EUR/HKD Bullish Reversal – Head & Shoulders + Order-Block🟢 EUR/HKD – Head and Shoulders Reversal with Order Block Confirmation

📈 Technical Overview:

The chart clearly shows a Head and Shoulders reversal pattern forming after a prolonged downtrend, signaling a potential bullish reversal.

Neckline Breakout: Price has successfully broken and retested the neckline, suggesting the beginning of a new bullish trend.

🧱 Key Zone – Order Block Support:

The Order Block area around 9.025 – 9.020 acts as a strong institutional demand zone.

This zone aligns perfectly with the right shoulder’s low and serves as an ideal entry/retest level for long setups.

🎯 Trade Setup:

Entry: 9.028500-9.028530

Stop-Loss: Below 9.01900 (order block invalidation)

Target:

TP1 - 9.05000

TP2 - 9.07100

Risk–Reward Ratio: 1:4+

📊 Confluence Factors:

Clear inverse Head and Shoulders pattern

Order Block providing smart-money entry confirmation

Volume expansion visible on breakout

Structure shift from lower lows to higher highs

Euro / Hong Kong Dollar

No trades

Market insights

EUR/HKD Trading SignalDirection: Sell

Enter Price: 8.65118

Take Profit: 8.62080667

Stop Loss: 8.68939667

We recommend opening a SELL position for the EUR/HKD currency pair based on the following key indicators and analyses derived through the EASY Quantum Ai strategy:

1. Technical Analysis: Recent charts show a significant bearish trend in the EUR/HKD currency pair. Moving averages and other trend indicators confirm the downtrend, suggesting that the currency pair is more likely to continue its decline.

2. Resistance and Support Levels: The specified entry price of 8.65118 aligns with a recent resistance level that has seen repeated tests without a breakout upwards, indicating a strong potential for a reversal and subsequent price drop.

3. Market Sentiment: Sentiment indicators reveal that the market participants are predominantly bearish on EUR/HKD. Factors such as economic disparities and policy differences between the Eurozone and Hong Kong are contributing to this sentiment.

4. Economic Indicators: Differences in economic performance metrics such as GDP growth rates and interest rate differentials between the Eurozone and Hong Kong are creating a favorable environment for the Hong Kong Dollar against the Euro.

Monitor your trades closely and adjust your risk management strategies as needed to optimize potential profits and mitigate losses.

Trade wisely!

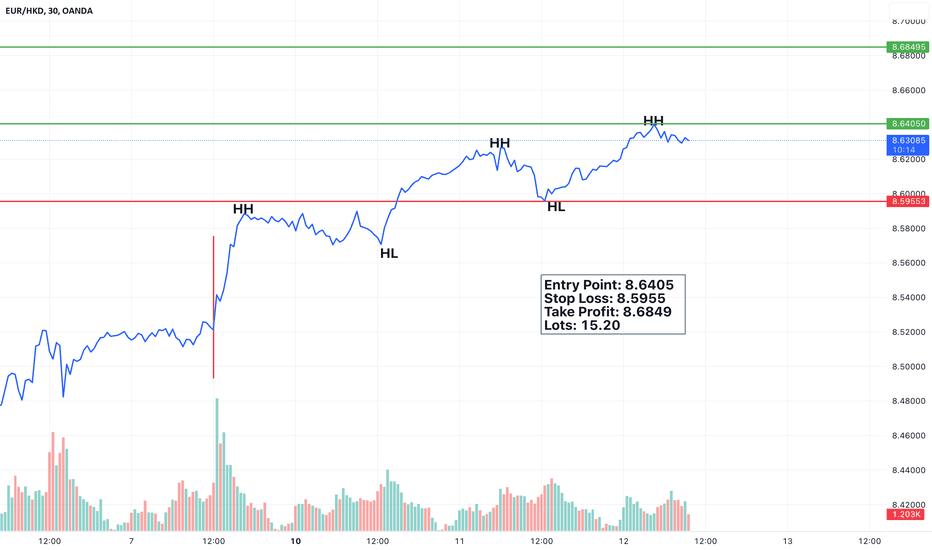

EURHKD Trading Signal: BuyTraders, our recent analysis indicates a profitable opportunity in the EURHKD currency pair.

Direction: Buy

Enter Price: 8.64124

Take Profit: 8.66174333

Stop Loss: 8.60065333

The prediction is founded on the comprehensive analytical capabilities of the EASY Quantum Ai strategy.

Justification:

1. Trend Analysis: The EURHKD pair has demonstrated a consistent upward trend supported by solid economic indicators from the Eurozone, suggesting a bullish market sentiment.

2. Market Sentiment: Positive sentiment towards the Euro has been bolstered by recent policy decisions by the European Central Bank aimed at stimulating economic growth.

3. Technical Indicators: Key oscillators and moving averages signal a continuation of the upward momentum, confirming strong buy signals.

4. Support and Resistance Levels: The entry price of 8.64124 has been identified as a significant support level, minimizing downside risk, while the take profit target of 8.66174333 aligns with the next resistance level, optimizing potential returns.

Make your moves confidently knowing that EASY Quantum Ai is backing your decision with data-driven insights. Always ensure to employ proper risk management techniques to protect your capital. Trade wisely!

EURHKD Trading Signal: BuyDear Traders,

We have identified a new opportunity on the EURHKD currency pair and recommend a Buy position based on our analysis using the EASY Quantum Ai strategy.

Direction: Buy

Enter Price: 8.50041

Take Profit: 8.51149

Stop Loss: 8.49095

Reasoning:

Our decision to enter a Buy position is supported by several key factors detected through the EASY Quantum Ai system:

1. Trend Analysis: The current trend for EURHKD indicates a bullish movement, with strong upward momentum identified in recent price action.

2. Technical Indicators: Key technical indicators such as Moving Averages and Relative Strength Index (RSI) show signs of continued growth, suggesting a favorable condition for buying.

3. Market Sentiment: Data on market sentiment and trader positions reveal an increase in buying interest, which aligns with our bullish outlook.

4. Economic Factors: Recent economic reports from the Eurozone show potential for further strengthening against the HKD, providing additional support for the upward movement.

Please ensure you set your entry, take profit, and stop loss levels as suggested to manage risk effectively.

Happy Trading!

Best regards,

The Trading Team

EURHKD 1H - ABCD PatternAnalysis:

EURHKD 1H is currently in a bearish trend. The is printing a potential ABCD pattern. If the price breaks below levl B at 8.54253, it will be a sign of bear trend continuation. In this case we can enter in a short trade. For this trade the stop loss will be at level C at 8.58506

------ Trade ------

Type: Short

Entry: 8.54253

Stop Loss: 8.58506

TP1: 8.50000

TP2: 8.45747