CHFJPY I Weekly CLS I Model 1 I Target 50% and Full CLS HighYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Don't hesitate to ask any questions or share your opinions

CHFJPY trade ideas

CHFJPY BUY OPPORTUNITY Price is set to go bullish from the current price . We’re looking forward to buying from the currenT market price as a pullback in the H4 timeframe completes. Leaving a reversal candlestick pattern (bullish Engulfing) at the pullback support level. A buy opportunity is envisaged from the current market price

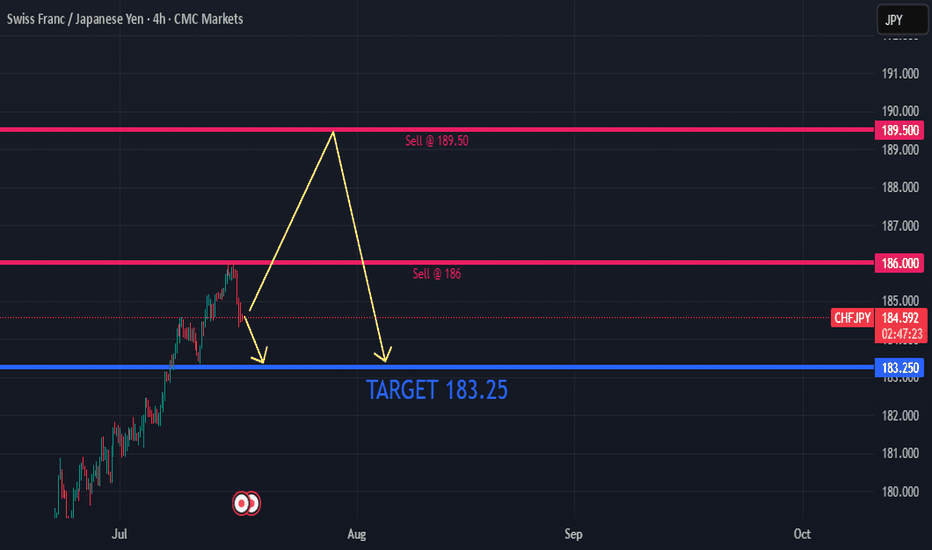

CHFJPY: Pullback From Resistance Confirmed?! 🇨🇭🇯🇵

CHFJPY may retrace from a key daily horizontal resistance.

A breakout of a support line of a consolidation range

on that on an hourly time frame provides a strong intraday confirmation.

Goal - 182.42

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHF/JPY Finally Broke Sideway Area , Breakout Confirmed ?Here is my 4H Chart on CHF/JPY , As we see we have a clear breakout after this long time in sideway after this huge movement to upside without any correction , so the price will go down for sometime in the next few days maybe weeks , we are looking for short setups only now , and we have a very good place o sell from it , it`s show in the chart , it`s my fav place right now to sell from it and we can targeting 100: 200 pips . if we have a daily closure above my res we can wait the price to go up a little and waiting for bearish price action and we can sell .

