Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.12 EUR

1.10 B EUR

1.58 B EUR

220.86 M

About Klepierre SA

Sector

Industry

CEO

Jean-Marc Jestin

Website

Headquarters

Paris

Founded

1968

ISIN

FR0000121964

FIGI

BBG000BDX939

Klépierre SA operates as a real estate investment trust, which focuses on shopping centers. It operates through the following geographical segments: France, Italy, Scandinavia, Iberia, Netherlands and Germany, Central Europe, and Other Countries. The France segment includes Belgium and other retail properties. The Scandinavia segment is composed of Steen & Strom, Norway, Sweden, and Denmark. The Iberia segment consists of Spain and Portugal. The Central Europe segment includes Poland and Czech Republic. The Other Countries segment consist of Greece and Turkey. Its portfolio includes Field's, Hoog Catharijne, Prado, Rives d'Arcins, L'esplanade, Centre Bourse, Milanofiori, Allum, Colombia, Okernsenteret, Viva, Galleria Boulevard, and Place d'Armes. The company was founded in November 1990 and is headquartered in Paris, France.

Related stocks

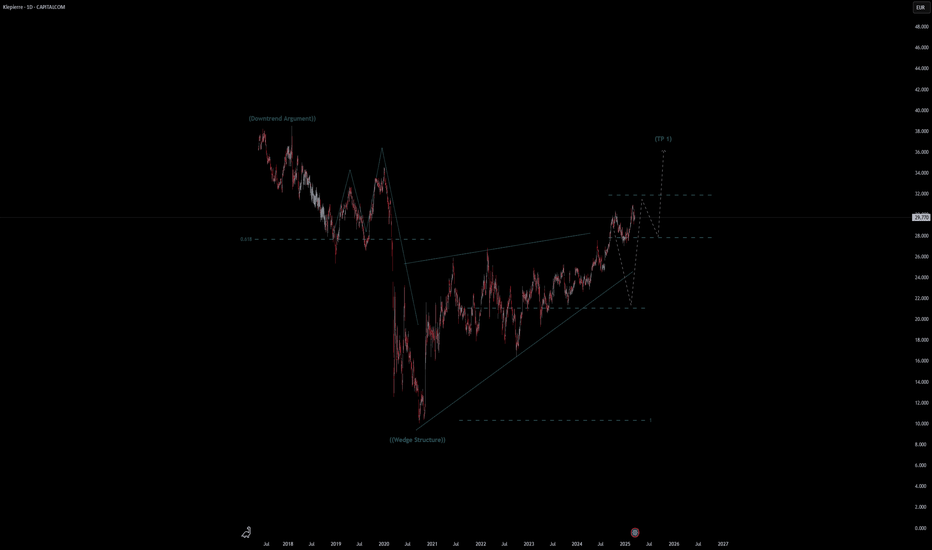

Kleppiere Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Kleppiere Stock Quote

- Double Formation

* (Downtrend Argument)) | Completed Survey

* 0.618 Retracement Area | Short Bias Entry | Subdivision 1

- Triple Formation

* ((Wedge Structure

A clear buy if it stays more than 2 weeks above EUR 25 ps.Fundamentals for European shopping mall REITs have improved dramatically and they are coming out of a 9 year old long bear market, now appearing to break out out a consolidation pattern formed in the past 3 years.

What initially started as revenue cannibalization and retail death due to e-commerce

Bullish outlook Horizontal volume levels seems to be broken trough by bulls. The moving average of 200 has been retested once, though might be retested once more. When "retouching" the MA 200 (in case of), there will be a confluence of large volumes and the MA, giving a strong trampoline effect. If this support wil

