BITCOIN Will Go Down! Short!

Please, check our technical outlook for BITCOIN.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 86,886.48.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 84,673.23 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

Market insights

BTCUSD: Market Sentiment & Forecast

Balance of buyers and sellers on the BTCUSD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the buyers, therefore is it only natural that we go long on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

BTCUSD Technical Analysis! BUY!

My dear subscribers,

BTCUSD looks like it will make a good move, and here are the details:

The market is trading on 87461 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 87892

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

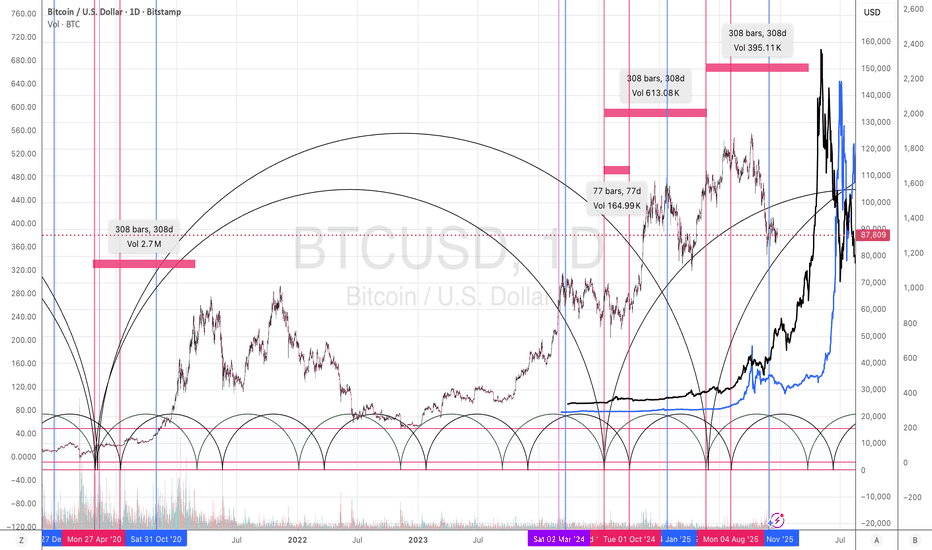

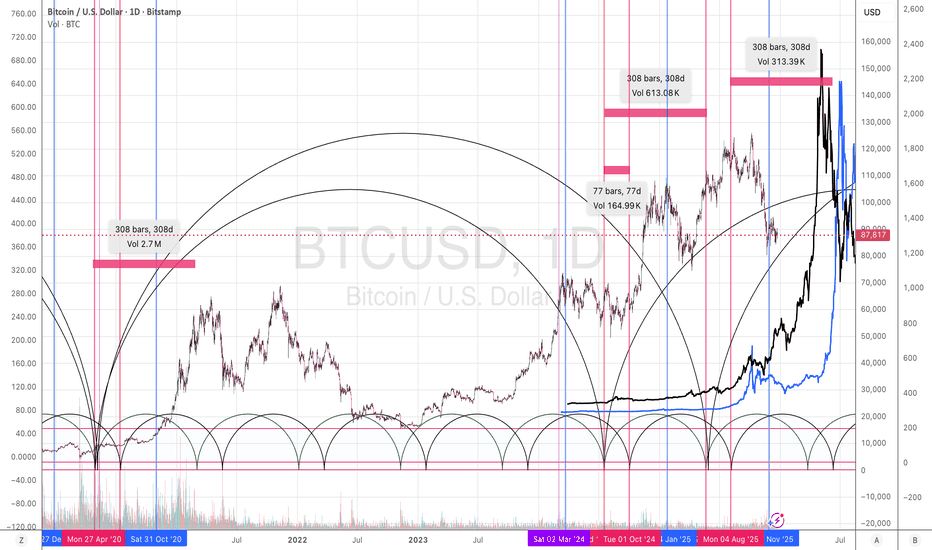

BTCUSD VIEW!! Macro trader plur daddy (@plur_daddy) argues bitcoin’s 2026 setup is less about crypto-specific catalysts and more about whether US liquidity conditions normalize after what he described as an unusually tight few months for risk.

