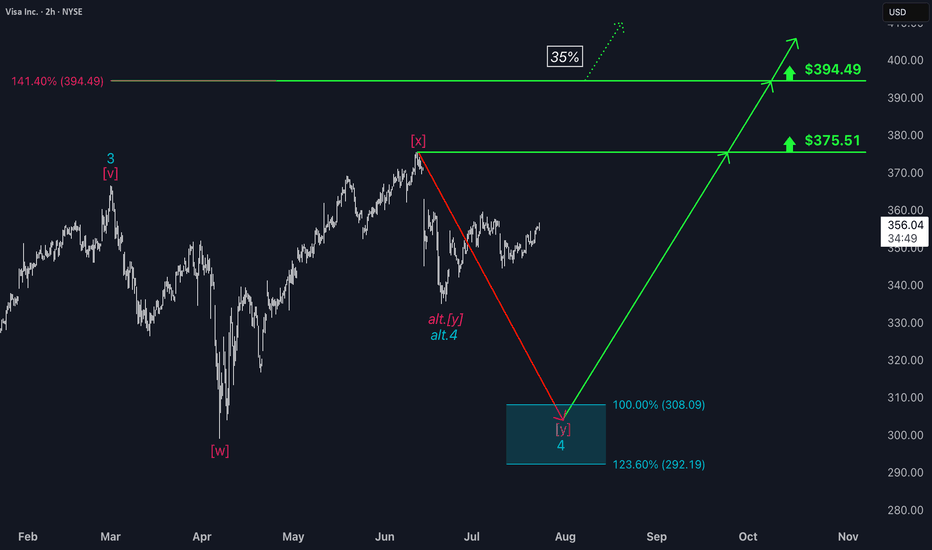

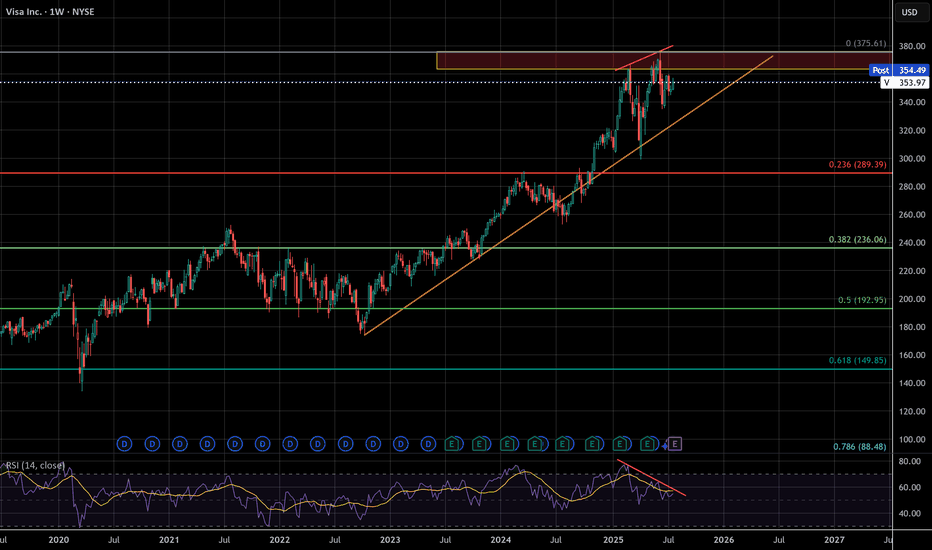

Visa: Waiting in the Wings Visa has entered a phase of sideways consolidation — but this does not affect our primary scenario. We continue to see the stock moving within magenta wave , which is expected to complete the larger turquoise wave 4 inside our turquoise Target Zone between $308.09 and $292.19. After that, we antici

Key facts today

Visa's Q3 results showed an adjusted EPS of $2.98, net income of $5.3 billion, and revenue of $10.2 billion, all surpassing estimates and reflecting strong growth.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9,650 CLP

17.54 T CLP

32.39 T CLP

1.71 B

About Visa

Sector

Industry

CEO

Ryan McInerney

Website

Headquarters

San Francisco

Founded

1958

FIGI

BBG00YFSGHY5

Visa, Inc. engages in the provision of digital payment services. It also facilitates global commerce through the transfer of value and information among a global network of consumers, merchants, financial institutions, businesses, strategic partners, and government entities. It offers debit cards, credit cards, prepaid products, commercial payment solutions, and global automated teller machines. The company was founded by Dee Hock in 1958 and is headquartered in San Francisco, CA.

