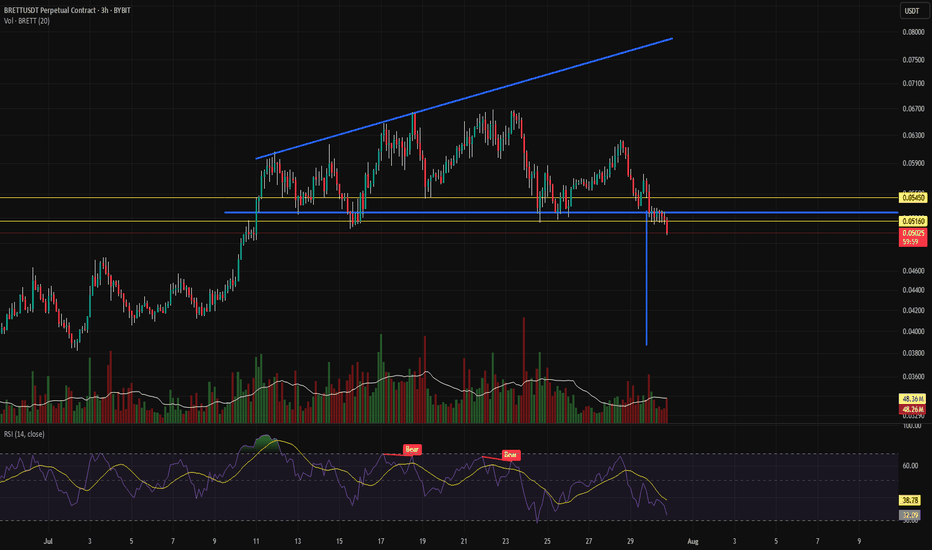

BRETT HTF Liquidity Raid + Demand TapWhat’s up, Candle Craft fam 🔥

We’re eyeing a high-probability bounce zone below structure for BRETT. No need to wait for confirmation here — the liquidity + structure setup is too clean.

📍 Updated Setup:

– Price broke rising wedge + retracing

– Anticipating dip into HTF demand pocket

– Bounce expec

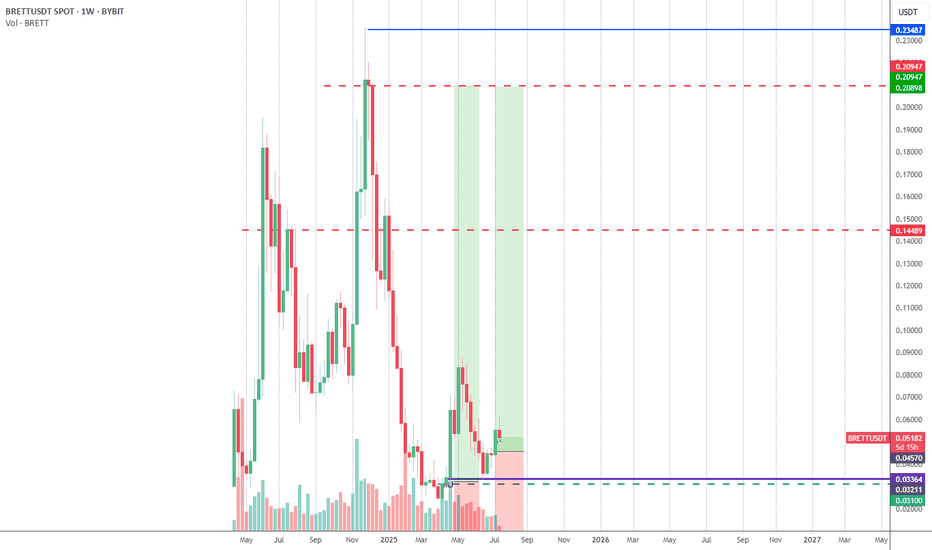

BRETTUSDTA lot of people still don’t get $BRETT — they see it as just another meme coin. But let me break it down. 🧠📉📈

BRETT isn’t random.

It comes straight from the Base ecosystem, backed by the viral success and culture of Matt Furie — the same creator behind Pepe the Frog 🐸. Yeah, that Pepe.