His central claim is that repo “plumbing” has been strained by a shortage of bank reserves as leverage in the economy grew faster than the Fed’s balance sheet, and that the resulting stress showed up in broader markets — “very choppy and rotational dynamics in equities” — alongside “a quite adverse environment for crypto.” Going into the new year, he expects a set of incremental shifts that could move conditions from tight back toward neutral, even if they do not create a new “loose” regime.

Bitcoin (BTCUSD) – Demand Zone Rebound Targeting 90,400 ResistanMarket Structure

Short-term structure: Corrective / pullback within a broader bullish trend

BTC previously swept liquidity near the 90,400–90,500 area (marked target point), then rejected sharply.

Current price action shows lower highs, indicating a retracement phase rather than continuation yet.

🟥 Demand / Support Zone (Red Area)

Zone: ~85,400 – 86,450

This is a key demand & liquidity zone:

Prior impulsive bullish departure

Multiple reactions historically

Price recently tapped into this zone and bounced, confirming buyers are active here.

🟩 Upside Target / Supply (Green Area)

Target zone: ~90,400 – 90,500

This is:

Previous high

Strong resistance / liquidity pool

If price breaks structure to the upside, this zone becomes the primary bullish target.

📈 Current Price Behavior

Price is trading around 87,300

Structure shows:

Higher low forming inside demand

Early signs of bullish reversal, but confirmation is still needed

A break above the recent lower high (~88,000–88,200) would strengthen bullish continuation.

🧠 Trade Scenarios

✅ Bullish Scenario (Preferred)

Entry idea: Buy continuation after confirmation above 88,000

Aggressive entry: Deep pullback inside 86,000–85,500

Invalidation: Clean break & close below 85,388

Targets:

TP1: 88,800

TP2: 90,400 – 90,500

⚠️ Bearish Scenario

If price:

Fails to hold 86,000

Shows strong rejection from 88,000

Then price could range or revisit 85,000 liquidity

📌 Summary

Trend: Bullish overall, short-term corrective

Key zone: 85.4k–86.4k demand

Confirmation level: ~88k

Bias: Buy dips, wait for structure break before full conviction

If you want, I can:

Give a short chart title

Mark exact entry / SL / TP

Align this with H1 / H4 / Daily trend

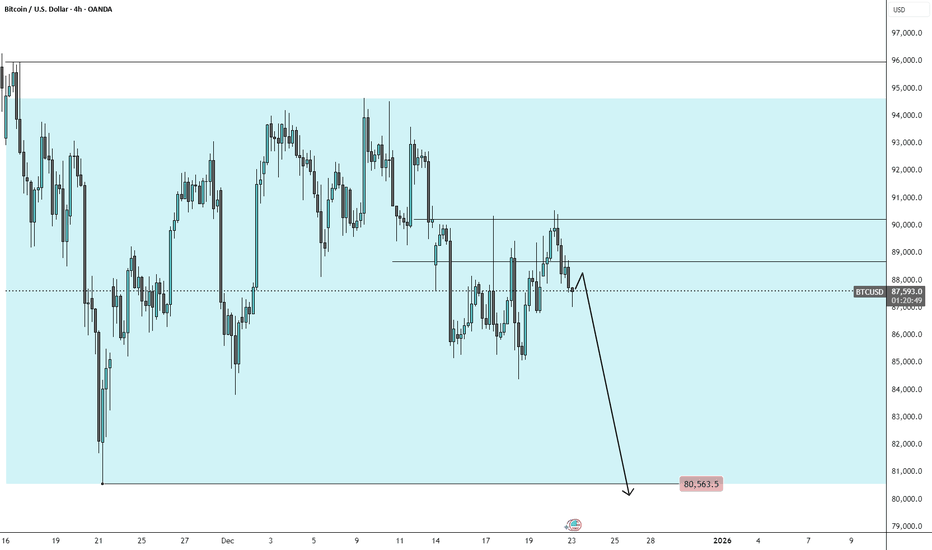

BTCUSD Today: Bearish Momentum Holds, Eyes $80,000.Analysis:

Bitcoin (BTCUSD) is currently showing signs of a bearish bias, as price tests key resistance levels and market structure suggests potential downside momentum. Sellers are likely to remain active while the broader market monitors macro and technical triggers.

