EURCHF INTRADAY sideways consolidation EUR/CHF – Simple Technical Analysis

The EUR/CHF pair is currently showing a neutral sentiment, with price moving sideways in a consolidation range. Recent intraday action suggests a corrective pullback toward support at 0.9317, which is a key level from a previous range.

If the pair bounces from 0.9317, it could push higher toward 0.9475, and potentially extend gains to 0.9586 and 0.9743 over the longer term.

However, if 0.9317 breaks down and the pair closes below it, the bullish scenario would be invalidated. This could trigger further downside toward 0.9200, and possibly 0.9050.

Conclusion

Above 0.9317 = Neutral-to-bullish bias; watch for upside toward 0.9475+

Below 0.9317 (daily close) = Turns bearish; opens downside toward 0.9200 and 0.9050

Current sentiment: Range-bound / wait for breakout confirmation

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CHFEUR trade ideas

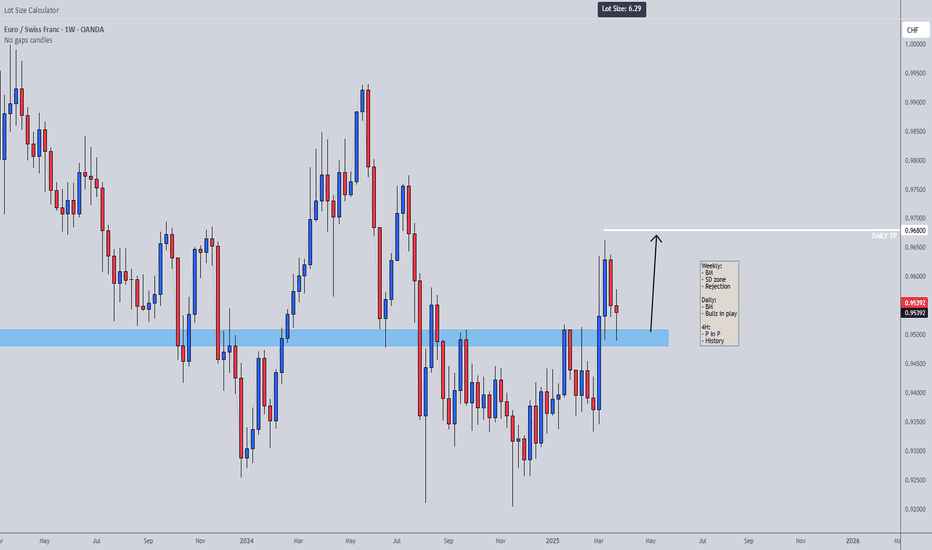

EUR/CHF Bullish Reversal Setup from Key Support Zone – Targeting1. Support Zone (Purple Box at Bottom):

The price has tested this zone multiple times (marked by green arrows), indicating strong demand and a potential double or triple bottom pattern forming.

This support zone ranges roughly between 0.93150 and 0.93350.

2. Projected Bullish Move:

A projected move is drawn from the current price level (around 0.93638) to a target zone near 0.94774, which is marked as the "EA Target Point".

This suggests a potential gain of approximately 1.53% (142.7 pips).

3. Exponential Moving Averages (EMAs):

EMA 30 (red) is currently below the

EURCHF: Classic Gap Down To TradeOut of the different gap openings present today, the one I noticed on 📈EURCHF appears to be a promising trading opportunity.

I have identified a clear double bottom pattern on the hourly chart following the gap down opening.

There is a strong likelihood that the gap will be filled soon, with a target set at 0.9431.

EURCHF: One More Gap 🇪🇺🇨🇭

One more gap is going to be filled today.

EURCHF violated a resistance line of a narrow consolidation range

on an hourly time frame.

It looks like the price is heading towards a gap down opening level now.

Goal - 0.9429

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/CHF: Bullish Continuation in ProgressWelcome back! Let me know your thoughts in the comments!

** EURCHF Analysis !

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support! Welcome back! Let me know your thoughts in the comments!

EUR_CHF BULLISH BREAKOUT|LONG|

✅EUR_CHF is going up now

And the pair made a bullish

Breakout of the key level

Of 0.9570 which is now a support

And the breakout is confirmed

So we are bullish biased

And after the pullback

We will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCHF INTRADAY breakout retest at 0.9520

The EUR/CHF currency pair is showing a bullish sentiment, supported by the prevailing long-term uptrend. Recent intraday price action indicates a bullish breakout from a sideways consolidation phase, with the previous resistance now acting as a new support zone.

Key Support and Resistance Levels:

Support Zone: The critical support level to watch is 0.9530, representing the previous consolidation price range. A corrective pullback toward this level, followed by a bullish rebound, would confirm the continuation of the uptrend.

Upside Targets: If the pair sustains a bounce from 0.9530, it may aim for the next resistance at 0.9640, followed by 0.9665 and 0.9690 over the longer timeframe.