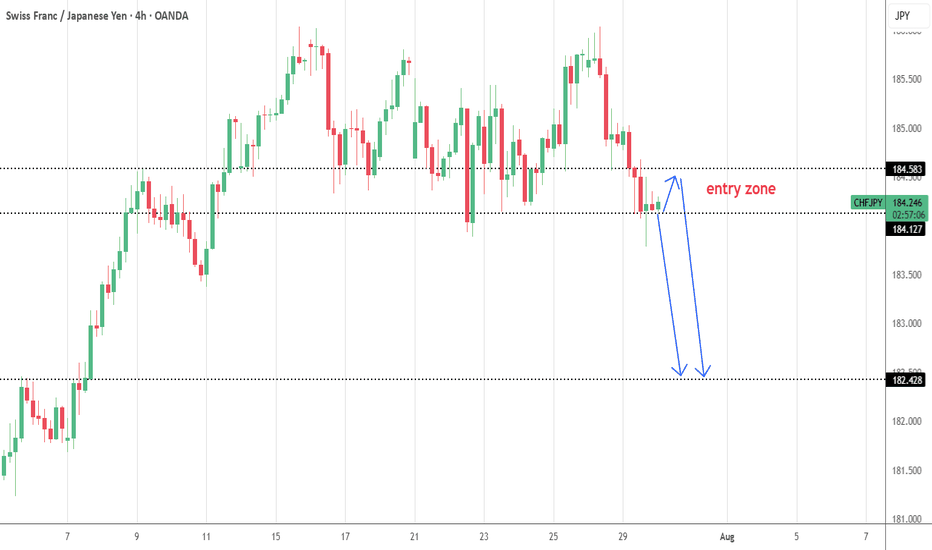

CHFJPY: Pullback Confirmed?! 🇨🇭🇯🇵

CHFJPY may pull back from a key daily support.

A formation of a bullish imbalance candle on an hourly time frame

with a bullish CHoCH provide a reliable confirmation.

Goal - 182.45

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHF/JPY SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are going short on the CHF/JPY with the target of 181.383 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

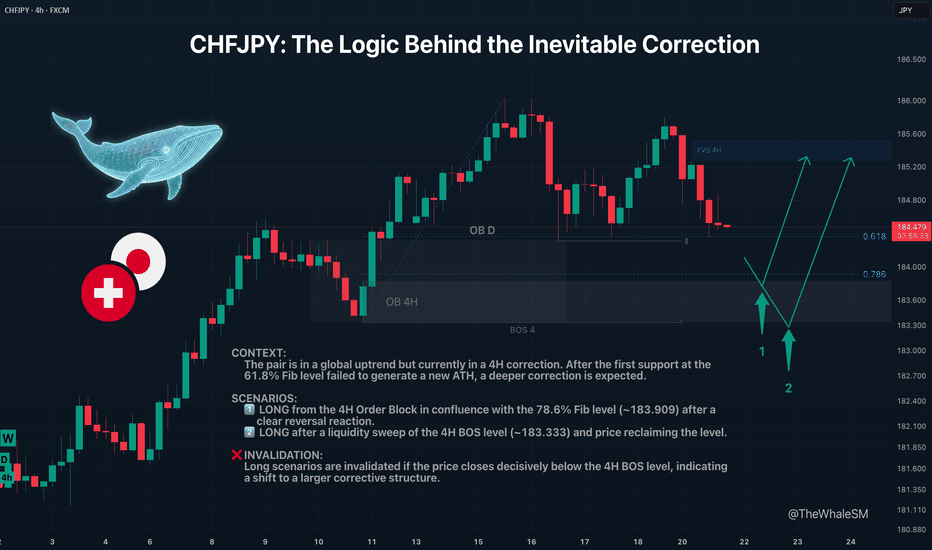

CHFJPY: The Logic Behind the Inevitable CorrectionCHFJPY recently bounced from what seemed like a perfect support level. Many likely saw this as a buy signal. But when the price failed to make a new high, it sent a clear warning: the correction isn't over yet.

This analysis dives into why that first bounce was a trap and where the next institutional levels are waiting below—the ones with the real fuel for the next major move up.

The CHFJPY pair continues its long and strong global uptrend . However, the market cannot move in one direction indefinitely without pullbacks; sooner or later, corrections occur. Large capital, or "Whales," who are the most important market participants, need to refuel with liquidity to continue their advance and to shake off piggybacking competitors. Right now, CHFJPY is in a 4H structure correction .

The first target for this correction was the 61.8% Fib level and a daily order block. The price did show a reversal reaction from them, but it lacked enough liquidity to create a new ATH, and the price continued its corrective movement. The next target for the correction will be the 78.6% Fibonacci retracement level at ~183.909, in conjunction with a 4H order block . This move will also sweep liquidity from the low of July 16th.

Two Potential Long Scenarios

SCENARIO 1: Entry from the 78.6% Fib Level & 4H Order Block

The first long entry scenario will be triggered by a clear reversal reaction from this support confluence.

► Setup Condition: Price must reach this zone, mitigate the order block, and close decisively above the 78.6% level, showing strength. An entry will require LTF confirmation (a BOS or the beginning of LTF order flow).

