Trade ideas

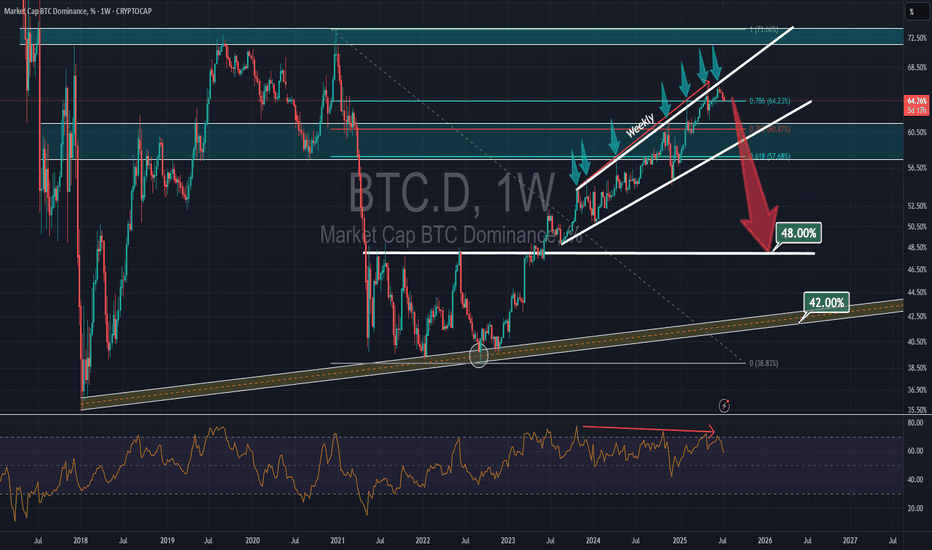

Bitcoin Dominance Found The Top; ALTcoin Dominance Stepping InHello Crypto traders! BTC.Dominance is falling in an impulsive fashion after we spotted the top within the wedge pattern. Now that is trading in wave (v) of a five-wave impulse from the highs, it just confirms a bearish reversal, which indicates that ALTcoin dominance is stepping in. And with still bullish Crypto market, we might be in the ALTseason.

Bitcoin Dominance about to flip BIG TIMEWe are about to see a kind of altseason only investor from 2017 can remember !

here is a possible ranking for the bull run peak !

and Yes, I believe XRP will flip ETH and retrieve it's historical 2nd spot !

Altcoin market cap forecasts of $5T to $8T

Forecast Ranking

Rank Coin Target Price Estimated Market Cap

1 BTC $200,000 $3.96 Trillion

2 XRP $30 $1.71 Trillion

3 ETH $12,000 $1.45 Trillion

4 SOL $2,500 $1.18 Trillion

5 DOGE $5 $733 Billion

6 BNB $4,000 $584 Billion

7 ADA $7 $250 Billion

8 LTC $2,000 $150 Billion

Dominance & Altcoins- This graph is purely based on fibonacci law.

- 61.8% is the core of the system ( check rectangles in graph to get it )

- Most of long term traders not even look at the price.

- they just wait the good time to buy using Fibo.

- in 2016 BTC was almost 100%. Altcoins were inexistant. (less than 2% of the market with ETH)

- in 2021 BTC Dominance pushed to 75% (altseason followed the push)

- in 2024 we could see BTC dominance knocks 60% ish ( Altseason will follow )

- BTC is maturing.

- Cryptos are growing.

- Don't look too much at your altcoin wallets.

- Most of the time the story repeats itself.

- Respect the cycle, be patient and eat noodles!

Happy Tr4Ding !

BTC Dominance at Critical Breakdown Point: Alts Could Shine NextBTC Dominance is now testing a major support zone for few days. A confirmed breakdown here could unlock significant strength for altcoins in the near term.

Chart Overview:

• Price has consistently made lower highs (LH) and recently printed a lower low (LL).

• After a failed bullish retest at 64.80%, it's back at the critical 64.46% support, which:

→ Aligns with the 0.382 Fibonacci retracement

→ Sits on top of a long-standing demand zone (marked in blue)

Bearish Continuation Bias:

• If this 64.46% zone breaks, the next downside targets lie at:

• 63.99% (0.5 Fib)

• 63.51% - 63.38% (0.618–0.65 golden zone)

• The yellow arrow path shows expected continuation in case of a confirmed breakdown.

