Back at supportA leading company in semiconductor circuit design is undergoing a sharp correction following an earnings report that fell short of expectations.

The price has dropped again to touch the support level at $386 (blue trendline) that has held firm for nearly 4 years.

This could be a potential entry or

Key facts today

On September 9, 2025, Synopsys reported Q3 revenue of $1.740 billion, below guidance, with net income down 43% year-over-year. Stock fell 35.84% to $387.78 on September 10.

28,545.86

0.02 BRL

11.81 B BRL

31.97 B BRL

About Synopsys, Inc.

Sector

Industry

CEO

Sassine Ghazi

Website

Headquarters

Sunnyvale

Founded

1986

ISIN

BRS1NPBDR004

FIGI

BBG00RHG3663

Synopsys, Inc. engages in the provision of electronic design automation (EDA) software that engineers use to design and test integrated circuits (ICs). It also offers semiconductor intellectual property (IP) products. It operates through the following segments: Design Automation, Design IP, and Software Integrity. The Design Automation segment includes silicon design, verification products and services, system integration products and services, digital, custom, and FPGA IC design software, verification software and hardware products, and manufacturing software products. The Software Integrity segment includes a solution for building security and compliance testing into the customers' software development lifecycle and supply chain. The company was founded by Aart J. de Geus, Bill Krieger, Dave Gregory, and Rick Rudell in December 1986 and is headquartered in Sunnyvale, CA.

Related stocks

SNPS (Synopsys, Inc.) — 2H TF | Long Setup

SNPS (Synopsys) experienced a parabolic run into $651 ATH, followed by a brutal selloff wiping out nearly $250 in value in a matter of days. This sharp capitulation was after the earnings shock and news impact. However the company fundamental and historical growth still very healthy!

Currently, p

SNPS - LONG Swing Entry PlanNASDAQ:SNPS - LONG Swing Entry Plan

E1: $414.00 – $400.00

→ Open initial position targeting +8% from entry level.

E2: $339.00 – $329.00

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

AD: $257.00 – $247.00

Synopsys — a sharp sell-off, risky entry and clear opportunitySynopsys plunged roughly 30–34% on 10 September 2025, wiping out a large chunk of market value after quarterly results missed expectations and guidance was cut. That kind of move often feels like a “falling knife”: attractive on paper, dangerous in practice.

Price action and technical context

Th

Wyckoff Stage #4 Markdown?- NASDAQ:SNPS crashed on September 10, 2025 but I'm not interested in buying it yet.

- Fundamentally it had a premium valuation which has gotten little compressed but I think it deserves to be punished more.

- Monthly chart looks ugly and NASDAQ:SNPS is likely in a Wyckoff Stage #4

- Funda

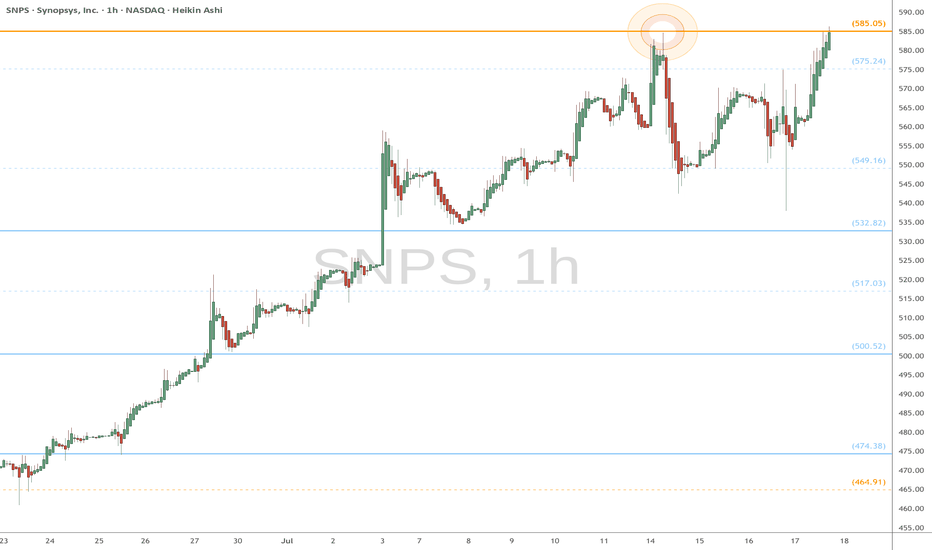

Synopsys (SNPS): Ready to Rally Again After a Brief Pause

Strong Climb, Then a "Breather" : SNPS has been going up very strongly since April. The Pattern clearly displays bull flag continuation patterns, with price consolidating in downward-sloping channels before breaking out to the upside.

Current Pause Ending: After its big jump in July, the sto

Inverse Head and Shoulders Already Completed Toward a New ATHThe price has completed the formation of an inverse head and shoulders pattern, with the final breakout occurring last week.

Volume confirms the validity of the pattern.

The distance from the head to the neckline projects a target toward a new all-time high (ATH).

As often happens after a breakout

SNPS – Dangerous Correction Wave Nearing Completion?The wave structure marked in red often indicates a corrective move. While it appears impulsive at first glance, such formations typically end with a strong candle in the direction of the trend, followed by a full retracement.

This rally is likely not a new bullish impulse but a complex correction w

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SNPS6020496

Synopsys, Inc. 5.7% 01-APR-2055Yield to maturity

5.78%

Maturity date

Apr 1, 2055

SNPS6020495

Synopsys, Inc. 5.15% 01-APR-2035Yield to maturity

5.01%

Maturity date

Apr 1, 2035

SNPS6020494

Synopsys, Inc. 5.0% 01-APR-2032Yield to maturity

4.68%

Maturity date

Apr 1, 2032

SNPS6020493

Synopsys, Inc. 4.85% 01-APR-2030Yield to maturity

4.42%

Maturity date

Apr 1, 2030

SNPS6020492

Synopsys, Inc. 4.65% 01-APR-2028Yield to maturity

4.15%

Maturity date

Apr 1, 2028

SNPS6020491

Synopsys, Inc. 4.55% 01-APR-2027Yield to maturity

4.11%

Maturity date

Apr 1, 2027

See all S1NP34 bonds

Curated watchlists where S1NP34 is featured.