► Invalidation: If the 78.6% level is broken and the price closes below it, this scenario is invalid. In this case, the 4H order block itself will act as liquidity, and an attack on the 4H structure's break level (BOS 4) will likely occur.

SCENARIO 2: Entry After a Deeper Liquidity Sweep

This path becomes active if the first scenario fails.

► Setup Condition: A liquidity sweep with a candle wick below the 4H BOS level (183.333), with the price then closing back above this level. The final confirmation would be the start of a new order flow on a lower timeframe.

► Invalidation: A decisive close below the 4H BOS level will invalidate all long scenarios and will signal that the correction is shifting to a higher timeframe structure.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this wonderful, advanced TV community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always use a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView to get real-time updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

CHFJPY Day/Swing Trade Setup – Bearish Move Loading...💸"Operation Swiss Shadow: The CHF/JPY Forex Heist Blueprint" 💸

(Thief Trading Style: Master Plan Edition)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Robbers & Market Ninjas 🤑💰✈️,

This ain't your average trade idea — this is a Thief Trading certified forex heist targeting the CHF/JPY aka "Swiss vs Japanese". Based on my unique blend of 🔥technical traps + fundamental pressure points🔥, we've built the perfect blueprint to rob this pair at its weakest moment.

💣 Our target? The overhyped bullish zone — oversold, consolidating, and ripe for reversal. This is where institutional bulls camp, and we’re about to hit ‘em where it hurts.

🎯 Trade Setup Breakdown (Bearish Bias)

🎯 Entry Point:

The heist begins at 183.800 — wait for a neutral level breakout and prepare your sell orders.

💥 Recommended play:

Place Sell Stop just below the breakout confirmation.

For pros: use Sell Limit orders above MA or at pullback zones (15m/30m chart) near recent swing highs/lows — layer in using DCA style to catch premium entries.

🔔 Pro Tip:

Set alerts at the breakout zone. Don’t sleep on the move — timing is key in every robbery.

🛑 Stop Loss Strategy

"Yo listen! This ain't no demo drill!"

SL = 185.500 (4H swing high wick)

Place SL ONLY after breakout confirms — no pre-breakout SLs, no pre-heist drama.

Adjust SL based on risk %, lot size, and number of entries you're stacking.

If you’re reckless, go wild. But don’t say I didn’t warn you. You’re dancing with the FX devil here.

📉 Target Exit Zone

TP = 181.500

But real thieves know: If the heat gets heavy, vanish early. Escape before the target if price action warns you.

Survive > Greed. Always.

🔍 Macro Market Intel for Our Heist Plan

CHF/JPY is in a Bearish narrative, aligned with:

🧠 Fundamental Shifts

🏦 Macro Trends (Swiss deflation concerns + Japanese carry trade dynamics)

📉 Commitment of Traders (COT) Data

🌦️ Seasonal & Intermarket Correlation

🧭 Sentiment, Risk Flows & Future Pricing Models

🗞️ Before you break in, read the news, study the reports, watch the market smoke signals.

🚨 Trading Alert (News Protocol):

📢 Important: News releases = wild volatility. Stay smart:

No new trades during high-impact releases

Use trailing SLs to protect bagged profits

Adjust sizing to dodge unnecessary exposure

💖💥 Support the Robbery Plan 💥💖

Smash that 🚀BOOST button if you're vibing with the Thief Trading Style.

Every click helps build the strongest robbery crew in the FX game. This ain't luck — it's strategy, timing, and execution. 💪📈🎯

I'll be back soon with another market heist plan — stay sharp, stay paid. 🐱👤💼📊

CHF/JPY: Bearish Momentum Persists, Oversold Risks LoomTechnical Analysis:

CHF/JPY hits a one-month low at 182.65, following a steep correction from recent highs. Price trades below both WMA and lower Bollinger band.

• Indicators: RSI deeply oversold (29), Stochastics still negative.

