AUDCHF trade ideas

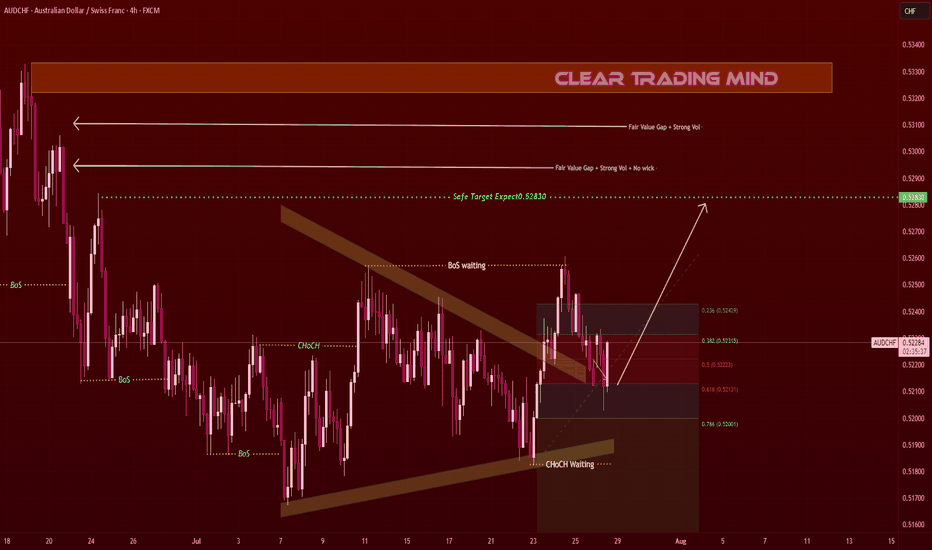

AUDCHF Triangle Breakout – Targeting 0.52830AUDCHF on the 1-hour chart is respecting a contracting triangle pattern 🔺 and showing bullish intent.

From a 4hr perspective:

- Fair Value Gap + Strong Volume Zone 🟧 above price

- Safe Target: 0.52830

Key Observations:

- CHoCH waiting for confirmation (bullish structure)

- BoS expected above the triangle top

- Current pullback holding near Fib 0.382 – 0.5 (0.52300 – 0.52220)

Plan:

- Watching for bullish breakout and continuation to 0.52830 (≈ 60 pips) 🎯

- Support area near 0.52000 – 0.52100 should hold for bullish scenario

- Break below 0.52000 invalidates

Reasoning:

- Contracting triangle breakout pattern 🚀

- Strong volume-based Fair Value Gap above

- 4hr structure supports bullish continuation

(Personal chart study, not financial advice)