🔑 Key Technical Levels

Support: 84,359

Resistance: 90,640

Bearish Target: 80,000

📉 Technical Outlook

From a technical standpoint, BTCUSD has started to form lower highs, indicating potential continuation of the bearish trend.

The 90,640 resistance is acting as a strong supply area, preventing upward movement.

A decisive break below 84,359 could accelerate downside momentum toward the 80,000 target, where the next major support zone is expected.

Short-term pullbacks may occur, but the overall structure favors bears as long as price remains below resistance.

🌍 Fundamental Context

Market sentiment remains sensitive to macro developments. A strengthening US Dollar or risk-off sentiment may further support downside pressure on Bitcoin.

🔮 Outlook

As long as BTCUSD holds below 90,640, the bearish scenario remains valid. Traders should watch 84,359 closely as a key level for potential acceleration toward 80,000.

Regards: Chart Analyst Pro.

#BTCUSD #Bitcoin #BTCAnalysis #CryptoTrading #CryptoMarket #BearishTrend

BTCUSD UNDER SELLING PRESSURE ?BTCUSD is currently trading around 86,800, with resistance near 87,560 and support around 86,500. Price failed to sustain momentum after reacting below the 92,000 supply zone, indicating weakening bullish strength.

On the 1H timeframe, the structure appears weak, suggesting increasing selling pressure at higher levels. If this weakness continues, a move toward the 85,500 demand zone could occur, where liquidity may be tested.

Key levels should be monitored closely for confirmation and price reaction.

Bitcoin Is Not Weak — This Is Liquidity CompressionCURRENT MARKET ANALYSIS – BTC/USD (H1)

Market Context

Bitcoin is currently trading in a compressed structure after a prolonged sideways range, following a strong rejection from the upper resistance zone. This move is not a trend reversal, but a liquidity-driven correction within a broader consolidation phase.

Structure & Price Behavior

The market previously formed a clear range between resistance (upper red zone) and support (lower gray zone), with multiple liquidity sweeps on both sides.

Price has now returned to the lower boundary of the range, where demand historically stepped in.

The recent sell-off shows weak follow-through, suggesting selling pressure is decreasing, not accelerating.

Technical Signals

Price is currently below EMA 34 and EMA 89, indicating short-term bearish pressure.

However, price is reacting at the range support, not breaking impulsively — a key sign of absorption rather than distribution.

The structure suggests a potential spring / false breakdown, commonly seen before range expansion.

Probable Scenarios

Primary Scenario (Higher Probability):

Price holds the 86.5k–87.0k support zone

Short-term base formation

Rotation back into the range

Continuation toward 88.8k → 89.5k → 90.6k

Invalidation Scenario:

A strong impulsive breakdown below the support zone with volume

This would open risk toward deeper downside liquidity

Market Conclusion

Market State: Sideways → Compression

Current Phase: Liquidity absorption at range support

Bias: Cautious bullish reversal from support

Strategy: Patience — wait for confirmation, do not chase volatility

👉 Bitcoin is not breaking down it is building energy. The next expansion will be clear once the range resolves.

Bitcoin Is Not Trending — This Is a Liquidity RangeBTC/USD (H1) — MARKET STRUCTURE ANALYSIS

1. Market State: Range-Bound, Not Trending

Bitcoin is currently trading inside a well-defined sideways range, bounded by a clear resistance zone above and a support base below. Price action confirms range rotation, not a directional trend.