• Scenario: Swiss franc remains under pressure after recent SNB dovishness, while the yen recovers on global rate cut bets and a softer USD. Immediate support at 182.65, then 182.60 (127% Fibo), with deeper risk to 182.03 (200%). Resistance at 183.10 and 183.58.

• Outlook: Trend remains bearish, but oversold levels signal risk of near-term stabilization or short squeeze.

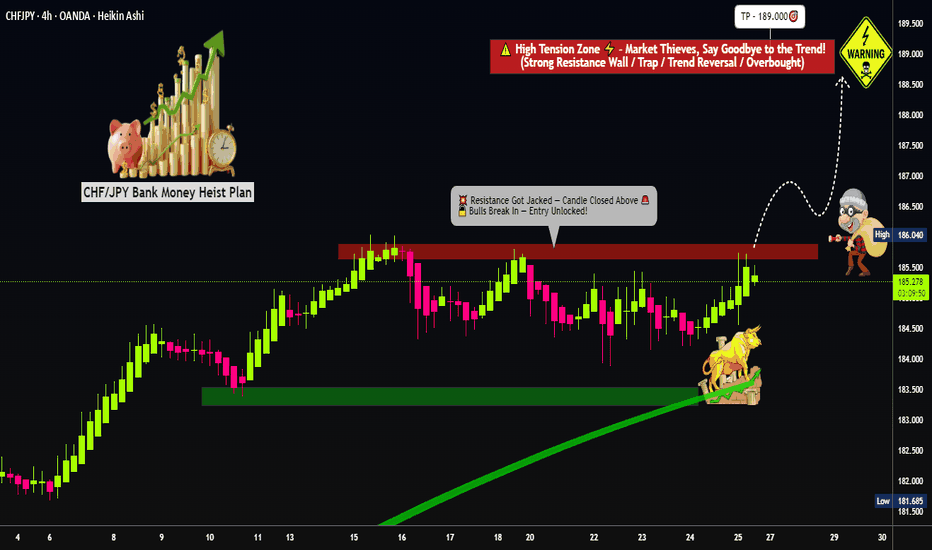

"Master Plan to Rob CHF/JPY – Breakout Trading Idea"💣CHF/JPY Forex Heist: Swiss vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the CHF/JPY "Swiss vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 186.000. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 4H timeframe (around 184.000)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 189.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why CHF/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

CHF_JPY RISKY LONG|

✅CHF_JPY has retested a key support level of 182.800

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 183.700 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SELL CHFJPY for bullish trend reversal SELL CHFJPY for bullish trend reversal

STOP LOSS : 185.38

Trade trade is based on false breakout and divergence.....

First what is false breakout, A false breakout in Forex occurs when the price breaks through a key level (like support or resistance) but quickly reverses and returns to its original range, often trapping traders who were expecting a continuation of the breakout. It's essentially a false signal, indicating a potential trend reversal or continuation, but the price doesn't follow through....

Secondly what is divergence ,In forex trading, divergence occurs when the price of a currency pair moves in one direction, while a technical indicator (like an oscillator) moves in the opposite direction. This mismatch can signal a potential trend reversal or weakening trend. There are two main types: bullish and bearish divergence.

On this trade we are taking it because we saw regular bearish divergence

Regular Bearish Divergence

In case of Regular Bearish Divergence:

* The Indicator shows Lower Highs

* Actual Market Price shows Higher Highs

We can see a strong divergence on the RSI already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this level resistance so we are looking for the trend reversal and correction push from here .....

CHFJPY LONGReason for entry

1. Regular flat structure

2. Ending structure in play

3. Gap 183.065 taken

4. Liquidity at the top (equal highs)

5. MACD divergence

Strategy: Engulfing candle should take out 184.058 to enter

Take Profit : 186.023

Stop loss: 183.211

Entry: 184.058/183.587 (GAP)

Once 185.208 is taken out, place trade at BE or Take profit

CHFJPY On The Rise! BUY!

My dear friends,

My technical analysis for CHFJPY is below:

The market is trading on 183.63 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 184.54

Recommended Stop Loss - 183.16

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CHFJPY: Bearish Continuation is Expected! Here is Why

The price of CHFJPY will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️