CRO - Very nice ROI, from $0.11 to $0.34Congratulations to those that followed along.

Its not done yet, expect some profit taking with some support / consolidation near $0.25, tiny at $0.25 but its there. Stronger support at $0.18-$0.20.

Careful if trading perps due to the bullish gaps getting filled. Dont get liquidated, watch and set tight stop losses and adjust those trailing stop losses and brackets carefully

CROUSD trade ideas

CRO Breaks Multi-Year Range With Eyes on $0.48 ResistanceCronos (CRO) has broken out of its long-term accumulation channel for the first time since 2022. A shallow correction could form the base for continuation toward $0.48 resistance.

Introduction:

After years of range-bound trading, CRO has posted an impulsive breakout candle, officially leaving behind its long-term accumulation structure. This decisive move marks a shift in market sentiment, as price is now establishing a new high outside the 2022 trading channel. While the move is strongly bullish, a shallow correction or consolidation is needed to confirm acceptance above the range and build the foundation for sustained continuation.

Key Technical Points:

- Breakout From 2022 Channel: CRO has broken its long-term accumulation phase with a powerful impulsive candle.

- Shallow Correction Needed: A bull flag formation could set the stage for continuation.

- Next Resistance at $0.48: The next high time frame target emerges if consolidation confirms bullish strength.

Main Analysis:

CRO’s breakout represents a major structural shift in its price action. After years of being confined within a range dating back to 2022, buyers have finally pushed price above the channel with conviction. This impulsive candle is a clear signal that accumulation has transitioned into expansion, with bulls firmly in control. Such transitions are critical moments in a market cycle, often leading to extended rallies when confirmed by continued demand.

A shallow correction would serve as the healthiest next step for CRO. This would allow overextended conditions to cool while providing bulls the chance to confirm acceptance above prior resistance. If price consolidates within a bull flag structure, the setup for continuation strengthens considerably. The presence of such consolidation would validate the breakout as sustainable rather than a short-lived spike.

The next upside target lies at $0.48, a high time frame resistance that is expected to act as a magnet for price action. Once reached, this level will determine whether CRO can sustain its breakout momentum. A clean test and breakthrough of $0.48 would establish new bullish territory and reinforce the structural reversal already underway. Traders should monitor whether bullish volume inflows persist during this consolidation phase, as this will be key to maintaining upward momentum.

What to Expect in the Coming Price Action:

If CRO continues to consolidate above its breakout zone with bullish volume, a rally toward $0.48 resistance becomes highly probable. A shallow correction forming a bull flag would be the ideal setup for continuation. Failure to maintain acceptance above the breakout zone, however, would risk invalidating the move and could trigger a deeper pullback before trend continuation resumes.

Conclusion:

Cronos has broken out of its multi-year accumulation channel with a decisive impulsive move, officially shifting its market structure to bullish. A shallow correction would likely solidify this breakout and prepare CRO for continuation toward $0.48. As long as consolidation holds with sustained demand, the path of least resistance remains to the upside.

CRO: Is this the first sign of bull trend resuming?CRO's current chart on the 4-hour may be the first significant signal that the shakeout is over and the bull trend is resuming. The price closed solidly above the downward trend line and bounced off the 21-day MA. On the 2hr, 1hr, and 30min price charts, price is still trading underneath the 21-day MA, but a little bump up in price and price will bring it above on all charts. On the 1-min, 5-min, 15-min, 30-min charts a consolidation is seen forming that could create the next bump up as price recovers. I'll wait to see if this price confirms by steady upward movement before declaring that the downward trend of the last 32-hours is over.

I am not a financial adviser and this is not financial advice. Just sharing my thoughts and insights in real investments. If you buy or sell because you think I'm saying to buy or sell then that is your problem, not mine.

DDP

CRO Outlook: Breaking Structure, Eyeing Higher LevelsCRO has broken out above the long-term downtrend line and is now testing the $0.23–$0.30 zone.

