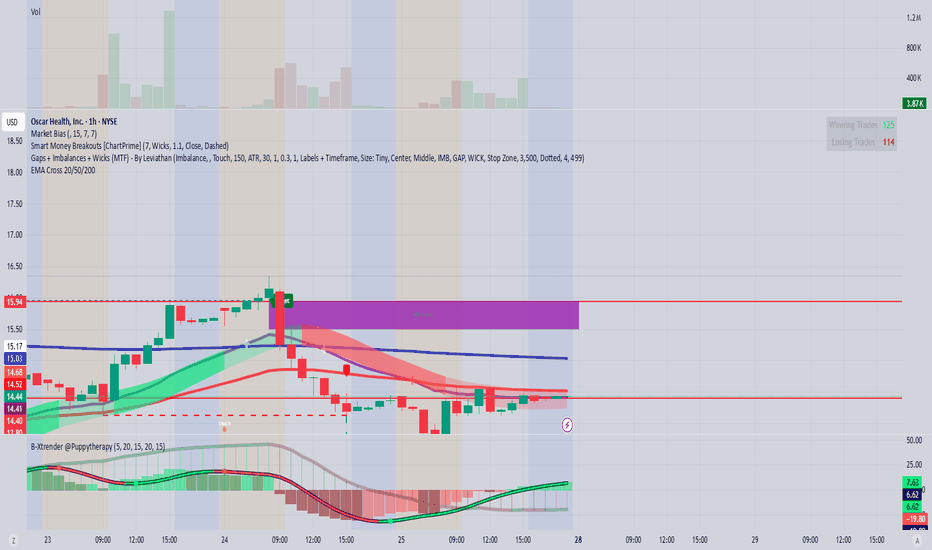

OSCR runningOSCR is on the move again. I have noted the greater range, but we have had trouble getting right back to the zone. I have created a target before the larger macro range setup. If you are short-term trading this, this would be a safer zone to exit.

My plan:

I was assigned most of my shares with ca

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−12.03 MXN

530.24 M MXN

191.35 B MXN

186.10 M

About Oscar Health, Inc.

Sector

Industry

CEO

Mark T. Bertolini

Website

Headquarters

New York

Founded

2012

FIGI

BBG01V59VCG7

Oscar Health, Inc. is a health insurance company, which serves its customers through a technology platform. It offers individual and family, small group and medicare advantage plans, and technology platform to others within the provider and payor space. The company was founded by Mario Tobias Schlosser, Kevin Nazemi, and Joshua Kushner on October 25, 2012 and is headquartered in New York, NY.

Related stocks

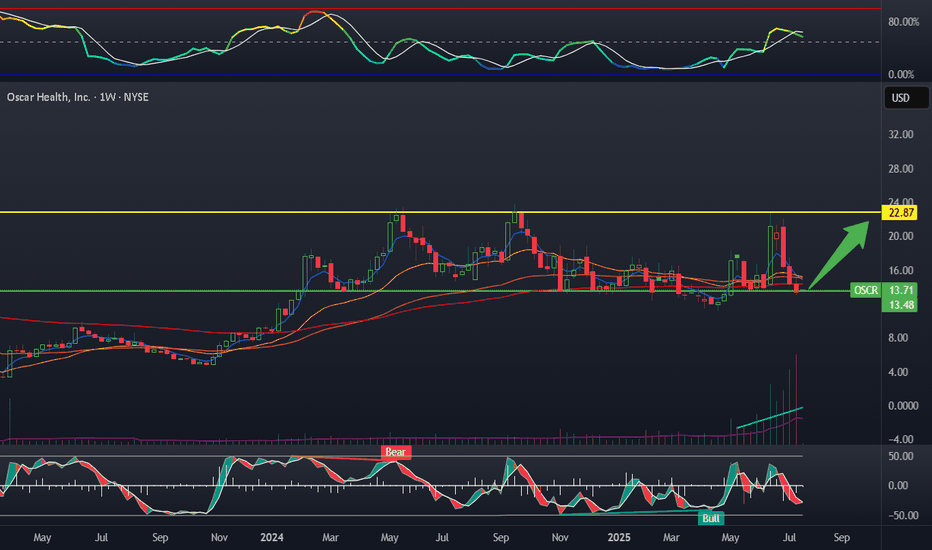

Aggressive pricing after ACA Hit.Oscar Health took a major hit this year due to ACA-related votes and sector headwinds, leading to sharp price declines.

The stock broke its downtrend aggressively, signaling strong momentum, although the pullback has also been volatile.

Oscar currently trades far below its estimated fair value of

OSCR - When in Doubt, Zoom out.When in doubt, Zoom out. Here we are at the current low point of NYSE:OSCR . As long as this holds which hopefully will, as it holds alot of weight to it, we have only UP from here. Holding alot of Cash, maintaining & raising Guidance marginally are clearly good signs.

What we have to take into ac

OSCR forming a Double Bottom – Bullish Reversal PotentialNYSE: OSCR - Oscar Health shows a potential double bottom, with a force bottom likely clearing stop-losses. Price has reclaimed key support, and stochastic is turning up, suggesting early bullish momentum.

