BA (Boeing Co.) – Trade Setup Alert🚀✈️ A major new defense contract is on the horizon — and if confirmed, it could skyrocket BA’s valuation to new heights. This could be the catalyst that propels the stock far beyond its current range.

Boeing is showing renewed strength with a bullish setup developing. With multiple entry points and

−0.09 BRL

−63.70 B BRL

358.60 B BRL

About Boeing Company (The)

Sector

Industry

CEO

Robert Kelly Ortberg

Website

Headquarters

Arlington

Founded

1916

ISIN

BRBOEIBDR003

FIGI

BBG0025NPMZ5

The Boeing Co. is an aerospace company, which engages in the manufacture of commercial jetliners and defense, space, and security systems. It operates through the following segments: Commercial Airplanes (BCA), Defense, Space and Security (BDS), Global Services (BGS), and Boeing Capital (BCC). The Commercial Airplanes segment includes the development, production, and market of commercial jet aircraft and provides fleet support services, principally to the commercial airline industry worldwide. The Defense, Space and Security segment refers to the research, development, production and modification of manned and unmanned military aircraft and weapons systems for global strike, including fighter and combat rotorcraft aircraft and missile systems, global mobility, including tanker, rotorcraft and tilt-rotor aircraft, and airborne surveillance and reconnaissance, including command and control, battle management and airborne anti-submarine aircraft. The Global Services segment provides services to commercial and defense customers. The Boeing Capital segment seeks to ensure that Boeing customers have the financing they need to buy and take delivery of their Boeing product and manages overall financing exposure. The company was founded by William Edward Boeing on July 15, 1916 and is headquartered in Arlington, VA.

Related stocks

Boeing Breakdown? $210 LEAP Put Trade Could Explode🚨 BA LEAP Put Play – Bearish Setup Into 2026 🚨

📉 Boeing (BA) is setting up for a long-term downside move. With monthly RSI < 45, negative momentum, and a macro headwind backdrop, this is a high conviction bearish LEAP trade.

📊 TRADE DETAILS 📊

🎯 Instrument: BA

🔻 Direction: PUT (SHORT)

🎯 Strike:

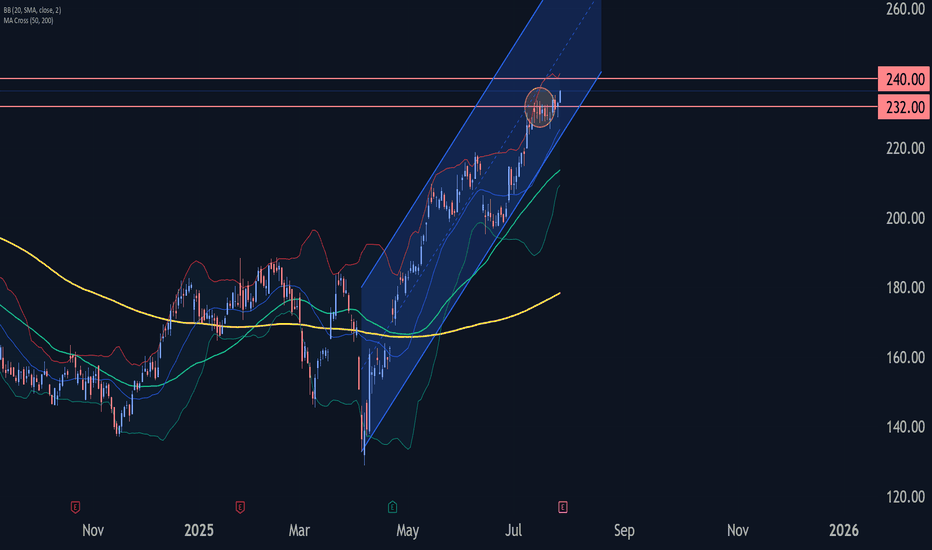

Boeing Headed back up to close gaps near 260 in the short term

Zoomed in you can see its a channel trade

The next best long entry is above 235.00

On your daily chart, go back and look at the gap from Jan 2024 at 234.00 now if you stroll back to last month you'll see all of the price action that refl

BOEING for a Short Term Swing and LEAP tradeI'm liking Boeing here. Currently looks to be in the final move of a 5 year inverse head and shoulders / ascending triangle pattern, which I take as very bullish.

For a short term swing I'm targeting $250-$255 where I will take profit.

For long term leaps I'm targeting purple range ($300+).

Boein

Boeing Wave Analysis – 5 August 2025- Boeing reversed from the support zone

- Likely to rise to resistance level 230.00

Boeing recently reversed up from the support zone between the pivotal support level of 217.50 (former top of wave 1 from June) and the lower daily Bollinger Band.

This support zone was further strengthened by the 5

Boeing Has Pulled BackBoeing hit a 19-month high last week, and now it’s pulled back.

The first pattern on today’s chart is a price gap from January 2024. BA briefly entered that resistance area after earnings and revenue beat estimates on July 29.

Second is the June 9 close of $217.51. Sellers drove the aerospace gian

Boeing Company (BA) Long Setup Boeing Company (BA) Long Setup

Probable **Wave (5)** upside impulse from the recent \$225.26 low.

* Wave (4) looks complete — bullish structure shift starting from LL.

* Price is now breaking minor resistance, building momentum for continuation.

* **Demand Zone:** \$224.00–\$226.00 — proven boun

Boeing Wave Analysis – 28 July 2025- Boeing broke the resistance level 232.50

- Likely to rise to resistance level 240.00

Boeing recently broke the resistance level 232.50 (which stopped the previous minor impulse wave 3 in the middle of July, as can be seen below).

The breakout of the resistance level 232.50 continues the active s

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BA5803363

Boeing Company 6.259% 01-MAY-2027Yield to maturity

—

Maturity date

May 1, 2027

BA4983329

Boeing Company 5.705% 01-MAY-2040Yield to maturity

—

Maturity date

May 1, 2040

BA.IW

Boeing Company 7.5% 15-AUG-2042Yield to maturity

—

Maturity date

Aug 15, 2042

BA5946120

Boeing Company 7.008% 01-MAY-2064Yield to maturity

—

Maturity date

May 1, 2064

BA5964674

Boeing Company 6.858% 01-MAY-2054Yield to maturity

—

Maturity date

May 1, 2054

BA4762314

Boeing Company 3.45% 01-NOV-2028Yield to maturity

—

Maturity date

Nov 1, 2028

BA4762315

Boeing Company 3.85% 01-NOV-2048Yield to maturity

—

Maturity date

Nov 1, 2048

BA.IQ

Boeing Company 8.625% 15-NOV-2031Yield to maturity

—

Maturity date

Nov 15, 2031

BA4983332

Boeing Company 5.04% 01-MAY-2027Yield to maturity

—

Maturity date

May 1, 2027

BA5803372

Boeing Company 7.008% 01-MAY-2064Yield to maturity

—

Maturity date

May 1, 2064

BA5072875

Boeing Company 2.75% 01-FEB-2026Yield to maturity

—

Maturity date

Feb 1, 2026

See all BOEI34 bonds

Curated watchlists where BOEI34 is featured.