A retest of this breakout area could provide confirmation before a potential move higher. If momentum holds, the next significant target range sits around $1.58–$2.51, which aligns with prior supply and Fibonacci extensions.

Plus Trump Media, Crypto.com, and Yorkville are rolling out a SPAC-backed treasury play, stacking heavy into CRO and tying it into their platforms. This move injects fresh institutional weight and demand pressure behind $CRO.

CRO - Bullish Pennant FormationBullish Pennant Analysis for CROUSD (based on provided chart as of late Aug/early Sep 2025):

• Flagpole: Sharp upward surge from ~0.15 to ~0.48 around Aug 28, driven by strong momentum, forming the pattern’s “pole.”

• Consolidation Phase: Post-peak, price enters a symmetrical triangle (pennant) with converging trendlines: declining highs (~0.48 to ~0.30) and rising lows (~0.27 upward), lasting ~1 week on 1H timeframe, indicating temporary pause in uptrend.

• Characteristics: Pattern resembles a small flag/pennant; volume likely decreases (not visible but typical); shorter duration fits bullish continuation criteria.

• Current Status: On Aug 31, 2025, price at ~0.279 is within the pennant, near apex, showing formation but no breakout yet. Down 4.63% suggests consolidation pressure.

• Breakout Signal: Bullish if price breaks upper trendline (~0.35) with rising volume; confirms continuation.

• Price Target: Measure flagpole height (~0.33), add to breakout point; potential target ~0.60-0.68.

• Invalidation: Bearish if breaks lower trendline below ~0.27, signaling reversal.

• Implications: High probability (~70% historically) of upward move if valid; watch for crypto market catalysts like BTC correlation.

Hitting new recent highs breaking out of a pennant consolidationCRO seems prime for another leg up. After a few days of strong upside it’s running into resistance on the weekly chart, but even though it is at a current high, not all-time I’ll add, CRO still has significant upside potential .

CRO is consolidating strongly after breaking out of a pennant consolidation - on all charts 4-hour and under it can be seen, you will not see it on the daily. The resistance it encounters now traces back to November 2021 through April 2022 — on the weekly its more easily seen.

I am not an investment adviser, and this is NOT investment advice. Crypto is very volatile and you could lose your shirt if you listen to what I’m saying or think I’m advising you to buy. However, since transparency is key, after taking a nice profit yesterday doing an 1-hour trade, and then deeper analysis I’ve personally invested $$$ tens of thousands at this level based on my analysis of the trend continuation.

DO NOT BUY CRO unless you are prepared to lose money. I have a much higher risk tolerance than most and this could be a dangerous, losing trade, but I do feel it will be a real nice win today . If you follow me and my advice and you lose, it’s your fault not mine. Oh also, if you buy and it starts going up, the minute you get that feeling “I’m going to be rich”… SELL right away and take your damn profit!

DDP 👊🏼👊🏼☝🏼🙏🏼

CRO Pennant Update - One more dayCRO is progressing along the pattern I’ve been suspecting, however, the pennant just expanded to the final adjustment, I think, which allows until Monday evening before the next up love begins. I do believe a big green candle will take place but just a feeling.

This is not investment advice and you should not make any trades based on my reads. This is just me sharing insights.

DDP 👊🏼👊🏼

CRO Bull is Resuming, ConfirmationContinuation of my previous posts on Trading View and X . CRO’s strong downward move that started yesterday seems to be over.

After inking 7 straight green 4-hour candles, working #8, and about to break out of a final downtrend line, CRO seems destined to continue its upward trajectory. Today CRO price almost full recovered and I suspect it will ink a strong green candle out of this pennant flag it’s been forming since yesterday. There’s a possibility of a final shakeout down before a strong move out of the w pennant, but I feel price will just move up strong. The price has to close about .3271 to confirm the bull trend is resuming. I suspect the upside move will be significant from here before 8p EST.