Related stocks

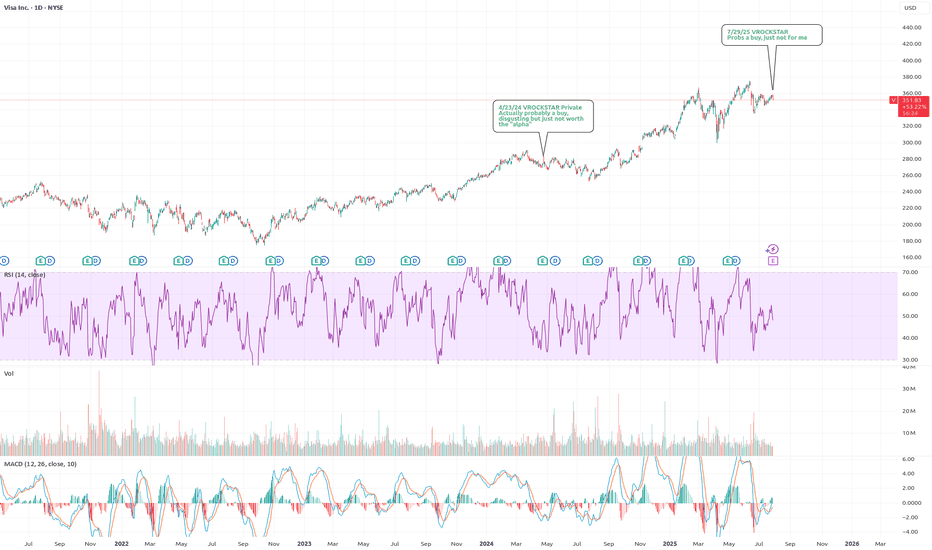

7/29/25 - $v - Probs a buy, just not for me7/29/25 :: VROCKSTAR :: $V

Probs a buy, just not for me

- over 3% fcf yields, growing, consumer spending well

- over time (probably long duration) I think the biz model probably gets eroded, but also mgmt has done a nice job evolving, perhaps they keep up with the times etc.

- don't think anything

VISA - The missing puzzle piece - Suffering from successI've seen a lot of negative sentiment online lately about the impending bubble, but even with social media, crude AI, and the US dollar being the peak of that negativity this whale has been dying slowly and few have taken notice.

VISA has begun to censor what can be bought, overcharge merchants, an

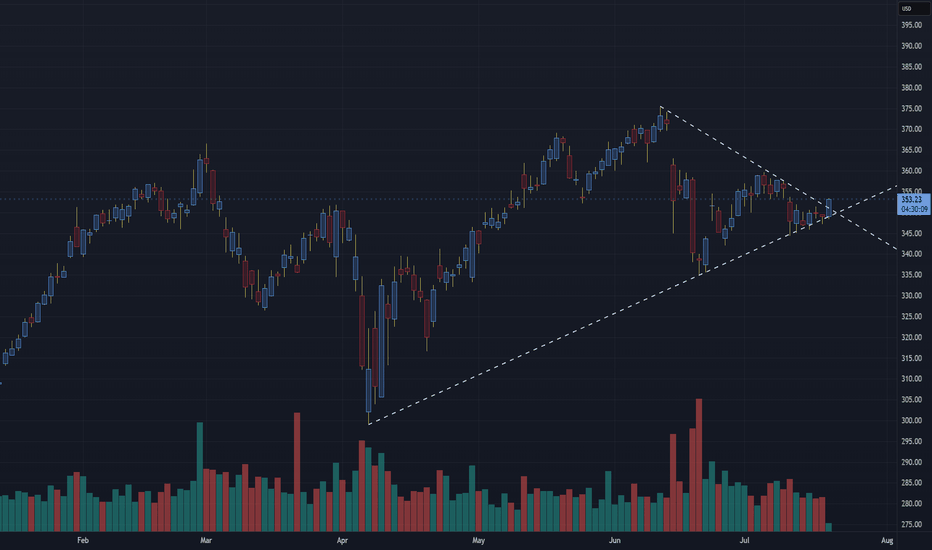

V will be joining crypto soon... BULLISH UPSIDETechnical Analysis: Visa Inc. (V) – Thesis: V will integrate cryptocurrency in the near future.

