullish pennant

Moonshot incoming soon?

ARCUSDT - Bullish Breakout Confirmed ARC has been trading in a well-defined descending channel for several weeks, forming a consistent downtrend. However, the price has now broken out of the channel resistance, signaling a potential bullish reversal.

Descending Channel Breakout: ARC has clearly broken above the channel’s upper trendline, indicating a shift in market structure from bearish to bullish.

Resistance Zone Flipped: The price broke through a recent horizontal resistance zone.

EMA: ARC is now trading above both the 50 EMA and 100 EMA,

ARCUSDT LONG IDEAhi all. when we look at the arcusdt chart, we can see that price dropped hard in the last two weeks. it seems that price trying to recover. EMA breakout on 1h chart almost happened. also price seems accumulating in the box.i expect price at least touches 50 EMA on 4h timeframe chart. so we can setup long position ;

entry : 0.06366

stop : 0.05895

target: 0.07500 (50 EMA on 4h timeframe)

#ARCUSDT is showing signs of reversal📉 Short BYBIT:ARCUSDT.P from $0.06780

🛡 Stop loss $0.07117

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is at 0.05873, indicating the area with the highest trading volume.

➡️ The 0.07117 level acts as strong resistance where the price previously reversed.

➡️ The chart shows a potential topping structure followed by a decline.

➡️ Volume concentration between $0.065 and $0.06210 suggests key zones for potential profit-taking.

🎯 TP Targets:

💎 TP 1: $0.06510

💎 TP 2: $0.06210

💎 TP 3: $0.06050

📢 Watch the key levels and enter after confirmation!

📢 The price has already started to move down — downside momentum remains strong.

📢 The TP levels are near a previous consolidation zone, allowing quick target execution.

BYBIT:ARCUSDT.P is showing signs of reversal — considering shorts with clear downside targets!

Potential Head and Shoulders Pattern on ARCSOL/USDTTimeframe: 1H | Exchange: MEXC

Date: March 23, 2025

Hey traders! 👋

Spotted a possible Head and Shoulders pattern forming on ARCSOL/USDT. 👀

Left Shoulder: Around 0.0503

Head: Bottomed out at 0.0415

Right Shoulder: Currently forming near 0.0471

This pattern is typically a bearish reversal signal, especially after an uptrend — which we’ve seen over the past few days. If price breaks below the neckline (around the 0.047 region), we could see further downside. 📉

🧩 Supporting indicators:

Momentum indicators are cooling off

Stochastic RSI is showing potential for a downtrend continuation

Bearish divergence on oscillators

Volume declining on the right shoulder — a classic sign 👌

🚨 Key levels to watch:

Neckline support: ~0.047

Breakout target (if confirmed): ~0.038–0.040 zone

Invalidation: Break above 0.055 with strong volume

Not financial advice — just sharing what I see. Stay sharp and manage risk! 🛡️

What’s your take? Comment below! 💬

#ARCSOL #USDT #CryptoTrading #HeadAndShoulders #ChartAnalysis #TechnicalAnalysis #CryptoTA #TradingView

Inverse Head & Shoulders Pattern on ARCSOL/USDTChart Timeframe: 1H | Exchange: MEXC

📅 March 23, 2025

This setup is looking textbook bullish! A clean Inverse Head and Shoulders has printed, backed by volume and momentum confluence.

📐 Pattern Anatomy:

Left Shoulder: ~$0.0503

Head (Major Low): ~$0.0415

Right Shoulder: ~$0.0471

Neckline Breakout Zone: ~$0.055

Measured Target: $0.098 USDT

✅ Pattern Confirmations:

Broke downtrend with bullish divergence

Volume spike on neckline test

Laguerre + Cipher confirming upward momentum

Bullish market structure shift post right shoulder

Falling wedge breakout led into head formation — added confluence 🔥

💥 Next Steps:

Watch for support confirmation at $0.055 — a retest with bounce would be ideal before targeting the full move to $0.098.

🎯 Potential Trade Setup (not financial advice):

Entry: Break & retest of neckline

TP: $0.098

SL: Below right shoulder ~$0.0465

This is a powerful reversal signal after a prolonged downtrend — eyes on volume and momentum follow-through.

What do you think? Is this the start of a major shift for $ARCSOL?

👇 Drop your analysis in the comments!

#ARCSOL #InverseHeadAndShoulders #CryptoBreakout #AltcoinSeason #TA #CryptoCharts #TradingView #ReversalSetup

ARC ANALYSIS🔮 #ARC Analysis

💲💲 #ARC is trading in a Symmetrical Triangle Pattern. If the price of #ARC breaks and sustain the higher price then will see a pump. Also there is an strong support zone. We may see a retest towards the support zone first and then a reversal📈

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀

#ARC #Cryptocurrency #Support #Resistance #DYOR

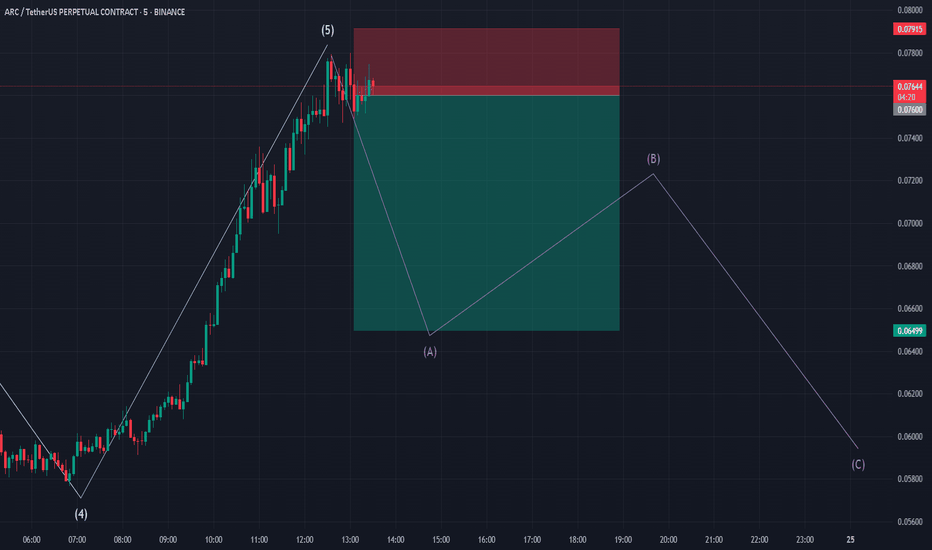

ARC/USDT - Elliott Wave Completion and ABC Correction ExpectedThe ARC/USDT perpetual contract on Binance has completed a classic 5-wave Elliott impulse pattern, peaking at wave (5). Based on Elliott Wave Theory, a corrective ABC pattern is expected, with wave A initiating a decline.

Entry: Short position near wave (5) peak

Target: Wave C completion zone around 0.056

Stop Loss: Above recent high near 0.0817

The retracement aligns with Fibonacci levels and prior support zones, suggesting a potential pullback before further trend continuation. Manage risk accordingly.

Bullish pattern signalThere is a short-term bullish pattern forming, indicating a potential profit target of 2% upon reaching it. It's important to closely monitor the liquidity in the market, as fluctuations could impact price movement significantly. Keep an eye on trading volumes and support levels to gauge the strength of this bullish signal.