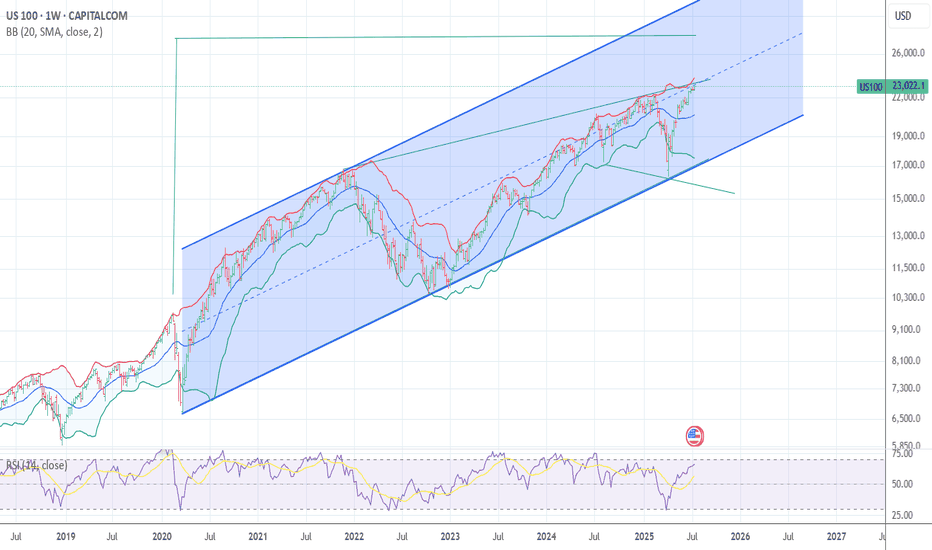

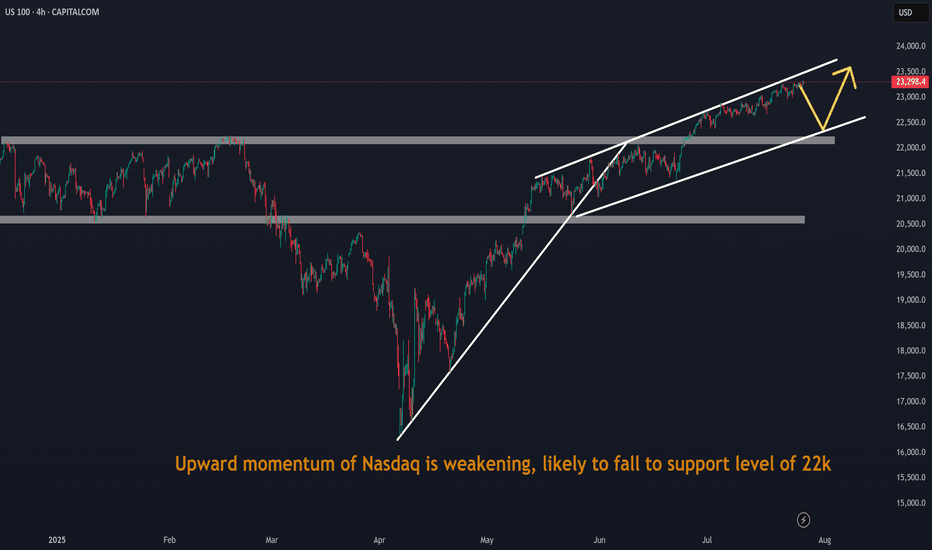

Risk off The cycle low is due 10/10 -20th The Bullish wave count is that we are ending wave 1 of 5 in super cycle blowoff wave 2 would drop in a ABC decline and drop back to .382 alt 50% of the whole rally from 4835 low . This is the bull wave count ! The bearish wave count is that we are ending the final 5th wave up from 2020 low march 23th see my work calling for a panic into 3/18/3/20 2020 the low was 3/23 20 into perfect math at 2191 as was the call for 3510 to 3490 low and the 4835 low all are in near perfect math . My worry for this oct 10 to the 20th Is I see a 1987 like decline taking out the 4835 in a wave E CRASH . Under all three counts I moved to a 110 % short. best of trades WAVETIMER