The chart shows a symmetrical triangle pattern forming on Visa Inc. (V), which is a consolidation pattern often leading to a breakout in the direction of the prevailing trend — which in this case, has

VISA on a strong Bullish Leg targeting $440.Visa Inc. (V) has been trading within a Channel Up pattern since the October 10 2022 market bottom. After December 2022, every test of the 1W MA50 (blue trend-line) has been the most optimal long-term buy opportunity, being also a Higher Low (bottom) of the pattern.

Every Bullish Leg has been +5% s

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US92826CAQ5

VISA 20/50Yield to maturity

7.23%

Maturity date

Aug 15, 2050

3V69

VISA 17/47Yield to maturity

6.09%

Maturity date

Sep 15, 2047

V4972835

Visa Inc. 2.7% 15-APR-2040Yield to maturity

5.90%

Maturity date

Apr 15, 2040

3V68

VISA 15/45Yield to maturity

5.82%

Maturity date

Dec 14, 2045

US92826CAE2

VISA 15/35Yield to maturity

4.95%

Maturity date

Dec 14, 2035

3V67

VISA 15/25Yield to maturity

4.55%

Maturity date

Dec 14, 2025

V4972836

Visa Inc. 2.05% 15-APR-2030Yield to maturity

4.53%

Maturity date

Apr 15, 2030

V5028512

Visa Inc. 1.1% 15-FEB-2031Yield to maturity

4.48%

Maturity date

Feb 15, 2031

US92826CAP7

VISA 20/27Yield to maturity

4.11%

Maturity date

Aug 15, 2027

3V6A

VISA 17/27Yield to maturity

4.10%

Maturity date

Sep 15, 2027

V4972834

Visa Inc. 1.9% 15-APR-2027Yield to maturity

4.10%

Maturity date

Apr 15, 2027

See all VCL bonds

Curated watchlists where VCL is featured.

Frequently Asked Questions

The current price of VCL is 327,200 CLP — it hasn't changed in the past 24 hours. Watch VISA INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange VISA INC stocks are traded under the ticker VCL.

We've gathered analysts' opinions on VISA INC future price: according to them, VCL price has a max estimate of 425,531.91 CLP and a min estimate of 294,970.99 CLP. Watch VCL chart and read a more detailed VISA INC stock forecast: see what analysts think of VISA INC and suggest that you do with its stocks.

VCL stock is 2.82% volatile and has beta coefficient of 0.77. Track VISA INC stock price on the chart and check out the list of the most volatile stocks — is VISA INC there?

Today VISA INC has the market capitalization of 666.65 T, it has decreased by −0.49% over the last week.

Yes, you can track VISA INC financials in yearly and quarterly reports right on TradingView.

VISA INC is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

VCL earnings for the last quarter are 2.79 K CLP per share, whereas the estimation was 2.66 K CLP resulting in a 4.68% surprise. The estimated earnings for the next quarter are 2.92 K CLP per share. See more details about VISA INC earnings.

VISA INC revenue for the last quarter amounts to 9.52 T CLP, despite the estimated figure of 9.21 T CLP. In the next quarter, revenue is expected to reach 10.26 T CLP.

VCL net income for the last quarter is 4.32 T CLP, while the quarter before that showed 5.05 T CLP of net income which accounts for −14.55% change. Track more VISA INC financial stats to get the full picture.

Yes, VCL dividends are paid quarterly. The last dividend per share was 556.60 CLP. As of today, Dividend Yield (TTM)% is 0.64%. Tracking VISA INC dividends might help you take more informed decisions.

VISA INC dividend yield was 0.76% in 2024, and payout ratio reached 21.69%. The year before the numbers were 0.78% and 22.09% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 29, 2025, the company has 31.6 K employees. See our rating of the largest employees — is VISA INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. VISA INC EBITDA is 25.24 T CLP, and current EBITDA margin is 70.13%. See more stats in VISA INC financial statements.

Like other stocks, VCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade VISA INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So VISA INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating VISA INC stock shows the strong buy signal. See more of VISA INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.