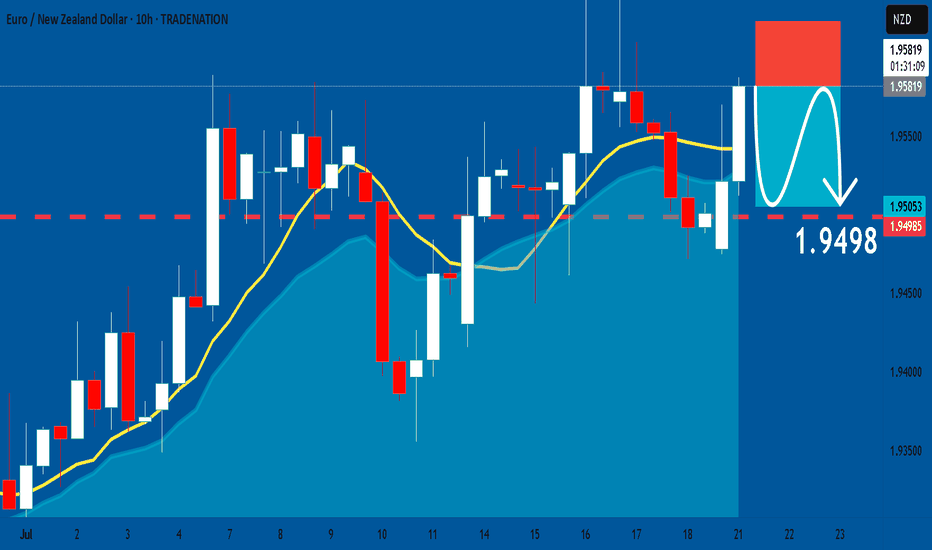

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD trade ideas

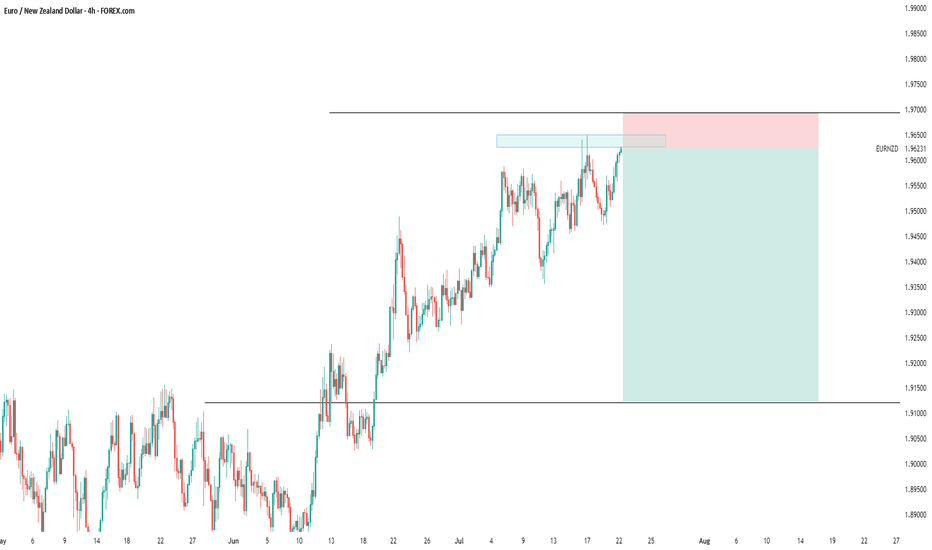

EURNZD long setupBuying from fresh demand zone after bullish structure break.

Daily showing strong momentum, 1H confirms continuation with clean break and retest zone.

📍Entry: Demand zone

🎯 Target: 2R

🛑 SL: Below demand zone

Risk-Reward: Favorable setup aligning with higher timeframe bias.

#trading #forextrading #EURNZD #priceaction #smartmoney #demandzone #tradingsetup #forexanalysis

