EUR/CZK

No trades

Trade ideas

EUR/CZK will retest a key resistance lineThe pair will retest a key resistance line after hitting its 88-month low. Bulgaria is now in a waiting game after the country changes its legislation to allow its accession to the eurozone. If the Balkan country fulfilled the requirements for the euro currency adoption, it will be its 20th member. International Monetary Fund (IMF) President Kristalina Georgieva said the adoption will be possible until 2023. Bulgarian Parliament is seeking to adopt the euro at an exchange rate of 1 euro to 1.95583 leva. Economists expect that all the 27 members of the European Union will soon adopt the euro currency. A pro-Brexit website, the BrexitCentral, previously tweeted that member states will need to adopt the euro after 2020. Bulgaria’s decision is the biggest news for the euro after the UK’s withdrawal from the EU on January 31. This will be catastrophic for Czech Krona who saw its value to soar against the single currency in the past few months.

EUR/CZK : bearish trend at the test of the bottom.FOREXCOM:EURCZK

The trend is bearish, of course. However, the currency cross is exactly at the test of the previous bottom (see the support line and the yellow circled areas). It could be a rebound or a volatility exhaust. The mentioned bottom is a key level.

Let's look at the next trading sessions.

EURCZK: Buy opportunity (long term).The pair is trading within a multi month Rectangle with 25.4100 being the 1M Support. This month 1D has succeeded at pricing a bottom on this support as it stopped the previous downtrend and consolidated (neutral RSI = 44.755, ADX = 16.849, CCI = -10.1188, highs/Lows = 0.0000).

We are taking this as a strong long term buy signal with 25.8300 - 25.9000 as our Target Zone.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

EUR/CZK 1:2 Risk Reward Ratio (potentially more) SHORTEURO pairs have been in a downtrend for quite some time already, while most have had a recent

retracement leaving you thinking that you might have missed out and the wide stop losses arent worth it, its worth looking into more exotic and not as popular pairs that still havent reacted or are yet to touch the critical price points. The entries for this specific trade are quite basic and easy to understand whereas exits you have to be a bit more creative with

Entry : Top of the trendline

TP (1) : At 1:2 Risk Reward Ratio, or 50 Day moving average

TP (2) : The support area marked at the bottom OR below (watch for breakout, if successfully broken keep the trade at your own risk until you determine or see a retracement (1D wick, incredibly oversold RSI etc.)

Stop loss is not based on any pivotal points and is strictly based on reasonable percentage, we're not allowing a lot of room for error because the trade is based solely on the trendline, meaning that if/once its broken, we no longer want to participate/stay in the trade. RSI indicators are also showing overbought.

EURCZK: Sell opportunity on the Descending Triangle.The pair is trading on a year long 1W Descending Triangle with clear Lower Highs that provided optimal sell entries throughout 2019. We are currently on such a Lower High and with 1W neutral (RSI = 52.272, STOCH = 45.628, Williams = -46.569, Highs/Lows = 0.0000) we are targeting the top of the 1D Support zone (TP = 25.62400). Notice how a 1D Higher High sequence (curves) precedes every Lower High rejection on 1W. Similar formation printed in April.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

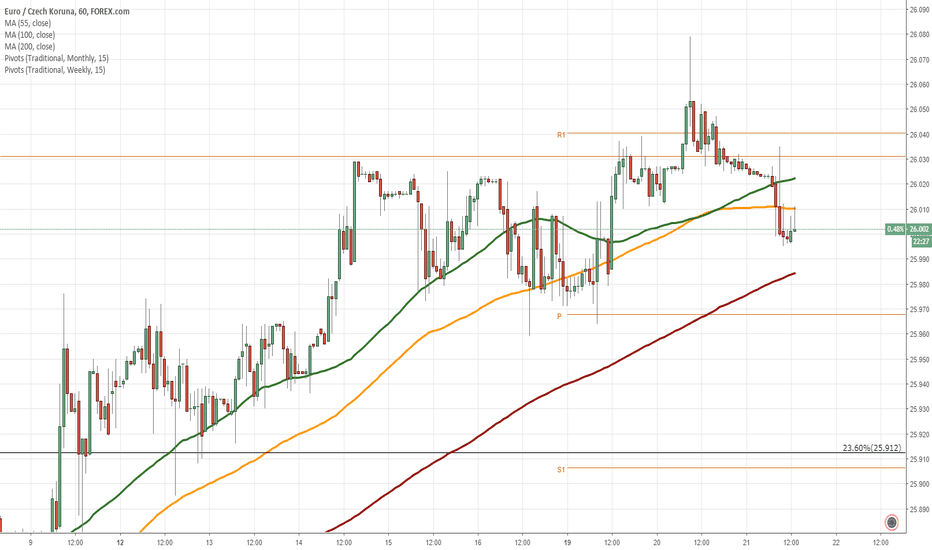

EUR/CZK 1H Chart: Upside potentialThe Euro has been appreciating against the Czech Koruna since the currency pair reversed from the lower boundary of a long-term ascending channel near the 25.40 mark.

Given that the exchange rate is being supported by the 55-, 100– and 200-period SMAs (4H), it is expected that the rate targets the Fibonacci 0.00% retracement at 26.16. Technical indicators for the short run also support bullish scenario.

The general price movement is expected to be upside within the following weeks until the upper channel line near 26.35 is reached.

EUR/CZK 1H Chart: Rising wedge in sightThe Euro has been appreciating against the Czech Koruna after the currency pair reversed from the lower boundary of a long-term ascending channel at 25.43.

As apparent on the chart, the rate has been trading in a rising wedge since the end of September. The pair's neat movement in this pattern suggests that its next move should be north towards the Fibonacci 23.60% retracement at 25.94.

The general price movement is expected to be upside within the following weeks until the 2018 high is reached at 26.14.