What This Means for Traders: 📌

• A drop in BTC Dominance often coincides with altcoin rallies.

• A clean breakdown below 64.4% may fuel rotation from BTC into ALTs, especially in mid caps and L1 ecosystems.

Btc dominance I think btc dominance has peak , no way it keeps going up . Historically when it peaks money start to flow to ethereum first then alts . I am bullish on alts and eth I expect money to keep flowing to them gradually then fear of missing out will push up the price . I think alt season is warming up and will accelerate quickly

BTC DOMINANCE? Just wait few days guys It seems that Bitcoin dominance , after a long and exhausting uptrend, is finally showing signs of fatigue. The momentum appears to be fading, and a new downtrend has already begun. As you can observe, both the long-term and short-term trendlines have been broken on the daily timeframe, clearly indicating that Bitcoin dominance is shifting into a downtrend.

So, after waiting patiently for so long, hold on just a little bit more. A few more days of patience could change everything. Once dominance starts to fall, the altcoin index will rise, and your favorite altcoins will begin to pump rapidly.

Don’t lose hope. Stay alert. The tides are about to turn in your favor.

Yes, I agree—this time Bitcoin dominance tested everyone’s patience far more than usual. But that’s the nature of the market. It will always push you to your limits, make you sell at a loss, and then move exactly where you expected it to go.

Can an alt-season occur?Hello friends..

The area marked in Bitcoin dominance is an important area for market rotation, now what does market rotation mean?

That is, if Bitcoin dominance is corrected, we can see altcoins grow more than Bitcoin.

That is, in this period, the profit of altcoins will be greater than Bitcoin.

BTC.D – Distribution Confirmed. Is the Final Altseason Next?Over the past couple of months, I’ve been tracking the development of a potential high time frame (HTF) Wyckoff distribution range forming on BTC Dominance (BTC.D), and it’s now looking like that structure is starting to break down.

Back on June 14th, I noted that while we hadn’t confirmed a trend shift yet, BTC.D was showing strength and likely to push into the 65% region, with altcoin weakness to follow. The very next day, I shared my idea of a potential Wyckoff distribution forming — and since then, it’s followed that path almost perfectly.

🧠 What’s Happened Since?

✅ Sweep of the HTF range high at ~65%

✅ Second deviation of the highs

✅ Volume divergence into supply — declining volume + strong rejection candles

✅ Formation of a UTAD (Upthrust After Distribution)

✅ 1D bearish market structure break after the sweep

✅ Price now back inside the range

This is textbook distribution behaviour — even if it doesn’t follow the Wyckoff schematic to the letter, the key elements are present: deviation, volume drop-off, and structural breakdown.

🔮 What Comes Next?

BTC.D is currently holding inside a prior unmitigated daily demand, but given the structural shift, I’m expecting:

A pullback to 65–65.5% (daily supply + range high retest)

Then a continuation bearish, targeting:

🔸 49% (prior accumulation range high)

🔻 46% (FVG fill + range breakout retest)

These lower targets align with where I expect altcoins to top out — so as BTC.D breaks down, I expect capital to rotate hard into ETH and alts, triggering the final phase of altseason before the macro cycle top.

⚠️ Why This Matters

This distribution range has been developing since late 2024, and with BTC.D now showing bearish market structure, combined with:

- ETH.D flipping bullish

- OTHERS.D pushing higher

- Stablecoin dominance pairs breaking down

…we’re seeing confluence across the board for a risk-on altcoin environment.

I believe this is the setup that leads to the final euphoric altcoin rotation before the 4-year cycle top prints later this year.

📌 Watch for the retest. Watch for the rejection. The breakdown will be fast.

This is the window — time to stay sharp.

Let me know in the comments if you’ve been tracking this too, or drop your altcoin rotation picks.

— Marshy 🔥

1D:

3D:

1W:

1M:

Rising Wedge on Bitcoin Dominance - [BROKEN DOWNWARDS] The MASSIVE Rising Wedge on Bitcoin Dominance was broken downwards during the past week, most likely the 1W candle will also close below the support of the wedge.

