AXIS BANK🔎 Multi-Timeframe (MTF) Analysis – AXIS BANK

TF Zone Trend Logic Proximal Distal Avg

Yearly Demand UP Demand 867 616 742

Half-Yearly Demand UP BUFL 1151 814 983

Quarterly Demand UP BUFL 1151 814 983

Monthly Demand UP BUFL 970 814 892

Weekly Demand UP BUFL 945 814 880

Daily Demand UP DMIP BUFL 964 81

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

90.00 INR

280.55 B INR

1.55 T INR

3.06 B

About Axis Bank Limited

Sector

Industry

CEO

Amitabh Chaudhry

Website

Headquarters

Mumbai

Founded

1993

ISIN

INE238A01034

FIGI

BBG000BD60T0

Axis Bank Ltd. engages in the provision of financial solutions to retail, small and medium enterprises, government, and corporate businesses. It operates through the following segments: Treasury, Retail Banking, Corporate or Wholesale Banking, and Other Banking Business. The Treasury segment includes investments in sovereign and corporate debt, equity and mutual funds, trading operations, derivative trading and foreign exchange operations on the proprietary account and for customers and central funding. The Retail Banking segment constitutes lending to individuals or small businesses subject to the orientation, product and granularity criterion and also includes low value individual exposures not exceeding the threshold limit. It also covers liability products, card services, internet banking, ATM services, depository, financial advisory services and NRI services. The Corporate or Wholesale Banking segment involves in corporate relationships, advisory services, placements and syndication, management of public issue, project appraisals, capital market related and cash management services. The Other Banking Business segment encompasses para banking activities such as third party product distribution and other banking transactions. The company was founded on December 3, 1993 and is headquartered in Mumbai, India.

Related stocks

Global Stock Market IndicesIntroduction

When people talk about “the market going up” or “the market crashing,” they are usually referring to a stock market index rather than individual stocks. Indices like the Dow Jones, S&P 500, FTSE 100, Nikkei 225, or Sensex are names that investors, traders, and even common people hear a

AXIX BANKAxis Bank Ltd. (currently trading at ₹1082) is India’s third-largest private sector bank, offering a full suite of financial services across retail banking, corporate banking, treasury, and wealth management. With over 5,000 branches and 15,000 ATMs, the bank serves more than 30 million customers. I

Axis BankRight now, Axis Bank is giving investors almost ₹90 per share ( EPS), at a premium of around 12. Now think of this — there was a time when a company looked attractive even at an 18x premium, when its earnings were just about ₹58 per share. Can you imagine what I’m trying to say? Think like a custome

Review and plan for 18th July 2025Nifty future and banknifty future analysis and intraday plan.

Analysis of quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

-

Axis Bank Hi,

price Trade in zone . And currently it is available at support area.

So it's possible that price will move above The support area

This idea is for Educational purpose and paper trading only. Please consult your financial advisor before investing or making any position. Facts or Data given

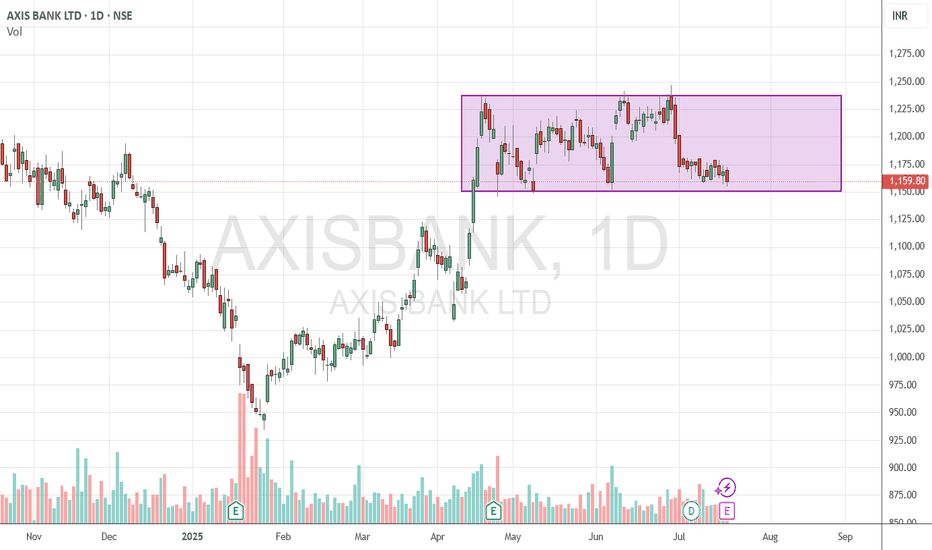

AXIS BANK at Best Support !!Here are two charts of Axis Bank — one in the 4-hour timeframe and the other in the 1-hour timeframe.

4-Hour Timeframe Chart:

In this chart, Axis Bank is moving within a parallel channel, with the support zone lying in the 1150–1160 range.

1-Hour Timeframe Chart:

Axis Bank is forming a descending

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AXISBANK is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of AXISBANK is 1,056.20 INR — it has increased by 0.57% in the past 24 hours. Watch Axis Bank Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange Axis Bank Limited stocks are traded under the ticker AXISBANK.

AXISBANK stock has risen by 0.37% compared to the previous week, the month change is a −1.60% fall, over the last year Axis Bank Limited has showed a −10.66% decrease.

We've gathered analysts' opinions on Axis Bank Limited future price: according to them, AXISBANK price has a max estimate of 1,691.00 INR and a min estimate of 827.00 INR. Watch AXISBANK chart and read a more detailed Axis Bank Limited stock forecast: see what analysts think of Axis Bank Limited and suggest that you do with its stocks.

AXISBANK reached its all-time high on Jul 12, 2024 with the price of 1,339.55 INR, and its all-time low was 14.30 INR and was reached on Nov 11, 2003. View more price dynamics on AXISBANK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AXISBANK stock is 0.99% volatile and has beta coefficient of 1.35. Track Axis Bank Limited stock price on the chart and check out the list of the most volatile stocks — is Axis Bank Limited there?

Today Axis Bank Limited has the market capitalization of 3.28 T, it has decreased by −2.29% over the last week.

Yes, you can track Axis Bank Limited financials in yearly and quarterly reports right on TradingView.

Axis Bank Limited is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

AXISBANK earnings for the last quarter are 18.70 INR per share, whereas the estimation was 20.10 INR resulting in a −6.97% surprise. The estimated earnings for the next quarter are 18.53 INR per share. See more details about Axis Bank Limited earnings.

Axis Bank Limited revenue for the last quarter amounts to 208.18 B INR, despite the estimated figure of 204.85 B INR. In the next quarter, revenue is expected to reach 204.16 B INR.

AXISBANK net income for the last quarter is 62.44 B INR, while the quarter before that showed 74.75 B INR of net income which accounts for −16.47% change. Track more Axis Bank Limited financial stats to get the full picture.

Yes, AXISBANK dividends are paid annually. The last dividend per share was 1.00 INR. As of today, Dividend Yield (TTM)% is 0.09%. Tracking Axis Bank Limited dividends might help you take more informed decisions.

Axis Bank Limited dividend yield was 0.09% in 2024, and payout ratio reached 1.10%. The year before the numbers were 0.10% and 1.17% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 6, 2025, the company has 104.45 K employees. See our rating of the largest employees — is Axis Bank Limited on this list?

Like other stocks, AXISBANK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Axis Bank Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Axis Bank Limited technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Axis Bank Limited stock shows the neutral signal. See more of Axis Bank Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.