Repeated rejections from the upper resistance zone

Multiple bounces from the same support area

No sustained impulsive follow-through beyond the range

This behavior signals liquidity accumulation, not trend continuation.

2. Moving Averages & Structure

EMA34 and EMA89 are flat and intertwined, confirming a non-trending environment.

Price oscillates around the MA cluster → classic consolidation signature.

The latest pullback returned price to range support, where buyers are reacting.

As long as price remains trapped between these boundaries, mean-reversion dominates.

3. Price Action Behavior

High wicks near resistance → aggressive sell-side defense

Strong reactions at support → demand absorption

Expansion attempts are repeatedly faded

This is textbook institutional range control, where liquidity is built on both sides before a decisive move.

4. Scenarios Ahead

Primary Scenario (High Probability):

Continued oscillation between support and resistance

False breaks to collect liquidity

Compression builds toward a future expansion

Breakout Scenario (Confirmation Required):

A clean H1 close above the resistance zone, followed by acceptance

Only then does upside continuation toward the next major liquidity zone become valid

Bearish Breakdown Scenario:

A decisive breakdown below support with strong volume

This would open a deeper corrective leg toward lower demand zones

5. Trading Logic

Avoid trend-chasing inside the range

Favor reaction-based trades at extremes

Patience is key until the market reveals direction

Conclusion

Bitcoin is not weak and not strong either. It is controlled, balanced, and preparing.

This range is a decision zone, and the real opportunity will come after price commits outside of it.

Until then, discipline and structural awareness outperform prediction.

Bitcoin with falling wedge!Price is compressing inside a falling wedge, suggesting fading downside momentum.

BTC bounced from the lower boundary and is now testing upper wedge resistance.

This area is a decision zone:

Acceptance above may shift short-term structure, rejection keeps the correction active.

Wait for price action confirmation on lower timeframes.

No anticipation, manage risk.

Educational only. No financial advice.

BTCUSD 12/23/2025Come tap into the mind of SnipeGoat, as he gives you THEE BEST Full Top-Down Analysis YOU'VE EVER SEEN!

_SnipeGoat_

_TheeCandleReadingGURU_

#PriceAction #MarketStructure #TechnicalAnalysis #Bearish #Bullish #Bitcoin #Crypto #BTCUSD #Forex #NakedChartReader #ZEROindicators #PreciseLevels #ProperTiming #PerfectDirection #ScalpingTrader #IntradayTrader #DayTrader #SwingTrader #PositionalTrader #HighLevelTrader #MambaMentality #GodMode #UltraInstinct #LawOfCirculation #TheeBibleStrategy

BTCUSD bearish sideways consolidation capped at 93,700The BTCUSD currency pair continues to display a bearish outlook, in line with the prevailing downward trend. Recent price action suggests a corrective pullback, potentially setting up for another move lower if resistance holds.

Key Level: 93,700

This zone, previously a consolidation area, now acts as a significant resistance level.

Bearish Scenario (rejection at 93,700):

A failed test and rejection at 93,700 would likely resume the bearish momentum.

Downside targets include:

84,340 – Initial support

82,350 – Intermediate support

80,490 – Longer-term support level

Bullish Scenario (breakout above 93,700):

A confirmed breakout and daily close above 93,700 would invalidate the bearish setup.

In that case, potential upside resistance levels are:

95,160 – First resistance

97,085 – Further upside target

Conclusion

BTCUSD remains under bearish pressure, with the 98,240 level acting as a key inflection point. As long as price remains below this level, the bias favours further downside. Traders should watch for price confirmation around that level to assess the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

BTC 4hr chartT.A explained -

BackSide (BS)

FrontSide (FS)

Inverse BS (Inv.BS)

Inverse FS (Inv.FS)

BS & FS levels are expected support when dashed lines, tested when dotted and resistance when solid lines.

The inverse is true for the Inv. BS Inv. FS levels, they are resistance as dashed lines, tested as dotted and support as solid lines.