This isn’t

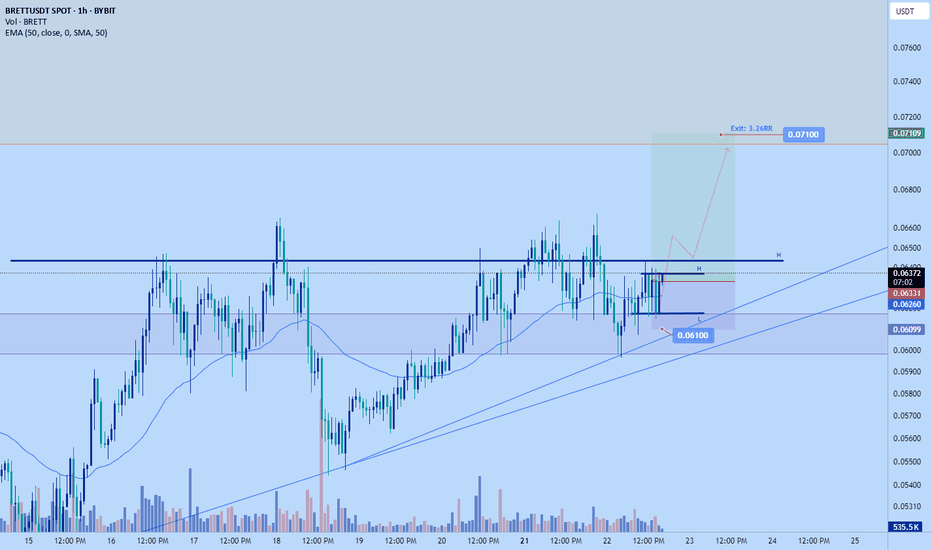

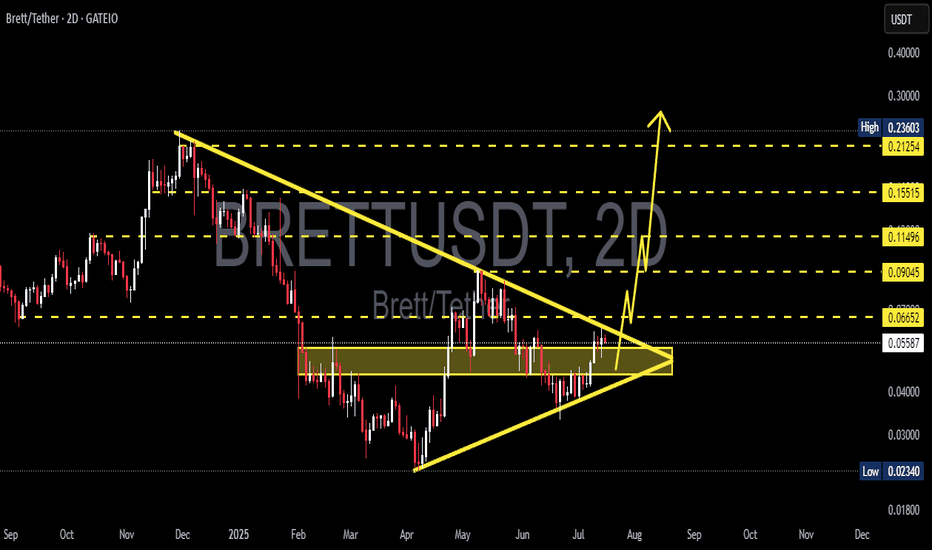

BRETT/USDT Poised for Explosive Breakout from SymmetricalThe crypto market is heating up again, and BRETT/USDT is showing one of the most promising technical setups right now. The pair is approaching a critical breakout point from a well-defined Symmetrical Triangle, signaling that a major move may be imminent.

🧠 Technical Pattern: Symmetrical Triangle

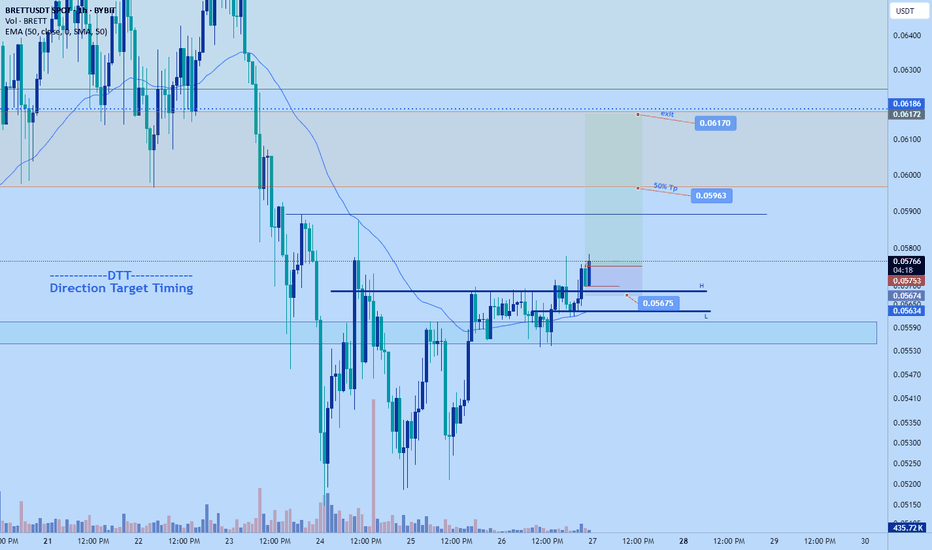

BRETT | Bullish StructureThe BRETT/USDT daily chart shows a significant bullish development as price has successfully reclaimed the 90-day VWAP (orange line) around $0.05802. This reclaim represents a crucial shift in market sentiment after months of consolidation.

Key Technical Observations:

Price broke above the 90-day

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.