What does it mean? The dominance will dump from 64% to at least 59%. This move can already provide us with the huge Altcoin Season! After this there more likely be a small correction towards 60%, and then we can freely dump further towards 54% zone.

I expect not only small cap, but major altcoins to be sent to new highs as well. Mark my words & be prepared for the last opportunity of this bull cycle!

BTC.D Slipping ! ALTSEASON Loading ? This is BTC.D on the daily chart.

It has shown a strong relationship with the 50MA (blue/cyan line), often using it as support. While there were a couple of daily closes below it in the past, they lasted only 1 or 2 candles.

Now we’ve seen 4 consecutive daily closes below the 50MA (including today), which increases the likelihood of a deeper move to search for support.

The next key support zone (green rectangle) is defined by the 200MA (red line) and the 62.25% level (black line) — both of which acted as support before.

If BTC.D drops into that zone, ETH and altcoins could experience a strong bounce.

Always take profits and manage risk.

Interaction is welcome.

$BTC.D: Failed breakout above 66%. Was that it? Time and again we investigate the CRYPTOCAP:BTC dominance chart. In my opinion it is the most important chart in the Crypto markets. I have supported the idea that we will see CRYPTOCAP:BTC.D touch 66% in this market cycle. In my first blog on this topic on April 14th I published the idea here in Trading view.

CRYPTOCAP:BTC.D to 66%, CRYPTOCAP:TOTAL2 / BTC down to 0.43 for CRYPTOCAP:BTC.D by RabishankarBiswal — TradingView

Since April time and again we looked at this chart and since I first preached the idea of CRYPTOCAP:BTC.D to 66.2% from 63% in April we had some hiccups in the way where the Altcoins tried to claim leadership. On May 20th I indicated that the short-term blip is not consequential.

CRYPTOCAP:BTC.D : Have we seen the top or a local top in the CRYPTOCAP:BTC.D ? for CRYPTOCAP:BTC.D by RabishankarBiswal — TradingView

We reaffirmed our view on June 22nd, and we confirmed our commitment to CRYPTOCAP:BTC.D to 66%.

CRYPTOCAP:BTC weathering the storm: CRYPTOCAP:BTC.D close to 66%. CRYPTOCAP:BTC to 160K. for BITSTAMP:BTCUSD by RabishankarBiswal — TradingView

We briefly touched 66% and failed to breakout on June 27th. Now we have hit an air pocket. In my opinion this should also pass. Confirming my view of CRYPTOCAP:BTC.D to 66.2% and 160K $BTC.

Verdict: CRYPTOCAP:BTC.D will cross 66.2% before all set and done. Price performance of Altcoin can be good going from here.

Verdict: CRYPTOCAP:BTC.D will cross 66.2% before all set and done. Price performance of Altcoin can be good going from here.

Btc Dominance Just doing retest, HOLD Everyone is selling their altcoins out of fear after minor pumps, but they don’t realize that Bitcoin dominance is only retesting its supply zone. It has already broken its structure, indicating a shift into a downtrend. This retest is not a reversal—yet people are spreading fear among each other as if something major is about to happen. Many will miss what’s coming and regret it later. Don't miss Altseason which is coming in few days not weeks.

Mind It

Bitcoin DominationHistorical cycle data on the indicator points to the possible end of bitcoin's dominance growth. This may indicate the beginning of capital reallocation in favor of altcoins. At least until May 7 we will have a short-term altcoin season, but if we are lucky, even until the end of May.

⚠️ Caution Amid Geopolitical Factors

While a temporary altcoin season may be on the horizon, it's essential to consider broader economic factors. Ongoing trade tensions, particularly involving the U.S., could introduce volatility into the markets. Such geopolitical uncertainties might render the current altcoin rally a bull trap, with potential downturns in the summer months.

BTC Dominance is OverCome one, come all, Bitcoins Dominance begins to fall. Alt coins are at the threshold of the precipice but like machines made to climb, they will do so with grace, ruthlessness and unforgiving elegance. Bitcoin may be the first cryptocurrency but does it matter if it’s the best?