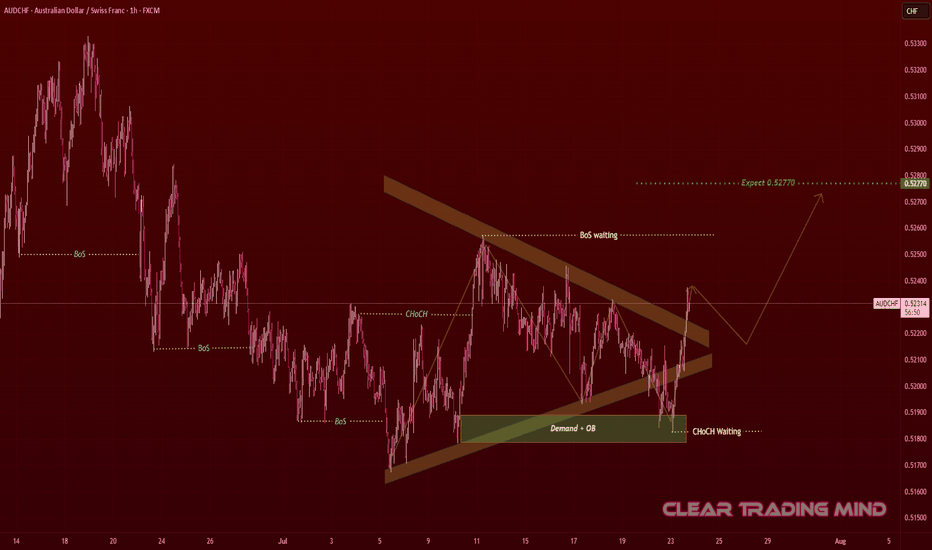

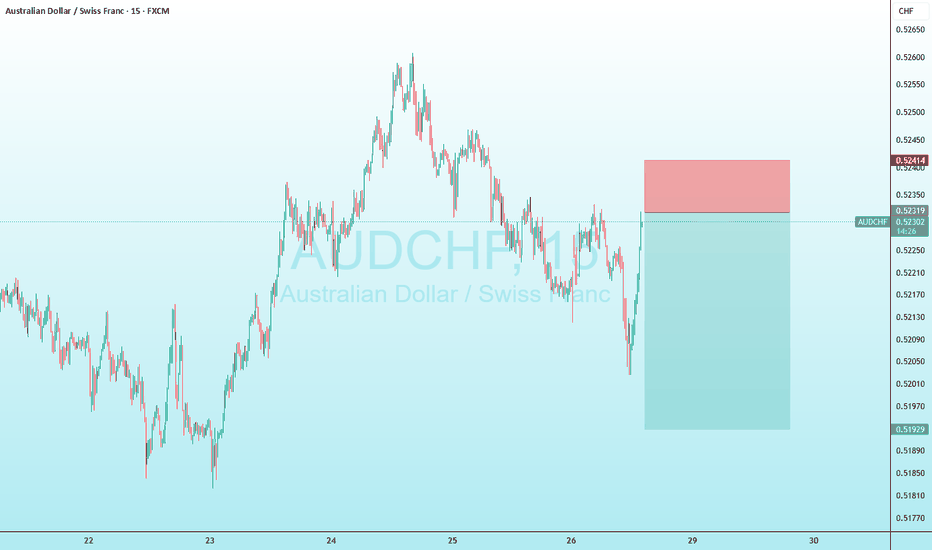

AUDCHF Contracting Triangle – Waiting for Breakout Confirmation

AUDCHF on the 1-hour chart is forming a contracting triangle 🔺, showing consolidation after a downtrend.

From an SMC perspective:

🟩 Demand + OB (Order Block) zone holding strong near 0.51900

🔄 Previous CHoCH shows buyer interest

⏳ Waiting for BoS (Break of Structure) confirmation above the triangle

Plan:

* Breakout Entry: Above 0.52400 after retest 🔓

🎯 First Target: 0.52770 – 0.52800 (≈ 37 pips from breakout)

🛡 Invalidation: Below 0.51900 (demand failure)

Reasoning:

+ Contracting triangles often lead to strong impulsive moves ⚡

+ Buyers are already active at demand 🔥

+ Confirmation of CHoCH + BoS could push price to targets 🚀

// (Not financial advice – personal chart observation)

