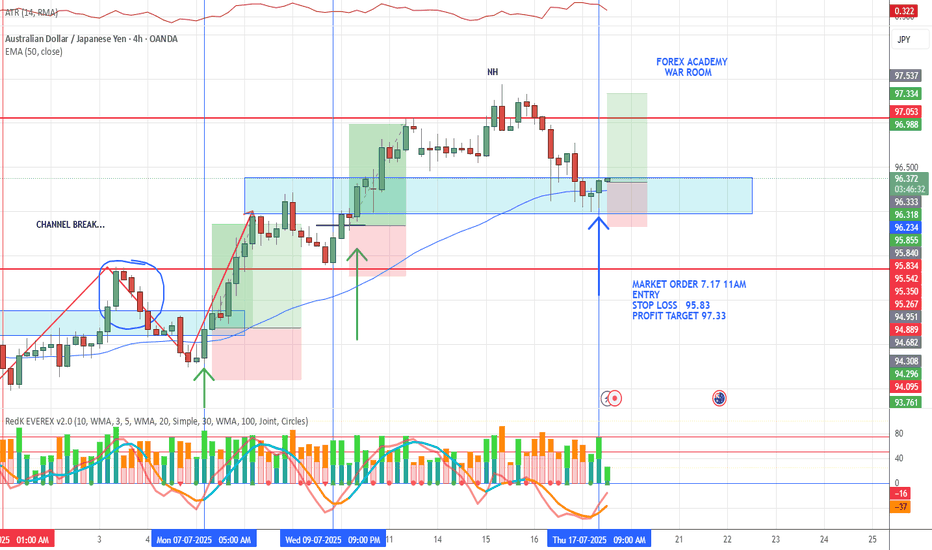

Market analysis 7/22/2025Today we look in to AUD and JPY and discuss their fundamentals and also their relative strength. With strength and activity not matching the fundamentals outlined from this weeks and last weeks.

after review it did not appear that fundamentals were being followed currently. We have to respect this and continue to wait for our opportunity.

Bye for now.