Monthly timeframe is color pink

weekly grey

daily is red

4hr is orange

1hr is yellow

15min is blue

5min is green if they are shown.

strength favors the higher timeframe.

2x dotted levels are origin levels where trends have or will originate. When trends break, price will target the origin of the trend. its math, when the trend breaks, the vertex breaks too so the higher timeframe level/trend that breaks, the more volatility there could be as strength in the orders flow in to fuel the move.

BTCUSD: Massive Bullish Reversal from Support? Targeting 90kBitcoin has recently undergone a sharp correction, but it is now finding significant interest at lower levels. Based on the price action, we are seeing a classic "double bottom" or "W-formation" developing right above a crucial demand zone.

Technical Breakdown

The Bounce: BTC rejected the lower levels near 87,000 and is currently carving out a reversal pattern.

Support Zone: Current support is holding firm around 88,500.

The "Strong Support" Target: If momentum continues, the primary objective is the liquidity zone at 90,388.

Invalidation (Stop Loss): If the price drops below the recent swing low and breaks the 86,243 zone, this bullish thesis is invalidated.

Trade Setup

Entry Idea: Looking for a successful retest of the immediate support before the next leg up.

Target: 90,388 (Previous supply zone).

Risk/Reward: With a tight stop loss at the bottom red zone, the R:R on this trade is excellent.

December 19 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

Shortly, at 10:30 AM and 12:00 PM, the Nasdaq indicators will be released.

At the bottom left, the purple finger indicates the strategy, which follows yesterday's final long position entry point of $84,682.

*If the red finger follows the path, it is a one-way long position strategy.

1. Touch the first point of the purple finger at the top, or even if it doesn't, the red finger indicates the long position entry point at $86,935.2. Stop-loss price if the green support line is broken.

2. $90,815 is the first target for the long position -> Target price is up to Miracle over the weekend.

If the strategy is successful, the top point can be used as a long position re-entry point.

The first point at the top is today's maximum resistance level.

If it touches this point after 9:00 AM tomorrow,

it can ignore the resistance line and continue to rise.

Conversely, if it touches the bottom immediately, a sharp correction could occur, so focus on the 86.9K long position entry point.

Today, it's best to avoid breaking below the light blue support line (bottom) to safely move upward.

Below that, the weekend's lowest support line (2nd) -> double bottom (84082.2 dollars) remains.

If it reaches the double bottom,

unless a very strong rebound occurs,

an additional downtrend could occur next week, so be careful.

(The gray uptrend line is marked in section 2.)

**It's been a while since I've made this fully public.

My daily analysis, which I diligently write, is divided into key support and resistance levels,

and can be utilized in real-time from entry to liquidation.

So, I think it's no different.

Thank you for your support, and I'll make more full public releases in the future.**

Please use my analysis to this extent for reference only.

I hope you'll operate safely, with a strict trading strategy and stop-loss orders.

Thank you for your hard work this week.

BTCUSD – TMA Band Rejection & Mean Reversion ViewBitcoin moved aggressively into the upper TMA band, which usually signals overextension, not continuation.

Price failed to hold above that band and quickly got rejected from the premium zone marked on the chart.

After that rejection, BTC started moving back toward the mean / lower side of the TMA structure, which is a very common behavior in band-based systems.

This is not weakness — this is normal rebalancing after an extended move.

✨ My View

Once price rejects the upper TMA band and loses momentum, I don’t chase longs.

I simply follow the mean-reversion logic.

The next natural expectation area lies near the lower TMA band / value zone, which is already marked on the chart:

🎯 Expectation Zone: 85,610

This zone often acts as a magnet after a strong upper-band rejection, especially when momentum cools down quickly like this.

The arrow shows the probable path of price normalization, not prediction — just how TMA structures usually behave.

📘 Disclaimer

This is only my personal market approach, not financial advice.

Always manage risk.