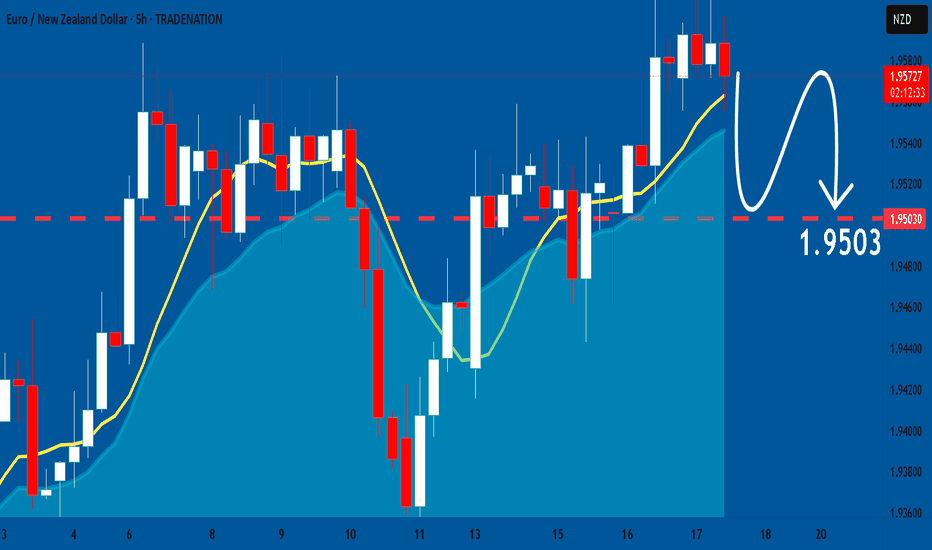

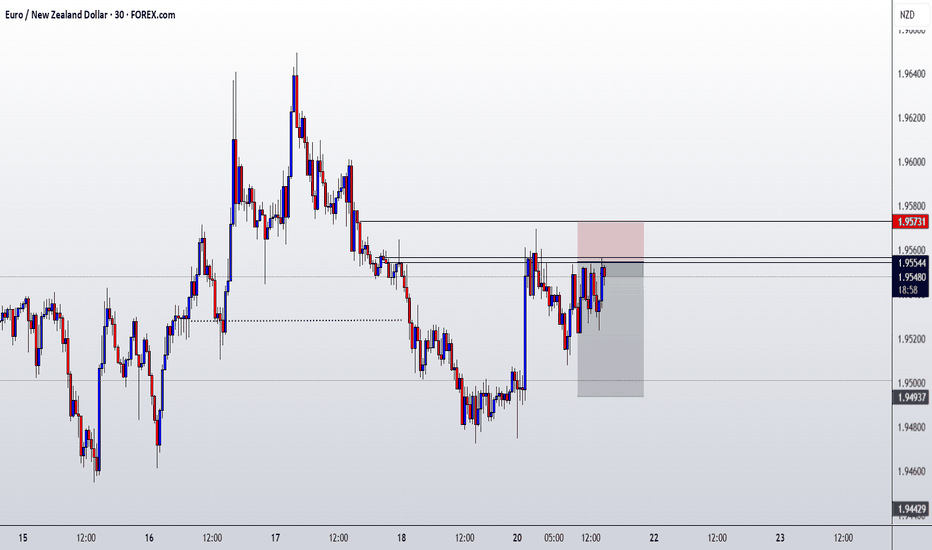

EURNZD Will Go Lower From Resistance! Sell!

Take a look at our analysis for EURNZD.

Time Frame: 15m

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 1.945.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 1.943 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

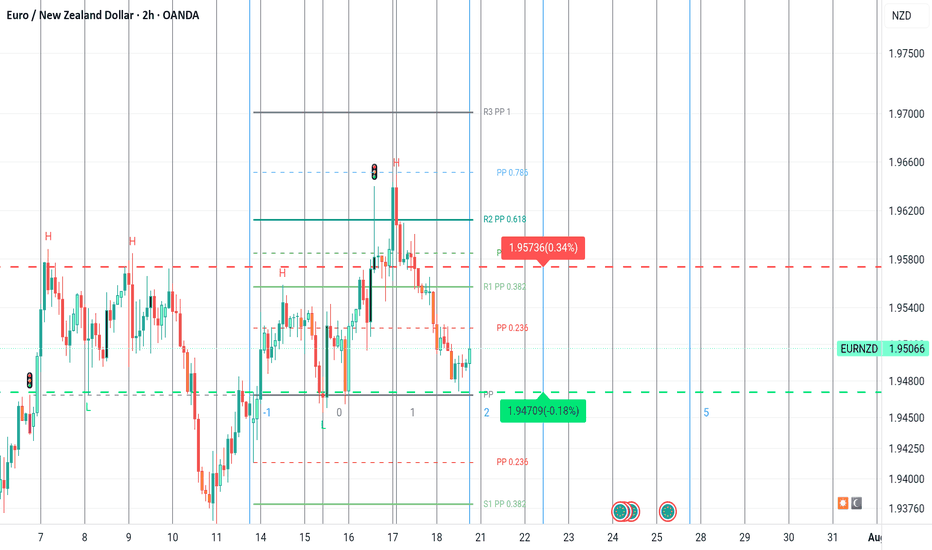

EURNZD Wave Analysis – 18 July 2025

- EURNZD reversed from the resistance area

- Likely to fall to support level 1.9400

EURNZD currency pair recently reversed down from the resistance area between the major long-term resistance level 1.9655 (which has been reversing the price from the start of 2020) and the upper weekly Bollinger Band.