CRO Looks Like It Will Resume Upward Trend NowMy assessment that price would continue up last night was off by a day, as the market structure kept developing and price action caused the pennant flag formation to get bigger. It does look like this continuation of the upward price action will continue by midnight, as we’re deep into the apex of the flag and on the 4-hour price is sitting on top of the 21-day EMA and CRO is in an uptrend. Couple this with alt-season being in full swing now, and the potential seems really strong that this will continue soon.

DDP

- not trading or financial advice just my insight and I’m not an investment adviser. If you make a trade based on this you can lose all or part of your money…or you could make a ton of 💰💰 COINBASE:CROUSD .

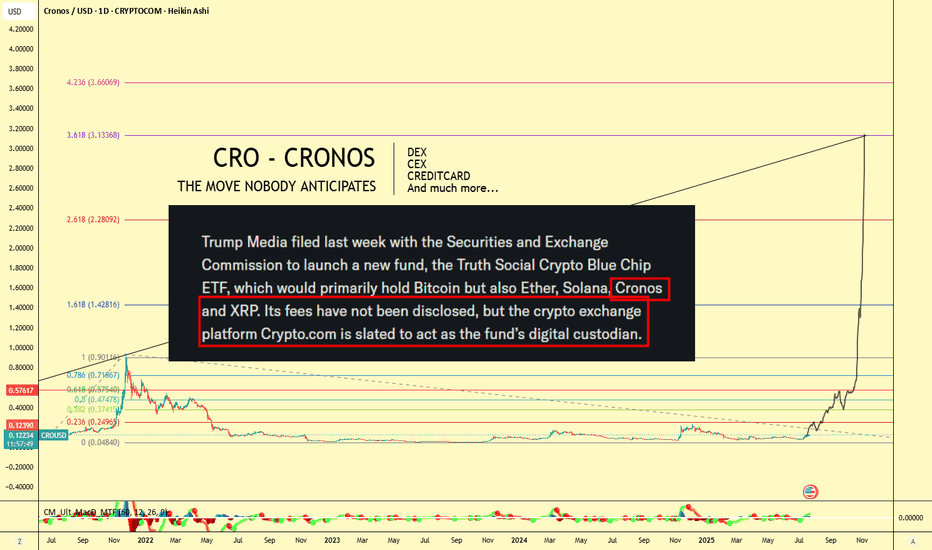

CRO (Crypto.com) $3 Target! Don't Miss This Move🪙 Ticker: OKX:CROUSDT

🕰 Chart: 1D (Heikin Ashi)

🔧 Tools Used: Fibonacci Extension, Fundamental News (ETF Filing)

🔍 Chart Analysis: Fibonacci Extension Targeting $3+

The Fibonacci Extension tool has been applied to the major CRO impulse wave from its peak near $0.90 (late 2021) to the 2022–2023 bottom at $0.0484, confirming a multi-year retracement and consolidation period.

Let’s break down the major Fib levels:

Extension Level Price Target

0.236 $0.2495

0.382 $0.3741

0.618 $0.5745

1.0 $0.9011

1.618 $1.4281

2.618 $2.2809

3.618 $3.1336

📌 Current Price: ~$0.12

🔥 Upside Potential to $3.13+ — a 25x move from current levels if full extension plays out!

📣 Fundamental Catalyst: CRO in Trump Media ETF

According to the chart note (sourced from SEC-related headlines):

"Trump Media filed with the SEC to launch a new ETF, the Truth Social Crypto Blue Chip ETF, which would primarily hold Bitcoin, but also Ether, Solana, Cronos (CRO), and XRP."

Even more important:

"Crypto.com is slated to act as the fund’s digital custodian."

This is massive fundamental validation for CRO — not just as a token, but as an ecosystem and financial infrastructure provider.

🌐 Why Crypto.com Matters: Utility, Ecosystem, Adoption

Crypto.com isn't just an exchange — it's a comprehensive Web3 ecosystem, which includes:

🔁 CEX (Centralized Exchange):

Buy, sell, stake, and trade hundreds of cryptocurrencies with high liquidity and low fees.