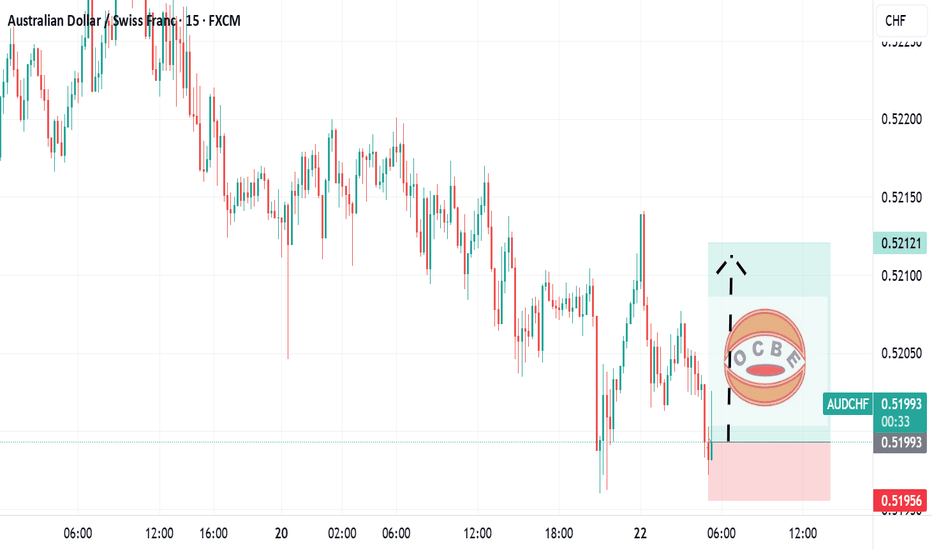

AUD/CHF Eyes Bullish Reversal Toward 0.52606This AUD/CHF 1-hour chart shows a potential bullish reversal from the 1st support at 0.52036. Price is expected to rise toward the 1st resistance at 0.52335 and possibly reach the 2nd resistance at 0.52606 if momentum continues. Key support lies at 0.51922.

AUDCHF Will Grow! Buy!

Take a look at our analysis for AUDCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 0.519.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 0.534 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

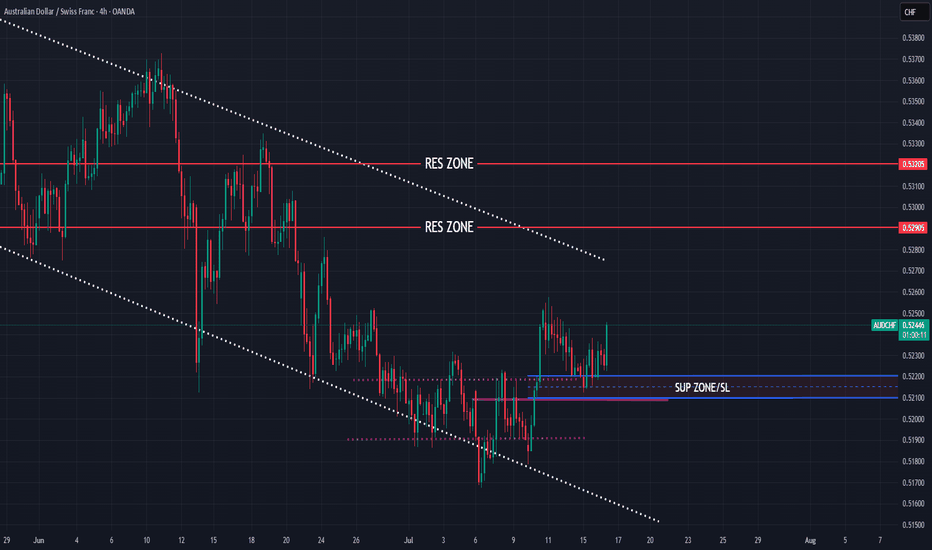

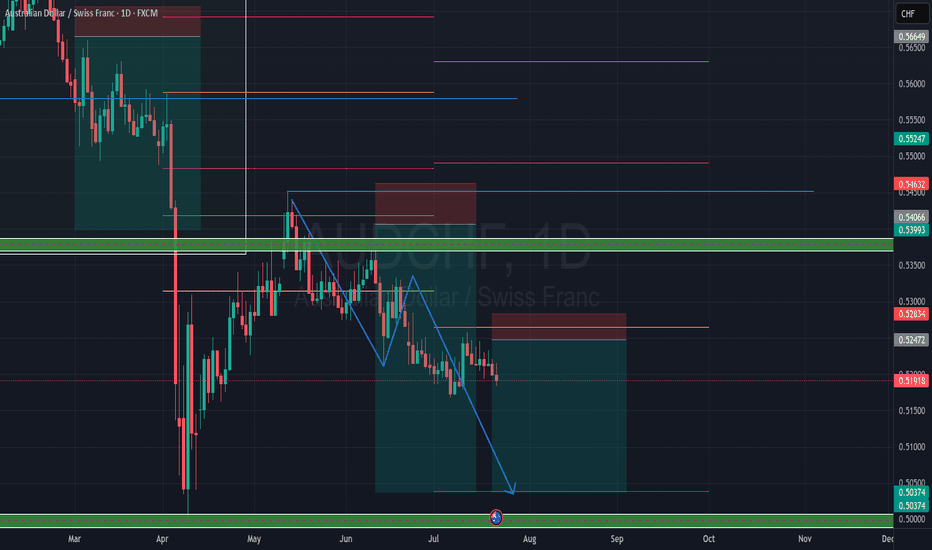

AUD/CHF Bearish Breakdown – Daily Chart

Price remains in a solid downtrend, respecting lower highs and bearish order blocks. With clean rejection from the 0.54 supply zone, we’re seeing continued bearish pressure heading toward the 0.5037 demand zone.

