I've lost my patience with BCHMoB point... (682) I don't have much hope for pump... If the whales decide to buy... all of the above targets are possible and easy.

1. Picture before my patience runs out

2. Picture what I would like before my patience runs out.

P.S.

BCH at $5.500 || market cap $111,00B

BCH at $16.500 || market cap $333,00B

BCHUSD trade ideas

BCHUSD H4 | Bullish b ounce offBased on the H4 chart analysis, we can see that the price has bounced off the buy entry which is an overlap that aligns with the 61.8% Fibonacci retracement and could potentally riswe from this levl to the take profit.

Buy entry is at 541.09, which is an overlap support that lines up with the 61.8% Fibonacci retracement.

Stop loss is at 503.57, which is a pullback support that lines up with the 138.2% Fibonacci extension.

Take profit is at 589.33, whic is a pullback resistance that is slightly below the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

BCH Consolidates Below $620 HighsFenzoFx—Bitcoin Cash is consolidating after forming equal highs at $620.0. While the trend remains bullish, the current phase may push toward lower support.

Equal highs signal low liquidity, often followed by a move to lower levels before a rally. The bullish order block at $514.0 is a key discount level, offering a potential entry for buyers targeting $640.0 resistance.

If BCH closes below $514.4, consolidation could deepen toward $482.1.

BCH Breaking out. Possible TargetsLooking at the monthly chart there are two major multiyear trendlines (green, we are currently breaking out of) and the yellow one.

If we take the height of the green wedge we would have a PT of ~1900 which would allign with the 2.618 fib extension of wave 1 finally breaking the yellow trendline. This could mark the end of wave 3 followed by a possible corrective wave 4 with a retest of the yellow trendline.

If we now take the height of the yellow wedge we can set a PT of ~3300 being counted as an extended wave 5.

This is the base case. Given the nature of crypto and as BCH shares the same scarcity as BTC there is also a chance of a parabolic move (espacially once the yellow trendline is broken) with PTs of 6700 - 11000 using the fib extension on the whole structure and targeting the range between the 1.618 and 2.168 extenstion.

All this is off the table should BCH fail to break the yellow trendline.

BCHUSD H4 | Bullish continuationBCH/USD is falling towards the buy entry, which is an overlap support that aligns with the 61.8% Fibonacci retracement and could bounce from this level to the take profit.

Buy entry is at 572.22, which is an overlap support that aligns with the 61.8% Fibonacci retracement.

Stop loss is at 539.56, which is an overlap support level.

Take profit is at 623.30, which is a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Bitcoin Cash: - Bearish Setup Awaits Liquidity SweepFenzoFx—Bitcoin Cash continues its bullish momentum, currently trading around $609.5. The uptrend is expected to persist, with BCH targeting the December 2024 high of $640.0.

Once liquidity above this level is cleared, bearish setups may will likely come into play.

BCHUSD H4 | Falling towards major supportBitcoin Cash (BCH?USD) is falling towards the buy entry, which is an overlap support that aligns with the 61.8% Fibonacci retracement and could bounce from this level to the upside.

Buy entry is at 541.09, which is an overlap support that lines up with the 61.8% Fibonacci retracement.

Stop loss is at 503.57, which is a pullback support that lines up with the 138.2% Fibonacci extension.

Take profit is at 589.33, which is a pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Bitcoin Cash Makes Bullish "W" PatternThere is a clear W formation on the chart with a double-bottom which is very bullish.

It's easy to predict a coming bull run in phase 3 of the Bitcoin bull cycle, but the main goal of this post is to identify the potential price targets to secure profits at.

I'll be using the fib levels selling:

-30% at $670

-30% at $845

-30% at $1020

-Final 10% at $1300

Look for a break of trend in the Volume for confirmation if you want to wait and be safe.

Happy trading!