The downward reversal from this resistance area stopped the previous medium-term impulse wave (5).

Given the strength of the resistance level 1.9655, EURNZD currency pair can be expected to fall to the next support level 1.9400.

EURNZD On The Rise! BUY!

My dear friends,

EURNZD looks like it will make a good move, and here are the details:

The market is trading on 1.9481 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.9535

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURNZD: Bearish Forecast & Bearish Scenario

The analysis of the EURNZD chart clearly shows us that the pair is finally about to tank due to the rising pressure from the sellers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

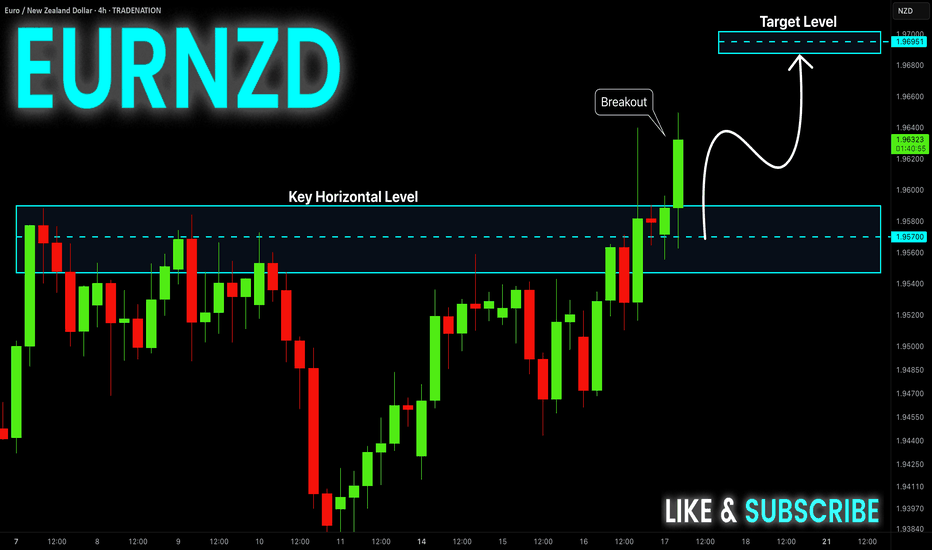

EUR-NZD Will Keep Growing! Buy!

Hello,Traders!

EUR-NZD is trading in a

Strong uptrend and the

Pair made a bullish breakout

Of the key horizontal level

Of 1.9580 so we are bullish

Biased and we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_NZD REBOUND AHEAD|LONG|

✅EUR_NZD fell again to retest the support of 1.9380

But it is a strong key level

So I think that there is a high chance

That we will see a bullish rebound and a move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURNZD Update: This short trigger could spark a waterfall dropYo traders, Skeptic from Skeptic Lab! 🩵 EURNZD just broke its daily upward trendline, setting up a sharp drop. Weekly shows a fading uptrend. Daily’s got a strong bearish candle, full body, no buyer fight. 4H trendline broke and... more on this video:)

👀Beware of fakeouts this week—volatility’s high! Trade smart, keep risk tight, and don’t FOMO. Share your thoughts in the comments, boost if it helps <3

EUR-NZD Will Grow! Buy!

Hello,Traders!