Trade ideas

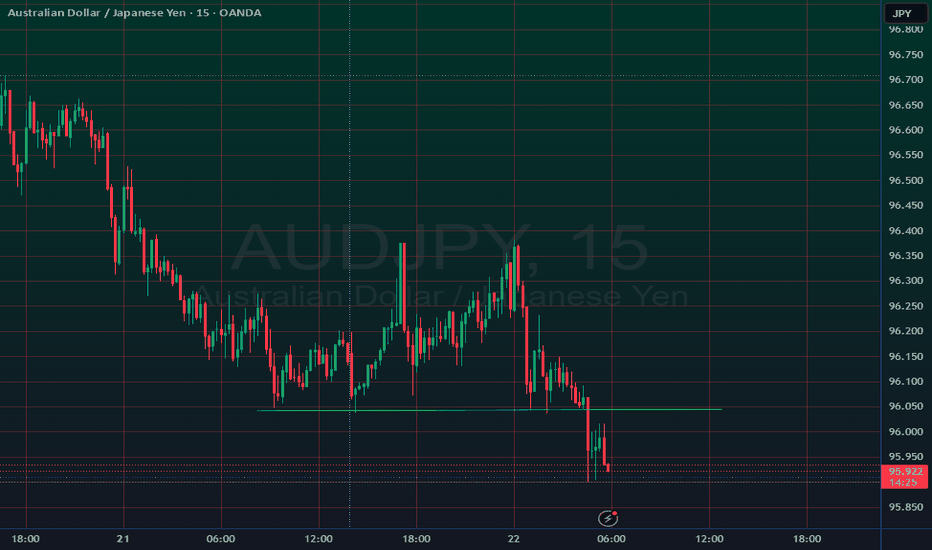

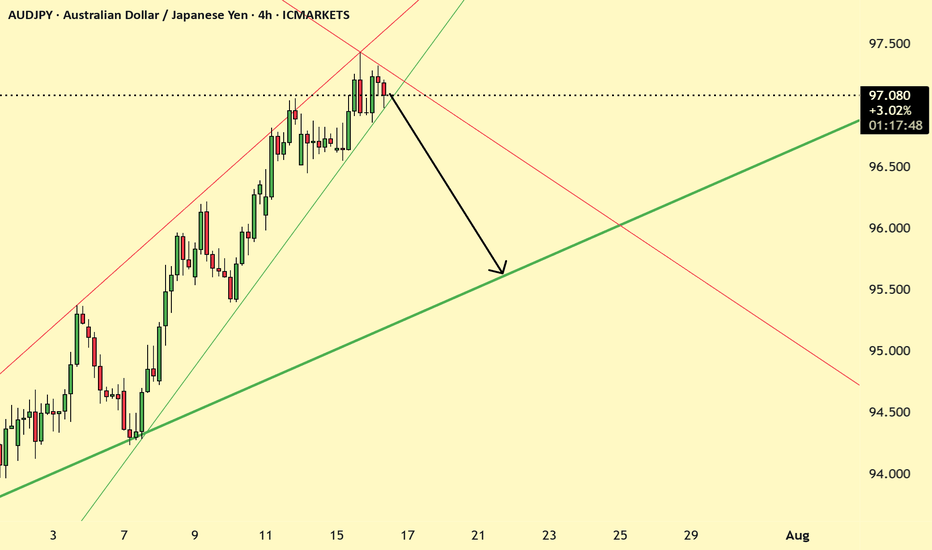

AUDJPY may reverse its upward trendAUDJPY is forming something remotely resembling a head and shoulders reversal pattern, based on consolidation support at 95.977. The price is consolidating near the level, the reaction to support is weakening, and the chances of a breakdown are growing. Consolidation of the price below 95.977 could increase pressure from sellers.

In addition, the fall of the dollar is causing the Japanese yen to strengthen, which could lead to a fall in the AUDJPY currency pair.