🟢 Watch for reaction around 0.50374

🔻 Trend: Bearish

📅 Timeframe: Daily

#AUDCHF #ForexAnalysis #SmartMoneyConcepts #SupplyAndDemand #MarketStructure #ForexGhana #PriceAction #The20PipsCenter

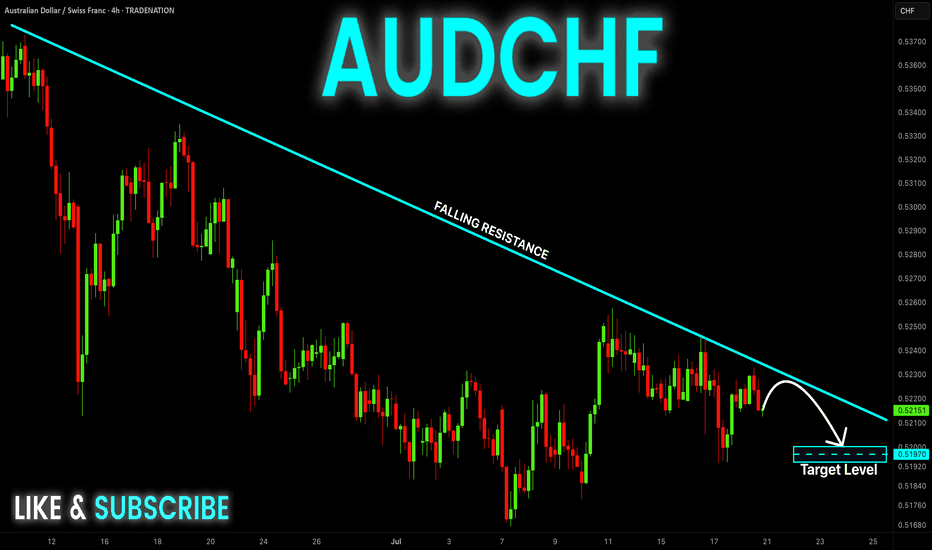

AUD-CHF Risky Short From Falling Resistance! Sell!

Hello,Traders!

