ICICI Bank on the move! A strong buy opportunity spotted.There are two charts of ICICI Bank—one on the 1-hour timeframe and the other on the 4-hour timeframe.

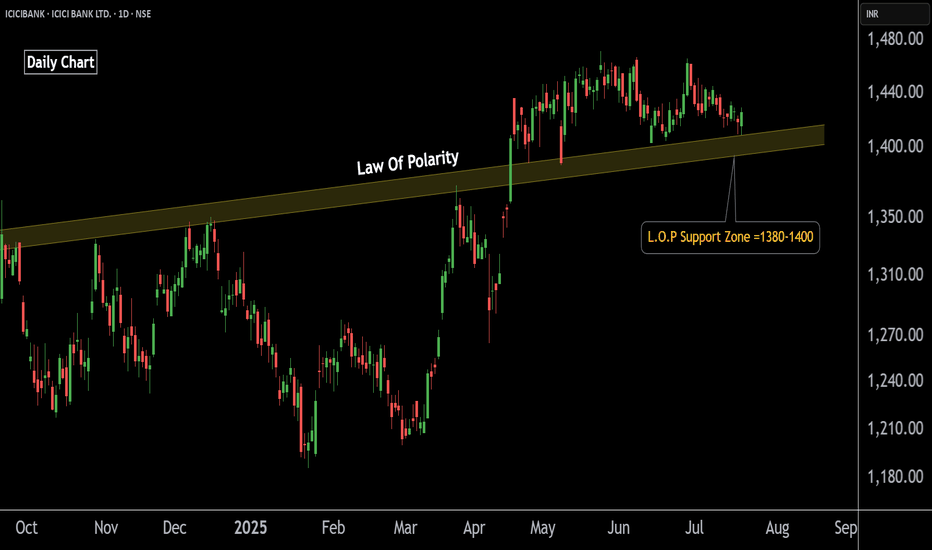

On the 4-hour chart, ICICI Bank is trading within a well-defined parallel channel, with strong support in the 1400–1410 zone.

“On the 1-hour chart, ICICI Bank is forming a Symmetrical Triangle pat

Key facts today

ICICI Bank shares are currently trading at Rs 1,430.40, marking a decline of 0.42% and positioning them among the top losers on the Nifty 50 index in early trade on Monday.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1,050 ARS

6.41 T ARS

36.79 T ARS

6.96 B

About ICICI BANK LTD.

Sector

Industry

CEO

Sandeep Bakhshi

Website

Headquarters

Mumbai

Founded

1955

ISIN

ARDEUT114048

FIGI

BBG000HP5Z57

ICICI Bank Ltd. engages in the provision of banking and financial services, which includes retail banking, corporate banking, and treasury operations. It operates through the following segments: Retail Banking, Wholesale Banking, Treasury, Other Banking, Life Insurance, and Others. The Retail Banking segment includes exposures of the bank, which satisfy the four qualifying criteria of regulatory retail portfolio as stipulated by the Reserve Bank of India guidelines on the Basel III framework. The Wholesale Banking segment deals with all advances to trusts, partnership firms, companies, and statutory bodies, by the Bank which are not included in the Retail Banking segment. The Treasury segment handles the entire investment portfolio of the bank. The Other Banking segment comprises leasing operations and other items not attributable to any particular business segment of the bank. The Life Insurance segment represents results of ICICI Prudential Life Insurance Company Limited. The Others segment include ICICI Home Finance Company Limited, ICICI Venture, ICICI International Limited, ICICI Securities Primary Dealership Limited, ICICI Securities Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Prudential Asset Management Company Limited, ICICI Prudential Trust Limited, ICICI Investment Management Company Limited, ICICI Trusteeship Services Limited, and ICICI Prudential Pension Funds Management Company Limited. The company was founded in 1955 and is headquartered in Mumbai, India.

Related stocks

“ICICI Bank – Triple Tops Rejected, Demand Zone in Focus”🔑 ICICI Bank – Key Technical Points

📌Multiple Times → Control Line acted as S/R (around 14nth Times)

price respected the Control Line – price took support & resistance near Control Line → confirms its importance.

📌 Repeated Triple Tops → Seller Pressure

Every time the stock formed a Triple Top,

ICICI Bank_Key Resistance Area/ All time HighICICI Bank - Price near all time high or key resistance area. Although the price is making a big green candle, volume doesn't support the breakout momentum (or atleast Breakout momentum is not created yet). Good part is - Price takes support at 20 DEMA and all other price structure looks good for po

ICICI Bank Ltd view for Intraday 22nd May #ICICIBANKICICI Bank Ltd view for Intraday 22nd May #ICICIBANK

Resistance 1450 Watching above 1452 for upside momentum.

Support area 1420 Below 1430 ignoring upside momentum for intraday

Watching below 1417 for downside movement...

Above 1430 ignoring downside move for intraday

Charts for Educational purpo

ICICI Bank Ltd view for Intraday 5th May #ICICIBANK ICICI Bank Ltd view for Intraday 5th May #ICICIBANK

Resistance 1435-1438 Watching above 1438 for upside movement...

Support area 1420 Below 1420 ignoring upside momentum for intraday

Watching below 1417 for downside movement...

Above 1435 ignoring downside move for intraday

Charts for Educationa

ICICI Bank Ltd view for Intraday 29th April #ICICIBANK ICICI Bank Ltd view for Intraday 29th April #ICICIBANK

Resistance 1430-1435 Watching above 1435 for upside movement...

Support area 1420 Below 1420 ignoring upside momentum for intraday

Watching below 1417 for downside movement...

Above 1430 ignoring downside move for intraday

Charts for Educati

ICICI Bank Ltd view for Intraday 28th April #ICICIBANK ICICI Bank Ltd view for Intraday 28th April #ICICIBANK

Resistance 1420 Watching above 1422 for upside movement...

Support area 1400 Below 1400 ignoring upside momentum for intraday

Watching below 1397 for downside movement...

Above 1420 ignoring downside move for intraday

Charts for Educational

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

IBN4344591

ICICI Bank Ltd. (Dubai Branch) 4.0% 18-MAR-2026Yield to maturity

—

Maturity date

Mar 18, 2026

655ICHCL26

ICHFC-6.55%-23-12-26-PVTYield to maturity

—

Maturity date

Dec 23, 2026

RRIHFCL27

IHFCL-3MTBILL+SPREAD-12-11-27-Yield to maturity

—

Maturity date

Nov 12, 2027

810IHFC27

IHFCL-8.10%-5-3-27-PVTYield to maturity

—

Maturity date

Mar 5, 2027

699IHFC28

IHFC-6.99%-1-11-28-PVTYield to maturity

—

Maturity date

Nov 1, 2028

875ISPDL28

ISPDL-8.75%-11-5-28-PVTYield to maturity

—

Maturity date

May 11, 2028

809IHFCL26

IHFCL-8.0915%-15-9-26-PVTYield to maturity

—

Maturity date

Sep 15, 2026

IHFC261124

IHFCL-3MTBILLS+SPREAD-25-2-28-Yield to maturity

—

Maturity date

Feb 25, 2028

736IHFCL30

IHFCL-7.36%-02-05-30-PVTYield to maturity

—

Maturity date

May 2, 2030

765IHFCL35

IFHCL-7.65%-10-12-35-PVTYield to maturity

—

Maturity date

Dec 10, 2035

788IHFCL28

IHFCL-7.88%-27-1-28-PVTYield to maturity

—

Maturity date

Jan 27, 2028

See all IBN bonds

Curated watchlists where IBN is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks