Walmart Beat the S&P 500 Over 12 Months. What Its Chart SaysWalmart NYSE:WMT has been on a tear over the past year, rising 37.1% over the past 12 months vs. 16.1% for the S&P 500. What does the retail giant's technical and fundamental analysis say heading into this week's Q2 earnings report?

Let's check things out:

Walmart's Fundamental Analysis

As a

Key facts today

Walmart is using AI to optimize pricing, cutting inventory costs by 10% and boosting product availability by 15% through better demand forecasting.

Walmart has gained market share as wealthier consumers are increasingly shopping at the store, driven by concerns over rising prices from tariffs.

0.40 BRL

106.59 B BRL

3.73 T BRL

About Walmart Inc.

Sector

Industry

CEO

C. Douglas McMillon

Website

Headquarters

Bentonville

Founded

1962

ISIN

BRWALMBDR005

FIGI

BBG001721TS0

Walmart, Inc. engages in the retail and wholesale business. The company offers an assortment of merchandise and services at everyday low prices. It operates through the following business segments: Walmart U.S., Walmart International, and Sam's Club. The Walmart U.S. segment operates as a mass merchandiser of consumer products, operating under the Walmart and Walmart Neighborhood Market brands, including walmart.com. The Walmart International segment includes operations of wholly-owned subsidiaries in Canada, Chile, China, and Africa, and majority-owned subsidiaries in India, as well as Mexico and Central America. The Sam's Club segment manages membership-only warehouse clubs and operates samsclub.com. The company was founded by Samuel Moore Walton and James Lawrence Walton on July 2, 1962 and is headquartered in Bentonville, AR.

Related stocks

Walmart Stock Trading in Bullish Trend – Upside Potential AheadWalmart Inc. (WMT) shares are currently exhibiting a bullish trend, maintaining upward momentum over recent trading sessions. While the stock has been consolidating in a range over the past few days, the broader outlook remains positive, suggesting potential for further gains in upcoming sessions.

Impulse buying WMT is always better than impulse buying AT WMTI meant to post this Friday and something came up. I meant to post it again Saturday but the weather was too nice. I meant to post this yesterday but my computer was glitchy. So hopefully this will post this morning. And if she goes higher from here, feel free not to give me credit because I'm p

WMT - Walmart turns southI attached the A-Handle of the fork to the GAP from November 2025, because a GAP is also a Pivot.

As we see, price reacts not bad at the Centerline.

Price failed to make a new high.

Then it broke the Centerline and retested it.

No we are trading in the midst of the old accummulation zone where Buy

Walmart Earnings Play: Cheap Calls Into Earnings

## 🚀 Walmart Earnings Play: Cheap Calls Into Earnings (Aug 21, 2025) 🚀

### 🏦 Earnings Outlook

* 📊 **Revenue Growth:** +2.5% TTM (stagnant but stable)

* ⚖️ **Margins:** Thin → Profit Margin 2.7%, Operating Margin 4.3%

* 🏷️ **Analyst Sentiment:** Still *Strong Buy*, but guidance slippage = caution

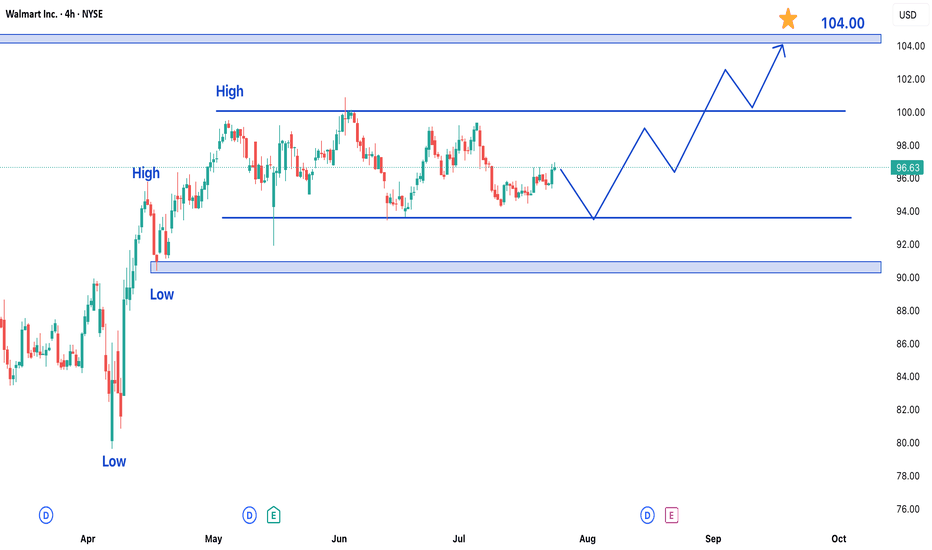

My 5% upside for WalmartMy 5% upside for Walmart.

There is a likely chance that WMT may push up from this psychological $100 zone. If this happens, we may see a 5% upside as shown on my chart with a risk-reward ratio of 1:2.1.

If it, however, drops further to the trend line, I will buy more using DCA and aim for 7% TP.

Will Walmart break into a new high NYSE:WMT Walmart has broken out of the consolidative range and is entering into a new high going forward. Major uptrend remain intact and ichimoku is showing a three bullish golden cross.

Long-term MACD is flat while Stochastic Oscillator has been rising steadily and formed a crossover above the

Walmart Stock Chart Fibonacci Analysis 080625Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 100/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

WMT6060990

Walmart Inc. 4.1% 28-APR-2027Yield to maturity

—

Maturity date

Apr 28, 2027

WMT4887055

Walmart Inc. 2.95% 24-SEP-2049Yield to maturity

—

Maturity date

Sep 24, 2049

WMT.IJ

Walmart Inc. 5.625% 01-APR-2040Yield to maturity

—

Maturity date

Apr 1, 2040

WMT3991377

Walmart Inc. 4.0% 11-APR-2043Yield to maturity

—

Maturity date

Apr 11, 2043

WMT4117478

Walmart Inc. 4.3% 22-APR-2044Yield to maturity

—

Maturity date

Apr 22, 2044

WMT.IM

Walmart Inc. 4.875% 08-JUL-2040Yield to maturity

—

Maturity date

Jul 8, 2040

WMT.IA

Walmart Inc. 5.875% 05-APR-2027Yield to maturity

—

Maturity date

Apr 5, 2027

WMT6060761

Walmart Inc. 4.35% 28-APR-2030Yield to maturity

—

Maturity date

Apr 28, 2030

WMT5571329

Walmart Inc. 4.5% 15-APR-2053Yield to maturity

—

Maturity date

Apr 15, 2053

WMT4055720

Walmart Inc. 4.75% 02-OCT-2043Yield to maturity

—

Maturity date

Oct 2, 2043

WMT5571289

Walmart Inc. 4.0% 15-APR-2030Yield to maturity

—

Maturity date

Apr 15, 2030

See all WALM34 bonds

Curated watchlists where WALM34 is featured.