Despite earnings missing estimates, the stock closed strong above support — a positive reacti

Oscar Health Stock Chart Fibonacci Analysis 080625Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 14/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

OSCR (Oscar Health Inc.) – BEARISH EARNINGS ALERTStrategy: Eagle Trap 🦅 | Bearish Confirmation 🔻

🟡 Current Price: $13.58

🔻 Trend: Bearish | Rejection at FBB 200 + Unfilled GAP

🗓️ Earnings: This Week

🔍 Quick Breakdown (35-criteria system):

✅ 32/35 bearish criteria confirmed

📉 Weak RSI, bearish MACD, trading below MA50 and MA200

📉 Rising volume on

OSCR LONGI know some love and some hate the stock, but from a fundamental standpoint, it's got a lot of potential. Cup and handle. Gaps to fill above. Resistance at 22-24 as of recent. Good Revenue, lots of cash on hand, classic profitable business model, low PE ratio and more all indicate a 30-50 dollar fut

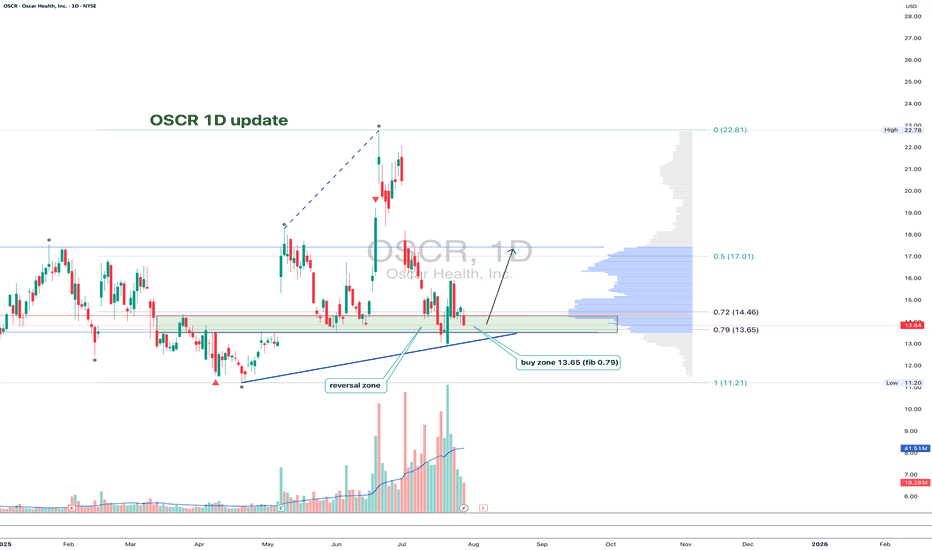

OSCR: back to support and now it’s decision timeAfter the recent impulse move, OSCR has pulled back to a key support zone around 13.65. That area aligns with the 0.79 Fib retracement, a horizontal level from spring, and a rising trendline that has already triggered reversals in the past. The structure is still intact, and buyers are testing the

OSCR will pumpOSCR was heavily shorted this past week despite growing fundamentals. The market seems split on the stock. I see heavy growth of baseline revenue, and operating cash flow turning positive. If the company makes 15 billion in revenue in 2023 with a 6% margin that will be 900 million in earnings. This

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Curated watchlists where OSCR is featured.

Frequently Asked Questions

The current price of OSCR is 310.40 MXN — it has increased by 6.68% in the past 24 hours. Watch OSCAR HEALTH INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange OSCAR HEALTH INC stocks are traded under the ticker OSCR.

OSCR stock has risen by 8.99% compared to the previous week, the month change is a 17.13% rise, over the last year OSCAR HEALTH INC has showed a 8.91% increase.

We've gathered analysts' opinions on OSCAR HEALTH INC future price: according to them, OSCR price has a max estimate of 335.37 MXN and a min estimate of 149.05 MXN. Watch OSCR chart and read a more detailed OSCAR HEALTH INC stock forecast: see what analysts think of OSCAR HEALTH INC and suggest that you do with its stocks.

OSCR reached its all-time high on Jun 20, 2025 with the price of 435.00 MXN, and its all-time low was 242.00 MXN and was reached on Jul 22, 2025. View more price dynamics on OSCR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

OSCR stock is 7.24% volatile and has beta coefficient of 0.35. Track OSCAR HEALTH INC stock price on the chart and check out the list of the most volatile stocks — is OSCAR HEALTH INC there?

Today OSCAR HEALTH INC has the market capitalization of 80.26 B, it has increased by 12.11% over the last week.

Yes, you can track OSCAR HEALTH INC financials in yearly and quarterly reports right on TradingView.

OSCAR HEALTH INC is going to release the next earnings report on Nov 11, 2025. Keep track of upcoming events with our Earnings Calendar.

OSCR earnings for the last quarter are −16.69 MXN per share, whereas the estimation was −15.18 MXN resulting in a −9.98% surprise. The estimated earnings for the next quarter are −10.28 MXN per share. See more details about OSCAR HEALTH INC earnings.

OSCAR HEALTH INC revenue for the last quarter amounts to 53.72 B MXN, despite the estimated figure of 54.75 B MXN. In the next quarter, revenue is expected to reach 57.44 B MXN.

OSCR net income for the last quarter is −4.28 B MXN, while the quarter before that showed 5.64 B MXN of net income which accounts for −175.96% change. Track more OSCAR HEALTH INC financial stats to get the full picture.

No, OSCR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 24, 2025, the company has 2.4 K employees. See our rating of the largest employees — is OSCAR HEALTH INC on this list?

Like other stocks, OSCR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade OSCAR HEALTH INC stock right from TradingView charts — choose your broker and connect to your account.