BTC-----Sell around 90300-90000, target 88500-87000 areaYesterday's Market Recap:

Yesterday's intraday analysis clearly indicated that the resistance level was around 90500, which had been touched and subsequently pulled back multiple times. Last night, BTC reached a high of 90574, precisely hitting the resistance level. After selling, the price dropped to a low of 87800 in the early morning, resulting in a conservative profit of approximately 2700 points.

Today's Market Analysis: After yesterday's sharp drop of 2700 points, there was a slight rebound of about 1000 points this morning in Asia. Currently, it is still fluctuating within the 86000-90500 range. The key resistance level to watch is 90500. If a short-term rebound reaches the 90300-90000 range and fails to break through, consider selling. If it breaks through, look for a further sell opportunity around 91000. On the downside, watch the trend support at 86000. If a pullback to the 86000-86300 range holds, consider buying. If it breaks through, look for a further buy opportunity around 84500.

Technical Analysis:

The daily Bollinger Bands are narrowing, and after a series of positive days, a doji candlestick pattern formed at the high, indicating a clear reversal signal. The price tested the 90000 psychological level before encountering resistance and falling back, suggesting a short-term bearish trend.

The middle Bollinger Band and the 30-day moving average (MA30) are forming a confluence of resistance around 89500, with the lower Bollinger Band at 85300 as the target.

On the 12-hour chart, the middle Bollinger Band and the 10-day moving average (MA10) are forming support around 88000. A break below this level could lead to a further decline to 85800.

On the 2-hour chart, after last night's high-level spike, a green 9 signal appeared in the TD indicator, indicating a short-term drop of 2700 points. If the Bollinger Bands continue to widen, there is still room for further decline.

In summary, the intraday strategy is primarily to sell on rallies, with buying on dips as a secondary approach.

Trading Strategy:

1️⃣ Sell in the 90300-90000 range, with a target of 88500-87000 and a stop-loss at 90800.

2️⃣ Buy in the 86000-86300 range, with a target of 87500-89000 and a stop loss at 85500.

BTCUSD VIEW!!A new VanEck report suggests the recent dip in mining activity could signal a bullish turn for bitcoin, echoing historical market patterns.

In a Monday report titled "Mid-December 2025 Bitcoin ChainCheck," VanEck analysts said bitcoin has historically been more likely to post positive returns following periods of declining mining activity.

They found that since 2014, 90-day forward bitcoin returns were positive 65% of the time when the network's hashrate was shrinking, compared with 54% when hashrate was growing.

Geopolitical Risk and Its Role in Causing Market VolatilityGeopolitical risk refers to the uncertainty and instability arising from political events, international conflicts, diplomatic tensions, trade disputes, sanctions, wars, terrorism, and changes in government policies across countries. In an increasingly interconnected global economy, geopolitical developments in one region can rapidly spill over into global financial markets. As a result, geopolitical risk has become one of the most powerful and unpredictable drivers of market volatility, affecting equities, bonds, commodities, currencies, and even cryptocurrencies.

Understanding the Link Between Geopolitics and Markets

Financial markets thrive on stability, predictability, and confidence. Geopolitical events disrupt these conditions by introducing uncertainty about future economic outcomes. When investors are unable to accurately assess risks or forecast returns due to political instability, they tend to react emotionally—often selling riskier assets and moving capital toward safer investments. This sudden shift in investor behavior leads to sharp price movements, higher volatility, and sometimes prolonged market turbulence.

Markets are forward-looking by nature. Even the expectation of a geopolitical event—such as a potential war, sanctions, or breakdown of trade negotiations—can trigger volatility well before the event actually occurs. This makes geopolitical risk particularly dangerous, as markets may overreact to rumors, media headlines, or speculative assessments.

Types of Geopolitical Events That Trigger Volatility

Several forms of geopolitical risk have historically caused significant market disruptions:

Wars and Military Conflicts: Armed conflicts directly impact global supply chains, energy markets, and investor confidence. Wars often lead to spikes in oil, gold, and defense stocks, while equities and emerging market assets may decline sharply.

