CHFEUR trade ideas

EURCHF LongHi Everyone,

Hope you are all well and enjoyed my gold signal that hit all TP's

Here is our EURCHF Signal. wait for the 15 minute candle to close above the entry, and then for price to respect the entry, then we can enter. Here are the numbers.

EURCHF Buy

📊Entry: 0.95727

⚠️Sl: 0.95176

✔️TP1: 0.96349

✔️TP2: 0.97141

✔️TP3: 0.98148

Stick to the rules

Hope you all earn lots of profit.

Best wishes,

Sarah

Watch Out for 0.9510 Support for EURCHFEURCHF is approaching the 0.9510 support level ahead of the SNB decision. Markets are currently pricing in a 25 basis point rate cut with a 68.1% probability. However, the recent relief in the Swiss franc may give the SNB reason to hold rates steady.

Our view is that the SNB will proceed with a 25 basis point cut today, and the 0.95–0.9510 support area is likely to hold. However, if this support zone breaks, it could trigger a medium-term selloff, potentially pushing EURCHF below 0.94.

EUR_CHF BEARISH BREAKOUT|SHORT|

✅EUR_CHF broke out

Of the bearish wedge pattern

So we are locally bearish

Biased and we will be

Expecting a further

Bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

#EURCHF 4HEURCHF (4H Timeframe) Analysis

Market Structure:

The price is currently testing a well-established trendline resistance, which has previously acted as a barrier for upward movement. Sellers have shown strong presence at this level, leading to potential downside pressure.

Forecast:

A sell opportunity may emerge if the price faces rejection at the trendline resistance and forms bearish confirmation. If the resistance holds, the market may continue its downward movement.

Key Levels to Watch:

- Entry Zone: Selling near the trendline resistance after confirmation of rejection.

- Risk Management:

- Stop Loss: Placed above the trendline resistance to minimize risk.

- Take Profit: Target lower support zones or previous swing lows.

Market Sentiment:

If the price remains below the trendline resistance, the bearish outlook stays valid. However, a breakout above this level could shift sentiment toward further bullish movement.

EURCHF My Opinion! BUY!

My dear followers,

This is my opinion on the EURCHF next move:

The asset is approaching an important pivot point 0.9588

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 0.9605

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

———————————

WISH YOU ALL LUCK

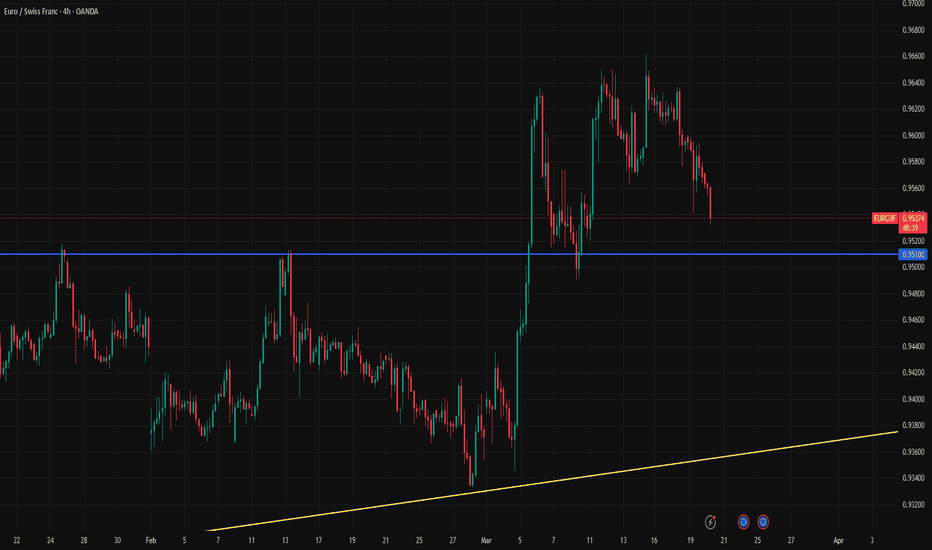

Scenario Analysis of EUR/CHF 4H Chart1. Market Structure

The market was previously in a downtrend but experienced a strong bullish breakout around early March.

Price surged upwards, breaking a key resistance zone (now acting as support).

The current price action appears to be forming a rising wedge, a potential reversal pattern.

2. Key Levels

Support Zone: Around 0.9500, which was previously resistance and now turned into a strong support.

Resistance Zone: Around 0.9650, where price is facing difficulty breaking above.

Current Price: 0.95986.

3. Chart Pattern - Rising Wedge

A rising wedge is visible, which is often a bearish reversal pattern.

Price is consolidating near the upper boundary of the wedge, showing signs of exhaustion.

If price breaks below the wedge, a bearish move towards the 0.9500 level is likely.

4. Confirmation Factors

EMA 50: The price is currently hovering around the 50-period EMA, indicating a possible shift in momentum.

Bearish Rejection Wicks: There are multiple rejection candles at the resistance zone, showing seller strength.

Breakout Zone: If the price breaks below the wedge and the gray support zone, it will confirm a bearish move.

5. Trading Plan

Bullish Scenario: If price breaks above the wedge and sustains above 0.9650, it could push towards 0.9700+.

Bearish Scenario: If price breaks below the wedge and the support zone, a drop towards 0.9500 or lower is expected.

Best Approach: Wait for a breakout confirmation before entering a trade.

VWAP + S&R - Technical & Fundamental ConfluenceTechnical Setup: EURCHF is rejecting Asia high, aligning with the two-day anchored VWAP, which reinforces this level as a key area of interest.

