DOT USDT TARGETPrice (USD)

56 ┤ 🎯 Final Long-term Target

50 ┤ ⚡ Strong Resistance / Major Target

45 ┤ 🎯 Extended Mid-term Target

40 ┤ 🎯 Mid-term Target

35 ┤ ⚡ Mid-term Resistance

30 ┤ 🎯 Mid-term Target

25 ┤ ⚡ Short-term Resistance

20 ┤ 🎯 Short-term Target

15 ┤ ⚡ Short-term Support

4.191 ┤━━━━━━ 🔹 Current Price / Strong Support

━━━━━━ ❌ Stop-Loss Zone

⚡ Major Support

**"🚨 Whale Alert: DOT 🚨

Polkadot is quietly sitting at $4.191 — a hidden gem before the next mega wave.

Here’s why whales are paying attention:

✅ Robust cross-chain ecosystem with real-world adoption.

✅ Increasing on-chain activity and liquidity, setting the stage for a strong surge.

✅ Price is still near a deep support zone, giving strategic entry for smart whales.

Targets to watch:

Short-term climb: $15 → $20 → $25

Mid-term surge: $30 → $35 → $40

Big whale breakout: $45 → $50 → $56

This is the ideal setup for those who move first:

🔹 Low-risk entry near $4.191

🔹 Clear roadmap for multi-fold upside

🔹 Positioned perfectly to ride the next Polkadot rocket 🚀

The market will wake up only after the surge starts.

Early whale accumulation now means controlling the trend tomorrow.

💥 Get ready — DOT is set to make the jump, and the early movers will dominate the wave."**

DOTUSDT trade ideas

Polkadot (DOT): Support Zone Holding Strong | BullishDOT seems bullish to us, as we are still holding that local support zone and buyers eat up that dip each time the price reaches this zone.

This being said, we are going to look for a strong upside movement as long as we are above that support zone (which low-key looks like a neckline zone as well).

If we see the breakdown from that neckline, then we will switch to the sell-side position.

Swallow Academy

DOT — 4th Test of Major Support. Time to Start Watching Closely?

Polkadot continues to trade within a multi-year accumulation range, with the ~$3.50 level acting as a strategic support zone. We’re now seeing the fourth retest of this base — and once again, buyers are stepping in.

🔍 Structural Notes:

Horizontal range: ~$3.50–$7.50

Support: ~$3.50 — key demand zone, respected on four separate occasions

Watch level (eye): ~$17.50 — potential target zone in a mid-term cycle expansion

DOT is showing signs of a "macro base" structure — extended sideways action after a deep bear market. This is often where long-term players begin to build positioning quietly.

🧭 Scenarios I’m Tracking:

✅ Bullish Case:

A reclaim and close above $4.80 would open the door toward the upper range near $7.50

In the case of a broader altcoin cycle — upside could extend to $10–$17

❌ Bearish Breakdown:

A confirmed loss of the $3.50 level with volume would be a warning sign — and could lead to a flush toward ~$2.60

📌 My Take:

CRYPTOCAP:DOT isn’t a "FOMO now or miss it" trade. This is a patience-based structure. These zones are where mid-cycle accumulation happens — and where large capital tends to position quietly.

I’m watching how price reacts around $3.50 — that’s where real decisions will be made.

DOT has nearly completed its recovery phase, and even a minor upDOT is about to complete a long-term consolidation and bottoming phase on the weekly chart. The $3.5 – $4.0 range is a critical support zone. A strong breakout from this level could bring $7 first, followed by a $16 target. The MACD indicator supports the bullish signal. However, if there is a weekly close below $3.5, the scenario breaks down and new lows may appear.

Stop-Loss: A weekly close below $3.30 USDT → scenario invalidates.

First target: $5.

In the past, ETH and DOT have risen and fallen almost simultaneously, but recently the gap between them has reached up to 70%. Therefore, even with a 70% difference under today’s conditions, DOT should be around $16

^Bullish DOT needs to confirm above trend lineHopefully Pokladot can break above this line of resistance and confirm above into a new channel in a bullish direction. When in doubt zoom out, the macro time frame looks very bullish on the weekly. We've been in consolidation for a very long time. I do truly believe in this project and will probably continue to dollar cost average for a long time.