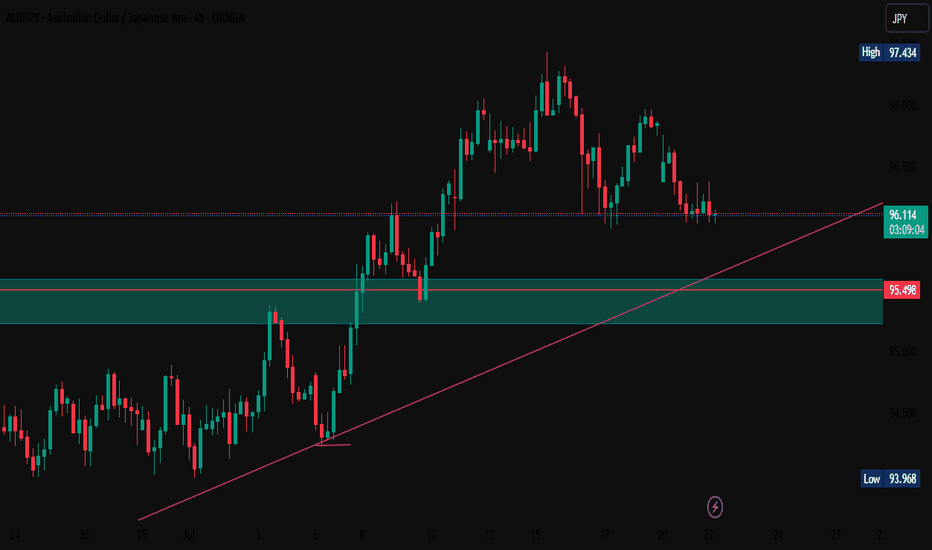

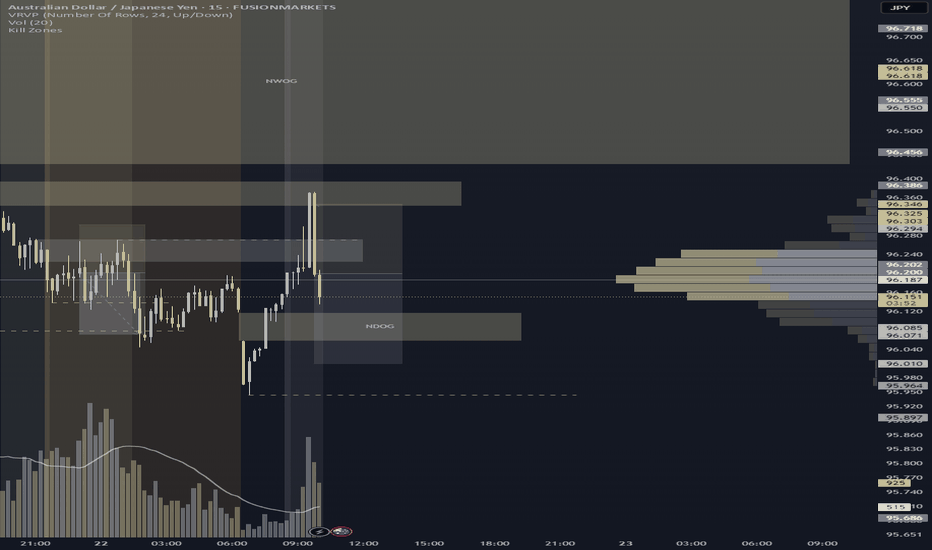

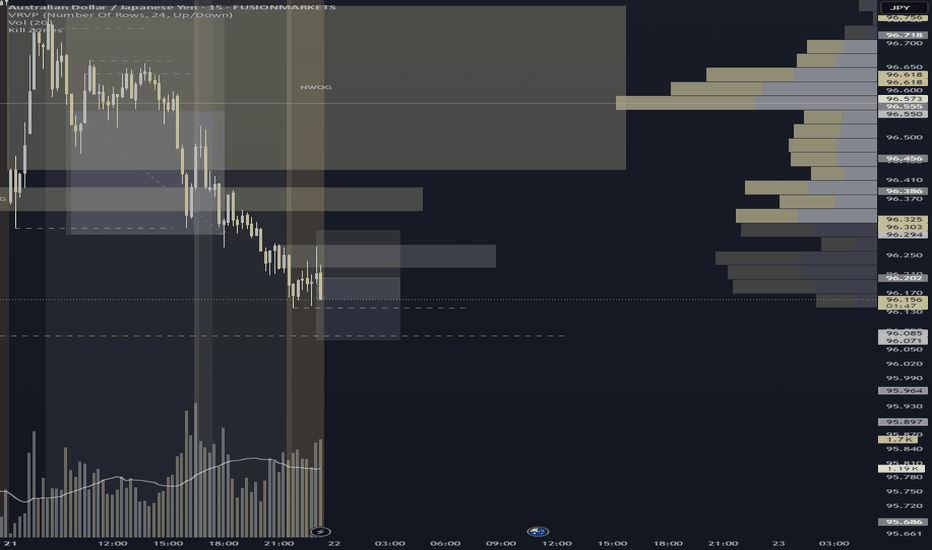

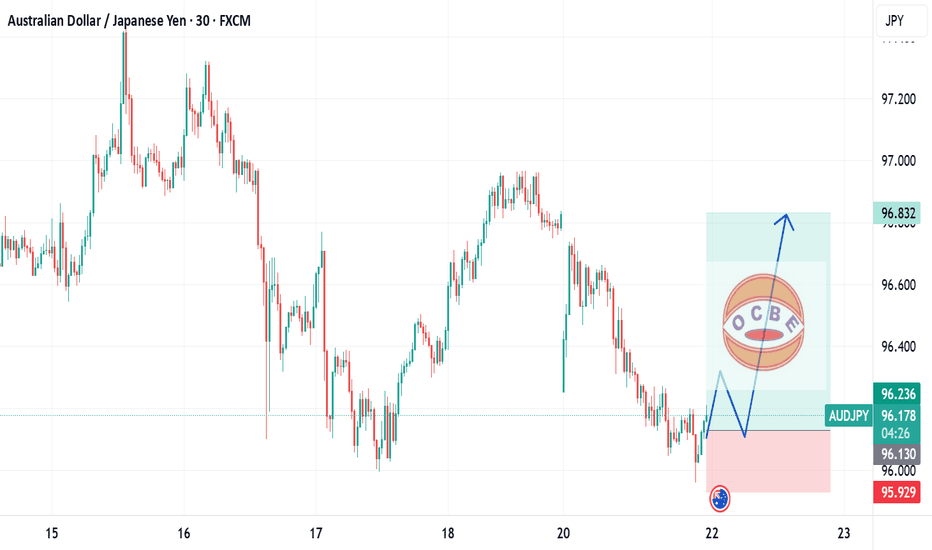

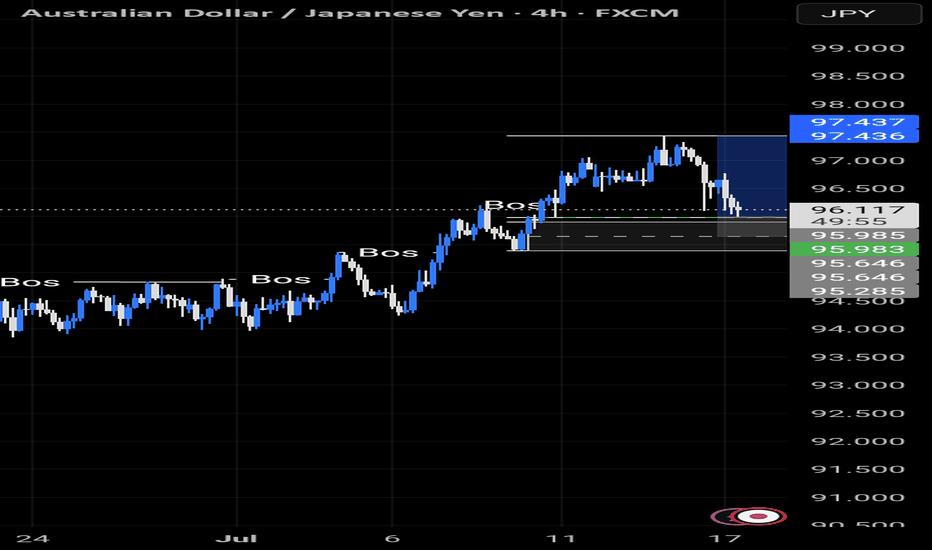

AUDJPY – Resistance Rejection Short Into Sellside Draw

Identified a key resistance zone at 96.224–96.273, with price showing rejection and wicking behavior after sweeping buyside liquidity at 96.271. Entered short following a decisive reaction candle. Trade is structured with stop loss above the swing at 96.303 and TP set at 96.010, targeting a clean overshoot of today’s NDOG (95.944).

🔹 Setup: Resistance rejection + liquidity sweep

🔹 Bias: Short into engineered sellside draw

🔹 SL: 96.303 | TP: 96.010

🔹 Narrative: Trap-to-draw execution with structure-backed confirmation

A disciplined short campaign rooted in polarity logic and session magnet flow. Let the market walk its choreography. 🩶

AUDJPY – Resistance Rejection at 96.224–96.273

Executed a disciplined short off the 96.224–96.273 resistance zone, which aligned with bearish structure and rejection candle confirmation. Entry followed lower high formation, with stops placed above the recent swing at 96.303 to allow for volatility breathing room. Target set at 96.079, aligning with a clean sellside draw. Price showed momentum alignment and polarity flip reaction off resistance.

🔹 Strategy: Trap-to-draw execution

🔹 Entry: Post-rejection confirmation

🔹 SL: Above 96.303 swing

🔹 TP: Into 96.079 liquidity magnet

A precise, structure-backed short targeting engineered liquidity

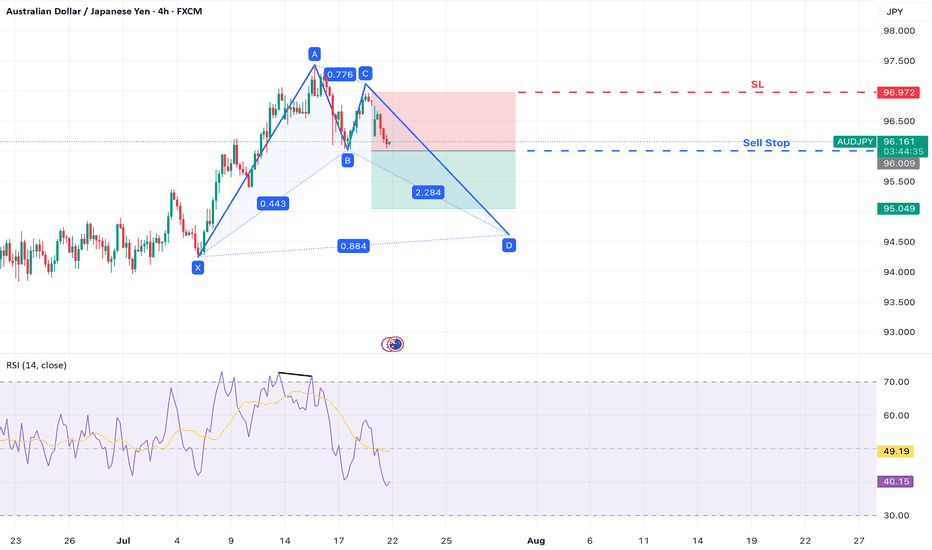

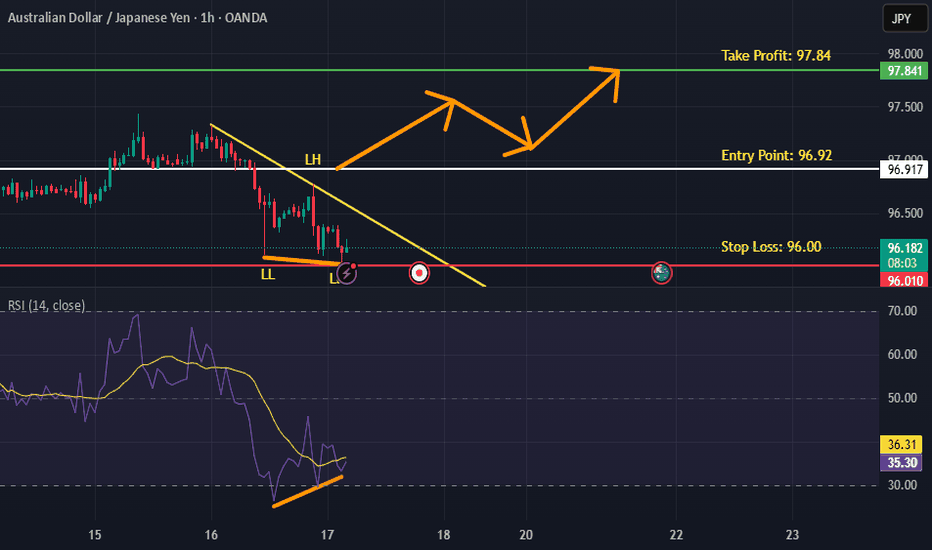

AUD/JPY – Bearish Move Within Bullish Bat StructureAUD/JPY is developing a Bullish Bat harmonic pattern on the 4-hour chart . While the full pattern has not yet completed, a potential short-term bearish opportunity is emerging as the pair begins forming the CD leg.

A clear b earish divergence on the RSI at Point A suggests waning bullish momentum, and a break below Point B may confirm the start of the final leg down toward Point D , completing the harmonic structure.