Bearish Scenario: A confirmed break and daily close below 0.9530 would negate the bullish outlook and increase the likelihood of further retracement. In this scenario, the pair could retest the 0.9500 support level, with further downside potential toward 0.9450.

Conclusion:

The bullish sentiment for EUR/CHF remains intact as long as the 0.9530 support holds. Traders should monitor the price action at this key level to assess potential buying opportunities. A successful bullish bounce from 0.9530 would favor long positions aiming for the specified upside targets. However, a break below 0.9530 would signal caution and increase the risk of a deeper pullback.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EUR/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

Bearish trend on EUR/CHF, defined by the red colour of the last week candle combined with the fact the pair is overbought based on the BB upper band proximity, makes me expect a bearish rebound from the resistance line above and a retest of the local target below at 0.948.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURCHF LONG LIVE TRADE AND EDUCATIONAL BREAK DOWN LONGCentral Bank Policies:

The Swiss National Bank (SNB) policy decisions significantly impact the CHF. Recent SNB rate cuts are a key factor influencing the EUR/CHF pair.

Conversely, the European Central Bank (ECB) policies regarding the Eurozone also have a large impact on the EUR side of the pairing.

EURCHF short bearish push expected

OANDA:EURCHF trend based analysis, we can see bearish trend in last period, we are have rectangle channel, which is breaked, price is start moving more bearish, its make few revers on sup zone, few touches of sup zone.

Now we can see strong bearish candle, from here now expecting this structure is confirmed and we can see now higher bearish fall.

SUP zone: 0.95500

RES zone: 0.94350

POTENTIAL LONG TRADE SET UP FOR EURCHFAnalysis: Utilizing chart patterns, highs & lows, and impulses & corrections, the focus is on identifying a continuation corrective structure following a breakout.

The price has approached a previous swing low zone on the higher time frame (HTF) while moving within a descending structure on the MTF. The price has broken out of the MTF descending structure and we will now monitor for a continuation structure to identify a potential entry point for the trade.

Expectation: A upward move is expected.

⚠️ Reminder: Always conduct your own analysis and apply proper risk management, as forex trading involves no guarantees. This is a high-risk activity, and past performance is not indicative of future results. Trade responsibly!

This chart is for EUR/CHF on the 1-hour timeframe. Here's the anMarket Structure & Trend

The pair was in a downtrend, as indicated by the descending trendlines.

Recently, there was a breakout to the upside, suggesting a potential trend reversal or correction.

Key Levels & Zones

Support Zone: Around 0.9500 - 0.9510, where price bounced strongly.

Resistance Zone: Around 0.9540 - 0.9550, where price is currently testing.

If price holds above this level, we could see a continuation toward 0.9569 - 0.9580.

Possible Scenarios

Bullish Continuation: If price stays above the breakout zone (0.9540 - 0.9550), it could head toward the next resistance at 0.9572 - 0.9581.

Rejection & Retest: If price rejects resistance, it might retest the breakout zone before continuing higher.

False Breakout & Reversal: If price breaks back below 0.9530, it could indicate a failed breakout and return to the previous downtrend.

Conclusion

Bias: Bullish above 0.9540, bearish below 0.9530.

Watch for confirmations at key levels before entering trades.

Skeptic | EURCHF: Trend Strength or Weakness? Trade SetupsWelcome back, guys! 👋I'm Skeptic.

Today, I’m bringing you a multi-time frame analysis of EURCHF , including both long and short triggers, along with a few educational tips. Let's dive in!

---

🕰️ Daily Time Frame Analysis:

After a solid accumulation phase and breaking above resistance, we've successfully shifted the trend to uptrend . Given the major trend direction, it's better to focus on long positions .

---

⏳ 4-Hour Time Frame Analysis:

Following the uptrend, we've formed a bullish ascending triangle, indicating a potential continuation. You might think that the RSI downtrend signals trend weakness, but here’s the key point:

- Lack of follow-through on the downside shows trend strengt h. If it was genuine weakness, we’d have seen a sharp downward move already.

This makes the bias towards long positions stronger .

---

🚀 Long Setup:

After breaking the resistance at 0.9649 7, we can consider a long position. A breakout of the RSI trendline to the upside would be an extra confirmation.

📉 Short Setup:

To go short, we first need a breakdown from the ascending triangle, followed by a break below the key support at 0.95726.

---

🎯 Target Setting:

You can use the height of the triangle or your own support/resistance levels to set targets. I’m not here to tell you where to place your stop loss or take profit since that heavily depends on your strategy, stop size, and R/R ratio.

---

💬 Final Thoughts:

I always provide the key levels and setups, but it's up to you to adapt them to your own strategy.

Thanks for sticking around until the end of this analysis.

See you on the next one!💪🔥

EUR_CHF LONG SIGNAL|

✅EUR_CHF made a retest

Of the horizontal support level

Of 0.9500 and we are already

Seeing a bullish rebound so

We can enter a long trade

With the TP of 0.9567

And the SL of 0.9488

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.