Trade Wars and Economic Sanctions: Trade disputes between major economies can disrupt global commerce, raise inflation, and reduce corporate profits. Tariffs and sanctions increase uncertainty for multinational companies, leading to stock market volatility.

Political Instability and Regime Changes: Coups, revolutions, contested elections, or sudden policy shifts can destabilize domestic markets and cause capital flight, especially in developing economies.

Terrorism and Security Threats: Major terrorist attacks often trigger immediate market sell-offs due to fear and uncertainty, particularly in travel, tourism, and financial sectors.

Diplomatic Tensions: Breakdown in diplomatic relations between powerful nations can affect currency markets, defense stocks, and global investor sentiment.

Impact on Different Asset Classes

Geopolitical risk does not affect all markets equally. Its impact varies across asset classes:

Equity Markets: Stock markets usually react negatively to rising geopolitical tensions. Higher uncertainty leads to lower risk appetite, reduced valuations, and sharp intraday swings. Defensive sectors like utilities and consumer staples may outperform, while cyclical sectors suffer.

Bond Markets: Government bonds of stable economies often benefit from “flight-to-safety” behavior. Yields fall as investors seek protection, while bonds from politically unstable regions face rising yields and falling prices.

Commodities: Commodities are highly sensitive to geopolitical risk. Oil prices often surge during Middle East tensions, while gold tends to rise as a safe-haven asset. Agricultural and industrial commodities may also face supply disruptions.

Currency Markets: Safe-haven currencies such as the US dollar, Swiss franc, and Japanese yen usually strengthen during geopolitical crises, while currencies of emerging markets and conflict-affected regions weaken sharply.

Cryptocurrencies: Although sometimes viewed as alternative safe assets, cryptocurrencies often experience heightened volatility during geopolitical shocks due to speculative behavior and liquidity concerns.

Investor Psychology and Volatility Amplification

Geopolitical risk amplifies volatility largely through investor psychology. Fear, uncertainty, and herd behavior play a crucial role in market reactions. News headlines, social media, and 24/7 global media coverage intensify emotional responses, often leading to exaggerated price movements. Algorithmic and high-frequency trading systems further accelerate volatility by reacting instantly to geopolitical news triggers.

In many cases, markets initially overreact to geopolitical events, followed by partial recoveries once the situation becomes clearer. However, prolonged or escalating conflicts can lead to sustained volatility and long-term repricing of assets.

Role of Globalization and Interconnected Markets

Globalization has magnified the impact of geopolitical risk on financial markets. Modern supply chains span multiple countries, meaning disruptions in one region can affect production, inflation, and earnings worldwide. Financial institutions are also deeply interconnected, allowing shocks to spread rapidly across borders. This interconnectedness ensures that geopolitical risk is no longer a local issue—it is a global market concern 🌐.

Risk Management and Strategic Implications

For investors and traders, understanding geopolitical risk is essential for effective risk management. Diversification across asset classes, regions, and sectors helps reduce exposure to political shocks. Hedging strategies using options, commodities like gold, or safe-haven currencies can also mitigate downside risk. Long-term investors often benefit from maintaining discipline and avoiding panic-driven decisions during geopolitical crises.

From a policy perspective, central banks and governments closely monitor geopolitical developments, as they can influence inflation, growth, and financial stability. In extreme cases, geopolitical shocks may prompt emergency monetary or fiscal interventions to stabilize markets.

Conclusion

Geopolitical risk is a persistent and unavoidable feature of global financial markets. By disrupting economic stability, altering investor sentiment, and triggering rapid capital flows, geopolitical events are a major cause of market volatility. As global political dynamics continue to evolve—with rising multipolar tensions, trade fragmentation, and regional conflicts—markets are likely to experience frequent bouts of uncertainty and sharp price swings.

For market participants, the key lies not in predicting geopolitical events—which is often impossible—but in understanding their potential impact and preparing resilient investment strategies. In an era where politics and markets are deeply intertwined, geopolitical risk will remain one of the most powerful forces shaping financial market volatility 📊⚠️.