Trade Setup

Sell Stop Entry: 96.009 (break of Point B – confirms CD leg underway)

Stop Loss: 96.978 (above Point C – invalidates CD leg projection)

Take Profit 1: 95.040 (1:1 risk-to-reward level)

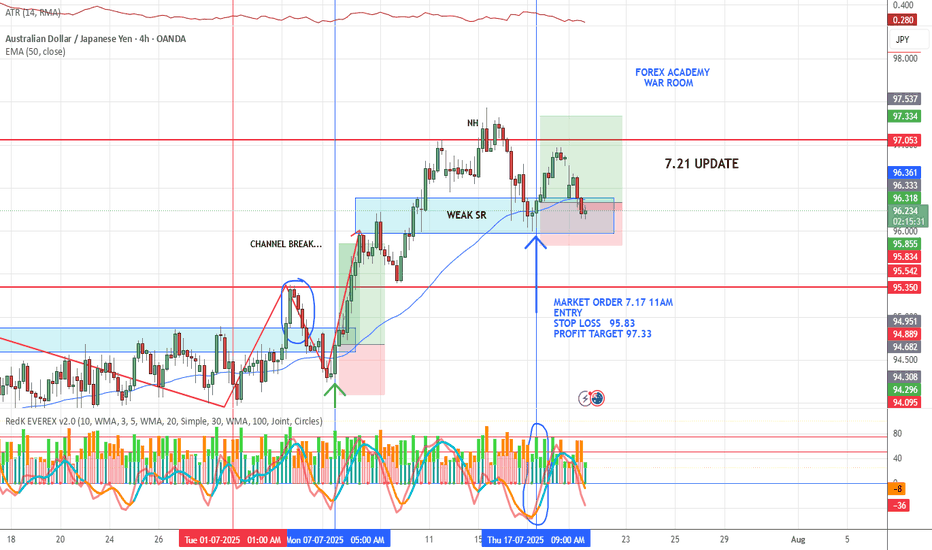

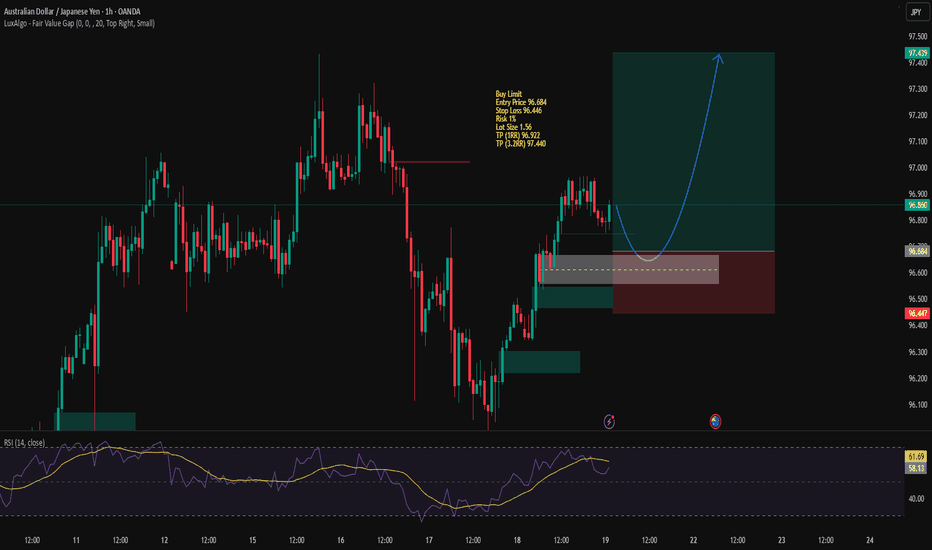

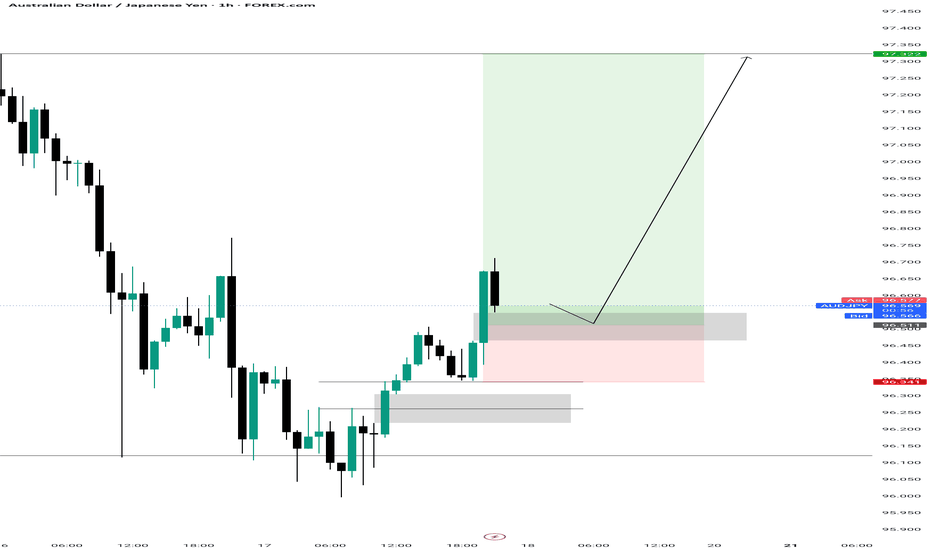

AUD/JPY LIVE TRADE UPDATESwing Trade Update – Gap Down Open

We entered this trade last Thursday based on our VMS swing setup.