AUD-CHF is trading in a

Downtrend along the falling

Resistance line so we are

Bearish biased and after

The potential retest of the

Falling resistance we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

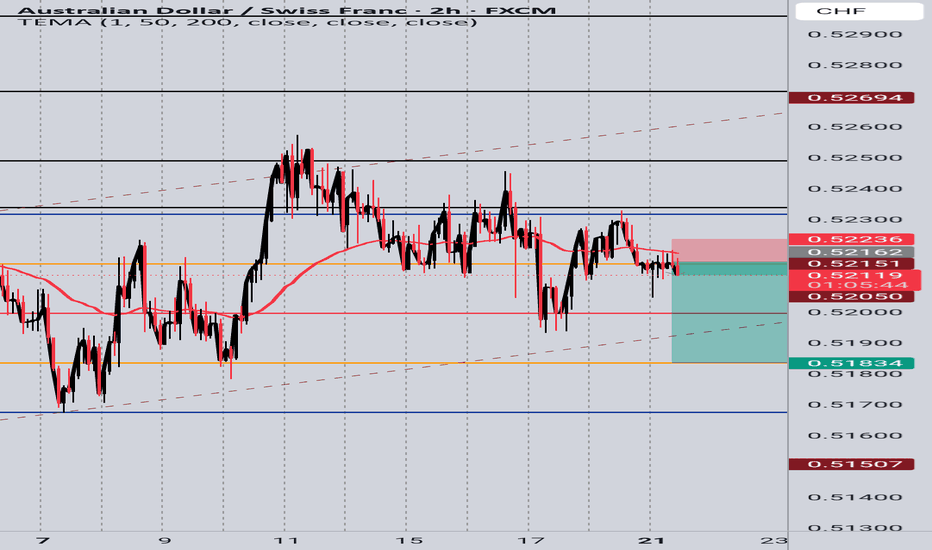

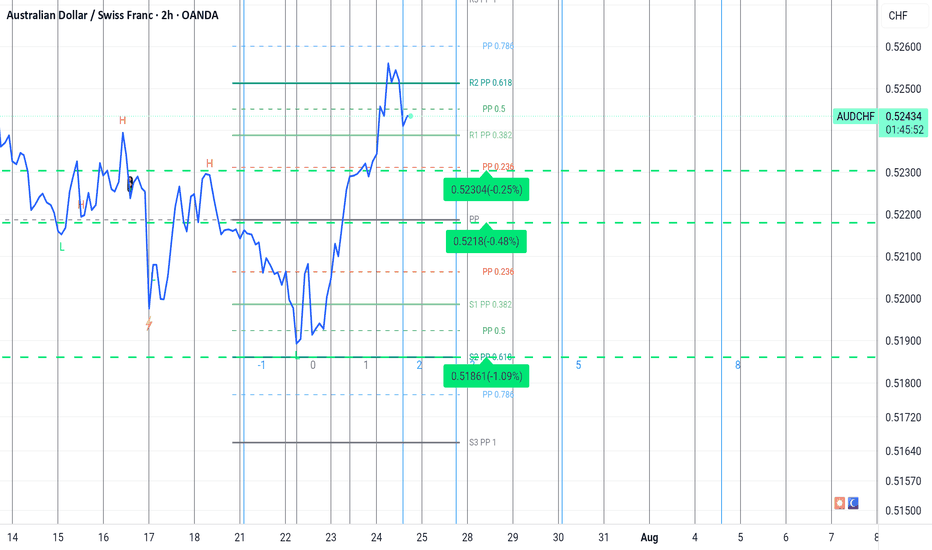

AUD/CHF 2H – Price Action Short Setup🔎 Why This Setup Makes Sense:

1.Trend Bias

Downtrend confirmed — price is below both structure and moving averages.

2.Resistance Rejection:

Price failed to break back above resistance near 0.5223 and left small bearish candles — showing seller strength.

3.Entry Idea:

Short entry just below the resistance zone with a tight stop above recent minor swing high (~0.5223).

4.Target Zone:

Your take profit is near 0.5183, where price previously bounced — a natural support and reaction zone.

AUD/CHF BEST PLACE TO SELL FROM|SHORT

AUD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.524

Target Level: 0.520

Stop Loss: 0.526

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 3h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

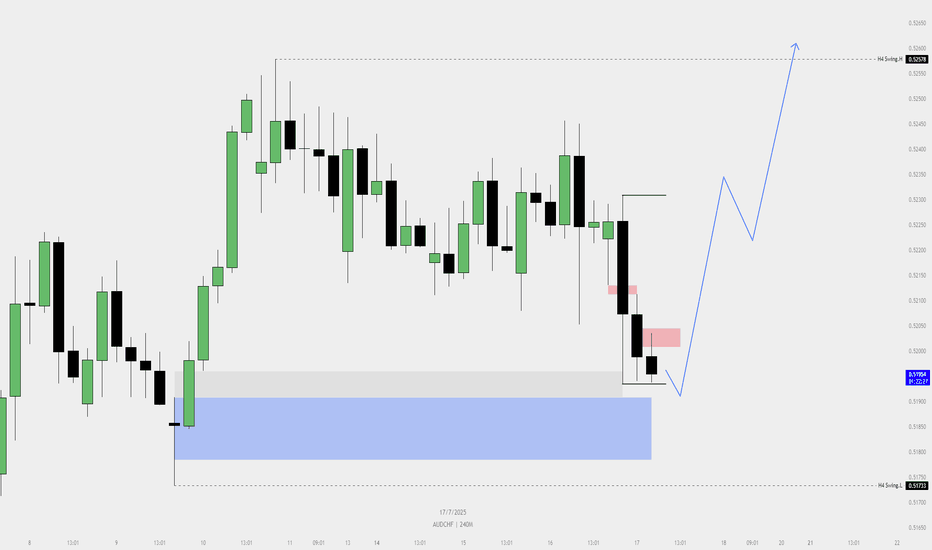

AUDCHF Buy PlanChatGPT said:

📈 AUDCHF Buy Plan

Bias: Bullish — Price tapped 4H demand zone (blue box).