🔄 DEX (Decentralized Exchange):

Cronos Chain supports decentralized trading and DeFi apps — with low gas fees and EVM compatibility.

💳 Visa Credit Card Integration:

Crypto.com offers one of the most popular crypto Visa debit cards — earn cashback in CRO and enjoy perks like Spotify/Netflix rebates.

📱 Mobile Super App:

Buy/sell/stake/farm on-the-go with a seamless user interface.

📈 Earn & Lending Services:

Stake CRO or other assets for up to double-digit yields.

🤝 Strategic Partnerships

Crypto.com has been aggressively investing in brand and adoption:

🏟 Official partner of UFC, FIFA World Cup, and Formula 1

🏀 NBA’s Los Angeles Lakers Arena naming rights (Crypto.com Arena)

💼 Member of Singapore's regulated exchanges

🔐 ISO/IEC 27701:2019, PCI:DSS 3.2.1, and SOC 2 compliance — one of the most secure platforms in the industry

🧠 Conclusion: The Perfect Blend of TA + FA

With CRO being included in a potential U.S.-regulated ETF, the Crypto.com ecosystem booming, and technical patterns pointing to a Fib-based target above $3, CRO might be the sleeper play of the next bull run.

"The move nobody anticipates" might just be the most explosive one.

🎯 Short-Term Targets:

$0.25

$0.37

$0.57

🎯 Mid-Term Bull Targets:

$0.90 (prior ATH)

$1.42

$2.28

🎯 Full Cycle Extension:

$3.13

📢 Let me know in the comments:

Are you holding GETTEX:CRO ? What do you think about its inclusion in the ETF?

#CRO #CryptoCom #ETF #TrumpMedia #Altcoins #Bullrun #CryptoTrading #DeFi #FibTargets #CronosChain

BULLISH - Head and Shoulder fake out - Upside > $0.16 USDBased on the analysis of recent market data, technical patterns, and aggregated forecasts, the short-term price prediction for Cronos (CRO) over the next five days, from July 28, 2025, to August 2, 2025, anticipates moderate upward momentum with a potential trading range of $0.145 to $0.160. This outlook considers the current price of $0.1468, reflecting a 0.85% increase over the past 24 hours, alongside a market capitalization of $4.74 billion and 24-hour trading volume of $81.85 million. The head and shoulders pattern observed in the provided chart suggests bearish reversal risks, with a potential downside target near $0.130 if support fails; however, recent positive sentiment on social platforms and short-term algorithmic predictions indicate resilience and possible gains of 7% to 12%.

Key influencing factors include elevated chain activity correlating with price appreciation, as noted in community discussions, and broader cryptocurrency market trends potentially buoyed by upcoming events, though no specific catalysts for CRO were identified in recent searches. Predictions from sources project incremental rises, such as reaching $0.160 by August 2, assuming sustained volume and no major sell-offs. This assessment is speculative and subject to volatility; it is not financial advice, and market conditions should be monitored closely.