NAS100 trade ideas

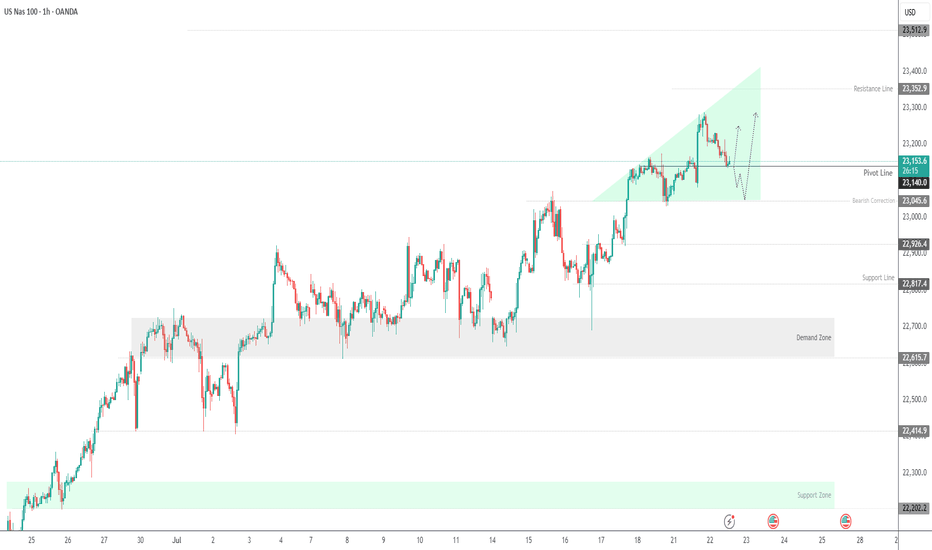

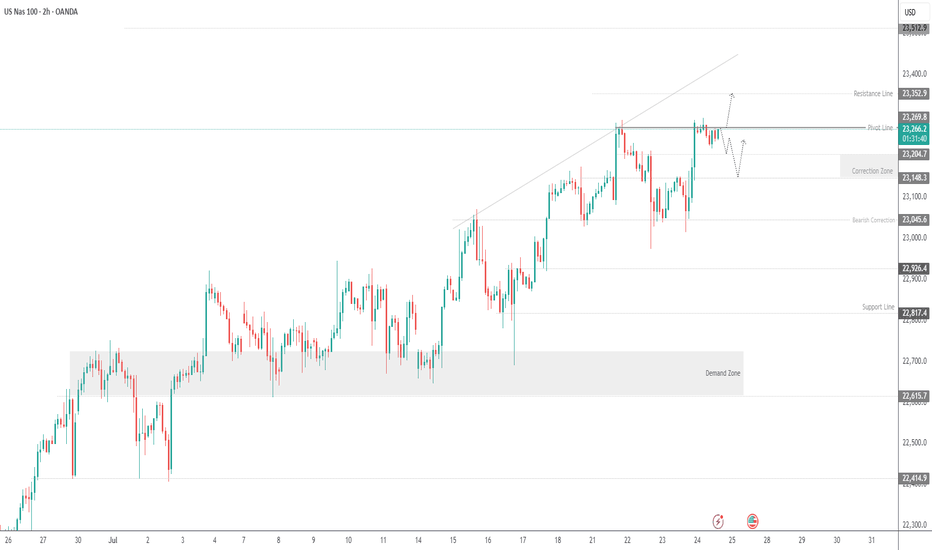

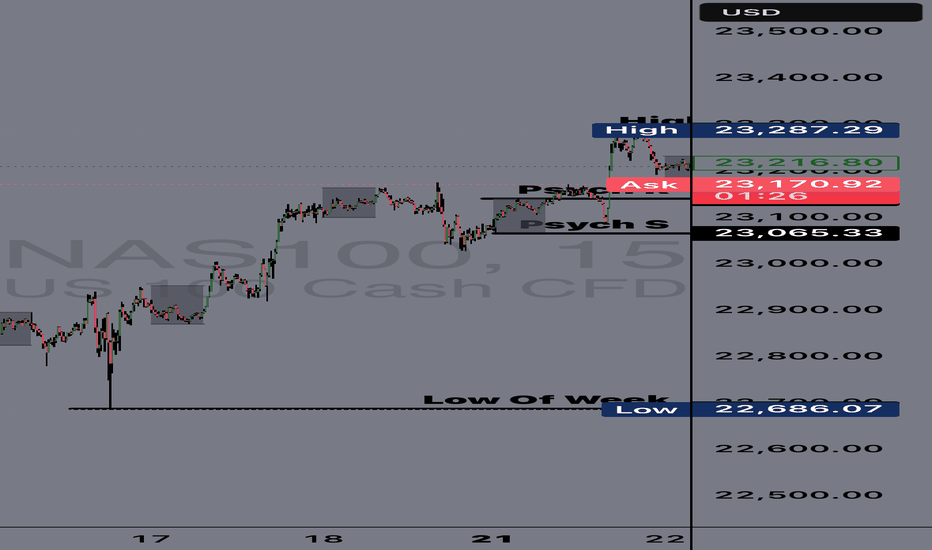

USNAS100 Eyes 23350 Ahead of Powell & Earnings StormUSNAS100

The price maintains bullish momentum, as outlined in the previous idea, with a clean rejection from the 23280 zone. Today, volatility is expected to increase ahead of Jerome Powell’s speech and a wave of key earnings reports.

As long as price holds above 23140, the outlook remains bullish toward 23230 and 23350.

A short-term correction toward 23045 is possible if we get a 1H close below 23140.

Resistance: 23230 · 23350 · 23510

Support: 23045 · 22920

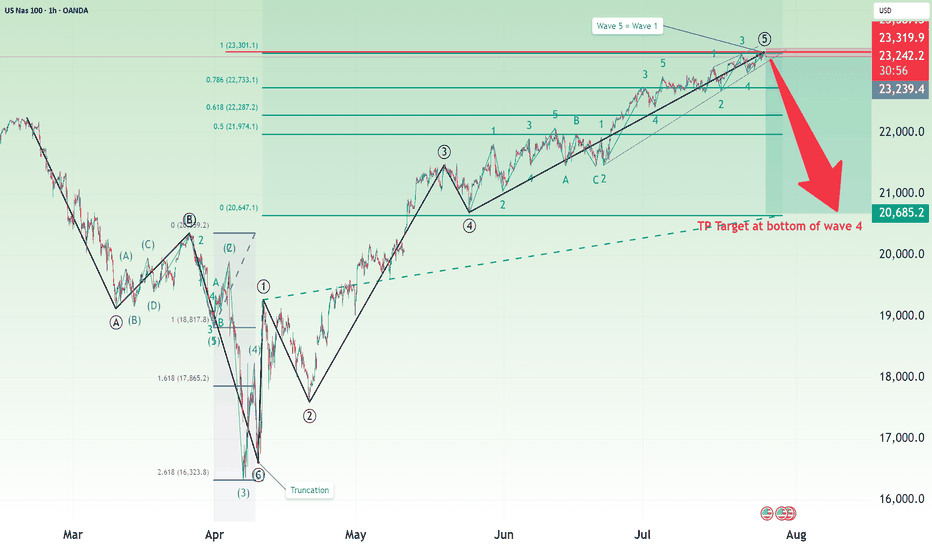

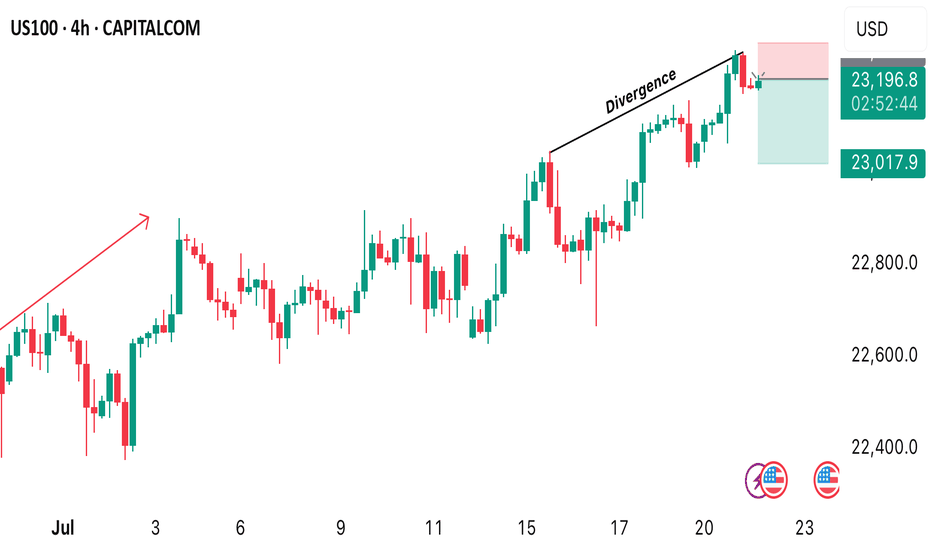

Nasdaq Short: Completion of 5 waves with wave 5=wave 1Over here, I present a short case for Nasdaq (and S&P500 by default since their correlations are high). The main reasons are:

1. Completion of 5 waves structure both on the high degree and on low degree, as shown in the chart.

2. Fibonacci measurement where wave 1 = wave 5.

The stop of this idea is to be placed slightly above the high, in this case, I placed it at around 23320. The take profit target is at the bottom of primary wave 4, around 20685.

