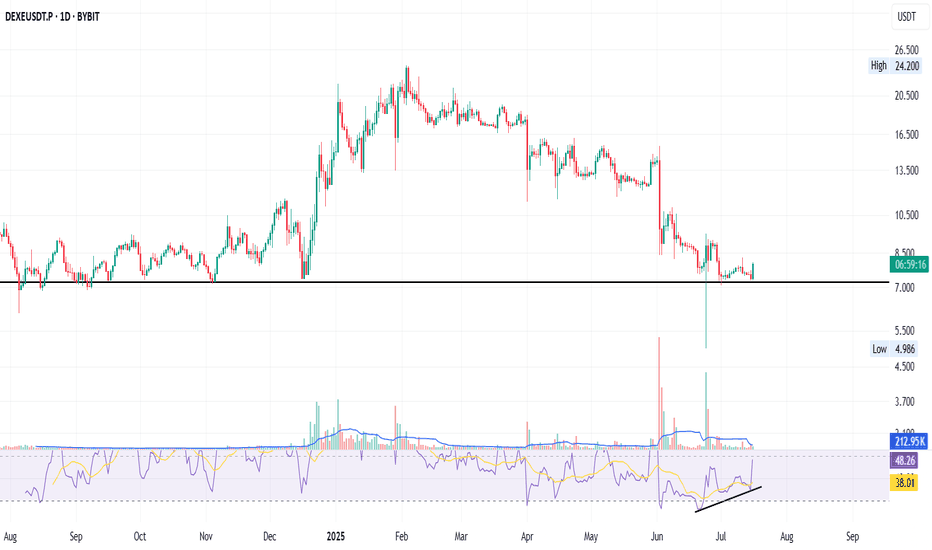

DEXE/USDT — Demand Zone Retest: Bullish Reversal or Breakdown?🔎 Overview

DEXE/USDT is currently retesting the weekly demand zone ($6–8) which has historically acted as a strong accumulation area during 2022–2023. After a massive rally in 2024 followed by a strong correction in early 2025, price has formed a series of lower highs, showing clear selling pressure from smart money.

Now, the market is at a critical juncture: will this demand zone hold and spark a new bullish phase, or will it break down and send price back toward historical lows?

---

📌 Market Structure & Pattern

Macro trend: still bearish since the 2021 peak, despite a relief rally in 2024.

Current structure: a sequence of lower highs, signaling sellers remain in control.

Demand zone $6–8: a major support zone that has served as an institutional accumulation area before.

False break wick below the zone, quickly reclaimed → typical sign of liquidity grab/shakeout before potential reversal.

---

🚀 Bullish Scenario

1. Confirmation: Weekly close above $8.975 → strong sign that buyers are regaining control.

2. Upside targets (layered resistances):

$11.571 → first target (minor supply test).

$15.602 → mid-term target, partial profit zone.

$20.115 → major bullish target if momentum extends.

3. Entry strategies:

Conservative: Wait for a confirmed close > $8.975.

Aggressive: Accumulate gradually within $6–8 with a stop below the zone.

4. Market psychology: This area often represents smart money re-entry after stop-hunting retail traders.

---

🔻 Bearish Scenario

1. Confirmation: Weekly close below $6.0 → demand zone failure.

2. Downside potential: Breakdown would open room toward lower support areas ($4.5 → $3.0 → even $1.8).

3. Strategy:

Exit longs if weekly closes below $6.0.

Shorts only for experienced traders due to limited liquidity.

4. Market psychology: A breakdown of this demand zone would trigger panic selling and shift sentiment heavily bearish.

---

🎯 Conclusion

DEXE/USDT is standing at a golden decision point that will define its mid-term direction:

If held → potential bullish rally toward $11–20+.

If broken → high risk of continuation down toward sub-$5 levels.

This is a high-risk, high-reward zone: the opportunity is big, but false breaks are common. Risk management is key.

---

📌 Trading Notes

Always use weekly close for confirmation, not just wicks.

Keep risk per trade < 3% of total capital.

Monitor BTC/ETH correlation as it strongly impacts altcoins.

#DEXE #DEXEUSDT #Crypto #Altcoins #TechnicalAnalysis #PriceAction #SupportResistance #SwingTrading #CryptoAnalysis

DEXEUSDT trade ideas

DexeDexe usdt Daily analysis

Risk rewards ratio >5 👈👌

Time frame daily

First target =16$

2th target = 19.5 $

Stop is very tight. Below of support line.

If price break the support line and my stop , I don't lose because it's very tight. On the other hand, if price reach to my target , I get good benefit

DEXE — Bullish Ichimoku Breakout Signals Uptrend ContinuationDEXE’s recent double-digit rally has propelled its price above the Ichimoku Cloud, a key indicator of trend strength and momentum. With this breakout, the token is now trading above both Leading Span A (green) and Span B (yellow), signaling a potential shift into a sustained bullish phase.