EUR-NZD keeps falling

Down and we are bearish

Biased mid-term but there is

A horizontal support level

Below at 1.9370 so after

The retest we might expect

A local bullish correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

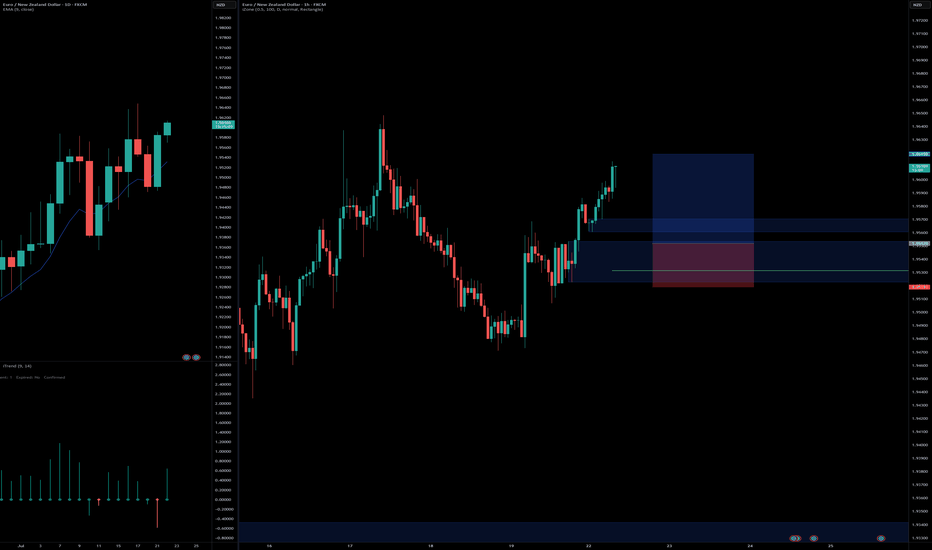

EURNZD Supply Test – Short Setup to DemandOn the 1-hour chart, EURNZD is approaching the 0.618 Fib retracement level and testing a Fair Value Gap (FVG) 🟧 after a strong bearish move.

- Supply + OB zone above 1.96600 is acting as resistance

- Demand + OB zone near 1.94000 is the target area

Plan:

- Expecting a rejection from current levels (1.95500 – 1.95700) or from the upper supply zone

🎯 Target: Demand Zone near 1.94200 – 1.94000 (≈ 150 pips potential move)

🛡 Invalidation: Clean breakout and hold above 1.96600 supply zone

Reasoning:

- Market structure remains bearish after the recent drop

- Supply zone + FVG + Fib retracement creates a strong confluence for rejection

- Looking for confirmation before short entry

(Not financial advice – just a personal market observation)

EURNZD SHORT UPDATE ON SHARE ANALYSIS

WE CREATED THE FVG AS PREDICTED

WE GOT A DECENT REACTION

WE CREATED A SMALL CHCOH + FVG ON 5M TF

JUST ENTERED THE POSITION

I am not a financial advisor, and this is not financial advice. The information shared is for educational and informational purposes only and reflects my personal opinion and analysis. Please do your own research and consult with a qualified financial professional before making any trading or investment decisions. Trading involves risk, and you should never invest more than you can afford to lose.

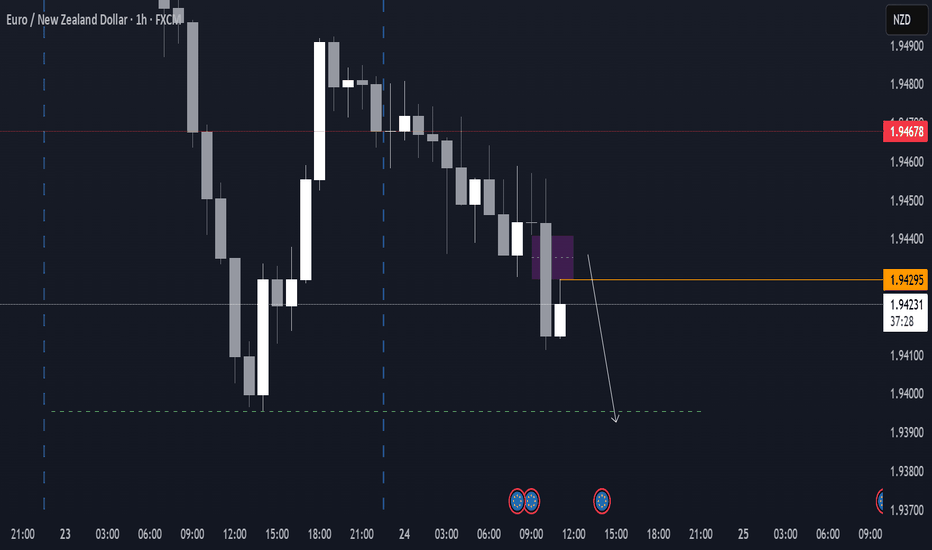

EUR/NZD short scalp opportunityI am looking for a short scalp opportunity on EUR/NZD.

Only if this 1H FVG will form and hold.

I will look for downside momentum to short after a reaction from the 1H FVG

Target = previous day low, but after 2RR you can take partials.

I am not a financial advisor, and this is not financial advice. The information shared is for educational and informational purposes only and reflects my personal opinion and analysis. Please do your own research and consult with a qualified financial professional before making any trading or investment decisions. Trading involves risk, and you should never invest more than you can afford to lose.