Context: Liquidity swept below previous low. Price inside FVG zone.

Trigger: Wait for bullish confirmation from this zone (bullish candle or market structure shift).

Entry: Upon confirmation within context area.

Stop Loss: Below the recent swing low.

Target: H4 swing high or higher liquidity zone.

Risk: Adjust position size to maintain fixed % risk (as per your plan).

Note: Ignore past price action. Focus only if trade aligns with your system.

Let price breathe. Execute only when criteria match

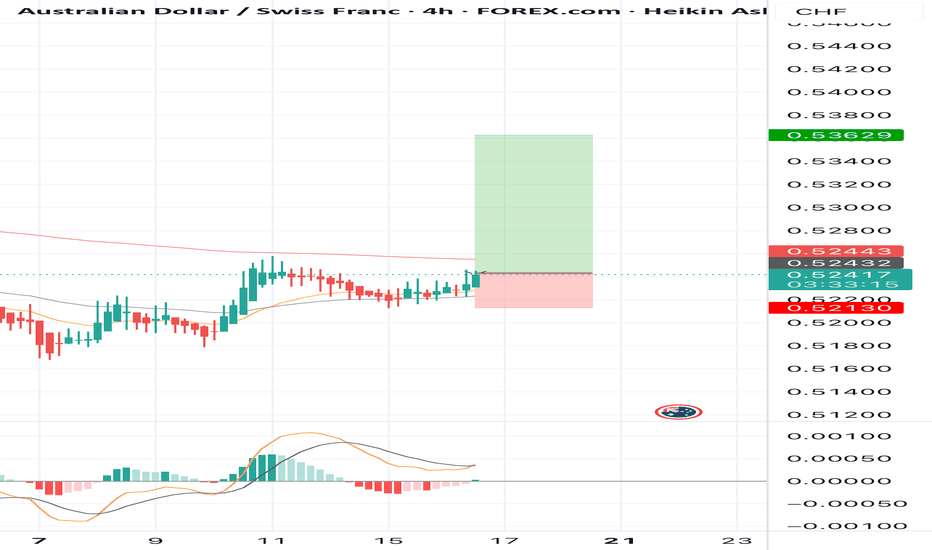

BUY AUDCHF for divergence bearish trend reversal STOP LOSS: 0.5BUY AUDCHF for divergence bearish trend reversal STOP LOSS: 0.52130

Regular Bullish Divergence

In case of Regular Bullish Divergence:

* The Indicator shows Higher Lows

* Actual Market Price shows Lower Lows

We can see a strong divergence on the MACD already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this strong level of Support so we are looking for the trend reversal and correction push from here.....

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything...

Remember to risk only what you are comfortable with... trading with the trend, patient and good risk management is the key to success here