At the time of writing, Span A and Span B have flipped into dynamic support levels at $7.74 and $7.21, respectively.

These levels are now crucial floors to watch in the coming sessions. Holding above the Cloud typically reflects strong positive sentiment and suggests further upside potential as long as price maintains this structure.

DEXE: Bounce + RSI Divergence + DeFi Strength

DEXE on the daily just bounced off an 11-month-old support - the key black line.

A strong bullish divergence on the RSI has been building for over a month — now confirming with momentum.

That long green wick under support? It’s signalling buyer interest and possible accumulation.

Fundamentals:

DEXE powers decentralized governance (DAO) with AI + DeFi alignment.

It enables transparent on-chain decision-making and sustainable DAO growth.

Backed by real partnerships, aiming for fair, merit-based participation.

I’m long: not financial advice.

Always take profits and manage risk.

Interaction is welcome.

#DEXE/USDT#DEXE

The price is moving within a channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the channel, this support at 8.93.

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We have a trend of consolidation above the 100 moving average.

Entry price: 9.30

First target: 9.60

Second target: 10.14

Third target: 10.65

DEXE/USDT: FALLING WEDGE BREAKOUT!!DEXE Breakout Alert – 80% Move Loading?

Hey Traders! If you're into high-conviction plays and real alpha — hit that like and tap Follow for trade setups that actually deliver.

DEXE has broken out of a falling wedge pattern on the daily timeframe and has successfully retested the breakout level. The structure looks strong, and momentum is starting to build.

Entry Zone: $13.4 – $14.4

Targets: $16.1 / $18.2 / $21.2 / $24.4

Stop-loss: $12.60

Leverage: Use low leverage (Max 5x)

This could be the beginning of a powerful upward move.

Keep this setup on your radar and manage risk accordingly.

Let me know your thoughts or if you're riding this one too.

DEXEUSDT UPDATE

Pattern: Falling Wedge Breakout

Current Price: \$14.08

Target Price: \$17.53

Target % Gain: 25.65%

Technical Analysis: DEXE has broken out of a falling wedge pattern on the 12H chart, supported by strong bullish candles and a clear breakout above resistance. Price is consolidating above the breakout zone.

Time Frame: 12H

Risk Management Tip: Always use proper risk management.

DEXEUSDT Forming a Bullish Wave DEXEUSDT is currently forming a bullish wave pattern, which indicates a strong continuation trend following a previous impulsive move. This technical formation, characterized by a series of higher highs and higher lows, reflects growing investor confidence and buying momentum. With good volume supporting the price structure, the likelihood of a breakout continuation is high, targeting an expected gain of 40% to 50% in the medium term.

DeXe (DEXE) has been gaining traction within the decentralized finance (DeFi) sector. As a governance and staking token for the DeXe network, it offers a unique proposition in decentralized asset and portfolio management. This aligns with the growing demand for transparency and user empowerment in financial decision-making, which enhances its fundamental appeal. The recent bullish wave setup complements this strong narrative, making DEXEUSDT a compelling asset on both technical and fundamental fronts.

From a chartist’s perspective, confirmation of this pattern with a breakout above recent swing highs could attract both momentum and position traders. Supporting indicators such as RSI trending upward and MACD crossover point to increasing bullish strength. The combination of technical alignment and rising on-chain activity for DEXE fuels a high-probability trade setup for bullish continuation.

In conclusion, DEXEUSDT is on the radar of many smart money traders looking to ride the next impulsive leg. If this bullish wave completes as anticipated, we could see significant upside in the coming weeks, especially as DeFi regains momentum across the crypto space.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

DEXE ANALYSIS📊 #DEXE Analysis

✅There is a formation of Descending triangle pattern on daily chart 🧐

Pattern signals potential bullish movement incoming after a breakout.

👀Current Price: $14.68

🚀 Target Price: $18.50

⚡️What to do ?

👀Keep an eye on #DEXE price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#DEXE #Cryptocurrency #TechnicalAnalysis #DYOR

DEXE Analysis (1W)It appears to be in a bullish diametric pattern, and we are likely approaching the end of wave F.

If the price returns to the green zone, we will be looking for buy/long positions there.

We’ve marked two main targets on the chart, which represent the potential objectives for wave G.

A weekly candle closing below the invalidation level will invalidate this view.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

DEXEUSDT UPDATE

Pattern: Bullish Pennant Pattern

Current Price: $14.835

Target Price: $26.61

Target % Gain: 80.18%

Technical Analysis: DEXE has broken out of a descending triangle pattern on the 1D chart. The breakout is supported by a strong bullish candle and sustained price action above the trendline resistance, indicating momentum toward the target.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

DEXEUSDT.P | Strong Bottom Formation: Is $17 Really the Target?Today's analysis is for #DEXEUSDT.P, friends! 🔍📊 We're seeing another solid bottom formation here. The minimum target is around $15.40 🎯.

