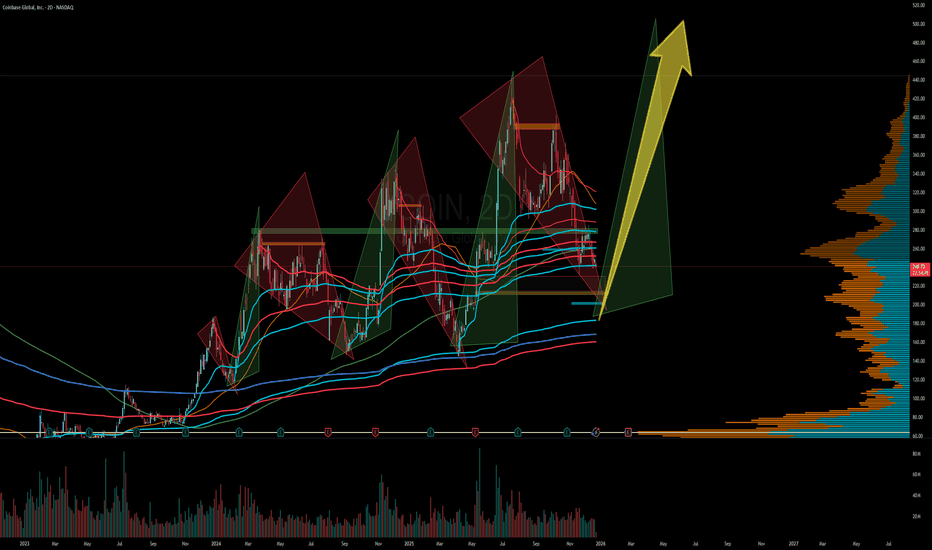

COIN Breakdown Setup Activated — Sellers in Control!🔥 COIN Bearish Heist 🕵️♂️ | Layered Sell Strategy in Play

📊 Asset Overview

COINBASE GLOBAL, INC. (COIN)

📍 NASDAQ Exchange

📈 Instrument Type: US Stock

⏱️ Trading Style: Swing Trade / Day Trade

COIN is currently showing structural weakness after failing to hold key consolidation levels. Price behavi

Coinbase Global, Inc. Class A

No trades

Key facts today

Coinbase will acquire The Clearing Company, a prediction market startup, expected to close in January. This move supports Coinbase's goal to broaden its services beyond crypto trading.

Clear Street sees Coinbase Global (COIN) as a leading fintech for 2026, highlighting its potential growth from blockchain adoption, stablecoins, tokenization, payments, and prediction markets.

Coinbase has complied with the EU's Markets in Crypto-Assets Regulation (MiCA) by submitting compliant whitepapers, solidifying its leadership in regulatory standards in Europe.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

231.63 MXN

53.74 B MXN

136.86 B MXN

220.65 M

About Coinbase Global, Inc. - 3

Sector

Industry

CEO

Brian Armstrong

Website

Headquarters

New York

Founded

2012

Identifiers

3

ISINUS19260Q1076

Coinbase Global, Inc. engages in the provision of a trusted platform that serves as a compliant on-ramp to the onchain economy and enables users to engage in a wide variety of activities with their crypto assets in both proprietary and third-party product experiences enabled by access to decentralized applications. It offers consumers primary financial account for the cryptoeconomy, institutions a full-service prime brokerage platform with access to deep pools of liquidity across the crypto marketplace, and developers a suite of products granting access to build onchain. The company was founded by Brian Armstrong and Fred Ernest Ehrsam in May 2012 and is headquartered in New York, NY.

Related stocks

COIN Testing Key Support – Potential Long SetupNASDAQ:COIN (Coinbase) is currently testing a major support zone in the $235–$240 range, which has acted as a strong base in previous pullbacks. This level is attracting renewed interest as the broader crypto market shows signs of upward momentum, with BTC and ETH stabilizing and pushing higher. A

Coinbase Completes its Reincorporation From Delaware to Texas Coinbase Global, Inc. (NASDAQ: NASDAQ:COIN ) has completed its reincorporation from Delaware to Texas, effective December 15, 2025. The move is largely administrative and does not change Coinbase’s business operations, management structure, or day-to-day activities. The company confirmed that its C