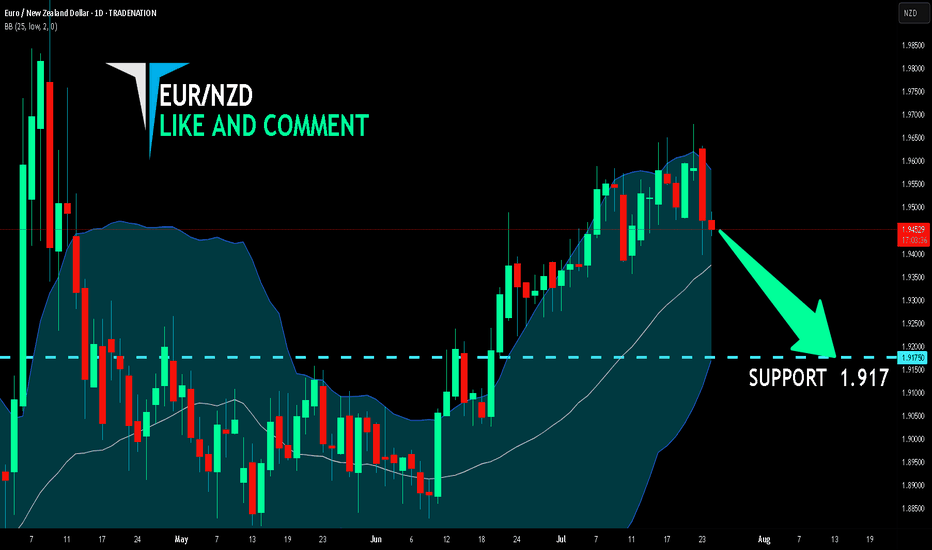

EUR/NZD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

The BB upper band is nearby so EUR-NZD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 1.917.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

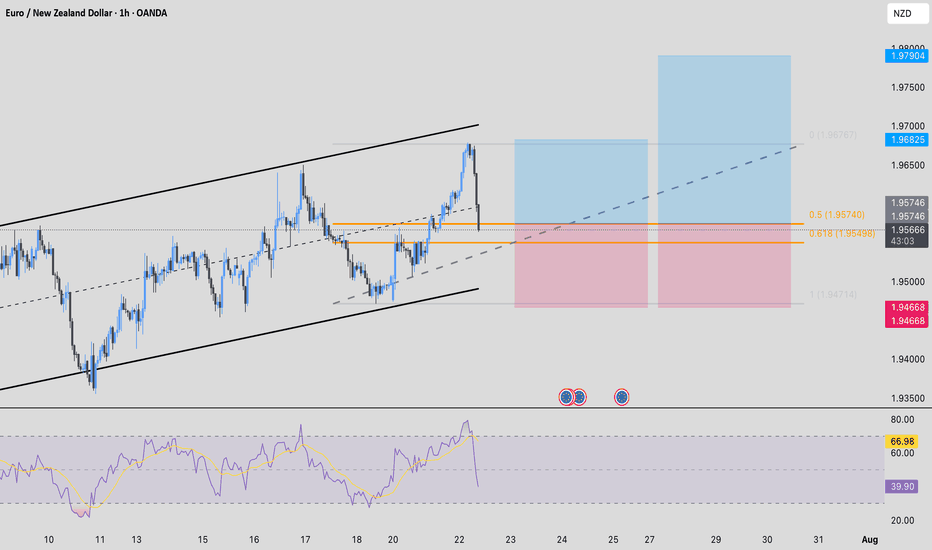

EUR / NZD - Buy on H1Buy EUR / NZD at Current Market Price on H1.

Entry Price : 1.95746

Stop Loss : 1.94668

TP1 : 1:1

TP2 : 1:2

Confluences for the trade are as follows:

- Price is an upward Channel

- No Divergence Detected

- Price is retracing and is at the 0.5 to 0.618 level after breaking the last higher high

EURNZD: Short Signal with Entry/SL/TP

EURNZD

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short EURNZD

Entry - 1.9581

Sl - 1.9622

Tp - 1.9498

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURNZD ENTRY CHARTOn this Pair, we are BEARISH, the Trend is still BEARISH, the NEW ZEALAND DOLLAR is beginning to gain STRENGTH, the DAILY open gave us a Confluence with the H4 tf giving us a SELL FORMATION, on the H1, we got our Structure area, with a LTF entry confirmation + Inducement, So if this matches with your Trade Idea, you can look to join US, and Apply a Good risk Management.We will give Update in the UPDATE SECTION THANK YOU.