$DOGE Long Setup – Bulls Returning

CRYPTOCAP:DOGE is rebounding from 0.151$ , forming a bullish structure on the 1h chart. Buyers are stepping in after a healthy pullback, signaling momentum building for a move higher.

🟢 Entry: 0.1670$ – 0.1655$

🎯 Targets: 0.174$ / 0.181$ / 0.190$ / 0.2$+

🔴 Stop Loss: 0.15$

💡 Holding above 0.166$ could confirm bullish strength and pave the way for an extended push toward 0.18$ - 0.2$ Keep an eye on volume for confirmation. ✅

Trade ideas

$DOGE (6-HOUR): WYCKOFF DISTRIBUTION pattern continuesI still haven't taken any profits off my CRYPTOCAP:DOGE short (18.7c), and it looks like another leg down might be coming next.

Another BEAR RSI divergence, a SELL signal flashing, and another LOWER HIGH on tiny VOLUME bars. Sellers are winning, so I wouldn't exclude a scenario where #Dogecoin has an unexpected surge to LIQUIDATE late BEARS (up to 17.5c as per the attached heatmap) first and then continues downwards.

I have modified my EXIT strategy — I would be 33% out of this position after each 4-HOUR candle close ABOVE 19c.

3 TAKE PROFIT levels are marked on the attached 6-HOUR chart.

💙👽

#WyckoffPattern continues

DOGEUSDT.P - November 4, 2025DOGEUSDT.P is maintaining a mixed-to-bearish market structure, with price currently consolidating near the $0.1665 region after forming a sequence of lower highs and lower lows. The projected structure suggests a potential push higher toward the $0.1709–$0.1737 resistance zone before a possible reversal lower. A rejection from this zone could accelerate a move back toward the $0.1594 support area, aligning with the broader bearish bias. However, a sustained breakout above $0.1737 would invalidate this outlook and signal a shift toward short-term bullish momentum.

DOGECOIN. USDTDogecoin could gradually decline to 12-13 cents.

However, if the market turns bearish, it will fall back to 10 cents.

In any case, a drop of 3-4 cents is guaranteed.

Considering that Ethereum could potentially fall to $3,400, and Bitcoin to $102,000/$101,000/$100,000/$99,000, therefore, a drop in Dogecoin between 10 and 14 cents seems inevitable.

So, every decline is a buying opportunity, and every green candle is just bait for emotional buyers.

Dogecoin Bounces from Value Area Low, higher next?Dogecoin price is showing a local bounce after successfully testing the Value Area Low (VAL) of its current trading range. This reaction indicates that short-term buyers are defending the lower boundary, but the next move will depend heavily on how price behaves around the Point of Control (POC) — a major resistance that must be reclaimed on a closing basis for continuation to the upside.

If Dogecoin fails to close above the POC, the likelihood of a rotation back toward $0.16 increases. Such a move would likely take out weak lows and absorb resting liquidity below the range before any meaningful reversal attempt occurs.

Key Points:

- Support Reaction: Local bounce confirmed at the Value Area Low of the range.

- Major Resistance: The Point of Control must be reclaimed for bullish structure to resume.

- Downside Risk: Failure to reclaim POC could lead to a liquidity sweep toward $0.16.

From a structural perspective, the market remains neutral-to-bullish as long as the VAL holds.

What to Expect:

Watch for a decisive close above the POC to confirm bullish momentum. Otherwise, expect range-bound movement or a liquidity grab near $0.16 before a potential rotation back upward.

Long setup is neutral biased now.Price is reacting inside a corrective pullback after impulsive downside.

Trade idea is based on multi timeframe Bias Matrix alignment.

Deep TF and DD TF are still negative so long exposure must be reduced.

Only NOW TF is showing early micro reversal potential.

Risk is defined below the last micro swing low.

Target zone is placed at the next structural liquidity cluster above.

Idea text (în engleză formal, profesional, eficient):

Trade Idea: DOGEUSDT Long Attempt – Neutral Probability Setup

The market is currently in a corrective pullback phase after a strong downward impulse. The multi timeframe Bias Matrix shows a neutral overall result: the higher timeframes remain bearish, but the NOW timeframe is showing a potential micro rotation. This entry is speculative and requires strict risk control.