Coin UpdatePrice seems to be headed for another low but unfortunately until it hits that low, we cannot be sure. This could just be another subdivision of minor A of (B). Even if it does make another low though it doesn't change the target for (B) by much. Should it decide to make another low I believe it will

COIN | 200 SMA Confluence + Bullish Doji = High-Value Setup🎯 COIN: The 200 MA Heist — Dip Buyers Stacking Bags While Others Panic 💼🔥

📊 Asset Intelligence

Coinbase Global Inc (COIN) — NASDAQ

Strategy Classification: Swing/Day Trade Hybrid

Market Bias: Bullish Pullback Confirmation

Risk Profile: Calculated Aggression

🧠 Technical Thesis — Why This Setup Slap

Extreme Volatility Analysis: Searching for Crypto-Linked Support🚀 Continued Upside (The Most Optimistic Scenario)

Following the green arrow, the stock immediately recovers from the current level ($270.12) or the first minor support, breaks the current high (near $420.54), and rapidly advances toward the Fibonacci extension levels, targeting $877.76 (1.272 Fib) a

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

COIN5259272

Coinbase Global, Inc. 3.625% 01-OCT-2031Yield to maturity

5.91%

Maturity date

Oct 1, 2031

COIN5259270

Coinbase Global, Inc. 3.375% 01-OCT-2028Yield to maturity

5.10%

Maturity date

Oct 1, 2028

COIN5424425

Coinbase Global, Inc. 0.5% 01-JUN-2026Yield to maturity

—

Maturity date

Jun 1, 2026

US19260QAG2

Coinbase Global, Inc. 0.0% 01-OCT-2029Yield to maturity

—

Maturity date

Oct 1, 2029

COIN6034335

Coinbase Global, Inc. 0.25% 01-APR-2030Yield to maturity

—

Maturity date

Apr 1, 2030

US19260QAJ6

Coinbase Global, Inc. 0.0% 01-OCT-2032Yield to maturity

—

Maturity date

Oct 1, 2032

See all COIN bonds

Curated watchlists where COIN is featured.

Interest-earning crypto wallets: Put your digital money to work

12 No. of Symbols

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of COIN is 4,318.75 MXN — it has decreased by −2.49% in the past 24 hours. Watch Coinbase Global, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange Coinbase Global, Inc. Class A stocks are traded under the ticker COIN.

COIN stock has fallen by −2.08% compared to the previous week, the month change is a −10.09% fall, over the last year Coinbase Global, Inc. Class A has showed a −20.25% decrease.

We've gathered analysts' opinions on Coinbase Global, Inc. Class A future price: according to them, COIN price has a max estimate of 9,171.01 MXN and a min estimate of 4,135.95 MXN. Watch COIN chart and read a more detailed Coinbase Global, Inc. Class A stock forecast: see what analysts think of Coinbase Global, Inc. Class A and suggest that you do with its stocks.

COIN stock is 1.64% volatile and has beta coefficient of 2.56. Track Coinbase Global, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is Coinbase Global, Inc. Class A there?

Yes, you can track Coinbase Global, Inc. Class A financials in yearly and quarterly reports right on TradingView.

Coinbase Global, Inc. Class A is going to release the next earnings report on Feb 25, 2026. Keep track of upcoming events with our Earnings Calendar.

COIN earnings for the last quarter are 27.50 MXN per share, whereas the estimation was 21.00 MXN resulting in a 30.92% surprise. The estimated earnings for the next quarter are 20.81 MXN per share. See more details about Coinbase Global, Inc. Class A earnings.

Coinbase Global, Inc. Class A revenue for the last quarter amounts to 34.26 B MXN, despite the estimated figure of 33.07 B MXN. In the next quarter, revenue is expected to reach 35.05 B MXN.

COIN net income for the last quarter is 7.93 B MXN, while the quarter before that showed 26.80 B MXN of net income which accounts for −70.42% change. Track more Coinbase Global, Inc. Class A financial stats to get the full picture.

No, COIN doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Dec 26, 2025, the company has 3.77 K employees. See our rating of the largest employees — is Coinbase Global, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Coinbase Global, Inc. Class A EBITDA is 74.76 B MXN, and current EBITDA margin is 47.56%. See more stats in Coinbase Global, Inc. Class A financial statements.

Like other stocks, COIN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Coinbase Global, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Coinbase Global, Inc. Class A technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Coinbase Global, Inc. Class A stock shows the sell signal. See more of Coinbase Global, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.