EURNZD: High probability reversal, to not missI am expecting a reversal on EURNZD, with a downside target at around 1.9300.

This area is where it can become a decision point, either price bounces, or it breaks above and the move can start to extend higher.

My expectation is for the price to reverse.

EURNZD trade ideas

EURNZD: Key Resistance Holds 🇪🇺🇳🇿

It looks like a key resistance that EURNZD reached keeps holding.

I even see some bearish clues on an hourly time frame,

such as a confirmed breakout of a support line of a triangle pattern.

I think that we may see a retracement lower.

Goal - 1.99

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURNZD Is Going Down! Short!

Please, check our technical outlook for EURNZD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 1.999.

The above observations make me that the market will inevitably achieve 1.952 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Next H8 Candle Expected RedThe next H8 candle's expected to close red. Since TradingView doesn't have an H8 chart, this outlook's shown on the H4 timeframe. The next two H4 candles combine to form the next H8 candle.

If that outlook's red then selling above the open tends to be profitable. If that outlook's green then buying below the open tends to be profitable.

My strategy's to place trades aggressively on the wick above or below the open depending on what's expected. I use fixed equity SL and TP levels which means trades close automatically once I hit my set floating profit target or floating loss limit. Please manage your own entries, SL, TP, and risk.

EURNZD 30m – Range BreakoutPrice has been consolidating in a tight range between 2.000 and 1.997 on the 30-minute timeframe.

Currently watching two key scenarios:

🔹 Bullish Scenario: A clean breakout and retest above 2.0010 could signal a strong continuation to the upside.

🔹 Bearish Scenario: If price breaks and closes below 1.9970 support, we could see a sharp move down toward 1.9840 and possibly 1.9760.

Setup favors a potential short if support fails, with a strong risk-to-reward ratio.

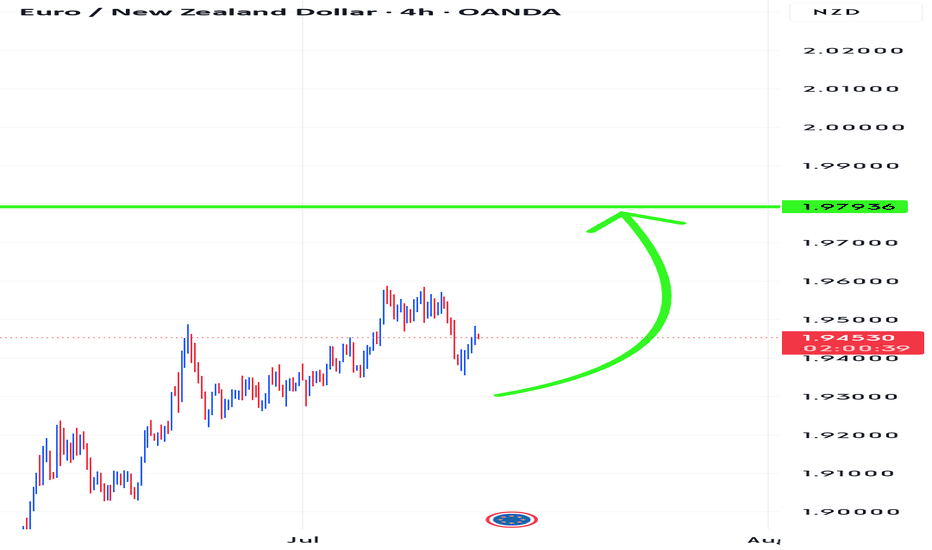

Buy EUR/NZD after retest broken support.UTC 02:00am on Wednesday there is an interest rate decision out of New Zealand so depends how you look at risk, if you like this trade or not. I am hoping for a spike into my entry because the trend is up at the moment.

Buy : 1.9650 retest broken support

Stop : 1.9514 below recent low

Profit : 1.9990 before double top ( weekly timeframe )

Risk 1 : 2.5

How to Identify Market Structure: From Uptrend to DowntrendUnderstanding market structure is key to trading well.

📈 In an uptrend, price forms a sequence of Higher Highs (HH) and Higher Lows (HL). As long as the most recent HL is respected, buyers remain in control. Pullbacks into demand often provide continuation opportunities.

📉 Once the most recent HL is broken, structure shifts — buyers lose control, and the market can flip into a downtrend with Lower Highs (LH) and Lower Lows (LL). Pullbacks into supply confirm bearish momentum.

🔑 Remember:

Market structure is fractal — always check higher timeframes for better understanding of price action.

A break of any important structure ( lows, highs ) tells us that either price is continuing or reversing.

Supply and demand zones are where reversals usually begin. And that is due to volatility and orders, volume coming into the market.

Don’t fight momentum — align with structure, and let the market confirm direction before you do anything.