Bitcoin Cash BCH: $495 | Breaking out back to FRESH HiGHS a fork or spin off from original Bitcoin

created for scale more txn lower fees and faster

nice consistent volume

supply under the custody of big 3

could be best performing among OG coins

with less fanfare promotion and founder being distant from it

Time fixes everything

and this may just be the True Essence of BITCOIN Satoshi hoped to see

instead of BTC being centralized under Saylor Dorsey and Trump

BCH May Be The Next MYX - 5-10x Coin TL;DR – BCH is lining up a classic supply-shock + utility-boom setup.

Halving has already cut new coins 50 %, while CashTokens + May-25 upgrade unlock real smart-contract demand. Fees are still < $0.01 so merchants keep onboarding, and Wall-Street-backed EDX just gave institutions a clean on-ramp. With on-chain volume at multi-year highs and regulatory clouds clearing (CLARITY Act), even a modest uptick in adoption can squeeze a float that’s shrinking fast. Add it up and the 10 factors below paint a clear path for BCH to re-rate well beyond current levels.

Post-halving supply squeeze – The 2 April 2024 halving cut block rewards 50 % to 3.125 BCH, slashing new supply while demand stays constant.

May 2025 protocol upgrade – Adds VM Limits & BigInt, letting devs deploy more complex smart-contracts directly on BCH.

CashTokens layer live – Since May 2023, anyone can mint fungible tokens & NFTs; 26 000+ tokens launched in the first 24 h.

Institutional on-ramp via EDX Markets – Wall-Street-backed exchange lists BCH next to BTC & ETH, unlocking RIA and pension flows.

Ultra-low fees (< US $0.01) & 32 MB blocks – Makes BCH practical for point-of-sale payments while BTC fees hover near US $2.

Growing merchant footprint – BCH ranks #4 on Crypwerk; BitPay shows alt-coin check-outs (inc. BCH) now 36 % of crypto payments.

On-chain activity surging – Daily tx count ~53 k; social buzz has pushed BCH to new 2025 highs, signaling fresh interest.

Regulatory clarity coming (CLARITY Act 2025) – Likely to classify many tokens as commodities, reducing U.S. legal overhang.

Re-rating potential – Still 60 % below 2021 high; a modest multiple expansion on revived fundamentals could move price sharply.

Positive momentum & analyst targets – After reclaiming US $600, several desks now project a move toward US $1 000 this cycle.

Marty Boots | 17-Year Trader — smash that 👍👍, hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!

A descending triangle Commonly known as bearish pattern. Price has been increasing for the past few weeks forming a descending triangle. It has attempted to two weeks in a row and price got rejected. As it got close the volume decreased in this particular patten, will this be the invalidation and is it in an accumulation period before the price breaks higher, or will it validate, trap bulls to reverse the price. Another opportunity developing itself for both players. What are your thoughts ?

Bitcoin Cash Breaks Structure With Bullish MomentumFenzoFx—Bitcoin Cash remains bullish, trading back above the VWAP from July 24 near $582.9. Today’s breakout above $572.6 featured a strong bullish engulfing pattern, leaving a fair value gap now under test.

The outlook favors revisiting the $607.0 high, and with the trend still positive, it’s advisable to leave a runner open. A further rally toward $630.0 remains likely if momentum persists.

BCH/USD Chart Analysis: Higher Highs Fuel Bullish Outlook

Price is riding the upper half of the Bollinger Band.

Price recently bounced from the middle band, a bullish continuation signal.

Multiple bullish candles with small upper wicks, showing buyers are in control.

Recent pullbacks have been shallow, indicating strong buying interest on dips.