Polkadot (DOT) Holds $3.70 Support, Eyes Breakout Toward $5.37Polkadot (DOT) has reverted to a critical daily support at $3.70, aligning with the 0.618 Fibonacci retracement. This level is acting as a key higher-low formation in the current uptrend, but price must clear dynamic resistance before a push toward $5.37 becomes likely.

Polkadot’s recent price action shows a clear reversion to an important structural level. The $3.70 support zone is not only a technical floor but also coincides with the 0.618 Fibonacci retracement, creating strong confluence for buyers. As DOT consolidates above this level, attention shifts to the dynamic resistance capping upside momentum. A breakout here would unlock higher targets and confirm continuation in the broader bullish structure.

Key Technical Points

- Major Support: $3.70 daily support aligned with the 0.618 Fibonacci retracement

- Higher Low Formation: Current structure suggests $3.70 may serve as a new higher low in the uptrend

- Dynamic Resistance: Needs to be cleared to confirm bullish continuation

After a corrective pullback, DOT has stabilized at $3.70, a level of major significance. The confluence of this price zone with the 0.618 Fibonacci retracement provides a strong technical foundation for a higher low. Historically, such setups favor bullish continuation if defended, especially within the context of an emerging uptrend.

The challenge for buyers remains the dynamic resistance that has capped price during this consolidation phase. This resistance has repeatedly forced rejections, keeping DOT within a compressed range. Breaking above this structure would be a pivotal event, signaling that accumulation is complete and momentum is shifting toward expansion.

The upside target for such a breakout is $5.37, a level that aligns with prior structural highs and offers the next significant liquidity cluster. If momentum carries beyond this zone, DOT could extend into higher time frame resistances, reinforcing the medium-term bullish trend.

What to Expect in the Coming Price Action

As long as DOT maintains $3.70 as support, the probability favors the formation of another higher low, keeping the local uptrend intact. A decisive breakout above the dynamic resistance would confirm the bullish continuation phase, targeting $5.37 as the next major objective. Failure to hold $3.70, however, would risk invalidating the bullish setup and open the door for deeper retracements.

DOTUSD Head & Shoulders Pattern Points to Lower LevelsDOTUSD has recently completed a head and shoulders formation, a bearish chart pattern that often signals further downside. After the breakdown, price retested the neckline, which has now acted as resistance.

From here, DOT is likely to continue lower, with potential downside targets at $3.55 and $3.45. These levels may provide the next areas of support.

Let’s see how price action develops around these zones to confirm the bearish momentum.

Polkadot

Polkadot (DOT) Cryptocurrency

A good opportunity to buy again is in the price range of $3.55 to $3.75.

If the price holds in this area, it could see a strong first-stage growth to around $4.60, and then in the second and third stages, it could reach $5.40 and $6.20, respectively.

This is another good opportunity to buy this cryptocurrency; with proper risk and money management, this price range could be a valuable entry point.

Please always follow your own risk management and investment strategy.

Thank you,

FXtrick🃏

DOTUSDT – Fakeout to the Ground, Then Longs Turn It AroundThe chart says it all.

Price has been sliding since 14 Aug, and we’re now sitting in a potential reversal zone. Order Flow shows a cluster of longs who opened shorts right at the bottom — this positioning could juice the first leg up as they get squeezed to the bone.

Chances are we’ll sweep the marked weak high around 4.360, fill the imbalance between ~3.400 – 3.600, and then roll back down. That move would also complete the harmonic setup in play.

RSI is signaling a weak final push down — sellers are clearly running out of steam. Still, no clear CVD divergence showing just yet.

Trade with care.

Current price action aligns with key confluences, making this a level worth watching closely.

DOT (Polkadot) | Triangle Breakout Setup Loading!#DOT is currently moving sideways and forming a triangle pattern on the 1D timeframe. At the moment, there are no bearish signs on the chart, which indicates strength in the structure.

Key Points:

#DOT is consolidating within a triangle pattern.

A breakout with strong volume will confirm the next big move.

For confirmation, I will wait for the break of the resistance level.

After the breakout, the retest zone will be the ideal entry for a long trade with proper risk management.

Risk Management Reminder: Always wait for confirmation and manage your positions wisely.

This setup looks promising for swing traders who are waiting for the next big leg up.

What are your thoughts on #DOT? Do you think we will see a bullish breakout soon, or is more consolidation ahead? Drop your views in the comments!

If you found this analysis helpful, don’t forget to like, comment, and follow for more updates on #DOT and other altcoins!