When the market opened Sunday, price gapped down against us.

Now we’re watching for:

*Price to find support at this level

*A potential bounce and continuation in trade direction

📌 The gap doesn’t break the setup—structure will tell the truth. Patience required.

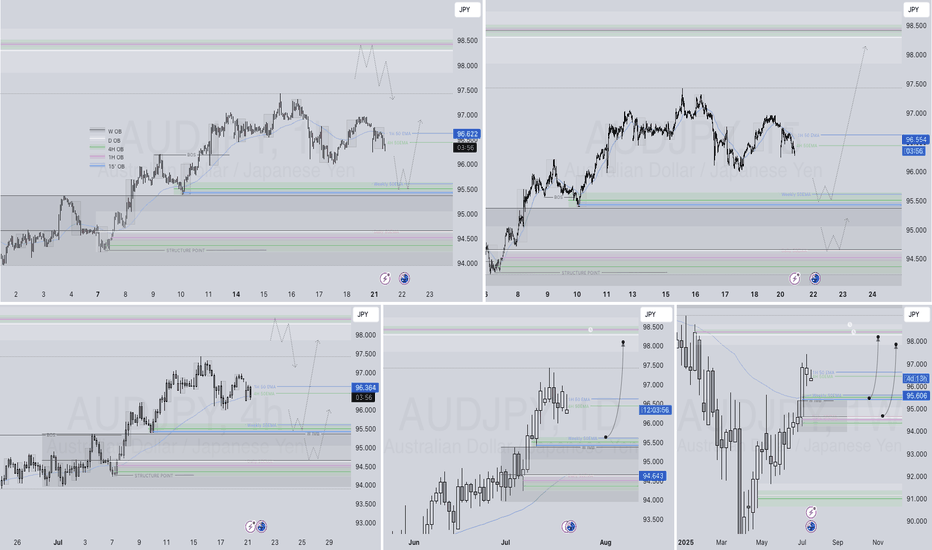

AUDJPY Q3 | D21 | W30 | Y25📊AUDJPY Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

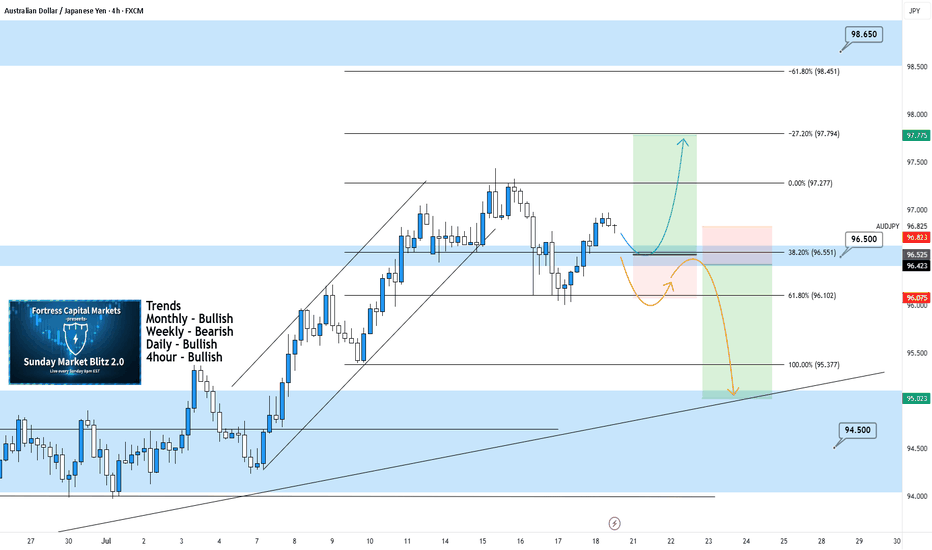

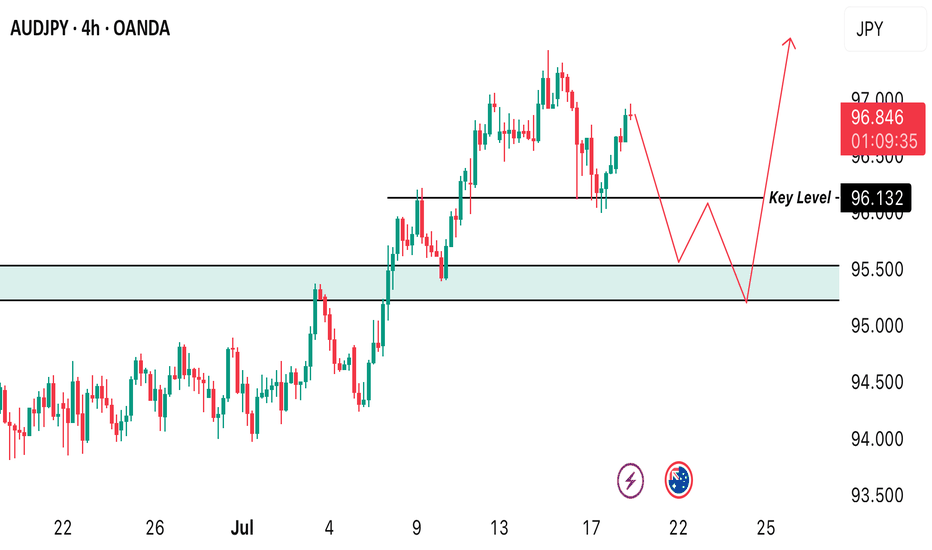

AUDJPY 4Hour TF - July 20th,2025AUDJPY 7/20/2025

AUDJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bearish

Dailly - Bullish

4hour - Bullish

We’re looking mostly bullish on AJ going into this week but will this 96.500 hold as support? Let’s take a look at two potential scenarios for the week ahead:

Bullish Continuation - This is the most likely for AU this week according to the trends in play. For us to get confident in long scenarios, we would like to see strong bullish rejection from support around 96.500. If this happens look to target higher toward our negative fib levels and key resistance.

Bearish Reversal - For us to consider AJ bearish for the week, we would need to see some bearish pressure step in and push us below 96.500. If this happens we only need confirmation in the form of a lower high below 96.500.

Look to target lower toward major support levels like 94.500 area if this happens.

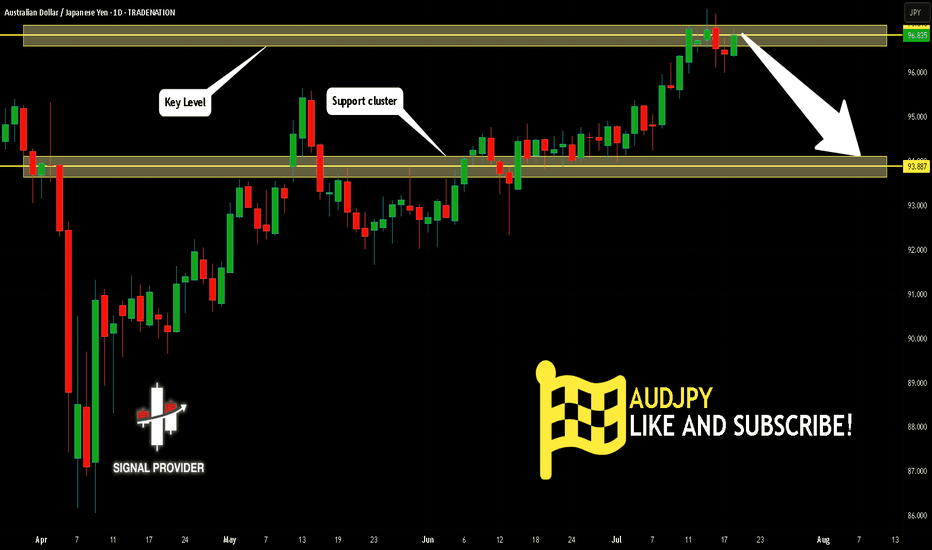

AUDJPY Will Go Lower From Resistance! Sell!

Please, check our technical outlook for AUDJPY.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 96.835.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 93.887 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

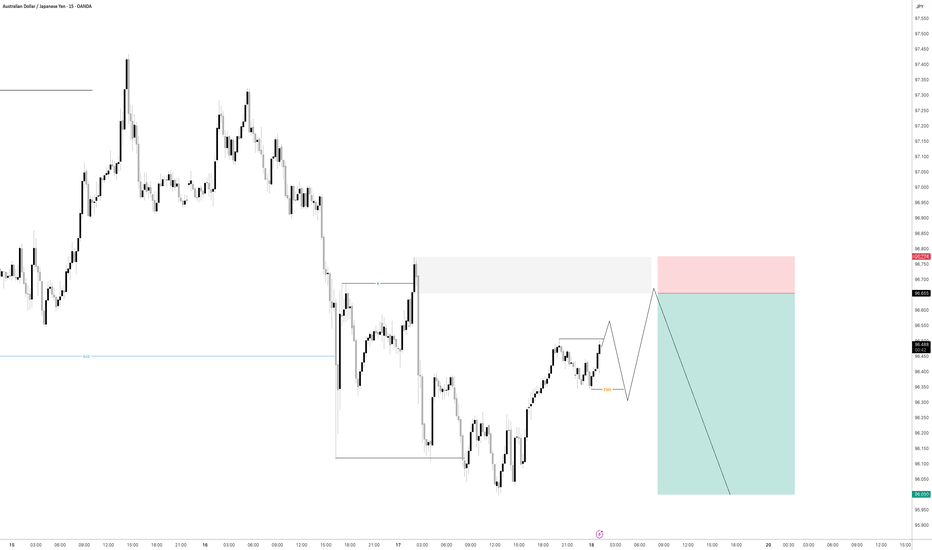

AUDJPY H4 MARKET OUTLOOK. Looking at how price reacted this week, we’re anticipating a new buy opportunity in this market from the H4 timeframe but before then, we’re waiting for proper confirmation before we buy. We’re waiting for price to test the major support level of 95.222 so we can spot a good deal.