Setup: Long attempt inside retracement zone

Reasoning: Local reversal signal on NOW TF while price is still in the lower liquidity band

Risk Control: Stop below the recent swing low

Target: Next liquidity cluster above current price

Notes: This is not a high confidence setup. Bias becomes more valid if the DD timeframe flips positive.

Conclusion: This is a controlled risk attempt to capture a short term bounce while macro bias remains bearish.

$DOGE (6-HOUR): ANOTHER WYCKOFF distribution variant, SHORTAnother chart and another variant of a WYCKOFF DISTRIBUTION schematic — this time on the medium-term CRYPTOCAP:DOGE charts.

Crypto is absolutely riddled with distribution patterns these days. Across all timeframes: I’ve shown you the clear 5-year CRYPTOCAP:DOT distribution, the current-cycle $RENDER distribution schematic, and the short-term $EVAA distribution setup.

Serious capital has been leaving crypto. You’ve seen rallies in metals, big stocks, and the Nasdaq — but not in crypto.

Cryptoville is Distribution-ville right now. Just my two cents.

As for the #DOGE mid-term charts (4H/6H), HIDDEN BEARISH divergences keep popping up on the 4-hour. The next leg should be DOWN, with the next SUPPORT at 17.5c.

Lose that, and my SHORT is going to start PRINTING.

💙👽

$DOGE (DAILY): lost the 200 MA + horizontal SUPPORT: SHORT 18.7cCRYPTOCAP:DOGE is now a BEAR MARKET coin and I'm shorting it at $0.187.

Similar story to CRYPTOCAP:XRP after both have lost their confluence of supports (200 MA + horizontal) and bearishly retested, in DOWNTRENDS, DEATH CROSSES (50 MA to cross below 200 MA) on the DAILY chart, HIDDEN BEARISH RSI divergences on many timeframes, a lot of stuff and nearly all of it — bearish.

Low-leverage #short with a manual STOP LOSS: I will close in 4 parts, 25% on each 4-HOUR candle close above the 200 MA ($0.209 atm), or sooner if any solid BULL divergences occur.

There is no intent on the chart; buyers never stepped in in OCTOBER and are unlikely to do so anytime soon.

Risk-off climate across all markets, not surprised that the KING #memecoin has been entering its BEAR MARKET territory. And many other coins look very similar.

Anything below the 200 MA on a DAILY chart, I would rather not LONG as long set-ups tend to fail too often. Longs above 200 MA, shorts below 200 MA — this is the approach.

💙👽

$DOGE Bouncing Off Key Support – Breakout or Breakdown?BINANCE:DOGEUSDT CRYPTOCAP:DOGE Bouncing Off Key Support – Breakout or Breakdown?

DOGE is testing the crucial 0.154 support on the 1H chart after a sharp dip, showing early signs of a bounce with increasing volume.

Bullish if it holds here—eyes on a potential breakout above 0.186 resistance targeting 0.20.

But watch for a deeper dip to 0.14 if it cracks; risk is real in this choppy market.

Key indicators: RSI rebounding from oversold (35), MACD histogram flipping positive, and rising buy volume.

Stay vigilant! 📈🐕

#Dogecoin #CryptoAnalysis #TradingView

DOGE coin in short-term uptrend movement roadmapDear Friend,

the lines are as per fibo's. I think it can hit 0.2 very soon and there is no important obstacle there till 0.2 usdt.

as you see on the chart the trend line in 30min. chart has already broken up and i think it can hit 0.2 without problem.

in due course i will update the chart. the important fibo time line is on 21 Nov. and i suppose till then we have hit the 1st target of 0.2

lets see and go step by step.

regards,

$DOGE (6-HOUR): SHORT printing, TRADE summary so farCRYPTOCAP:DOGE short doing well.

I couldn't remember if I published TP levels or not, so I asked #Grok to summarize my latest trade on #DOGE and it did an incredible job of it, actually.

Here is the summary it generated:

Latest CRYPTOCAP:DOGE Trade SummaryTrade Type: Short (Bearish position)

Open Date: November 1, 2025

Entry Price: $0.187

Rationale: CRYPTOCAP:DOGE entered bear market territory after losing key supports (200 MA + horizontal), bearish retest in a downtrend, impending death cross (50 MA below 200 MA on daily), and multiple hidden bearish RSI divergences across timeframes. Relative weakness confirmed vs. CRYPTOCAP:BTC (three bearish RSI divergences on DOGE/BTC daily). Low-leverage entry in risk-off market climate. Stop Loss Tactic: Manual, multi-part exit to manage risk:

Close 25% position on each 4-hour candle close above the 200 MA (~$0.209 at entry).