Polkadot Dot usdt daily analysis

Time frame hourly

Risk rewards ratio =1.75

Target = 4.33 $

I expected the price to drop to $3.67 and then rise.

Now, in the short term, I’m opening a position with low risk. If this position gets closed, we’ll have to see whether the price breaks the green trendline or continues fluctuating between these two lines.

High Volume Support Could Push Polkadot 15% Higher Toward 4.90Hello✌️

Let’s analyze Polkadot’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

Polkadot added Elastic Scaling in Aug 2025 so parachains can rent extra power using DOT.

JAM upgrade is set for late 2025 to improve speed and cross chain links.

These updates could shape DOT’s activity in the coming months. 📊

📊Technical analysis:

BINANCE:DOTUSDT shows strong daily support and high trading volume 🚀. Maintaining this support could drive a 15% rally toward 4.90 📈.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

DOT Ready to Explode Above $4.20? Don’t Blink!📊 Market Structure

DOTUSDT is showing a bullish recovery after a recent pullback. From the August 7th low, the price trended upward strongly, making higher highs until around August 10th, where sellers took over and drove a retracement. The correction respected multiple support levels, and buying pressure re-emerged around $3.817–$3.757, leading to the latest rally.

Currently, DOT is trading just above the $4.181–$4.192 zone, which is a short-term support area. This level is important because it was previously resistance during the earlier uptrend and is now holding as a pivot for bullish continuation.

________________________________________

🔍 Price Action Insights

The chart shows multiple “B” buy signals during the dip phases, confirming accumulation zones. The most recent buy signal triggered right before price pushed toward the $4.309 resistance area. Sellers have previously been active around $4.234–$4.309, which explains the minor consolidation we’re seeing now.

The immediate upside target is $4.309 — a break and close above this on the 1H would likely send DOT toward higher resistances, possibly into the $4.40 area over the next sessions.

________________________________________

💼 Trading Setup (From Chart Data)

• Entry: $4.192 (current support & breakout retest)

• Stop Loss: $4.109 (below short-term support) – Risk ≈ 1.96%

• Take Profit: $4.309 (resistance) – Reward ≈ 2.82%

• Risk : Reward Ratio: ~1.44 : 1

________________________________________

📈 Bullish Scenario

If DOT holds above $4.181–$4.192 ✅, expect a retest and possible breakout above $4.309. Breaking that resistance could trigger a stronger rally toward $4.40+, with momentum building from the prior higher low.

________________________________________

⚠️ Bearish Risk

If $4.181 breaks decisively ❌, price could revisit the lower supports at $3.817 or even $3.757 before buyers attempt another push.

________________________________________

📌 Trade Management

1. Watch for bullish candles with strong closes above $4.234 — this would be the first sign of strength toward $4.309.

2. Take partial profit near $4.309 🏦 to secure gains.

3. Move stop-loss to breakeven once partial profits are taken.

4. If a breakout above $4.309 occurs, trail the stop under each new higher low to capture extended upside.

From this setup, DOTUSDT is in a bullish recovery mode and, as long as it stays above the $4.18 pivot, buyers have the advantage.

