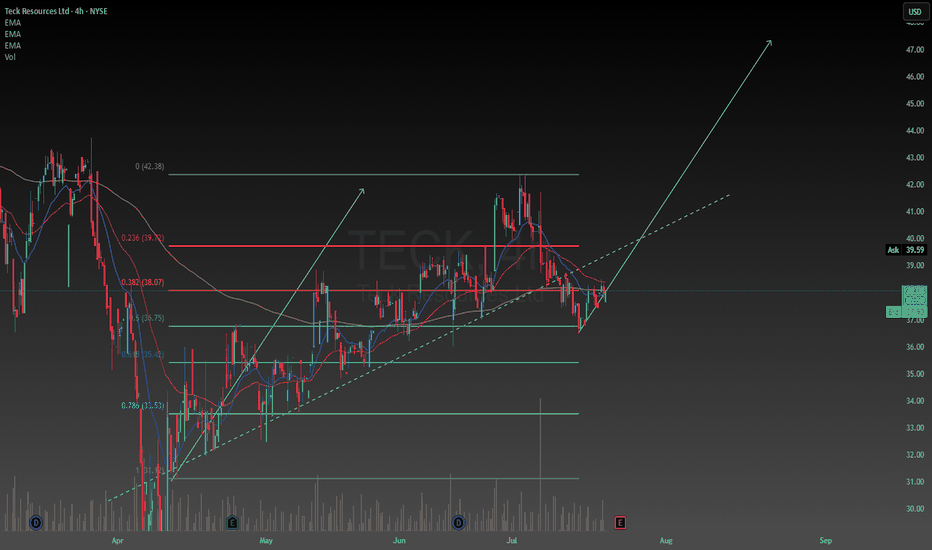

Long TeckThe fundamentals are good and macroeconomic factors contribute to the positive outlook. It seems to be trading above its intrinsic value but I'm going to take it anyways with the earnings report coming out soon the volatility should be interesting. Putting a couple percent of my portfolio to it and

Key facts today

Teck Resources is merging with Anglo American, with a shareholder vote on December 9 to create Anglo Teck, focusing on key copper projects in Chile and Peru.

Jefferies analysts believe the merger between Anglo American and Teck Resources will face little competition, especially after BHP retracted its bid for Anglo American.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

31.93 MXN

4.71 B MXN

131.34 B MXN

468.04 M

About Teck Resources Ltd

Sector

Industry

CEO

Jonathan H. Price

Website

Headquarters

Vancouver

Founded

1951

ISIN

CA8787422044

FIGI

BBG00CB4M0Y0

Teck Resources Limited is a resource company, which engages in the exploration, acquisition, development, production, and sale of natural resources. Its products include steelmaking coal, copper, zinc, industrial products and fertilizers, and other metals. Its project operations are located in Canada, Peru, U.S., and Chile. The company was founded on September 24, 1951 and is headquartered in Vancouver, Canada.

Related stocks

TECKgetting slightly higher highs, and higher lows which tells me its on its way up, the DI+ has spiked up which tells me the ADX will soon follow, once ADX is above 25 its considered a strong trend. RSI has just moved above the 14 day average RSI line which is a positive for it to gain in price. i thin

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US878744AB7

Teck Resources Limited 5.2% 01-MAR-2042Yield to maturity

6.26%

Maturity date

Mar 1, 2042

TCK.GR

Teck Resources Limited 6.25% 15-JUL-2041Yield to maturity

5.97%

Maturity date

Jul 15, 2041

TCK3884450

Teck Resources Limited 5.4% 01-FEB-2043Yield to maturity

5.96%

Maturity date

Feb 1, 2043

TCK.GN

Teck Resources Limited 6.0% 15-AUG-2040Yield to maturity

5.70%

Maturity date

Aug 15, 2040

US878742AE5

Teck Resources Limited 6.125% 01-OCT-2035Yield to maturity

5.48%

Maturity date

Oct 1, 2035

TCK5055534

Teck Resources Limited 3.9% 15-JUL-2030Yield to maturity

4.44%

Maturity date

Jul 15, 2030

TCK5005624

Teck Resources Limited 3.9% 15-JUL-2030Yield to maturity

2.71%

Maturity date

Jul 15, 2030

TCK5005625

Teck Resources Limited 3.9% 15-JUL-2030Yield to maturity

—

Maturity date

Jul 15, 2030

See all TECK/N bonds

Curated watchlists where TECK/N is featured.

Frequently Asked Questions

The current price of TECK/N is 740.05 MXN — it has decreased by −6.28% in the past 24 hours. Watch Teck Resources Limited Class B stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange Teck Resources Limited Class B stocks are traded under the ticker TECK/N.

TECK/N stock has fallen by −6.28% compared to the previous week, the month change is a −5.00% fall, over the last year Teck Resources Limited Class B has showed a −22.10% decrease.

We've gathered analysts' opinions on Teck Resources Limited Class B future price: according to them, TECK/N price has a max estimate of 1,054.61 MXN and a min estimate of 711.86 MXN. Watch TECK/N chart and read a more detailed Teck Resources Limited Class B stock forecast: see what analysts think of Teck Resources Limited Class B and suggest that you do with its stocks.

TECK/N reached its all-time high on Nov 12, 2024 with the price of 950.00 MXN, and its all-time low was 102.00 MXN and was reached on Feb 25, 2016. View more price dynamics on TECK/N chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TECK/N stock is 6.70% volatile and has beta coefficient of 1.90. Track Teck Resources Limited Class B stock price on the chart and check out the list of the most volatile stocks — is Teck Resources Limited Class B there?

Today Teck Resources Limited Class B has the market capitalization of 359.75 B, it has increased by 1.18% over the last week.

Yes, you can track Teck Resources Limited Class B financials in yearly and quarterly reports right on TradingView.

Teck Resources Limited Class B is going to release the next earnings report on Feb 18, 2026. Keep track of upcoming events with our Earnings Calendar.

TECK/N earnings for the last quarter are 10.00 MXN per share, whereas the estimation was 7.12 MXN resulting in a 40.50% surprise. The estimated earnings for the next quarter are 6.43 MXN per share. See more details about Teck Resources Limited Class B earnings.

Teck Resources Limited Class B revenue for the last quarter amounts to 44.55 B MXN, despite the estimated figure of 38.98 B MXN. In the next quarter, revenue is expected to reach 35.06 B MXN.

TECK/N net income for the last quarter is 3.70 B MXN, while the quarter before that showed 2.84 B MXN of net income which accounts for 30.31% change. Track more Teck Resources Limited Class B financial stats to get the full picture.

Yes, TECK/N dividends are paid quarterly. The last dividend per share was 1.67 MXN. As of today, Dividend Yield (TTM)% is 0.89%. Tracking Teck Resources Limited Class B dividends might help you take more informed decisions.

Teck Resources Limited Class B dividend yield was 0.86% in 2024, and payout ratio reached 79.39%. The year before the numbers were 0.89% and 10.71% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 24, 2025, the company has 7.2 K employees. See our rating of the largest employees — is Teck Resources Limited Class B on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Teck Resources Limited Class B EBITDA is 46.73 B MXN, and current EBITDA margin is 30.70%. See more stats in Teck Resources Limited Class B financial statements.

Like other stocks, TECK/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Teck Resources Limited Class B stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Teck Resources Limited Class B technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Teck Resources Limited Class B stock shows the sell signal. See more of Teck Resources Limited Class B technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.