Full exit sooner if solid bullish divergences appear on charts.

Invalidated if $0.21 flips into support (potential liquidation).

Take Profit Levels: Yes, explicitly mentioned:

Level 1: $0.143

Level 2: $0.130

Level 3: $0.092

(Targets subject to adjustment based on new technical developments; bearish bias holds until $0.21 reclaimed or risk-off ends.)

Overall Bias: Bear market coin below 200 MA daily—prefer shorts below, longs above. Position active as of November 2 update; monitoring for updates.

Wow. Let me know if you want summaries of this kind more, on top of my ramblings or instead of them, lol.

👽💙

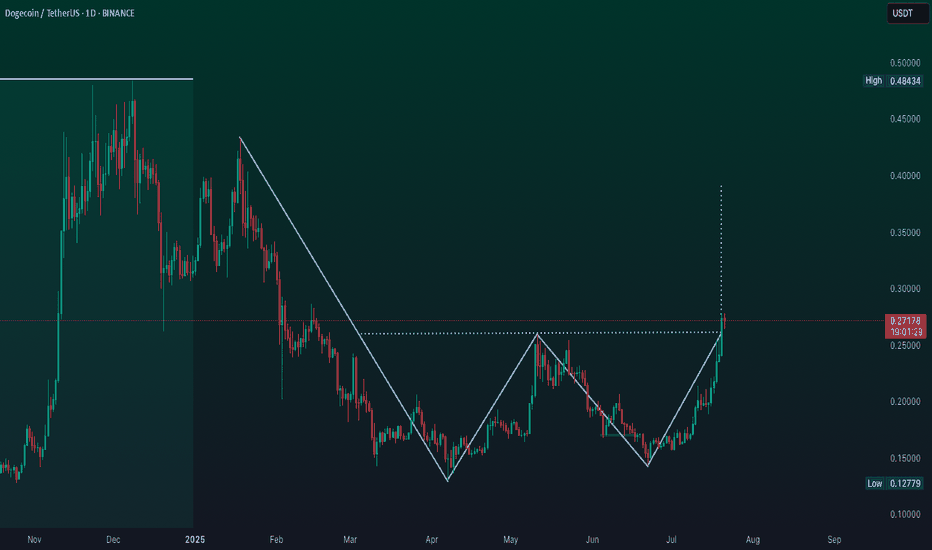

DOGECOINAfter a strong rally at the beginning of 2025, Dogecoin is in a downtrend within a broader consolidation phase.

The past 5–6 weeks have shown lower highs and lower lows, confirming a bearish phase within the wider range.

It is currently testing the critical support at 0.174, which marks the boundary between consolidation and a potential continuation of the decline.

DOGE daily timeframe updateOn-Demand Analysis: ❤️Like this post for more analysis!:

CRYPTOCAP:DOGE ’s surge combines a technical breakout, institutional validation, and sector rotation. While overbought signals suggest potential consolidation, the $0.25-$0.27 zone now acts as solid support

Support Zone: A strong base is at 0.2500-0.2700, where buyers might step in.

Resistance Level: The next big test is at 0.48434—break that, and it could climb higher!

Falling Wedge: This pattern, with its narrowing lines, often signals a bullish move if it breaks above 0.48434.

Momentum: The uptrend has steady volume, boosted by market activity.

Timeframe:Watch the next few days for the wedge to break out.

Possibilities:

Bullish Move: A jump above 0.48434 with good volume could push it to 0.5000 or more!

Bearish Drop: A fall below 0.2500 might take it back to 0.19621—stay careful!

Safety Tip: Set a stop-loss below 0.2500 to stay safe.

Dogecoin Witnesses Death Cross After 3 Months As Price Falls BelAt the time of writing, Dogecoin’s price sits at $0.185, holding just above its immediate support level. However, the bearish signals from both EMAs and whale behavior suggest a continued slide may be ahead.

If momentum weakens further, Dogecoin’s price could drop to $0.175 or even $0.165. This decline may trigger panic selling among retail traders, intensifying market losses and delaying any potential recovery.

Alternatively, a swift rebound could see Dogecoin reclaim $0.199 and potentially breach $0.209. Such a move would invalidate the bearish thesis and restore some investor confidence, signaling renewed market participation and short-term stability.