AUD/CHF BEARS ARE STRONG HERE|SHORT

AUD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.524

Target Level: 0.521

Stop Loss: 0.526

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

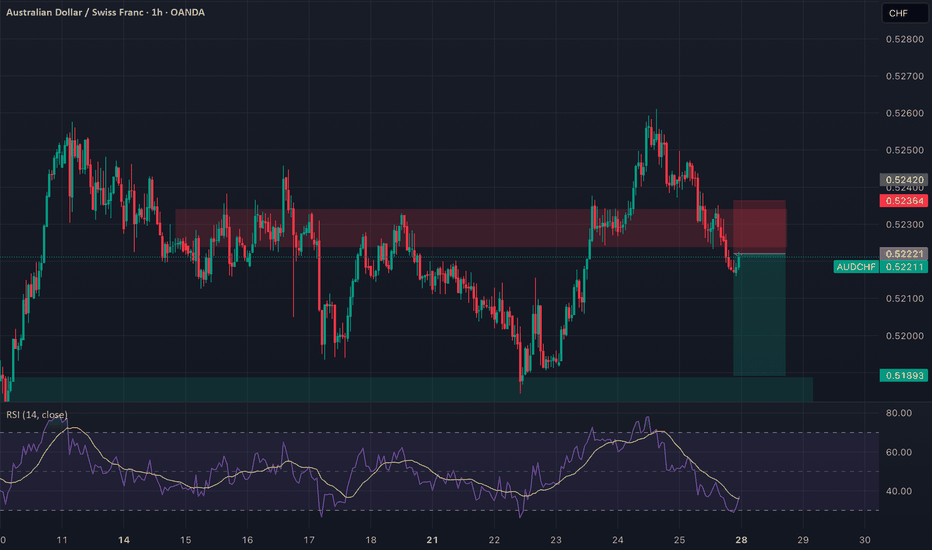

AUDCHF: Broken Support, Bearish Flow In Play Timeframe: 1H

Bias: Bearish

Type: Support Turncoat → Breakdown Play

📊 Technical Setup

AUDCHF previously broke the 4H resistance (0.5236) which flipped to support. However, price has now broken below this support, confirming it as a failed demand zone.

• Entry: Market execution or retest of 0.5236

• SL: Above 0.5245

• TP: 0.5189

• RR: ~1:2

• RSI: Below 50 and heading lower = momentum supports downside

📉 Macro & Fundamental Confluence

• AUD Weakness: RBA dovish, conditional score declining, bearish seasonality

• CHF Slightly Less Weak: Despite SNB dovish stance, CHF is outperforming AUD

• COT + Sentiment: AUD CFTC weakening, CHF holding steady

• Risk Sentiment: RISK ON environment reduces CHF demand but AUD still underperforms

🧭 Gameplan

“Support failed to hold. Bearish pressure intensifies. Target previous swing low zone.”

🔔 Watch for retest of 0.5236 for better RR setup before continuing short.

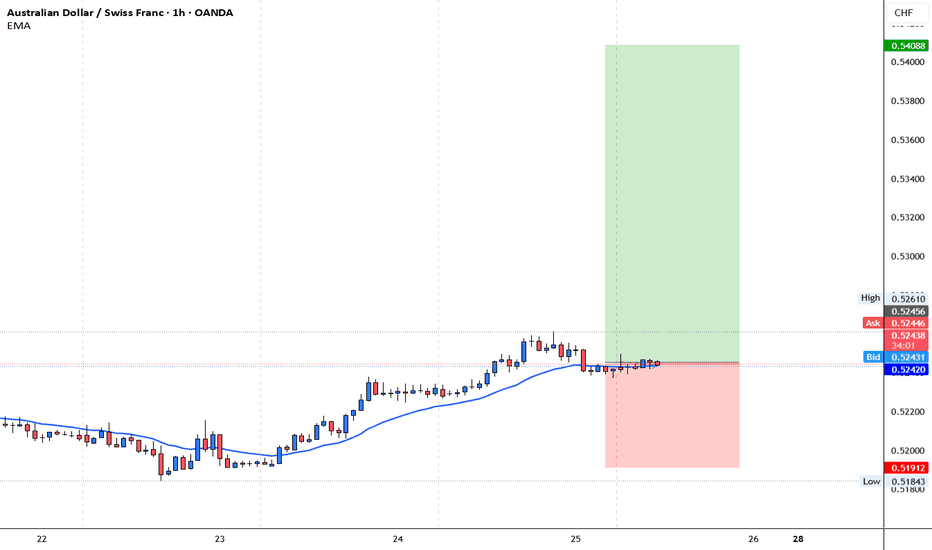

AUDCHF BUYJust an idea for short term target with SL and TP.

Timeframe: H1

Price: 0.52456

SL: 0.51912

TP: 0.54088

SL will move to breakeven at 1:1

Close 50% at 1:2

Remaining will run till 1:3

Risk Disclaimer:

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.