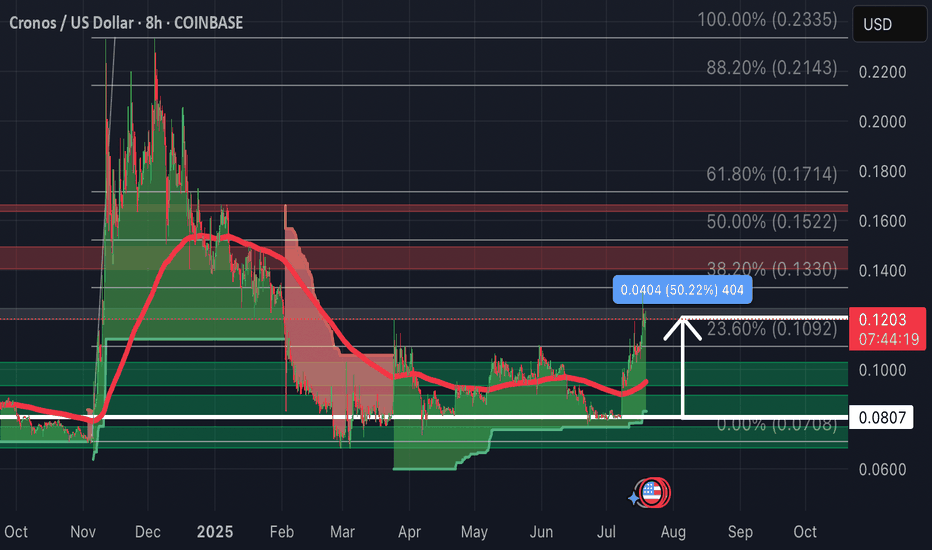

CRO-Update: Up 50% so far from February postThe took 5 months but we are up 50% so far.

Patience has paid off as price action breaks through resistance as it retest Fibonacci levels back towards 100% Fib Correction.

CRO surged after Trump Media & Technology Group filed for a “Crypto Blue Chip ETF” on July 8, allocating 5% to CRO. The ETF would track BTC (70%), ETH (15%), SOL (8%), XRP (2%), and CRO, with Crypto.com’s custodial arm securing assets. Approval would funnel passive institutional flows into CRO, driving demand.

Institutional tailwinds: SEC closed its Crypto.com review, boosting confidence.

Cronos (CRO) Soars +20% – Can the Rally Push to $0.10?Over the past 24 hours , the Cronos project with the CRO ( COINBASE:CROUSD ) token has seen a price increase of nearly +20% .

Let's see if we can still profit from the movement of the CRO token .

What is Cronos (CRO)?

Cronos is an EVM-compatible blockchain built on the Cosmos SDK. It supports DeFi, NFTs, faster payments, and even AI‑capable dApps. Its native token, CRO, powers fees, staking, and ecosystem activities.

Why CRO Jumped +20% Today (July 8)

Technical leap: Sub-second block times and faster throughput

Better UX: Real-world ready for fast DeFi, payments, and AI dApps

Increased adoption: Greater utility across CAPITALCOM:CROUSD ecosystem

Trader momentum: Volume surges and speculative interest

Strategic roadmap alignment: Upgrades following gas fee improvements ---------------------------------------------------------------------

Now let's examine the CRO token chart on the 4-hour time frame from a technical analysis perspective.

CRO token is currently trying to break the Resistance zone($0.0960-$0.0925) .

Also, in terms of Elliott wave theory , this CRO token price increase with high momentum should be in the form of wave 3 and we can expect a correction to the Potential Reversal Zone(PRZ) for CRO .

I expect CRO to re-attack the Resistance zone($0.0960-$0.0925) after entering the PRZ and rise to at least near $0.1(Round Number) .

Note: Stop Loss (SL) = $0.847= Worst Stop Loss(SL)

Note: If the CRO token breaks the Resistance zone($0.0960-$0.0925) without correction, we can expect a break of the Resistance lines.

Note: It is better to enter a trade if you find the right trigger for a Long position, as a Short position is more risky.

Please respect each other's ideas and express them politely if you agree or disagree.

Cronos Analyze (CROUSD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Cronos Ready to Reverse?Daily Chart

With today’s candle close, a reversal divergence will be confirmed on the VVV Destroyer if the price manages to close above 0.081.

The price has taken out the previous lows, collecting liquidity below.

Meanwhile, the VVV Destroyer has started to turn higher, indicating that buyers may be taking control.

The close back above the zone together with the divergence indicates a high-probability reversal.

The histogram has remained in the green zone, momentum is building, and the candles have started to tighten, signaling weakening sellers.

Cronos: Bear Market VibesCronos is resisting the persistent selling pressure after last week's low, but it should soon turn sustainably downward again. We anticipate the imminent bottom of the overarching turquoise corrective wave 2 within the green Target Zone between $0.06 and $0.02. According to our primary scenario, once CRO reaches this new bear market low, it can quickly move upward in the next impulse wave, with the resistances at $0.14 and $0.23 serving at most as temporary pauses.