Fundamental Outlook: Several factors support a bullish bias:

CO2 data, retail positioning, seasonality, GDP, and interest rates all indicate strength for EUR.

The combination of these factors suggests a continuation of the uptrend.

With both technical and fundamental confluence, this setup presents a strong case for a bullish move in EURCHF.

EURCHF Bullish Breakout supported at 0.9530The EUR/CHF currency pair is showing a bullish sentiment, supported by the prevailing long-term uptrend. Recent intraday price action indicates a bullish breakout from a sideways consolidation phase, with the previous resistance now acting as a new support zone.

Key Support and Resistance Levels:

Support Zone: The critical support level to watch is 0.9530, representing the previous consolidation price range. A corrective pullback toward this level, followed by a bullish rebound, would confirm the continuation of the uptrend.

Upside Targets: If the pair sustains a bounce from 0.9530, it may aim for the next resistance at 0.9640, followed by 0.9665 and 0.9690 over the longer timeframe.

Bearish Scenario: A confirmed break and daily close below 0.9530 would negate the bullish outlook and increase the likelihood of further retracement. In this scenario, the pair could retest the 0.9500 support level, with further downside potential toward 0.9450.

Conclusion:

The bullish sentiment for EUR/CHF remains intact as long as the 0.9530 support holds. Traders should monitor the price action at this key level to assess potential buying opportunities. A successful bullish bounce from 0.9530 would favor long positions aiming for the specified upside targets. However, a break below 0.9530 would signal caution and increase the risk of a deeper pullback.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURCHF is starting to turn upLooks like a trend reversal at last.

1. Strong pinbars from the levels below 0.92 that rob the stops.

2. A broken trend line, higher lows, higher highs

3. it is currently at a very important level,we are watching how it will react and whether it will be overcome.

4. We are now long on a larger time frame.

EUR-CHF Bearish Wedge Pattern! Sell!

Hello,Traders!

EUR-CHF was trading in an

Uptrend but the pair has formed

A bearish wedge pattern so

IF we see a bearish breakout

From the wedge we will be

Expecting a bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/CHF "Euro vs Swiss" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CHF "Euro vs Swiss" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.93800 (swing Trade Basis) Using the 4H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.96100 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

EUR/CHF "Euro vs Swiss" Forex market is currently experiencing a bullish trend,., driven by several key factors.

⚫Market Overview

Current Price: 0.94487

30-Day High: 0.95300

30-Day Low: 0.93300

30-Day Average: 0.94300

Previous Close Price: 0.94350

Change: 0.00137

Percent Change: 0.14%

🔴Fundamental Analysis

Economic Indicators: The Eurozone's GDP growth rate is expected to slow down to 1.2% in 2025, while Switzerland's GDP growth rate is expected to remain steady at 1.5%.

Monetary Policy: The European Central Bank is expected to maintain its interest rates at 0.0% in 2025, while the Swiss National Bank is expected to maintain its interest rates at -0.75%.

Trade Balance: The Eurozone's trade balance is expected to remain in surplus, while Switzerland's trade balance is expected to remain in surplus.

Inflation Rate: The Eurozone's inflation rate is expected to rise to 2.0% in 2025, while Switzerland's inflation rate is expected to remain steady at 1.0%.

⚪Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for the EUR, driven by increasing investor confidence.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for the EUR as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for the EUR.

Commodity Prices: Commodity prices are expected to rise by 5% in 2025, driven by increasing demand for raw materials.

🔵COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 50%

Open Interest: 80,000 contracts

Commercial Traders (Companies):

Net Short Positions: 40%

Open Interest: 40,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 10%

Open Interest: 10,000 contracts

COT Ratio: 1.3 (indicating a neutral trend)

🟢Sentimental Outlook

Institutional Sentiment: 55% bullish, 45% bearish.

Retail Sentiment: 50% bullish, 50% bearish.

Market Mood: The overall market mood is neutral, with a sentiment score of +10.

Technical Analysis

Trend: The EUR/CHF pair is experiencing a neutral trend, with the market respecting the 20-period Weighted Moving Average (WMA) as dynamic support

Key Levels: Support Zone: 0.93800 - 0.94000, Resistance Zones: 0.94800 & 0.95300 - 0.95500

Target: 0.95000, with a potential further decline to 0.93000

🟠Next Move Prediction

Bullish Move: Potential upside to 0.95300-0.96100.

Target: 0.96100 (primary target), 0.96500 (secondary target)

Next Swing Target: 0.97500 (potential swing high)

Stop Loss: 0.92800 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 0.013 vs potential loss of 0.006)

🟡Future Data Summary

1-Day: -0.01%

5-Days: 0.20%

1-Month: -0.50%

6-Months: -1.20%

🟤Overall Outlook

The overall outlook for EUR/CHF is neutral, driven by a combination of fundamental, technical, and sentimental factors. The expected stability in global economic growth, neutral interest rate environment, and neutral market sentiment are all supporting the neutral trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

11/03/2025 - EURCHF Short Trade PlanTrade Details:

Entry: 0.96251

Stop Loss: 0.96380

Take Profit 1: 0.95800

Final Target: 0.94176

Reason for Trade:

Bearish Rejection from the supply zone.

Bearish RSI Divergence, signaling potential downside movement.

Disclaimer : This trade plan is for educational purposes only and is not financial advice. Always perform your own analysis and risk assessment before executing any trade.

EURCHF: Short Trading Opportunity

EURCHF

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell EURCHF

Entry - 0.9606

Stop - 0.9661

Take - 0.9503

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️