Take note that this is a positional short, meaning the strategy is to short and hold and periodically adjust your stop loss based on unfolding on wave structure. Sizing is based on your risk tolerance.

Good luck!

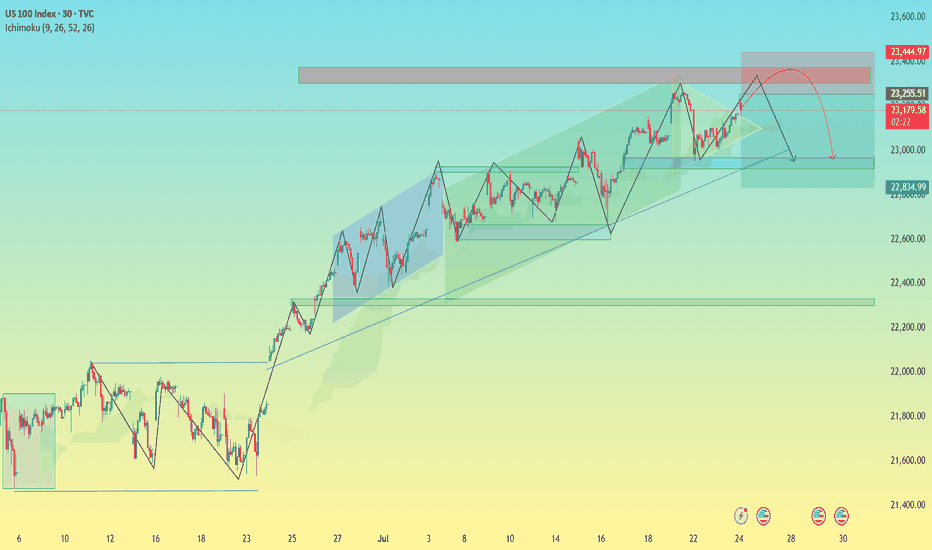

US100 Index – Potential Bearish Reversal in Key Resistance Zone🧠 US100 Index – Potential Bearish Reversal in Key Resistance Zone

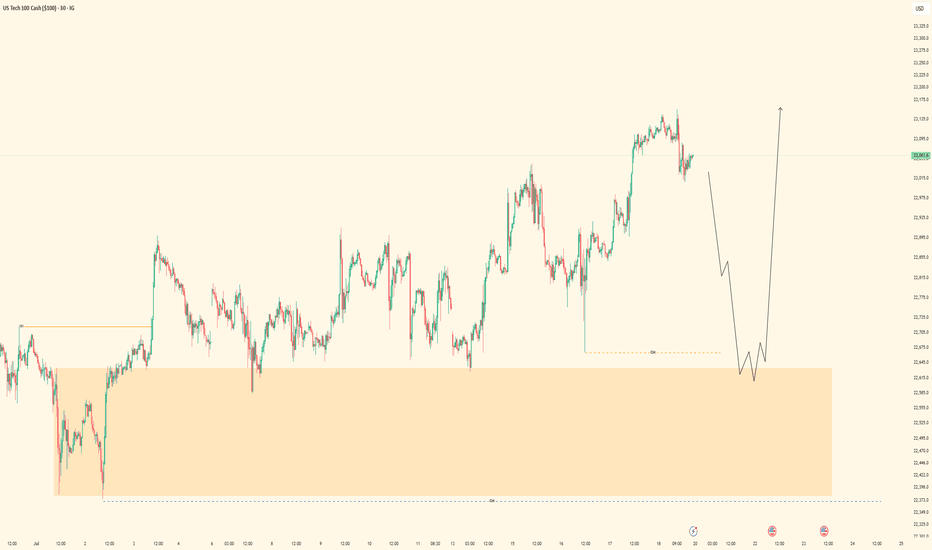

Timeframe: 30-Minute | Chart Published: July 24, 2025

---

🔍 Overview

The US100 (NASDAQ) has been trading in a well-structured ascending channel, forming higher highs and higher lows. However, recent price action suggests that the index is testing a critical supply zone near 23,400, with signs of weakening bullish momentum. This may signal a potential corrective phase or bearish reversal.

---

📈 Technical Analysis Breakdown

🔵 Trend Structure:

Price is respecting a clear ascending trendline (blue), connecting multiple higher lows.

Multiple bullish flag/channel formations have been completed within the uptrend, showing healthy momentum until the current point.

🟥 Resistance Zone:

Strong supply zone marked between 23,250 – 23,450.

Price action shows stalling candles and rejection wicks within this zone, indicating buyer exhaustion.

⚠ Bearish Patterns:

The red path projection suggests a head and shoulders-like structure forming at the top of the channel.

This, along with divergence in wave strength and shrinking momentum, supports a potential reversal.

🔵 Key Support:

First support lies around 23,000 — aligning with the ascending trendline and previous consolidation.

If broken, next demand zone is around 22,835 – 22,900, where historical consolidation took place.

---

🔁 Projected Scenario (as per visual path)

1. Price may attempt one last push into the 23,400–23,450 zone (possible false breakout).

2. Rejection from this level could trigger a fall toward the ascending trendline support.

3. A confirmed break of the trendline can lead to a larger correction toward the 22,800 zone.

---

🧠 Unique Insight

This chart combines multi-timeframe structure recognition with a real-time reversal formation inside a long-standing bullish trend. The analysis doesn’t just rely on textbook patterns—it recognizes real-time price behavior shifts, which makes it valuable for proactive traders.

---

📌 Conclusion

While the trend remains bullish overall, caution is warranted as the US100 approaches a historically significant resistance zone. The setup offers a compelling risk-reward short opportunity for aggressive traders, especially if the price confirms a break below trendline support.

---

🔧 Next Steps for Viewers

> “Watch for a clean rejection candle or lower high at resistance before entering short. If trendline breaks cleanly, 22,835 could be the next target zone.”

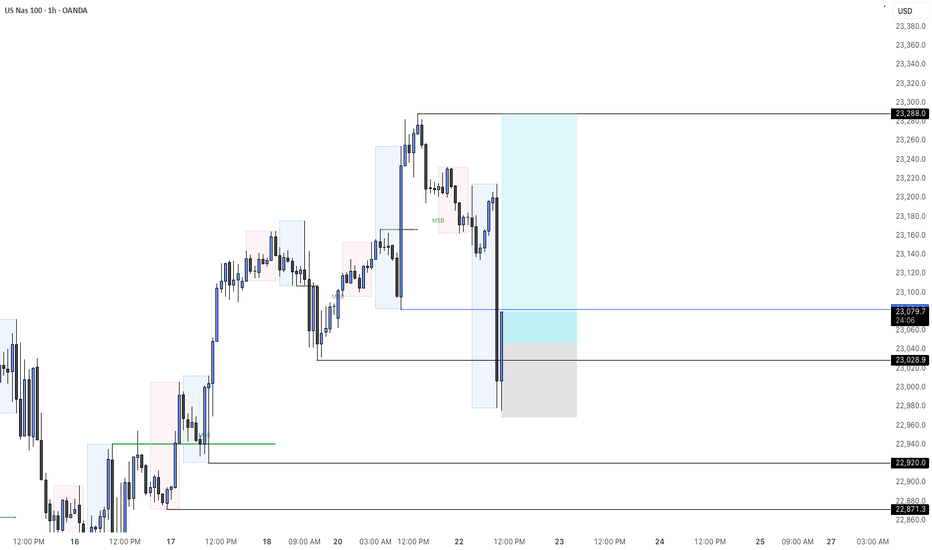

USNAS100 - Tech Index Pulls Back After Testing 23,295USNAS100 | OVERVIEW

The index came close to registering a new ATH at 23,295 before pulling back slightly.

Today, it appears to be in a bearish correction phase toward 23,200 and 23,150, as long as the price trades below 23,270.

Market sentiment may remain cautious, especially with no major earnings reports scheduled before the open, although Intel’s report after the close could have a notable impact.

A 1H close above 23,290 would invalidate the correction and open the way toward 23,350 and 23,500.

Key Levels:

Support: 23,200 · 23,150 · 23,050

Resistance: 23,350 · 23,520

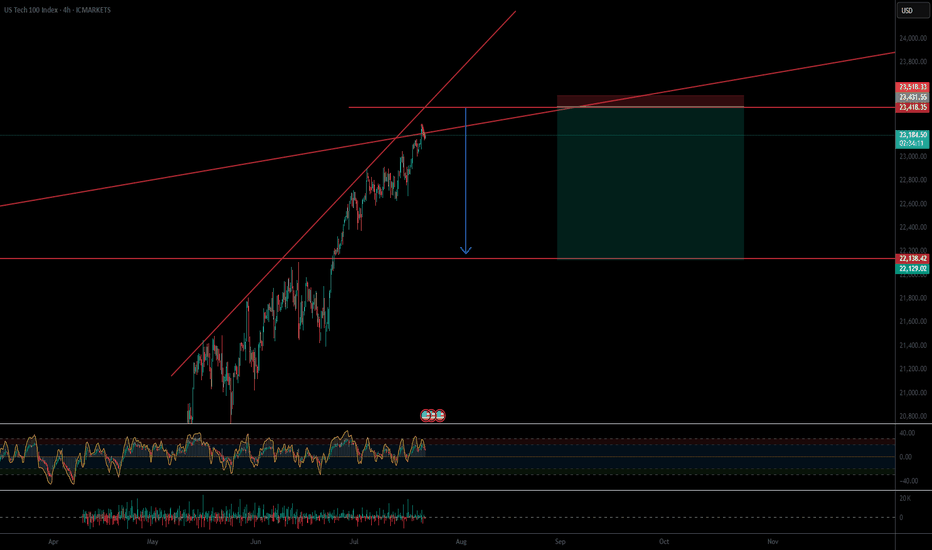

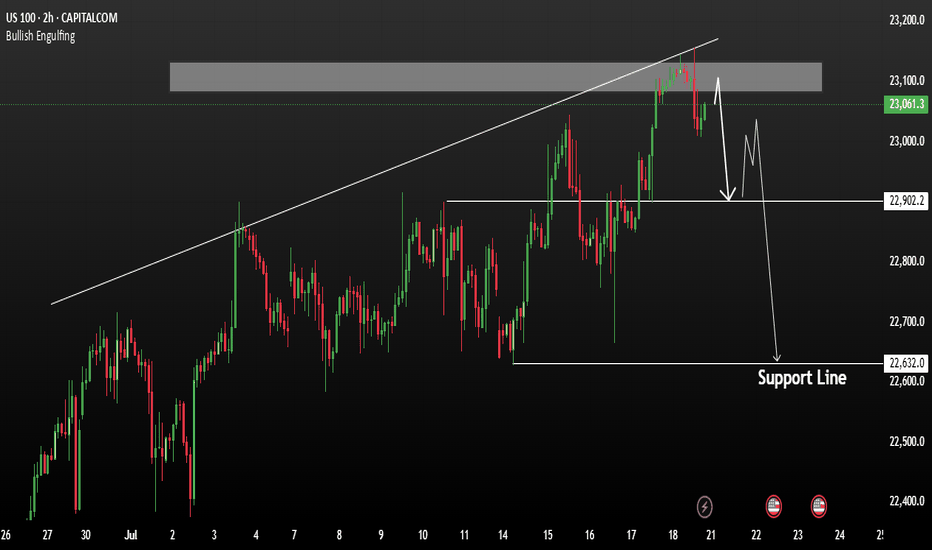

Nasdaq 100: Market Optimism Builds Ahead of Big Tech EarningsNasdaq 100: Market Optimism Builds Ahead of Big Tech Earnings

The earnings season is gaining momentum. This week, major technology companies such as Alphabet (GOOGL) and Tesla (TSLA) are scheduled to release their quarterly results.

Given that 85% of the 53 S&P 500 companies that have already reported have exceeded analysts’ expectations, it is reasonable to assume that market participants are also anticipating strong results from the big tech names. The Nasdaq 100 index (US Tech 100 mini on FXOpen) set an all-time high last week — a level that may be surpassed (potentially more than once) before the end of August.

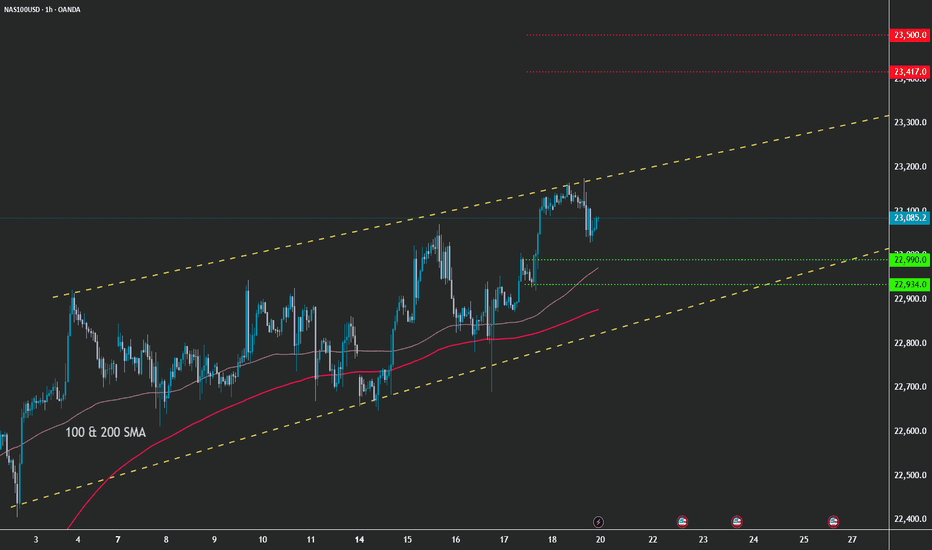

Technical Analysis of the Nasdaq 100 Chart

Price movements have formed an upward channel (marked in blue), with the following dynamics observed:

→ The bearish signals we highlighted on 7 July did not result in any significant correction. This may be interpreted as a sign of a strong market, as bearish momentum failed to materialise despite favourable technical conditions.

→ Buyers have shown initiative by gaining control at higher price levels (as indicated by the arrows): the resistance at 22,900 has been invalidated, while the 23,050 level has flipped to become support.

→ A long lower shadow near the bottom boundary of the channel (circled on the chart) underscores aggressive buying activity.

Should the earnings and forward guidance from major tech firms also come in strong, this could further reinforce the sustainable bullish trend in the US equity market.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

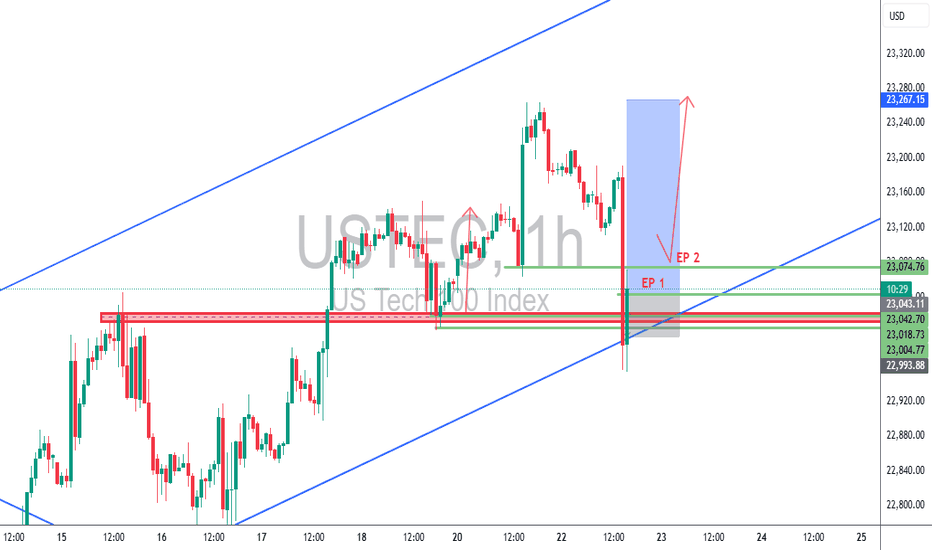

USTEC 1H – Dual Entry Precision | TCB Trend Phase SetupUSTEC 1H – Dual Entry Precision | TCB Trend Phase Setup

Market remained bullish with clear channel structure. After a pullback into the previous breakout zone, price swept liquidity and wicked below, offering two refined entries (EP 1 & EP 2) inside the demand zone.

🔸 EP 1 – Aggressive entry on first touch

🔸 EP 2 – Confirmation entry after rejection

🔸 SL placed below structural liquidity sweep

🔸 Target: Mid-channel + price inefficiency fill above

Trade Summary

🧠 Trend Phase entry with TCB logic

📌 Demand zone = Key structure

⏱️ Low drawdown

💥 RRR ~1:3

📈 TP in motion (or hit, if price reached 23,267)

📎 #Hashtags:

#USTEC #US100 #Nasdaq #SmartMoneyConcepts #SniperTrader #ForexTrading #PriceActionTrading #TCBSetup #TrendTrading #LiquiditySweep #RiskReward #TradingViewAnalysis

USNAS100 signs of a potential bearish trend Nasdaq Composite ended Friday little changed, recovering from a brief dip triggered by financial reports suggesting that former President Donald Trump is pushing for new tariffs. This geopolitical uncertainty is adding pressure to tech-heavy indices, with broader market sentiment turning cautious.

The price action on USNAS100 currently appears weak, showing early signs of a potential bearish trend in the upcoming week. However, before further downside, we may see the price retest key resistance levels.

You may find more details in the chart Ps Support with like and comments for better analysis.

Trend Exhaustion Detected – Bearish Structure AheadUS100 (NASDAQ) 30-minute chart as of July 26, 2025, with technical insights based on the visible elements.

🔍 1. Trend Analysis

Primary Trend: Uptrend (bullish structure)

The price has been respecting a rising parallel channel, marked by:

Ascending support (lower boundary)

Ascending resistance (upper boundary)

Market structure shows:

Higher Highs (HH)

Higher Lows (HL)

✅ This indicates continuation of bullish momentum until structure breaks.

📐 2. Market Structure Elements

Structure Type Label on Chart Price Zone (approx.)

Break of Structure (BOS) BOS (center-left) ~22,950

Higher Low (HL) HL (2x) ~22,700 (1st), ~23,050 (2nd)

Higher High (HH) HH (2x) ~23,150 and ~23,300

Resistance Labelled ~23,300–23,320

Demand Zones Labelled ~22,450–22,700

🔁 Break of Structure (BOS)

The BOS occurred after a prior swing low was broken, followed by a new higher high, confirming a bullish shift.

🧱 3. Support / Resistance Analysis

🔼 Resistance Zone

The price is testing strong resistance around 23,300–23,320

Multiple rejections in this area

Trendline resistance also aligns here

A rejection arrow is drawn, indicating potential bearish reaction

🔽 Support Zone (Immediate)

23,180–23,220: highlighted green box is a local support block

If broken, likely to revisit 23,000–23,050, or even down to 22,900 range

🟩 4. Demand Zones

Zone 1:

22,450–22,600: Strong bullish reaction historically — likely to act as a key demand if a deeper pullback occurs

Zone 2:

22,850–22,950: Validated with prior accumulation & BOS event

🧠 5. Key Observations

Price is at a critical inflection zone:

Testing a resistance zone

At the upper trendline of an ascending channel

A bearish reaction is projected (black arrow)

Possibly targeting the green support zone around 23,180–23,220

If that fails, demand at ~23,000 will likely be tested

Ichimoku Cloud:

Currently price is above the cloud → still bullish

Cloud is thin → potential weakness or upcoming consolidation

⚠️ 6. Trading Bias & Setup Ideas

✅ Bullish Bias (if price holds above ~23,180)

Long entries can be considered on bullish reaction from support

Target: retest of 23,300–23,350 or even breakout continuation

❌ Bearish Bias (if breakdown below support)

Short entry valid below 23,180 with:

TP1: 23,050

TP2: 22,900

A breakdown from the ascending channel would signal trend exhaustion

🔚 Conclusion

Current Price: 23,298.4

Trend: Bullish, but at resistance

Next move: Watch for reaction at resistance and support box below

Bias: Neutral-to-bullish unless the structure breaks below ~23,180

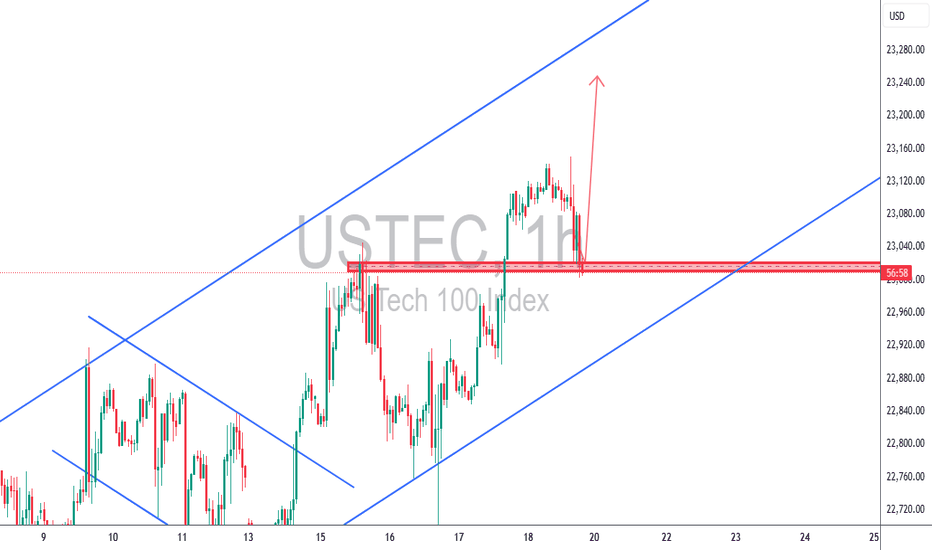

USTEC 1H – Bullish Continuation Play🔥 USTEC 1H – Bullish Continuation Play

Price pulled back into a strong demand zone and ascending channel support. We're in a clear bullish trend, and this retest offers a high-probability continuation setup.

✅ Demand zone confluence

✅ Previous resistance turned support

✅ Trendline + bullish wick rejection

✅ Clean structure with 1:3+ potential

🎯 Targeting 23,250+ while SL remains below 22,990

Strategy: TCB – Trend Phase (Pullback Entry)

Checklist Score: 100% ✅ A+ setup

Bias: Bullish – continuation expected

#USTEC #NASDAQ100 #US100 #TechnicalAnalysis #TCBStrategy #PriceAction #ForexTrading #IndicesTrading #SmartMoney #BreakoutTrading #TrendTrading #ChartAnalysis #BullishSetup #TradeIdeas #TradingView

Let me know if you want custom hashtags for XAUUSD, BTCUSD, USDCAD, or others.

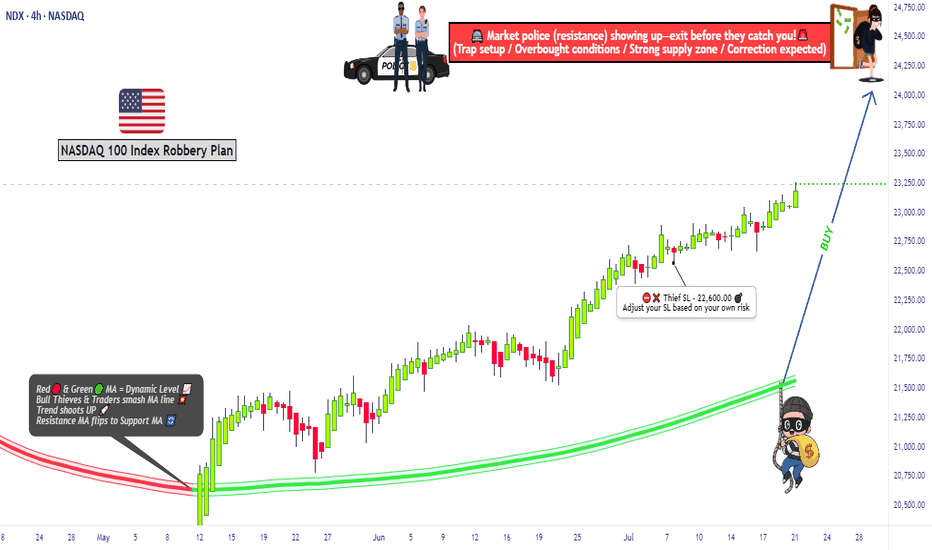

"NASDAQ 100 Heist – Scalp, Swing, or Hold? (Full Plan)🔥 NASDAQ 100 HEIST PLAN – BULLISH LOOT AWAITS! 🔥

🚨 Attention Market Robbers & Money Makers! 🚨

(Swing/Day Trade Strategy – High-Risk, High-Reward Play)

🎯 Mission Objective: Loot the NDX100/US100 (NASDAQ 100) Like a Pro!

Based on Thief Trading’s ruthless technical & fundamental analysis, we’re executing a bullish heist—targeting the Red Zone (high-risk, high-reward area).

⚠️ WARNING: Overbought market, consolidation zone, potential bear traps—weak bears may get slaughtered! Strong hands only!

🔐 ENTRY: The Vault is OPEN!

"SWIPE THE BULLISH LOOT!" – Any price is a steal, but smart thieves use:

Buy Limit Orders (15m-30m TF) near recent swing lows/highs.

DCA/Layering Strategy – Multiple limit orders for max loot.

Breakout Confirmation – Don’t jump in early; wait for the real move!

🛑 STOP LOSS: Protect Your Stash!

Thief’s SL Rule: Nearest 4H swing low (22,600) – WICK LEVEL ONLY!

DO NOT place SL before breakout! (Patience = Profit.)

Adjust SL based on risk, lot size, and number of orders.

🎯 TARGETS: Escape Before the Cops Arrive!

Main Take-Profit: 24,400 (or exit early if momentum fades).

Scalpers: Longs ONLY! Use trailing SL to lock in profits.

Swing Traders: Ride the wave like a true market pirate!

📰 FUNDAMENTAL BACKUP: Why This Heist Will Work

Bullish momentum in NDX100 driven by:

Macro trends (Fed, inflation, tech earnings).

COT Report & Institutional positioning.

Geopolitical & Sentiment Shifts.

Intermarket correlations (USD, Bonds, Tech Sector).

(Stay updated—markets change FAST!)

⚠️ TRADING ALERT: News = Danger Zone!

Avoid new trades during high-impact news.

Trailing SL = Your best friend.

Lock profits early if volatility spikes!

💥 BOOST THIS HEIST! 💥

👉 Hit LIKE & FOLLOW to strengthen our robbery crew!

🚀 More heists coming soon—stay tuned, thieves! 🚀

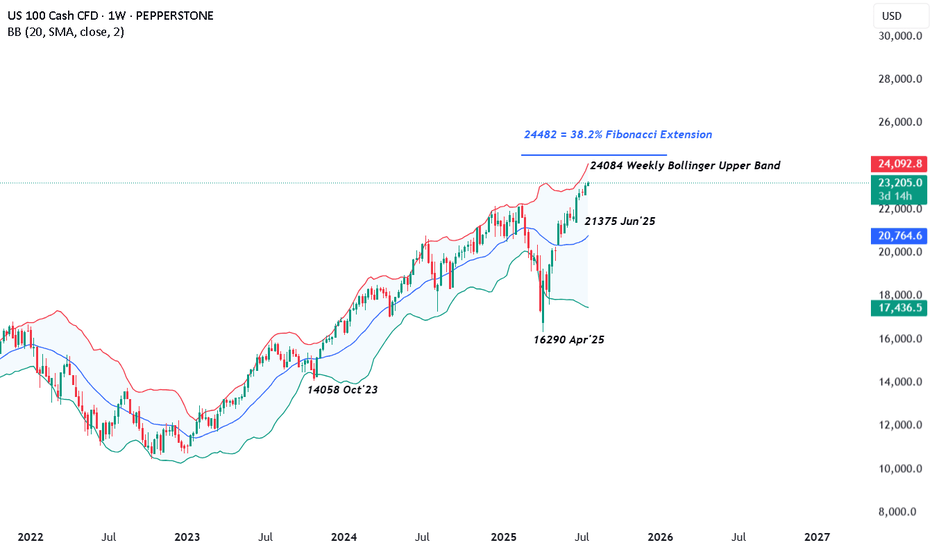

US 100 – All Eyes on Tariffs, Trade Deals and Tech EarningsRenewed demand for US assets has been evident throughout July so far and this has helped to lift the US 100 index to new heights with gains of over 2.5% across the month. The technology heavy index has risen from opening levels around 22650 on July 1st, then recorded several all time highs, before eventually finding some selling interest after printing the most recent record peak at 23282 yesterday afternoon.

This upside has been supported by fresh trader hopes of interest rate cuts, after Federal Reserve (Fed) policymaker Waller suggested last Thursday that he would consider a 25bps (0.25%) reduction at their next meeting on July 30th, despite Fed Chairman Powell maintaining the view that the US central bank are currently pursuing a wait and see approach, as they look for more information on inflation and growth trends to assist them to determine the on-going impact of tariffs.

Part of the reason for the Fed’s reluctance to cut rates has also been the resilience of US economic data. With US consumers still spending and employment yet to feel the negative impact of President Trump’s tariff policies, leading to a potential positive knock-on impact for growth and corporate earnings, when considered against prior downbeat market expectations.

This all leads nicely onto what could be a key sentiment driver for the direction of the US 100 this week, the start of earnings updates from the ‘Magnificent Seven’ tech companies, two of which, Alphabet and Tesla, report their earnings after the market close tomorrow. These are then followed by Microsoft and Meta on Wednesday July 30th, then Amazon and Apple on Thursday July 31st.

Traders will be keen to judge actual earnings against market expectations, alongside updates on AI spending and investment, forward guidance on the impact of tariffs and more specifically for Tesla, the time Elon Musk may dedicate to the company, rather than the distractions of politics.

The technical outlook could also be important.

Technical Update: Can The Positive Trend Extend Further?

There appears to be no clear-cut signs of a negative sentiment shift in the US 100 index yet, as fresh buying has continued to develop above support provided by the rising daily Bollinger mid-average, currently at 22785 (see chart below).

Of course, there is no guarantee this positive pattern of higher price highs and higher price lows will continue, especially given the on-going trade discussion between the US and its allies, as well as the earnings announcements from Alphabet and Tesla.

However, it can be useful for traders to prepare for any future volatility by assessing potential support and resistance levels that could impact the direction of the US 100 moving forward.

Potential Support Levels:

It is possible the rising Bollinger mid-average, currently at 22785, represents a first support focus for traders, and as such, closing breaks below this level might lead to a more extended phase of price weakness.

Such moves could see a deeper sell-off towards 22533, which is equal to the 38.2% Fibonacci retracement of June 23rd to July 18th 2025 price strength.

Potential Resistance Levels:

With fresh price strength emerging with the US 100 index above the rising Bollinger mid-average, a positive price pattern of higher highs and higher lows, may still be evident. This reflects buyers are currently willing to pay higher prices, each time a setback materialises.

However, to maintain this uptrend pattern in price, the focus could now be on resistance provided by the July high at 23282 (July 21st). Closing breaks above this level might be required to suggest further strength, towards the next potential resistance level at 24084, which is the weekly Bollinger upper band, even 24482, which is equal to the 38.2% Fibonacci extension.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

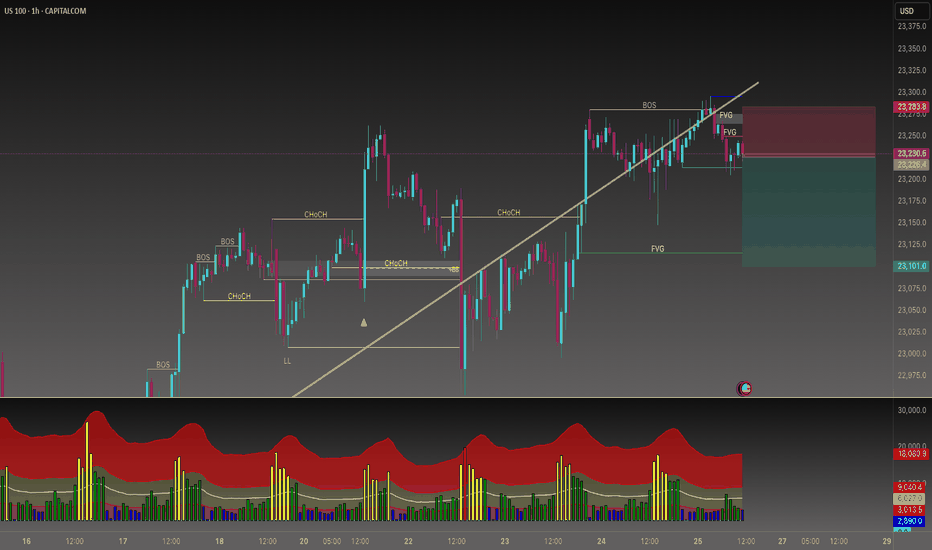

Do you want to keep buying NAS100?📉 Sell-Side Bias Activated

After PEPPERSTONE:NAS100 confirming the trend shift with a clean Break of Structure (BOS) and a strong rejection from the FVG (Fair Value Gap) zone, price failed to hold above 23,275.

This move validated the liquidity sweep and imbalance fill. Multiple FVGs stacked above suggest premium pricing and further downside potential.

🧠 I’m now watching for continuation setups toward discount zone. Especially below 23,100 and possibly targeting the lower FVG region.

This is a classic smart money play, manipulation, BOS, FVG retest, and selloff.

🔻Bias: Bearish

🎯 Target: Liquidity pools below 23,100

🛑 Invalidated above 23,280 (structure reclaim)

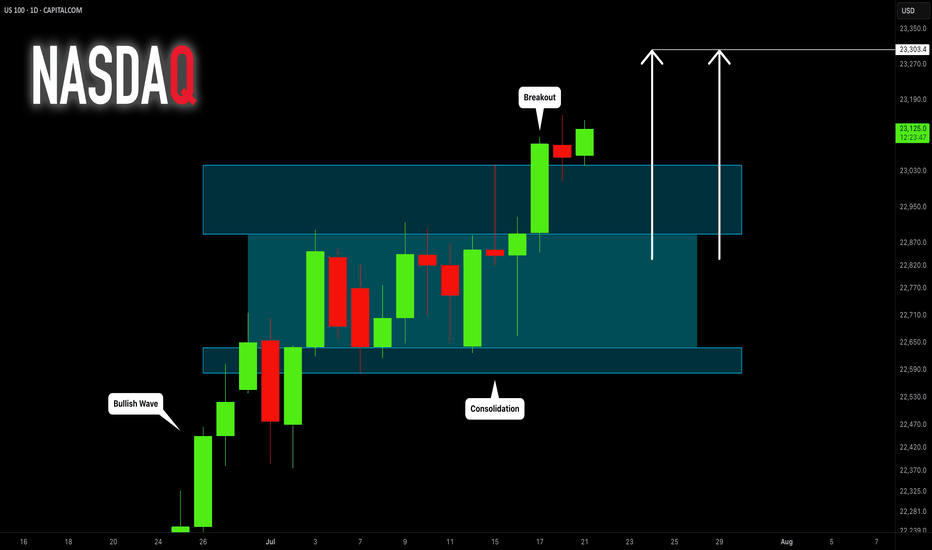

NASDAQ INDEX (US100): Bullish Continuation Confirmed

NASDAQ Index broke and closed above a resistance of a horizontal

parallel channel on a daily.

It confirms a bullish trend continuation and a highly probable growth

to the next strong resistance.

Goal - 23300

❤️Please, support my work with like, thank you!❤️

NAS100 - Bullish Trend Continuation Setup• Pair: NAS100 (Nasdaq)

• Bias: Bullish

• HTF Overview (4H):

• Strong bullish structure and momentum from last week.

• Price consistently printing higher highs with no signs of reversal.

• MTF Refinement (30M):

• Waiting for a clean sweep of SSL (sell-side liquidity).

• Looking for price to dip into 30M OB for continuation opportunity.

• Entry Zone:

• Watch 30M OB — once price sweeps liquidity and confirms, execute long.

• Targets:

• Structure highs / previous weekly highs.

• Mindset Note:

• Simple execution plan — ride the trend, trust the structure.

• Wait for confirmation before switching from analyst to trader mode.

Bless Trading!

NAS100 - Pattern & SMA PerspectiveDear Friends in Trading,

How I see it,

Not much new to report...

Exhaustion rising wedge continuation

1) Short corrections, new demands keep forming.

2) Can price break out to ignite an even steeper climb?

3) Or will price keep on respecting the wedge above 22900?

4) Still no catalyst to ignite a free fall...

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time study my analysis.