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

LIAC

Klepierre SA 4.23% 21-MAY-2027Yield to maturity

4.21%

Maturity date

May 21, 2027

FR14012ZD

Klepierre SA 3.75% 30-SEP-2037Yield to maturity

3.82%

Maturity date

Sep 30, 2037

FR1400NDQ

Klepierre SA 3.875% 23-SEP-2033Yield to maturity

3.54%

Maturity date

Sep 23, 2033

FR1330060

Klepierre SA 1.625% 13-DEC-2032Yield to maturity

3.29%

Maturity date

Dec 13, 2032

KPRA

Klepierre SA 1.25% 29-SEP-2031Yield to maturity

3.22%

Maturity date

Sep 29, 2031

FR14000KT

Klepierre SA 0.875% 17-FEB-2031Yield to maturity

3.08%

Maturity date

Feb 17, 2031

KPRB

Klepierre SA 0.625% 01-JUL-2030Yield to maturity

3.04%

Maturity date

Jul 1, 2030

FR1351223

Klepierre SA 2.0% 12-MAY-2029Yield to maturity

2.85%

Maturity date

May 12, 2029

FR1312175

Klepierre SA 1.875% 19-FEB-2026Yield to maturity

2.40%

Maturity date

Feb 19, 2026

FR1323804

Klepierre SA 1.375% 16-FEB-2027Yield to maturity

2.40%

Maturity date

Feb 16, 2027

FR001400ZFK4

Klepierre SA FRN 12-MAY-2028Yield to maturity

—

Maturity date

May 12, 2028

See all LI bonds

D5BK

Xtrackers FTSE EPRA/NAREIT DEVELOPED EUROPE REAL ESTATE UCITS ETF (DR) Capitalisation 1CWeight

3.54%

Market value

33.72 M

USD

EEUD

iShares MSCI Europe ESG Enhanced CTB UCITS ETF Shs Unhedged EURWeight

0.37%

Market value

25.20 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of LI is 33.90 EUR — it has decreased by −0.99% in the past 24 hours. Watch Klepierre SA stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EURONEXT exchange Klepierre SA stocks are traded under the ticker LI.

LI stock has risen by 1.56% compared to the previous week, the month change is a 3.42% rise, over the last year Klepierre SA has showed a 17.87% increase.

We've gathered analysts' opinions on Klepierre SA future price: according to them, LI price has a max estimate of 38.00 EUR and a min estimate of 26.10 EUR. Watch LI chart and read a more detailed Klepierre SA stock forecast: see what analysts think of Klepierre SA and suggest that you do with its stocks.

LI stock is 1.36% volatile and has beta coefficient of 0.36. Track Klepierre SA stock price on the chart and check out the list of the most volatile stocks — is Klepierre SA there?

Today Klepierre SA has the market capitalization of 9.68 B, it has increased by 2.09% over the last week.

Yes, you can track Klepierre SA financials in yearly and quarterly reports right on TradingView.

Klepierre SA is going to release the next earnings report on Feb 19, 2026. Keep track of upcoming events with our Earnings Calendar.

LI earnings for the last half-year are 1.32 EUR per share, whereas the estimation was 1.33 EUR, resulting in a −0.75% surprise. The estimated earnings for the next half-year are 1.40 EUR per share. See more details about Klepierre SA earnings.

Klepierre SA revenue for the last half-year amounts to 630.90 M EUR, despite the estimated figure of 636.73 M EUR. In the next half-year revenue is expected to reach 644.25 M EUR.

LI net income for the last half-year is 617.60 M EUR, while the previous report showed 561.80 M EUR of net income which accounts for 9.93% change. Track more Klepierre SA financial stats to get the full picture.

Klepierre SA dividend yield was 6.65% in 2024, and payout ratio reached 48.16%. The year before the numbers were 7.29% and 266.71% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 16, 2025, the company has 1.06 K employees. See our rating of the largest employees — is Klepierre SA on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Klepierre SA EBITDA is 1.01 B EUR, and current EBITDA margin is 63.74%. See more stats in Klepierre SA financial statements.

Like other stocks, LI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Klepierre SA stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Klepierre SA technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Klepierre SA stock shows the buy signal. See more of Klepierre SA technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.