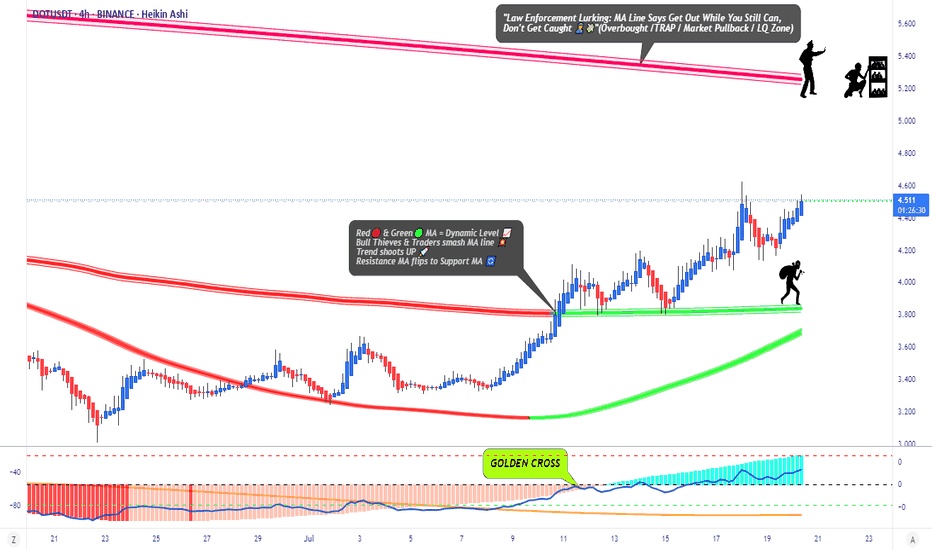

DOT/USDT Profit Heist | Don’t Let Bears Catch You🚨Polkadot Crypto Vault Break-In Plan | DOT/USDT Robbery Blueprint🚨

🌍 Hola Heist Crew! 💰📡

Ready for another vault-cracking strategy? Here's your DOT/USDT Crypto Heist Plan based on pure Thief Trading Style™—a fusion of smart-money tactics, technical traps, and stealth execution. 🎯💸

🔓 🎯 Entry Zone – Lockpick Ready

"The vault’s wide open! Swipe the bullish loot anywhere, anytime—but smart thieves plan pullback entries."

📌 Recommended: Use 15–30 min timeframe for sniper buys near swing highs/lows.

💡 Pro Move: DCA with layered buy limits like a seasoned thief stacking getaway routes. 🧠💵

🚔 Stop Loss – Evade the Patrol

📍 Secure SL just below the nearest 4H candle wick low (e.g., 4.000 zone)

🔐 Customize SL to match your risk profile & lot size—escape routes vary by thief rank.

💣 Target – Break the Vault & Vanish

🎯 TP: 5.200

🕶️ Optional: Dip out early if market heat rises near resistance traps. Escape clean.

⚠️ High Alert – Police Checkpoint Ahead

👮 Red MA Zone = Barricade.

It’s a hotspot for bearish cops + consolidation traps.

Only strong thieves survive here—book profits before you get cornered.

💼 For Scalpers & Swing Agents

🔍 Scalpers: Only ride long—quick bags, quick exit.

💰 Swingers: Follow the full robbery plan. Patience pays.

🎯 Trailing SL is your body armor—keep it tight.

📊 Fundamental Force Behind the Break-In

🔥 DOT/USDT is flashing bullish momentum supported by:

Sentiment shift

Intermarket alignment

COT positioning

On-chain data

📡 Stay updated via macro reports & sentiment dashboards—intel is profit.

📰 News Alert – Chaos Creates Opportunity

🧨 Avoid fresh entries during high-volatility news drops.

🎯 Trailing SL can save you during headline crossfire.

❗️Disclaimer:

This blueprint is for educational purposes only. Always conduct your own recon and apply strict risk management. Thieves who don’t scout first... get caught.

🚀 Boost the Heist – Support the Crew

💥 Smash that “Boost” if this plan adds value 💥

Your boost fuels more chart crimes, more profit hits, and a growing rob-the-market brotherhood! 💪💼📈

🧨 See you in the next job... Stay hidden, stay funded!

– Thief Trading Style™ HQ 🕶️🐱👤💰🚁

DOTUSDT - The Monster!It would be a shame if you’ve lost hope in DOT like many others have recently.

This is a strong project with a large market cap, and in every bullish season, it delivers solid performance — not explosive, but consistent. A moment will come when you’ll regret not buying it at $4.

From an investment perspective, its minimum long-term target is $40, while its more conservative mid-term target is $10.

Currently, the coin has broken out of a falling wedge pattern with a successful retest and has crossed above the 25 EMA on the 3-day chart.

These are all bullish indicators and a clear opportunity, especially with a nearby stop loss at $3.5.

Best regards:

Ceciliones🎯

DOT Predictions DOT Bullish DOT DOT DOT DOT Bullish DOT DOT DOT DOT Bullish DOT DOT DOT DOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOTDOT Bullish DOT DOT DOT

DOT | Bounce Setup from Major Support ZonePolkadot (DOT) has dropped sharply in recent weeks and is now testing a significant support zone between $3.60 – $3.70. This level has historically provided strong demand, making it a potential launch point for a bounce toward higher resistance levels.

Trade Setup:

🔹 Entry Zone: $3.60 – $3.70

🔹 Take Profit Zones:

• TP1: $4.30 – $4.70

• TP2: $5.20 – $5.60

🔹 Stop Loss: Below $3.30