Keep this framework in mind, and reading trends will become much clearer.

Blessings, T

EURNZD BUY TRADE PLAN**PAIR & DATE:** EURNZD – Aug 18, 2025

**PLAN ID:** EURNZD\_2025\_08\_18\_A

---

## 🔎 PLAN OVERVIEW

* **Category:** Swing / Intra-Day blend (H4 anchor, H1 trigger)

* **Trade Type:** Trend Continuation (after corrective pullback)

* **Direction:** Buy (pro-trend, macro-aligned)

* **Confidence:** 74%

* **Min R\:R:** 1:3

* **Status:** ✅ VALID

---

## 🎯 LEVELS CARD (Quick Action)

**Primary Setup (High Probability – Buy):**

* Entry: **1.9660 – 1.9650 zone** (H4 demand + OB/FVG)

* Stop Loss: **1.9605** (below OB base & liquidity sweep)

* TP1: **1.9720** (local swing high)

* TP2: **1.9770** (HTF resistance, daily imbalance fill)

* TP3: **1.9850** (stretch target, weekly high)

* Order: **Market on confirmation (H1 engulf/pin/BOS)**

* Session: **London / NY overlap preferred**

---

## ✅ EXECUTION CHECKLIST

1. News gate (15m pre / 30–60m post red events).

2. Price taps zone inside London/NY.

3. Confirmation on H1: bullish engulf / pin rejection / BOS.

4. Market execution only if confirmation prints.

5. TP1 partial → SL BE → trail toward TP2.

6. Exit on invalidation close below **1.9605**.

7. Skip trade if zone breaks without reaction.

---

## 🌐 FUNDAMENTALS & NEWS

* **CB Bias:** ECB slightly hawkish tilt; RBNZ neutral/dovish.

* **Upcoming Data (7d):** NZD trade balance, RBNZ Gov Orr speech; Euro PMI (Thursday).

* **Cross-Asset:** NZD vulnerable to China growth & risk-off. DXY sideways, equities soft.

* **Flows:** COT → net EUR long build-up; retail crowded NZD long.

* **Macro Lean:** Mild EUR+ tailwind; NZD flat/downside risk via China sentiment.

---

## 🗺️ MARKET MAP

* **D1:** Uptrend intact, BOS higher-highs, structure bullish.

* **H4:** Pullback into demand 1.9650–60, last BOS up.

* **H1:** Recent sell-off corrective; pinbars at zone bottom.

* **Liquidity Pools:** Equal highs \~1.9770, clean liquidity above.

* **Play Type:** **Trend Continuation → HTF demand → pro-trend resumption.**

---

## 💰 RISK & MONEY MANAGEMENT

* Risk: **1% per trade** (max basket 2%).

* SL logic: beyond OB + liquidity.

* ATR filter: H1 ATR(14) \~30 pips; SL \~50 pips acceptable.

* R\:R: min 1:3 (Primary setup → \~1:4 if TP2 hit).

---

## 📊 CONFIDENCE (One Line)

**74%** — HTF uptrend intact, macro EUR supportive, corrective pullback into H4 demand, clean R\:R.

---

## 📝 FINAL EXECUTION STRATEGY / PERSONAL NOTE

* **Zone Status:** Fresh test into 1.9660 band.

* **Action:** Buy only if H1 prints confirmation (engulf/pin/BOS).

* **Re-entry Logic:** If tapped and rejected but not near TP1, may re-engage with pending at 1.9660.

* **Stay Flat:** If H1 candle closes below 1.9605 → invalid, no buy.

* Professional close: **Execute only on elite confluence; skip if not clean.**

---

## 📓 POST-TRADE JOURNAL (to be filled after execution)

* Outcome: _

* Lesson: _

---

⚡ **EURNZD Primary Plan = BUY from 1.9660 demand zone (HTF continuation), confirmation required.**

EURNZD - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

#7282025 | EURNZD Supply Zone 1:15 (Premium Signal)EURNZD Supply Zone Appears in D1 Time Frame Looking Price Action for Long Term Sell

Risk and Reward Ratio is 1:15

After 50 pips Profit Set SL Entry Level

"DISCLAIMER" Trading & investing business is "Very Profitable" as well as risky, so any trading or investment decision should be made after Consultation with Certified & Regulated Investment Advisors, by Carefully Considering your Financial Situation.

EUR/NZD SELLERS WILL DOMINATE THE MARKET|SHORT

EUR/NZD SIGNAL

Trade Direction: short

Entry Level: 1.970

Target Level: 1.947

Stop Loss: 1.986

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURNZD Will Collapse! SELL!

My dear friends,

Please, find my technical outlook for EURNZD below:

The instrument tests an important psychological level 1.9718

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.9692

Recommended Stop Loss - 1.9735

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK