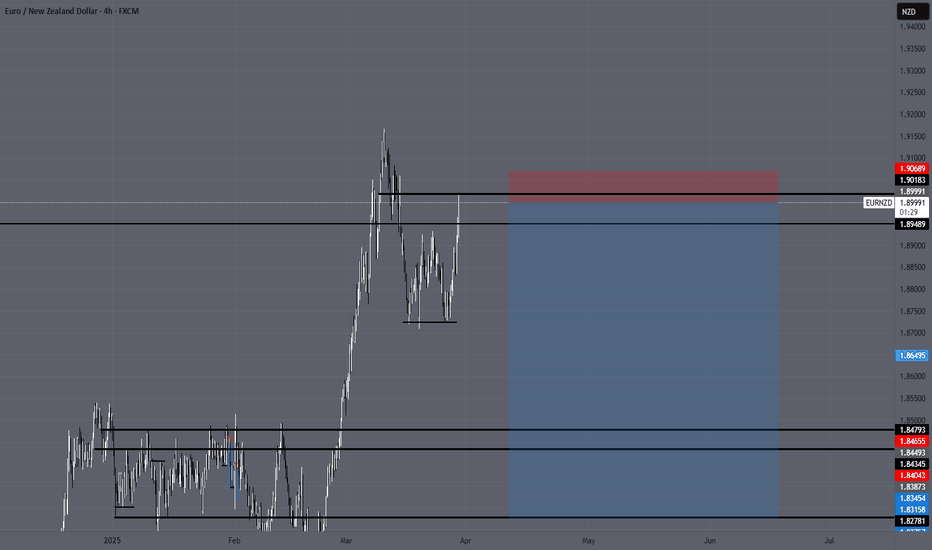

EURNZD SELL IDEA i love how the zones on eurnzd have been super clear and with the recent bos a pullback has occurred and on the lower time frame we can see that price is starting to close back under support and for me once price did that the probability of at least going back into half of that zone makes this trade idea worth one me taking.

EURNZD trade ideas

EURNZD Wave Analysis – 2 April 2025

- EURNZD reversed from resistance area

- Likely to fall to support level 1.8700

EURNZD currency pair recently reversed down from the resistance area located between the resistance level 1.9100 (which stopped the earlier sharp upward impulse wave I at the start of March) and the upper daily Bollinger Band.

The downward reversal from this resistance area stopped the earlier short-term impulse wave iii of the upward impulse wave 3 from the end of February.

Given the strength of the resistance level 1.9100, EURNZD currency pair can be expected to fall to the next support level 1.8700.

EURNZD SELLThe market here has previously tested a significant swing level as resistance and has just don’t the same on the daily chart printing a strong body bearish rejection candle.

I have chosen my entry to be a 50% retracement of the bearish signal candle.

My stop loss will be the previous swing level to account for spreads with my profit being 3x my risk.

Best of luck on the charts traders

EUR/NZD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

EUR-NZD uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 1.885 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the EUR/NZD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

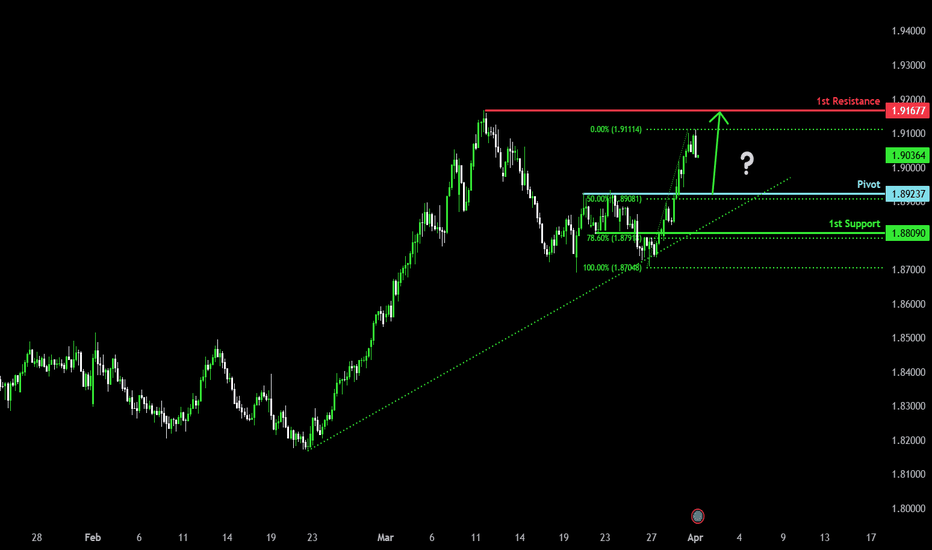

Falling towards 50% Fibonacci support?EUR/NZD is falling towards the pivot which has been identified as a pullback support and could bounce to the pullback resistance.

Pivot: 1.89237

1st Support: 1.88090

1st Resistance: 1.91677

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR-NZD Strong Resistance Ahead! Sell!

Hello,Traders!

EUR-NZD keeps growing

In a strong uptrend but a

Wide horizontal supply

Area is above around 1.9170

So after the pair retests

This level we will be expecting

A local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD - Swing trade IdeaHi everyone! The EURNZD shows a nice bearish momentum and a CHoCH/BOS on the 4-hour time frame. I am looking for a sell entry when it reaches the 71% Fib level and setting the take profit (TP) at the next demand zone area. Please conduct your own analysis before entering any trades

Sell Limit Order:

Sell @ 1.89600 - 100 pips

SL @ 1.90600 - 100 pips

TP1 @ 1.88600 - 100 pips

TP2 @ 1.87600 - 200 pips

TP3 @ 1.86600 - 300 pips

RR 1:3, better to move the SL to BE when the trade hits TP1.

Cheers.

EURNZD Bearish OutlookHere is my analysis for EURNZD for the coming weeks.

Price is approaching correctively towards the Lower time frame 0.618-0.500 area or Golden ratio, price is currently forming a Regular Flat pattern and may react from that Sell zone area.

Once the price reacts on the Sell zone, it will be expected to impulsively move towards the Buy zone area or Higher time frame 0.618-0.500 or Golden ratio. From there, we might be expecting a long-term Bullish Outlook.

EURNZD Long BiasThe EURNZD pair is currently breaking out of a descending trendline on the 4H timeframe, signaling a potential shift in momentum. The price has recently bounced from a key demand zone, aligning with the 38.2% Fibonacci retracement level, suggesting strong bullish interest.

Additionally, the price is now trading above key moving averages, reinforcing the bullish bias. A sustained break above the breakout level could confirm further upside potential, with the next target around the 1.92 zone. However, if the price fails to hold above the breakout level, a potential retest of the demand zone near 1.87 could be expected before resuming upward momentum.

EURNZD - Short Term Sell Trade Update!!!Hi Traders, on March 18th I shared this idea "EURNZD Bearish Trend Structure Indicates Potential Continuation"

We expected to see bearish continuation after retraces. You can read the full post using the link above.

The bearish move delivered, as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

KEEP IT SIMPLE STUPID!!! SELL EURNZDAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com