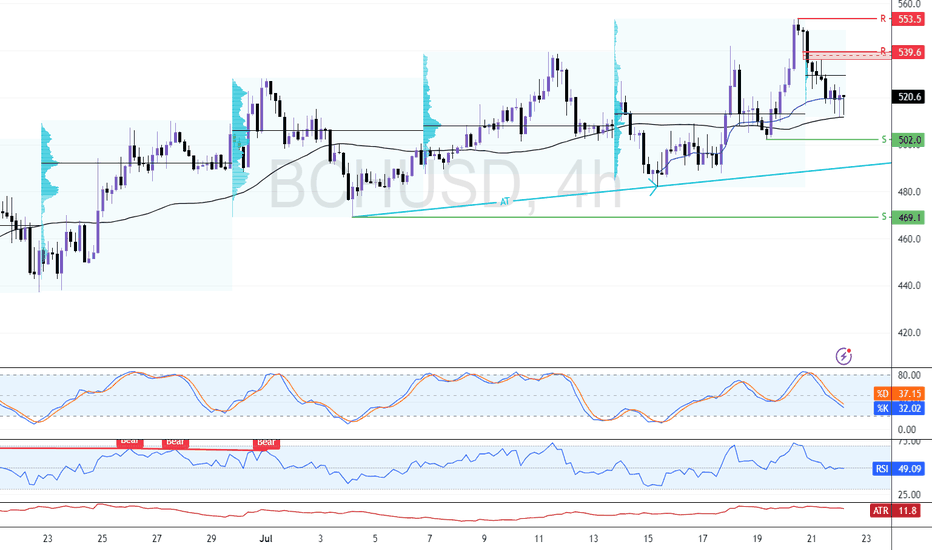

BCH/USD: Bullish Momentum Builds Near Key Volume ZoneFenzoFx—Bitcoin Cash is testing last week's volume point of interest, with bullish long-wick candlesticks signaling buyer strength on the 4-hour chart.

As long as BCH/USD holds above the ascending trendline, the price may rise toward the bearish FVG at $539.6, then target the previous high at $553.5. If the trendline fails, downside momentum could extend to $469.1.

BCH Eyes $600.0 on Bullish Continuation SetupFenzoFx—Bitcoin Cash remains bullish, consolidating above the ascending trendline after reaching $539.5. The price is pulling back toward the $469.1 support, which could trigger a new bullish wave if it holds. In that case, BCH may target the bearish fair value gap near $600.0.

However, if BCH/USD closes below $469.1, the current momentum dip could extend toward $437.0.

"BCH/USD Heist Mode: Enter Long, Exit Before Bears Strike!🚨 BCH/USD HEIST ALERT: Bullish Loot & Escape Plan! (Thief Trading Style) 🚨

🌟 Greetings, Market Bandits & Profit Pirates! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

🔥 Mission Briefing:

Based on Thief Trading tactics (TA + FA), we’re plotting a bullish heist on BCH/USD. Time to swipe the loot & escape before the cops (bears) show up!

🔓 ENTRY: "The Vault is Open!"

📈 Buy Zone: Retest of recent low/high (15-30min timeframe).

💡 Pro Tip: Use limit orders for precision—don’t chase!

🛑 STOP LOSS: Live to Steal Another Day

📍 Thief SL: Recent swing low (~440.00 on 4H TF).

⚠️ Adjust based on your risk, lot size, & multi-order strategy.

🎯 TARGET: 540.00 (or Bail Early!)

🏴☠️ Escape before the red zone (overbought, reversal risk, bear traps!).

💰 "Take profit & treat yourself—you earned it!"

📢 WHY THIS HEIST? (Bullish Catalysts)

✅ Fundamentals: Strong macro + sentiment.

✅ Technicals: Pullback entry + bullish structure.

✅ Intermarket trends: Crypto momentum favors bulls.

(For full intel—COT reports, on-chain data, sentiment—check 👉🔗🔗!)

🚨 NEWS ALERT: Avoid the Police (Volatility Traps!)

🔹 Avoid new trades during high-impact news.

🔹 Trailing stops to lock profits & dodge reversals.

💥 BOOST THIS HEIST! (Let’s Get Rich Together!)

👍 Smash that "Like" & "Boost" button to fuel our next robbery!

🚀 Follow for daily heist plans—easy profits await!

See you at the next heist, bandits! 🤑💎

Bitcoin Cash Tests $528.3 as Double Top FormsBitcoin Cash faces resistance at $528.3, forming a double top and trading slightly below this level. Stochastic readings above 80.0 signal an overbought market, increasing the risk of a correction.

If BCH fails to break above $528.3, a pullback to $514.1 and $500.0 is likely, offering potential bullish re-entry zones. Alternatively, a confirmed breakout above $528.3 could pave the way toward the next supply area at $560.0.