AUDJPY - POTENTIAL?USDJPY is getting super interesting.

If we can get some bearish intent to try and induce the early sellers to the downside creating some buyside liquidity then i will be all over this for a trade.

Lets see how price has moved by the morning as it does need a bit more development before we can consider entering for a short position

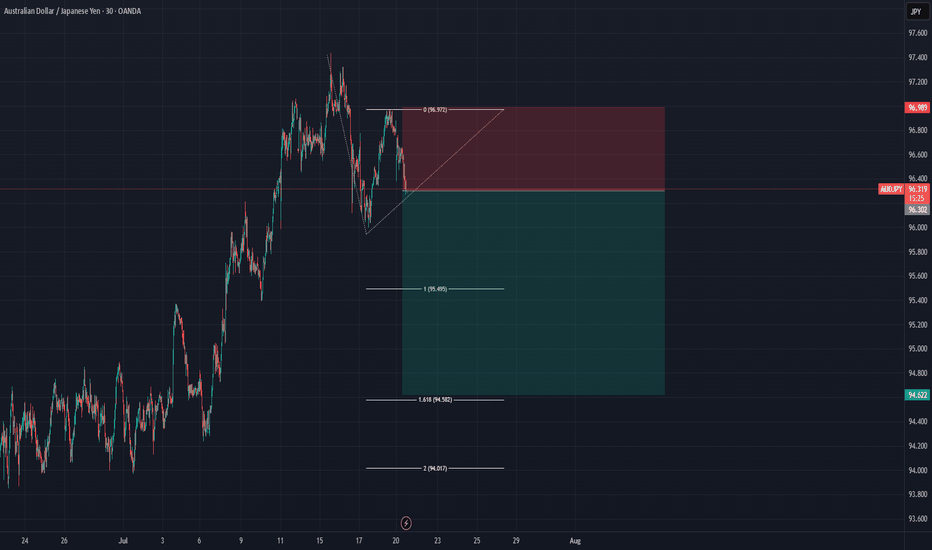

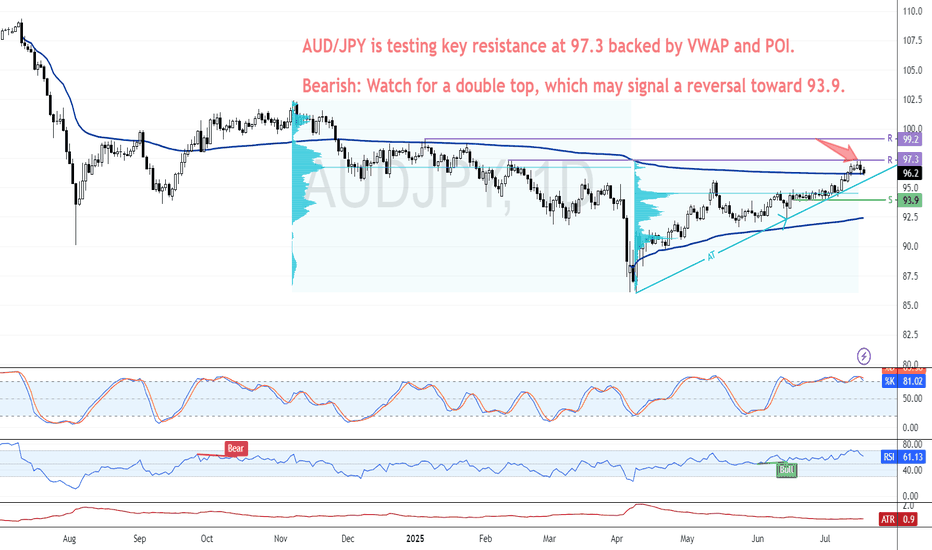

Unique Bearish Setup Emerges for AUD/JPY This QuarterFenzoFx—AUD/JPY is bullish, currently testing the critical resistance and order block at 97.3. This level coincides with the VWAP and volume profile point of interest. Bears are interested in adding short positions at the 97.3 price level.

Since this level is highly important and has the potential to change the trend, it is necessary to form a double top at this price, which has not happened before.

From a technical perspective, if a double top pattern forms at 97.3 and this level holds, a new bearish trend will likely emerge. In this scenario, the 93.9 level is likely to be targeted.