To be honest, I’ve been waiting for the $16.5–$17 range for a while, and with this move, it might get there quickly 🚀.

Why? Because sellers above have already been cleared out, and I don’t expect heavy resistance until around $16.4 ⚔️.

Also, the funding fee looks quite attractive 💰 — so if you're into swing trades, holding the position while keeping an eye on funding might be a smart move 🧠.

But for scalpers or those who prefer lower risk, $15.40 is a solid short-term target 🟢.

Wishing you a day full of green candles! 💚📈

Manage your risk, stay in the game! 🎯🔥

#AlyAnaliz #TradeSmart #CryptoVision #DEXEUSDT #Binanciega

#DEXEUSDT - Will the Delayed Correlation Work Again? Hey friends, 🌟

I’ve been battling an illness lately, so I haven’t been able to share many analyses—sorry about that! 😷 But I’m back today with a fresh new analysis.

Today's focus: #DEXEUSDT 🔍📊 Stay tuned for the details!

#DEXEUSDT | A Unique Correlation Unveiled! 🔍📊

Looking at the #DEXEUSDT chart, it may seem a bit complex at first. However, I’ve discovered a delayed correlation with another coin—#BROCCOLIF3BUSDT. 🍀📈 These two coins exhibit a positive correlation, but #DEXEUSDT follows BROCCOLI with a delay. This means #DEXEUSDT tends to mirror BROCCOLI's movements after some time.

This correlation helps us see the bigger picture more clearly. The sharp downward movement in the past (highlighted in the left red box on the chart) represents a Supply-Demand zone, meaning the price is likely to retest this area before making a decision. For #DEXEUSDT, this critical level is around $18.

🔹 Primary Target: $18

🔹 TP1: $16.555

🔹 TP2: $16.800 - $17

Additionally, we’re observing a bullish flag formation. 🚩 The potential breakout level currently stands at $15.40, though this may shift over time. A confirmed breakout and retest would make a long position a safer bet.

Let’s see how this multi-layered analysis unfolds! 🚀

Stay green & trade smart! 💰🌱

Manage your risk, stay in the game! 🎯🔥

#AlyAnaliz #TradeSmart #CryptoVision #DEXEUSDT #Binanciega

LONG Position DEXE/USDT#Singal

DEXE/USDT

🟢 LONG Position

🎲 Entry1 @ 14.048

🎲 Entry2 @ 13.920

🎲 Entry3 @ 13.769

✅ Target1@ 14.393

✅ Target2 @ 14.838

✅ Target3 @ 15.407

✅ Target4 @ 16.471

✅ Target5 @ 18.188

❌ Stop Loss @ 12.514

Leverage: 5X_15X

Margin: 10% of Wallet Balance

⚠️"Take Care of Risk Management for Your Account"

DEXE/USDT Analysis. Market Maker LiquidationNews emerged that market maker Wintermute has started selling off tokens including ACT, TST, DF, DEXE, KAVA, HIPPO, LUMIA, BANANAS31, and QUICK. Many of these assets have dropped by 20-50%. Let's analyze one of them.

From the cluster chart, we identified a buyer absorbing the market aggression of sellers. If the price returns to the $13-$12 zone , we will monitor the reaction and enter a long position if confirmation appears.

This trade is suitable for intraday traders and scalpers, as it carries increased risk

DEXEUSDT.SPOT.SIGNAL DEXEUSDT.SPOT.SIGNAL

We have a Spot signal for DEXE:

Entry: $15 - $17

Target: $28 - $32

Hold Time: Follow the new upward signal on the Weekly (W) timeframe

Note: Currently, the Weekly (W) is forming a bottom, nearly completing the process—just a little more time needed to finalize it.

Good luck!

Long Entry Signal for DEXE/USDT Based on the daily chart for DEXEUSDT on Bybit, here's a concise analysis:

MLR vs. SMA: The MLR (blue) is above the SMA (pink), indicating a bullish trend.

MLR vs. BB Center: The MLR is above the BB Center Line (orange), suggesting bullish momentum.

PSAR: The PSAR dots (black) are under the price, confirming a bullish trend.

Price vs. SMA 200: The price is above the 200-period SMA (red), supporting a long-term bullish trend.

Current Strategy: Since all entry conditions for a long position are met (MLR above SMA, MLR above BB Center, PSAR under price, price above SMA 200), you might consider entering a long position.

Stop Loss (SL): Set the stop loss at the current level of the PSAR dots to manage risk.

Monitor My Idea: Keep monitoring my idea for any changes in trend or for potential profit-taking opportunities.

DEXEUSDT shortHere is a short trade set-up for DEXEUSDT.

Entry: 20.85

SL: 23.35

TP1: 12.50

TP2: 7.50

Given the significant price movements, be prepared for potential volatility. Implement a stop-loss order to mitigate potential losses. For long positions, a stop-loss below the identified support level is advisable. For short positions, a stop-loss above the recent high can help manage risk.